More Related Content

More from Luis Santiago Garcia Merino

More from Luis Santiago Garcia Merino (15)

Cuadros

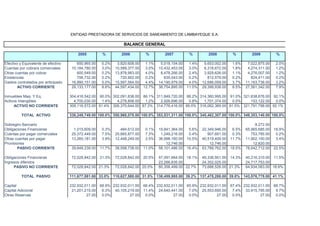

- 1. ENTIDAD PRESTADORA DE SERVICIOS DE SANEAMIENTO DE LAMBAYEQUE S.A.

BALANCE GENERAL

2005

Efectivo y Equivalente de efectivo

Cuentas por cobrara comerciales

Otras cuentas por cobrar

Existencias

Gastos contratados por anticipado

ACTIVO CORRIENTE

Inmuebles Maq. Y Eq.

Activos Intangibles

ACTIVO NO CORRIENTE

TOTAL ACTIVO

Sobregiro Bancario

Obligaciones Financieras

Cuentas por pagar comerciales

Otras cuentas por pagar

Provisiones

PASIVO CORRIENTE

Obligaciones Financieras

Ingresos diferidos

PASIVO NO CORRIENTE

TOTAL PASIVO

Capital

Capital Adicional

Otras Reservas

650,965.00

10,184,780.00

600,549.00

706,732.00

16,990,151.00

29,133,177.00

%

0.2%

3.0%

0.2%

0.2%

5.0%

8.6%

2006

3,820,608.00

10,589,377.00

13,878,983.00

720,902.00

15,587,564.00

44,597,434.00

%

1.1%

3.0%

4.0%

0.2%

4.4%

12.7%

2007

5,018,154.00

10,432,453.00

8,478,266.00

635,043.00

14,190,979.00

38,754,895.00

%

1.4%

3.0%

2.4%

0.2%

4.0%

11.0%

2008

5,653,002.00

6,318,672.00

3,929,626.00

812,579.00

12,686,059.00

29,399,938.00

%

1.6%

1.8%

1.1%

0.2%

3.7%

8.5%

2009

7,022,875.00

4,274,311.00

4,276,007.00

824,411.00

11,163,738.00

27,561,342.00

%

2.0%

1.2%

1.2%

0.2%

3.2%

7.9%

304,416,542.00 90.0% 302,091,838.00 86.1% 311,849,720.00 88.2% 314,360,995.00 91.0% 321,638,676.00 92.1%

4,700,030.00

1.4%

4,278,806.00

1.2%

2,926,696.00

0.8%

1,701,374.00

0.5%

153,122.00

0.0%

309,116,572.00 91.4% 306,370,644.00 87.3% 314,776,416.00 89.0% 316,062,369.00 91.5% 321,791,798.00 92.1%

338,249,749.00 100.0% 350,968,078.00 100.0% 353,531,311.00 100.0% 345,462,307.00 100.0% 349,353,140.00 100.0%

1,015,609.00

25,372,449.00

13,260,181.00

0.3%

7.5%

3.9%

484,612.00

25,665,877.00

12,448,249.00

0.1%

7.3%

3.5%

39,648,239.00

11.7%

38,598,738.00

11.0%

72,028,842.00

21.3%

72,028,842.00

20.5%

72,028,842.00 21.3%

72,028,842.00 20.5%

19,841,364.00

1,249,216.00

36,998,160.00

12,746.00

58,101,486.00

5.6%

0.4%

10.5%

16.4%

57,091,664.00 16.1%

23,266,835.00

80,358,499.00 22.7%

22,349,946.00

907,661.00

40,519,409.00

12,746.00

63,789,762.00

6.5%

0.3%

11.7%

18.5%

49,336,501.00 14.3%

24,352,025.00

73,688,526.00 21.3%

8,272.00

65,965,685.00

753,785.00

11,902,150.00

12,820.00

78,642,712.00

18.9%

0.2%

3.4%

22.5%

40,216,310.00 11.5%

24,717,753.00

64,934,063.00 18.6%

111,677,081.00 33.0% 110,627,580.00 31.5% 138,459,985.00 39.2% 137,478,288.00 39.8% 143,576,775.00 41.1%

232,932,011.00

21,201,215.00

27.00

68.9% 232,932,011.00

6.3% 40,105,219.00

0.0%

27.00

66.4% 232,932,011.00

11.4% 24,640,441.00

0.0%

27.00

65.9% 232,932,011.00

7.0% 25,553,695.00

0.0%

27.00

67.4% 232,932,011.00

7.4% 33,915,795.00

0.0%

27.00

66.7%

9.7%

0.0%

- 2. Resultados Acumulados

Resultados del Ejercicio

PATRIMONIO

TOTAL PASIVO Y PATRIMONIO

-28,544,232.00 -8.4% -28,747,444.00 -8.2% -33,605,581.00 -9.5% -43,312,792.00 -12.5% -58,762,903.00 -16.8%

983,647.00

0.3% -3,949,315.00 -1.1% -8,895,572.00 -2.5% -7,188,922.00 -2.1% -2,308,565.00 -0.7%

226,572,668.00 67.0% 240,340,498.00 68.5% 215,071,326.00 60.8% 207,984,019.00 60.2% 205,776,365.00 58.9%

338,249,749.00 100.0% 350,968,078.00 100.0% 353,531,311.00 100.0% 345,462,307.00 100.0% 349,353,140.00 100.0%

Fuente: Estados Financieros - Subgerencia Contabilidad y Finanzas EPSEL S.A.