Sheet1TFC Capital Budgeting Analysis - Week 6 ScenarioENTER CORREC.docx

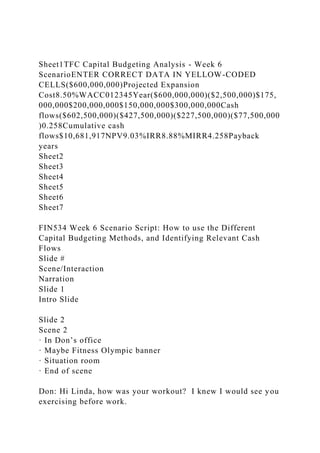

- 1. Sheet1TFC Capital Budgeting Analysis - Week 6 ScenarioENTER CORRECT DATA IN YELLOW-CODED CELLS($600,000,000)Projected Expansion Cost8.50%WACC012345Year($600,000,000)($2,500,000)$175, 000,000$200,000,000$150,000,000$300,000,000Cash flows($602,500,000)($427,500,000)($227,500,000)($77,500,000 )0.258Cumulative cash flows$10,681,917NPV9.03%IRR8.88%MIRR4.258Payback years Sheet2 Sheet3 Sheet4 Sheet5 Sheet6 Sheet7 FIN534 Week 6 Scenario Script: How to use the Different Capital Budgeting Methods, and Identifying Relevant Cash Flows Slide # Scene/Interaction Narration Slide 1 Intro Slide Slide 2 Scene 2 · In Don’s office · Maybe Fitness Olympic banner · Situation room · End of scene Don: Hi Linda, how was your workout? I knew I would see you exercising before work.

- 2. Linda: That is right Don. Our annual Fitness Olympics challenge is coming up and I want to be in shape for it. Don: I forgot about the company Fitness Olympics. Linda: Well, I did not forget. Last year our department just missed out on the top honors. This year we are planning on being the winning department. I may even try to recruit our intern! Don: Great attitude, Linda. Don: Before the Fitness Olympics, we still have a lot of work to do concerning this expansion project and whether or not we should go with it. Things are starting to move quickly. Recently, I heard from Joe and he wants us to do some capital budgeting analyses on the project. This analysis may be our make or break analysis for the project so we really need to be detailed. Linda: Okay Don. The intern and I are right on it. I plan on meeting the intern in the “Situation Room”. We dubbed the conference room that name as we are constantly making informed decisions. Slide 3 Scene 3 · Linda in conference room · · Go to next slide Linda: We have our hands full. The project is getting close to decision making time. Joe and Don want us to analyze the proposed expansion project from a capital budgeting standpoint. Currently, we have completed many internal analyses on TFC. Now, we must look at the viability of the expansion project.

- 3. Capital budgeting does just that. At the end of it, we should have a better idea of what our recommendation would be. Linda: Capital budgeting can be done whenever there is an initiative to invest in assets for the long term. Our project is doing just that. We want to be confident in our decision as this project is for the long term and is costly. Don is going to be joining us with the expected cost of the project. Slide 4 Scene 4 · Don in conference room with papers in hand? · Show on the papers - seven hundred fifty million dollars · Go to next slide Don: Hello all. With this expansion project we will double in asset size. But it comes with a price. The Accounting Department told us that the projected price to expand out West is seven hundred fifty million dollars. I also have the projected cash flow numbers. Now, I need the both of you to determine if we should proceed with the expansion. To do so you will need to use many capital budgeting techniques to arrive at a highly confident decision. Good luck! The faith of this expansion and the future success of TFC depend on your analysis. Linda: Don, the Intern and I will begin working on this now! Slide 5 Scene 5 · Linda In conference room (Don not in room) · Net Present Value · WACC =10.92% · Go to next slide Linda: We have our assignment so let’s starting working through this analysis. There are many capital budgeting techniques and the plan is to use some of them for our project as

- 4. Don said. But, it ultimately comes down to money. If the project is expected to bring in more cash than its costs, the project is a go, within reason, that is. As we have been saying all along, cash is the driving force behind our decision-making. To analyze our cash flows ,we need to look at the net present value of our future cash inflows and outflows including the cost of the project. Since these cash flows are being expected over time, we need to discount them back to today so we are valuing everything at the same point in time. Since we do not know the actual cost for undertaking the project, we will use our WACC, which is ten and ninety-two hundredths percent, as our discount rate. We also need our anticipated cash flows in the future years. This can be difficult to project, but it is extremely important that these numbers are as realistic as possible. From what I was told, the Accounting Department expects cash flows for this project only to be negative ten million in projected year one as the company will still be opening up fitness centers at a high rate. In year two, the cash flow is projected to be two hundred million, then two hundred fifty million, three hundred million, and four hundred million, respectively, for years two through five. A five-year projection will enable us to see where we will be in the immediate future. Anything after five years may be difficult to estimate as things change over time.. Linda: Now that we know all the inputs to our calculation, we can determine if this expansion project will have a positive net present value. While I gather data for our second cash budgeting technique, can you run the numbers to see what the outcome is? Slide 6 Scene 6

- 5. · CYU Linda would like you to determine the Net Present Value of the expansion project. Using a 10.92% discount rate and the cash flows as follows: Cash Flow Year 0 = $-750,000,000 Cash Flow Year 1 = $ - 10,000,000 Cash Flow Year 2 = $+200,000,000 Cash Flow Year 3 = $+250,000,000 Cash Flow Year 4 = $+300,000,000 Cash Flow Year 5 = $+400,000,000 Using present value calculations for an uneven stream of cash flows what will the Net Present Value of the project be? (Round to whole dollars) Answer: $23,164,711 (can you put a variance in there of $20?) If right – Great job. This project will generate cash for TFC If wrong – Nice try. Remember to discount each cash flow back at 10.92% and then sum all the amounts including the - $750,000,000 Slide 7 Scene 7 · Net Present Value · Go to next slide Linda: Nice work! From the calculations, the net present value of the project is expected to be over twenty-three million dollars. Now, that is some great news. But, we have to be careful here. We are assuming our discount rate to be ten and ninety-two hundredths, which is in line with our required rate of return under the WACC. If this rate changes, it can affect the project’s value.

- 6. Linda: Having a positive expected net present value indicates that we should proceed with the project. The capital budgeting technique is the best choice to use as it tells us the expected cash value of the project. If the numbers that came back were negative, we would suggest that we should not proceed with the project. As you can see, it all depends on cash. Linda: Even though the Net Present Value measure is the best one to use, it is good practice if we look at a few of the other ones. Slide 8 Scene 8 · Conference Room · Show calculation from excel · IRR =11.84% · Next slide Linda: Another measure is the Internal Rate of Return, or the IRR for short. It is the discount rate that makes all the future cash flows equal to the beginning cash outlay. Basically, it measures the expected rate of return on the project. If the IRR is greater than the project’s cost of capital, the shareholders will benefit by the project. The calculation can be quite involving if done by hand. Luckily at TFC, we have a financial calculator that handles the calculation and leaves the decision making up to us. Our calculator is showing eleven and eighty-four hundredths percent as the IRR. This is above our cost of capital of ten and ninety- two hundredths percent which shows a return higher than cost. So far everything is pointing toward proceeding with the project. Slide 9 Scene 9 – · Linda in room

- 7. · Cost of debt Linda: The third measure, called the Modified Internal Rate of Return or MIRR is similar to the IRR but it looks at cash inflows and outflows separately and then together. What I mean by that is, in order to do the calculations: First, take all negative cash flows and discount them back to today. Then, take all positive cash flows and compound them at our WACC to our last projected year, which is year five. At that point we have a present value amount and a future value amount. The MIRR is the rate that links the two cash flows, the present value and future value. Keep in mind, the present value cash flows are all the negative cash flows discounted, including today, while the future cash flows are all the positive cash flows compounded to the future, which is year five for TFC. Linda: Let’s now calculate the MIRR. Slide 10 Scene 10 · CYU Linda would like you to determine the MIRR of the expansion project. Using a 10.92% as the discount and compounded rates to rate and the cash flows as follows: Cash Flow Year 0 = $-750,000,000 Cash Flow Year 1 = $ - 10,000,000 Cash Flow Year 2 = $+200,000,000

- 8. Cash Flow Year 3 = $+250,000,000 Cash Flow Year 4 = $+300,000,000 Cash Flow Year 5 = $+400,000,000 Answer: 11.56% · (If they get it wrong. ) Nice try but remember to compound the positive cash flows in Years 2,3,4,5 and discount the negative cash flow in year 1. Add that amount to the beginning cash outlay. Then find the rate over 5 years Correct, The formula is to discount negative cash flow in year 1 to year zero and add it to that amount to get $759,015,506.67. Year 5 total cash flows would be $1,313,276,378.14. Discounting that back at 5 years would give 11.56% Slide 11 Scene 11 · Set up the cash flows on a clip board Cash Flow Year 0 = $-750,000,000 Cash Flow Year 1 = $ - 10,000,000 Cash Flow Year 2 = $+200,000,000 Cash Flow Year 3 = $+250,000,000 Cash Flow Year 4 = $+300,000,000 Cash Flow Year 5 = $+400,000,000 · Show $10,000,000/$400,000,000 =.025 of a year for a total of 4.025 years · Next Slide Linda: Great job! Another measure is the Payback Period. We like to say that this is our most straightforward measure but we need to be careful with it as it does not assume any rates. We use this measure when we think our cash balance for the project will be positive.

- 9. To do this, we look at the initial cash outlay of seven hundred fifty million dollars. We also anticipate another cash outlay of ten million in the first year. In year two is when we plan on generating some positive cash flows of two hundred million dollars. If we just look at it from a net cash perspective after year two we would have negative five hundred sixty million. The cash outlays from the beginning of the project and year one would put us in a deficit of seven hundred sixty million. By adding the two hundred million in year two our deficit would be five hundred sixty million. With that same approach, after year three we would still be at a three hundred ten million dollar deficit. After year four we are almost there at a deficit of ten million dollars. In year five, we anticipate the deficit to go away with the first ten million of the anticipated four hundred million in positive cash flows. When you take that ratio of what is needed to break even or ten million dollars over the expected cash flow in year five of four hundred million, the result is point zero two five of a year. When we put it all together, we can expect to be in the positive for the project in four point zero twofive years. So, the project will pay for itself in just over four years. Linda: This payback period measure has some drawbacks especially in the area of discounting. We are not factoring in time but for a quick measurement it is a good one to use. Also, this measure is not our deciding factor. As you know by now, our deciding factor is the net present value calculation.

- 10. Slide 12 Scene 12 · Don in room · Show results on screen · Thumbs up! Don: I left you with the most critical piece of the project. What were you able to find out? Linda: Don, I think you will be pleased by our analysis. We did a number of capital budgeting measures and the results are as follows: Net Present Value is positive twenty three million, one hundred sixty-four thousand, seven hundred eleven dollars. Internal Rate of Return is eleven and eighty-four hundredths percent, which is greater than our discount rate. Modified Internal Rate of Return is eleven and fifty six hundredths percent. And the Payback Period is four point zero two five years. Don: Wow. Great job. I can’t wait to share the results with Joe. But, before I do. Are you giving us thumbs up on the project? Linda: Of course from a financial standpoint we would always like to do some more analyses, but based on our numbers to date, Yes!A double thumbs up! Slide 13 Scene 13 · Linda talking about cash flows · Put words “Relevant Cash Flows” on board · Don enters

- 11. Linda: Great job with the capital budgeting analysis. While we do four different measures here at TFC, there are others, such as the Profitability Index and using the discount rate on the payback period measurement. But in our decision making, it all comes down to cash flow and the net present value tells us the cash outlook for the project. Linda: So I’ve been mentioning cash a lot...... When we started on the cash budgeting, we were given projected amounts from the Accounting Department. I’ve even mentioned that there was much debate on the cash flows. Keep in mind these are projected cash flows, so a lot of analysis and decision making goes into it. Probably the most critical part of our expansion project is projecting the cash flows from it. Our Accounting Department spent countless hours discussing what should be included in the analysis and what is not relevant. Don: That is right Linda. I spent some time in the Accounting Department when this analysis was being done and some of the points that were being considered included the following. First, there is a distinction betweenfree cash flows and accounting income. Typically accounting income is on an accrual basis which is different from actual cash flow. Remember for this project we are only concerned with the cash flows related to this project and not other areas of TFC. Second, depreciation needs to be added back into the project. It is a not cash item that needs to be added back when estimating cash flows. In fact all non cash charges related to the project should be added back for cash flow purposes. Third, we do not deduct any interest charges related to the project as this was already considered when we determined the WACC, which is the rate we use to discount all the cash flows.

- 12. Fourth, change in net operating working capital is a factor. Any activity related to this expansion project, whether assets or liabilities, need to be considered. This is one of the areas that really need to be looked at closely. Another area involves sunk costs, which are cash outlays that occurred prior to moving forward with the project and should be ignored. The Accounting Department determined that all of the research on the different locations to expand into are sunk costs and are not included in the net cash flow. Slide 14 Scene 14 · Don and Linda in room · Next Slide Don: These are just a few of the areas that need to be considered. For the most part, if it is a cash transaction and it is part of the project, then it should be included in determining cash flows. Linda: That is true. And at TFC we have many computer tools and spreadsheets that we use to aid us in making these cash flow decisions. That is why we were confident in our analysis. Don: And I passed that on to Joe. Working together as a team really helps in decision making. I can’t wait to see this project move forward. But like any hard day at work, it is always good to finish it with a workout. Before we head to the gym, let’s briefly go over what we accomplished today. Slide 15 Scene 15 · Summary Slide – Linda: Another great job by the team at TFC. We covered many capital budgeting techniques when looking at a project’s cash flows including the Net Present Value, Internal Rate of

- 13. Return, Modified Internal Rate of Return, and Payback Period. While all are important, the Net present Value should be used at the final deciding factor. We also looked at identifying relevant cash flows. They should be those activities that are related to the project now. There are many software packages that can help in the decision making. Don: Linda, you and the intern are doing fabulous work. You two made the determination to proceed with the project but your work is not done. Enjoy your workout as I have another project when you are finished. Slide 16 Scene 16 · Closing slide Closing slide