This document summarizes key aspects of Irish succession and land law. It covers topics like wills and intestacy under the Succession Act 1965, the validity requirements for wills, intestacy rules for distributing property when there is no will, legal rights of spouses and children, and restrictions on freedom of testation including provisions for spouses, children, divorced partners, and disinheritance. Case law precedents and recommended readings are also provided.

![Spouse/Civil Partner Legal Right share

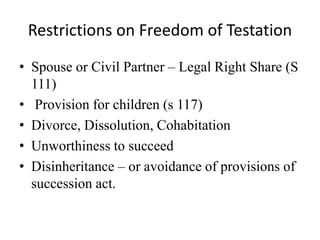

• Part IX Succession Act 1965 – Applies to Testate

succession (wholly or partly) s 109(1)

• Section 111: Testator leaving spouse (or civil partner)

and no children – spouse or civil partner takes half;

Testator leaving spouse (or civil partner) and children

– spouse or civil partner takes one third

• Can be renounced – prenup, separation agreement.

• Uruquhart [1974]- right to choose.

• Vests on death where no provision made for spouse

O Dwyer v Keegan [1997] 2 IR 585.

• S56 – Right to appropriate dwelling house in

satisfaction of gift in will or legal right share](https://image.slidesharecdn.com/land-law-webinar-150410071652-conversion-gate01/85/Land-Law-Webinar-12-320.jpg)

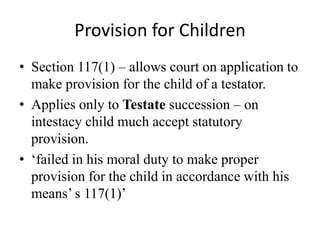

![‘moral duty to make proper provision’

• ‘proper provision’ – applies to facts at date of

death MPD v MD [1981] ILRM 179.

• FM v TAM (1972) 106 ILTR 82 – on the existence

of a moral duty. In this case no provision meant

failure of duty BUT

• Re IAC [1989] ILRM 815 – high onus of proof on

child – less than others not indicative of failure –

proper provision made by testator during her

lifetime discharges duty, but not in this case.](https://image.slidesharecdn.com/land-law-webinar-150410071652-conversion-gate01/85/Land-Law-Webinar-14-320.jpg)

![Section 117

• Re ABC deceased [2003] 2 IR 250- s117 directed

to children of an age and situation in life where

they might reasonably expect support from their

parents. Relationship of parent and child does not

automatically create obligation. Position of child

not to be taken in isolation.

• CC v WC [1990] 2 IR 143 SC Finlay CJ ‘ A

positive failure of moral duty must be established’](https://image.slidesharecdn.com/land-law-webinar-150410071652-conversion-gate01/85/Land-Law-Webinar-15-320.jpg)

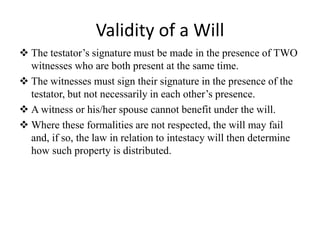

![Recommended Reading

Cases:

• Ross v. Caunters [1980] Ch. 297

• Wall v. Hegarty [1980] ILRM 124

• Fitzgerald v. Ryan [1899] 2 IR 637

• Lassence v. Tierney (1849) 1 Mac & G 551

• O’Dwyer v. Keegan [1997] 2 IR 585

• Bank of Ireland v. Gaffin [1971] IR 213.

• In b. GM (1972) 106 ILTR 82

• MPD v. MD [1981] ILRM 179

• Re Urquhart [1974] IR 197](https://image.slidesharecdn.com/land-law-webinar-150410071652-conversion-gate01/85/Land-Law-Webinar-20-320.jpg)