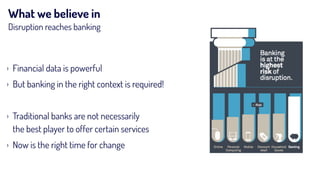

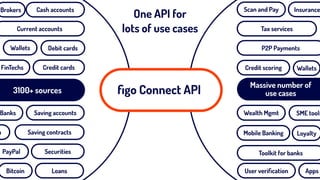

Figo is a European banking service provider that offers a comprehensive API to streamline access to financial data from over 99% of banks in Germany, enabling developers to integrate banking services into their applications efficiently. By addressing the complexities and inefficiencies of traditional banking interfaces, figo promotes innovation and facilitates the development of new banking-related products and services. The company also aligns with regulatory standards like PSD2, ensuring secure data handling and user control over their banking information.