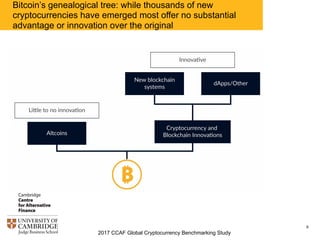

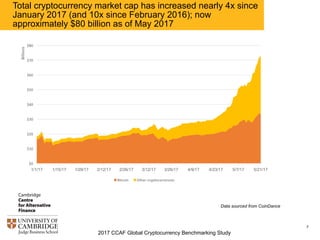

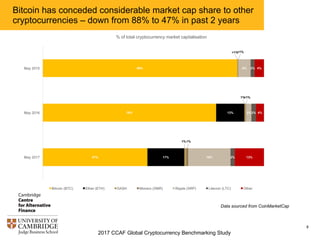

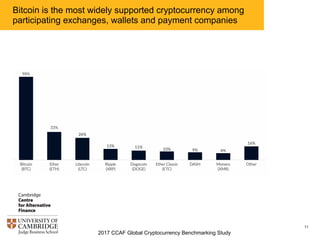

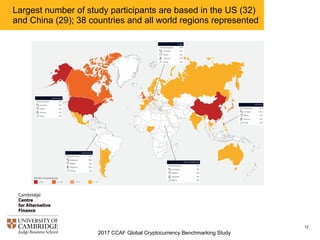

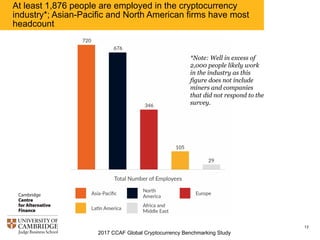

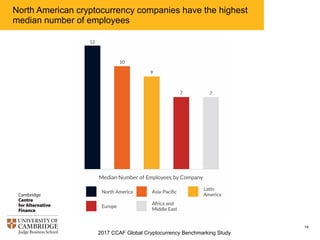

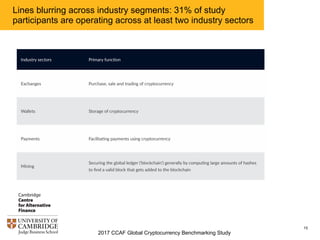

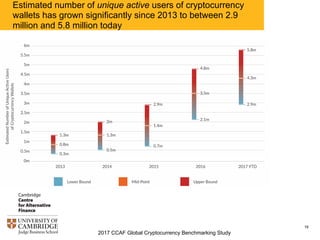

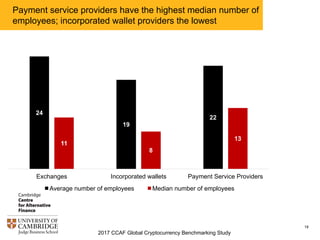

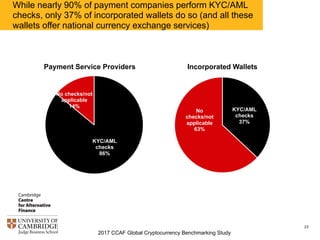

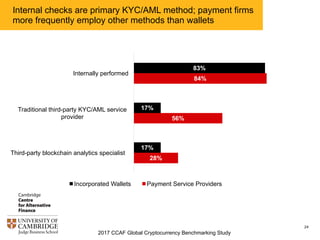

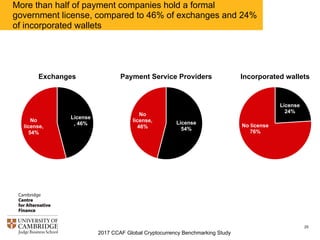

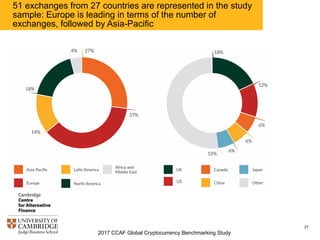

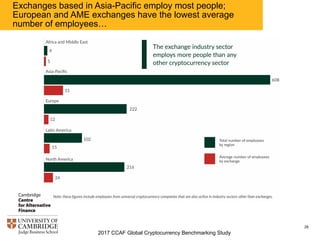

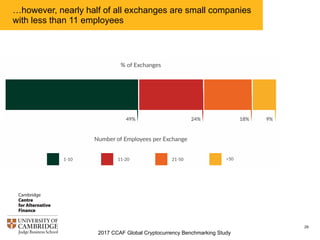

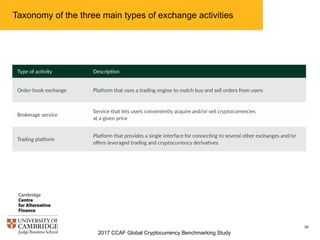

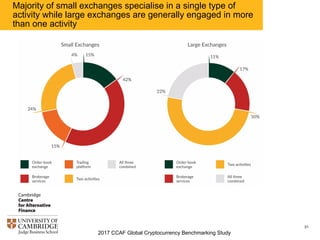

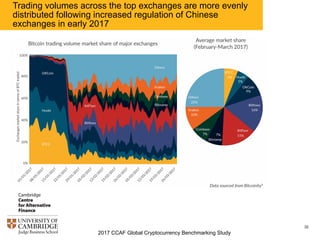

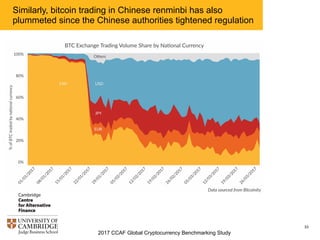

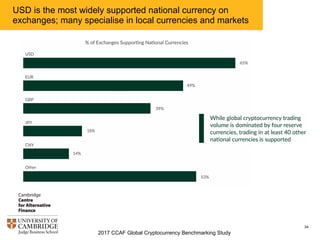

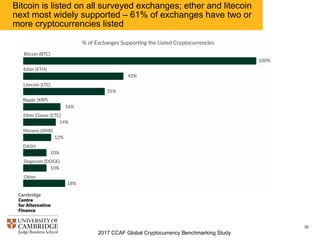

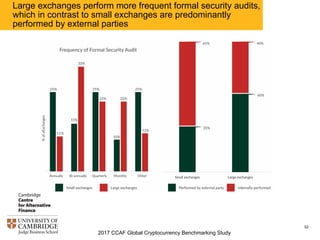

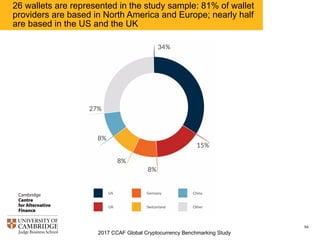

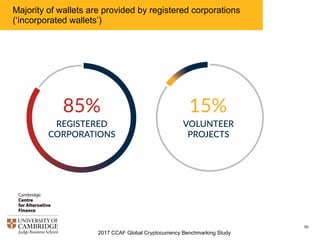

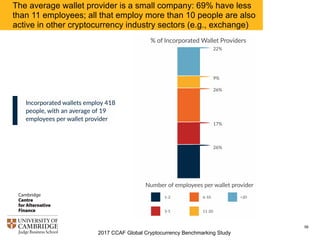

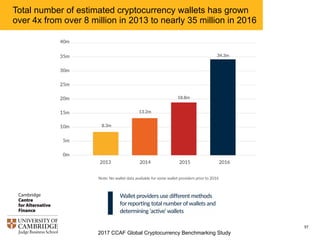

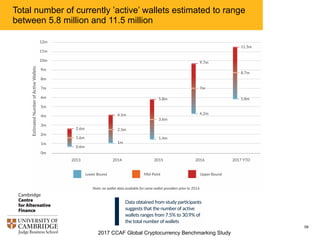

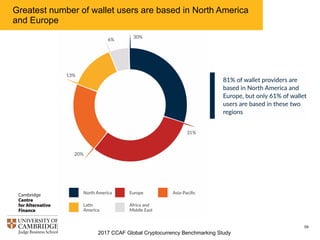

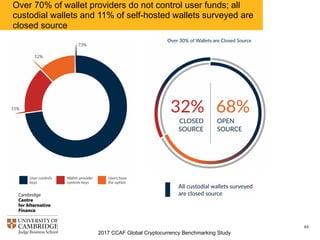

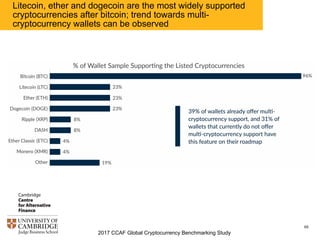

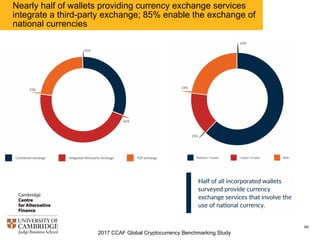

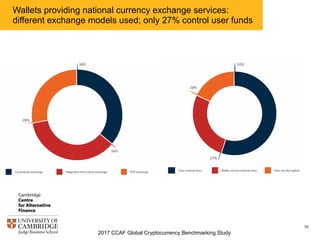

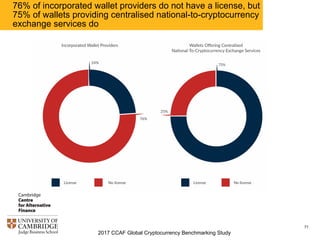

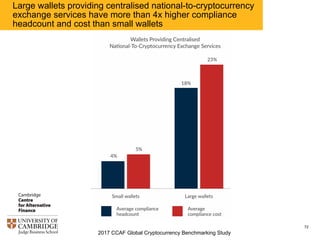

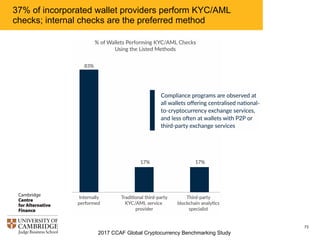

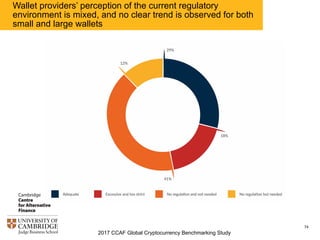

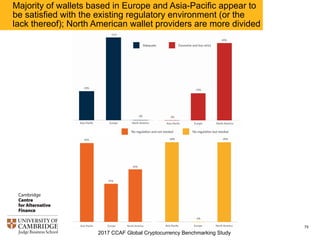

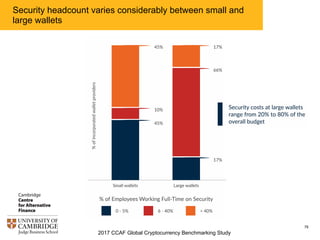

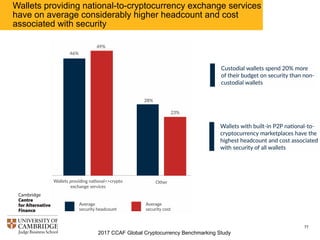

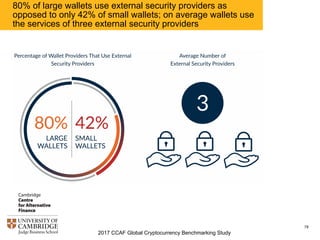

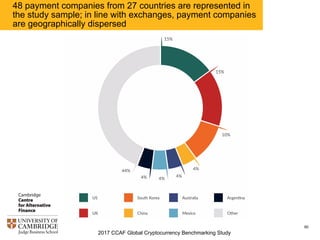

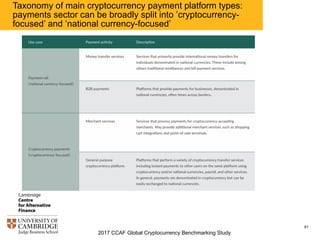

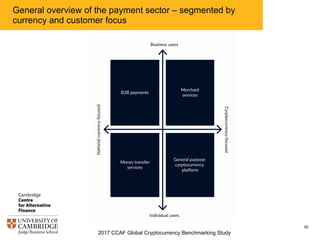

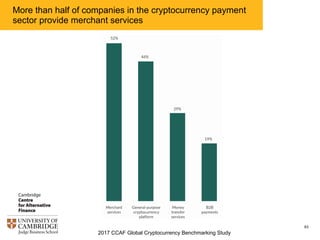

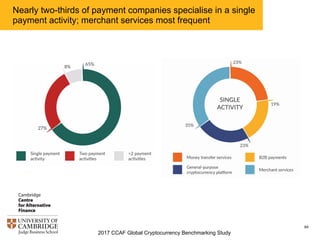

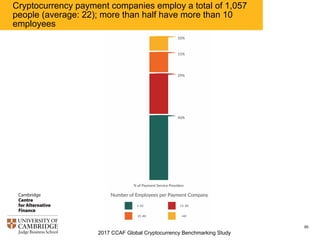

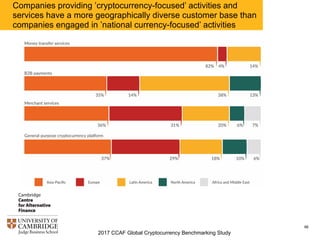

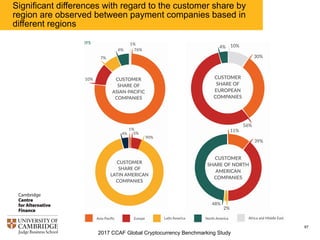

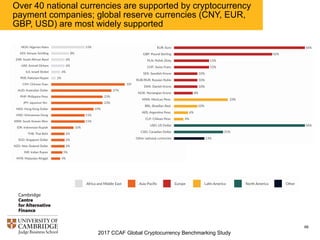

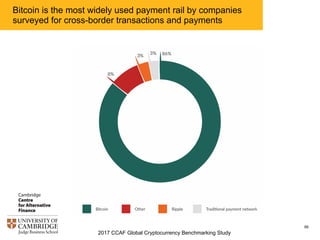

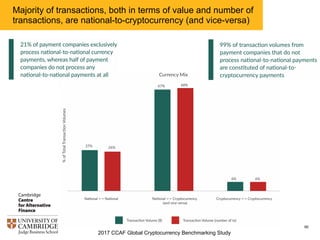

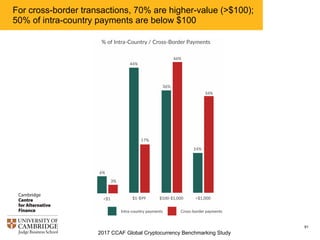

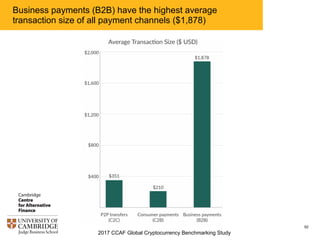

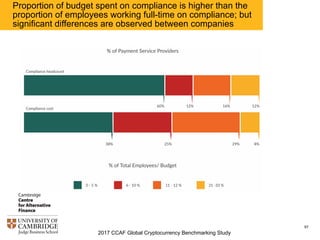

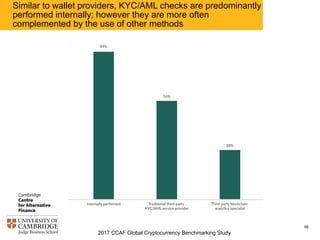

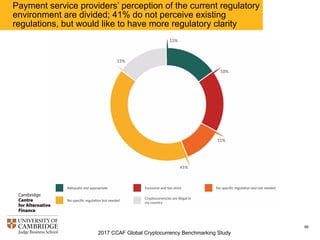

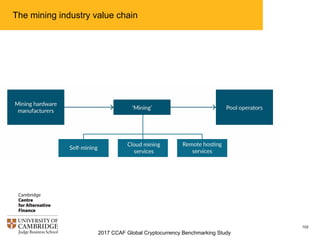

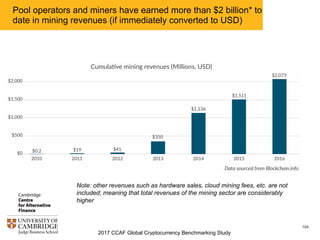

The 2017 CCAF Global Cryptocurrency Benchmarking Study analyzes over 100 cryptocurrency companies and individual miners, highlighting significant growth in market capitalization and the evolution of cryptocurrency usage. Bitcoin's market share has decreased while other cryptocurrencies like Monero and Ripple have gained traction. The study also reveals diverse employment patterns and operational characteristics across different sectors including exchanges, wallets, and payment service providers.