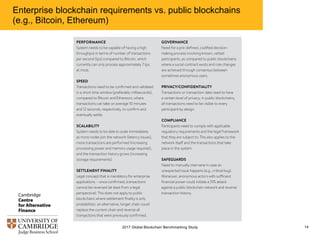

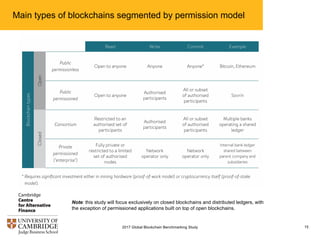

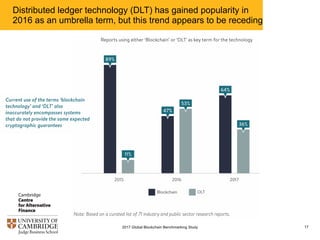

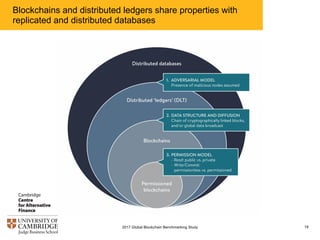

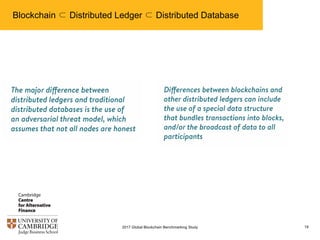

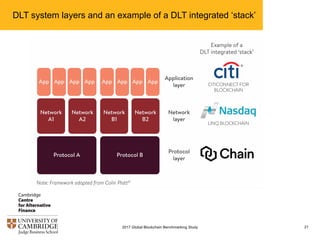

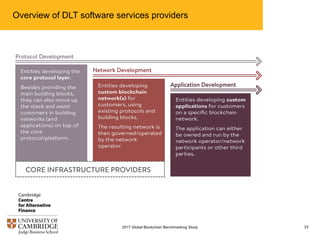

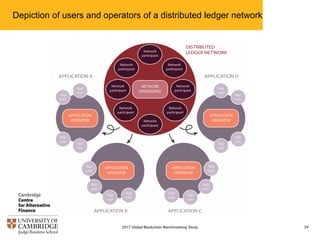

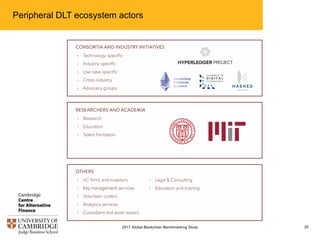

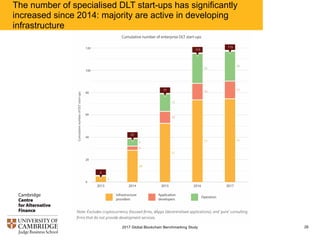

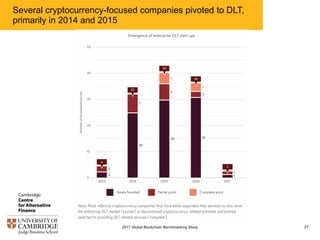

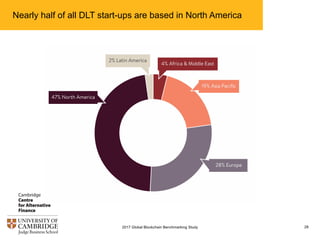

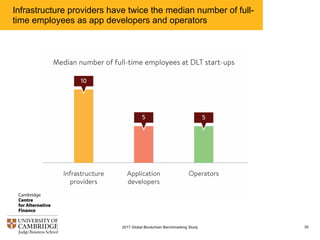

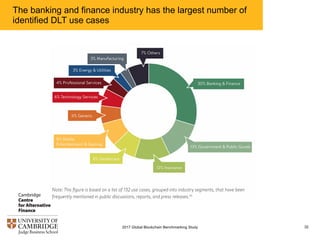

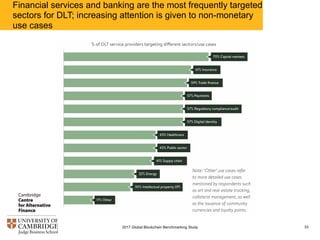

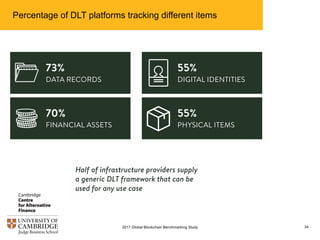

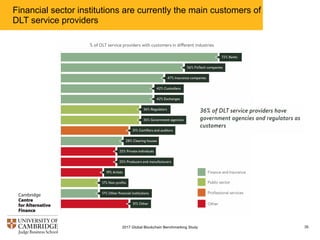

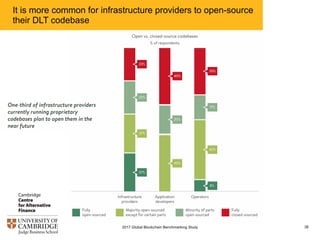

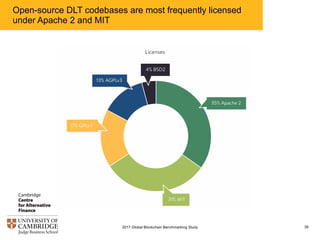

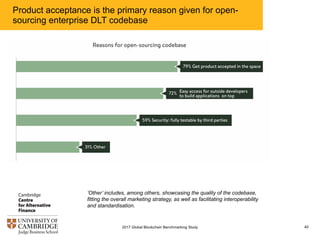

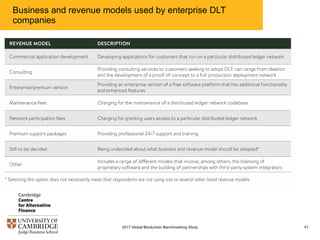

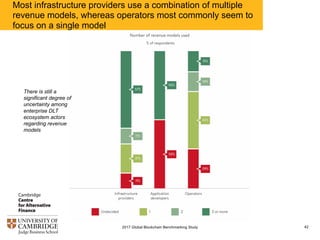

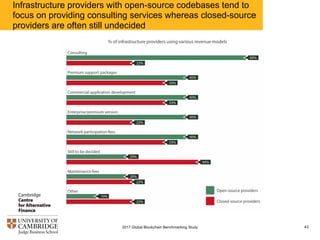

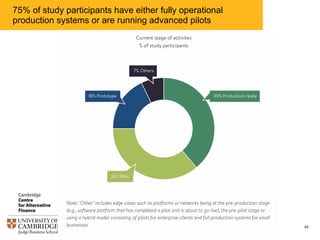

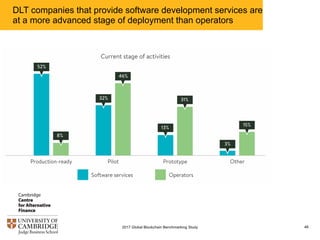

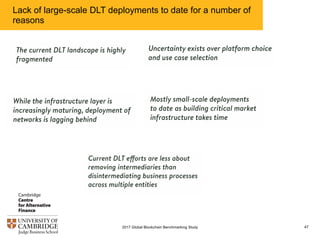

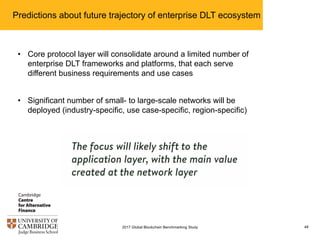

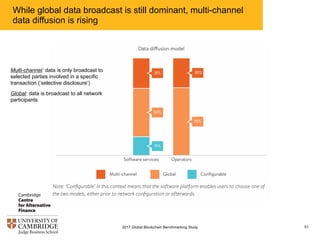

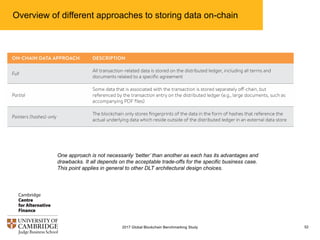

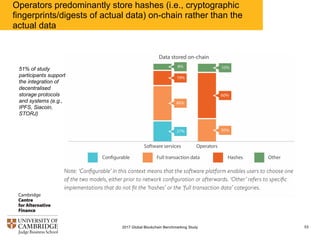

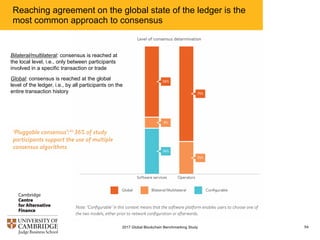

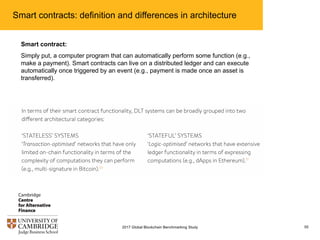

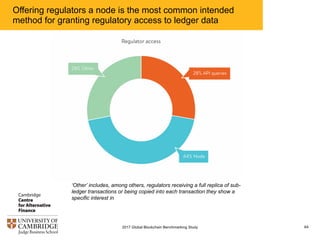

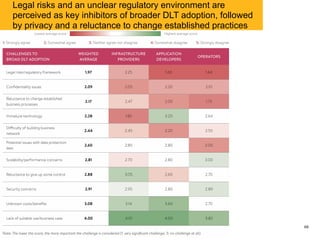

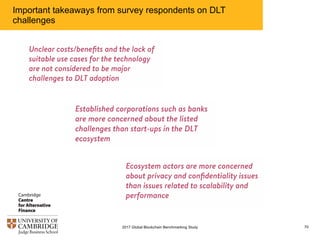

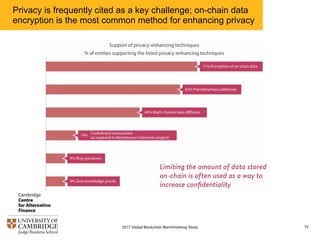

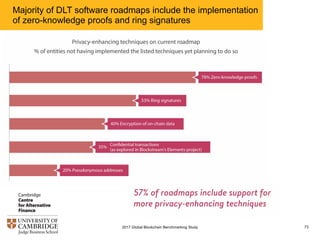

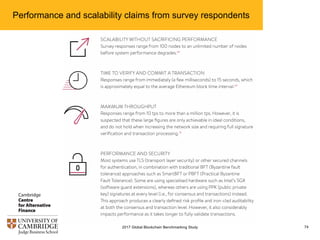

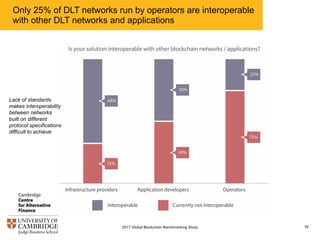

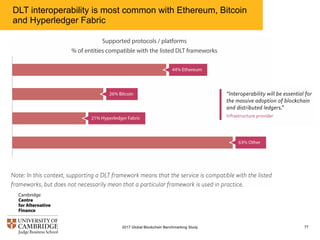

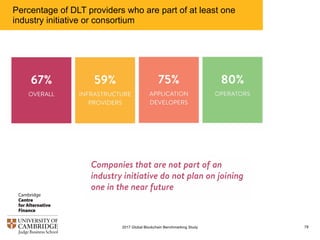

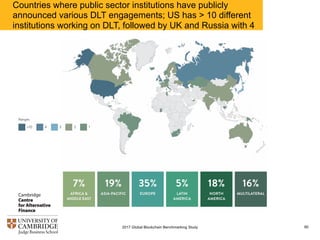

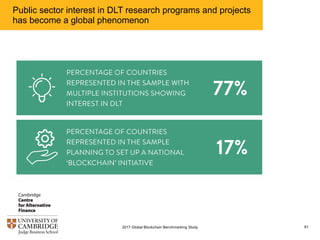

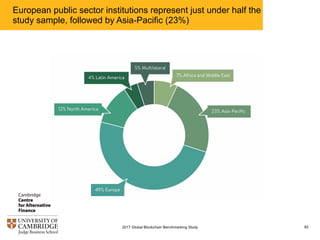

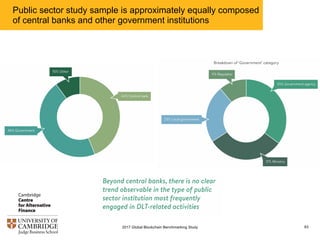

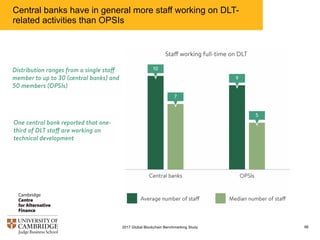

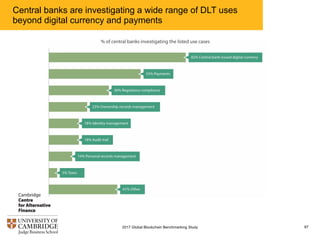

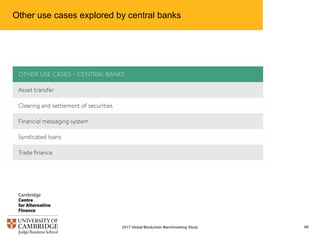

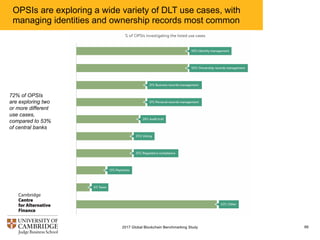

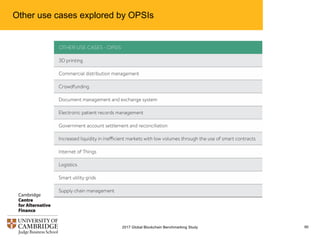

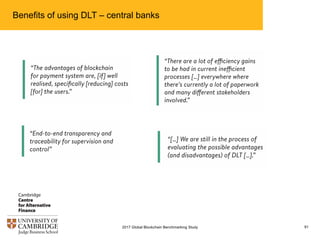

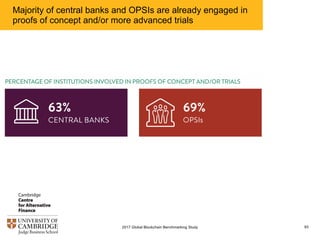

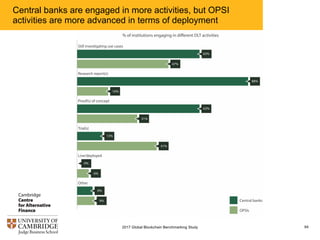

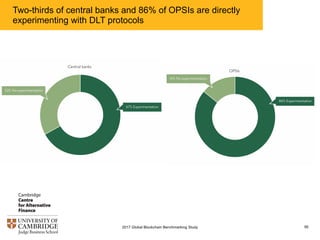

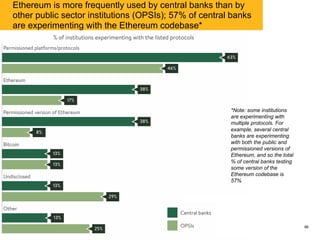

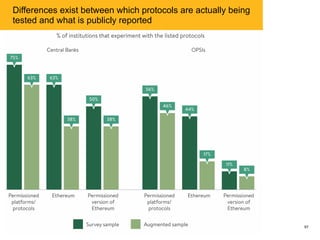

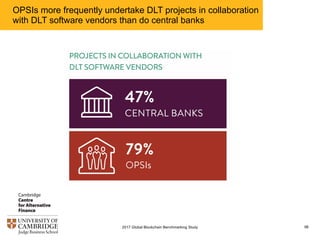

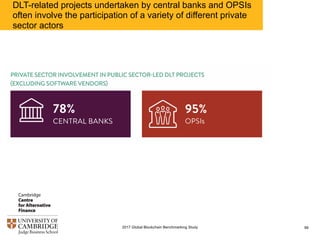

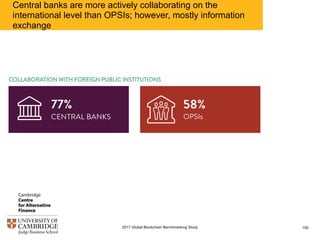

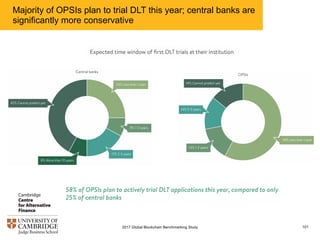

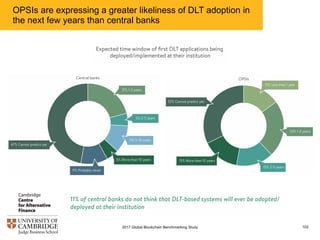

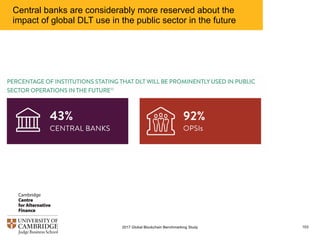

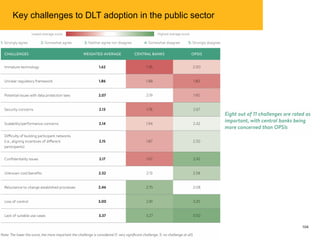

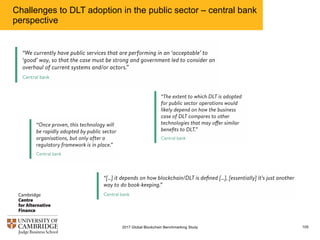

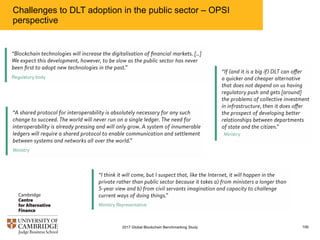

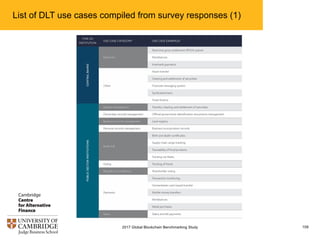

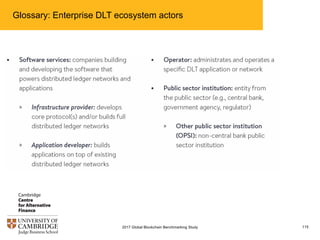

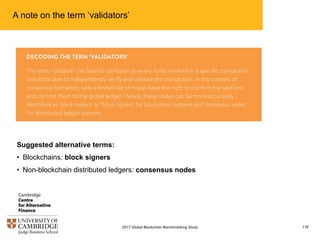

The 2017 Global Blockchain Benchmarking Study examines the distributed ledger technology (DLT) landscape, outlining components, use cases, and business models across various sectors, particularly in banking and finance. It identifies challenges to DLT adoption—including legal risks and privacy concerns—and highlights significant activity among public sector institutions globally, notably central banks. The study reveals a trend towards open-source development in the ecosystem and emphasizes the importance of interoperability among different DLT networks.