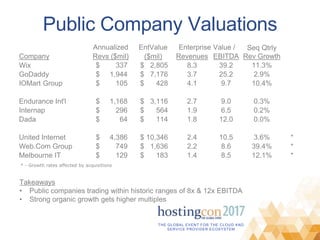

The document discusses valuation multiples for public cloud and hosting companies, noting they typically trade within 8-12x EBITDA. It also provides rules of thumb for private market valuations, such as consolidating shared/VPS acquisitions at around 1x revenues and larger EBITDA deals from 5-8x EBITDA. Significant recent transactions include Rackspace's buyout at 7x EBITDA and GoDaddy's acquisition of HostEurope Group at 12.1x EBITDA.