AssetsLiabilitiesTotal Reserves$50,000Demand Deposits$18.docx

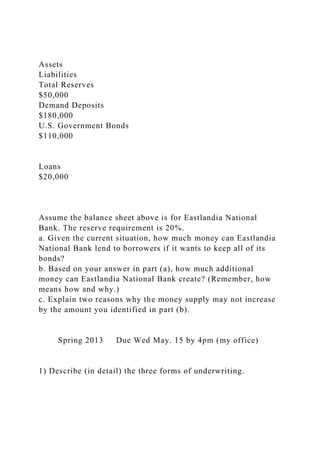

- 1. Assets Liabilities Total Reserves $50,000 Demand Deposits $180,000 U.S. Government Bonds $110,000 Loans $20,000 Assume the balance sheet above is for Eastlandia National Bank. The reserve requirement is 20%. a. Given the current situation, how much money can Eastlandia National Bank lend to borrowers if it wants to keep all of its bonds? b. Based on your answer in part (a), how much additional money can Eastlandia National Bank create? (Remember, how means how and why.) c. Explain two reasons why the money supply may not increase by the amount you identified in part (b). Spring 2013 Due Wed May. 15 by 4pm (my office) 1) Describe (in detail) the three forms of underwriting.

- 2. 2) You want to set up an education trust for a relative starting in 2014. The trust will pay $25,000 a year starting in year 2022 and ending in year 2025. The stated annual percentage rate is 8% compounded annually. a. How much will you have to invest in 2010 to achieve your objective? b. How much will you have to invest each year from 2012 – 2017 to achieve your objective? 3) Samuelson Plastics has 7.5 percent preferred stock outstanding. Currently, this stock has a market value per share of $52 and a book value per share of $38. What is the cost of preferred stock? 4) Tidewater Fishing has a current beta of 1.21. The market risk premium is 8.9 percent and the risk-free rate of return is 3.2 percent. By how much will the cost of equity increase if the company expands its operations such that the company beta rises to 1.50?

- 3. 5) Penn Corporation does not currently pay dividends. It is expected to begin paying dividends in year three (3) with a $2.50 dividend. This dividend is expected to grow at a rate of 14% for three years and then 6% every year after that forever. The required return on Penn’s stock is 16%. Calculate the price of Penn’s stock today. 6) Suppose Primerica has just paid a dividend of $1.75 per share. Sales and profits for Primerica are expected to grow at a rate of 5% per year. Its dividend is expected to grow by the same amount. If the required return is 12%, what is the value of a share of Primerica in 6 years? 7) IPOs typically experience underpricing. Describe (1) what is underpricing, (2) the evidence that underpricing occurs (be sure to include real world numbers/examples), and (3) why does underpricing occur.

- 4. 8) Adelson's Electric had beginning long-term debt of $42,511 and ending long-term debt of $48,919. The beginning and ending total debt balances were $84,652 and $78,613, respectively. The interest paid was $4,767. What is the amount of the cash flow to creditors? 9) You arrived at work today to see the CFO, COO and most of the company’s top management team taken away in handcuffs. The only executive who was not arrested was the newly appointed CEO. Before you can even reach your cube, the CEO calls you into his office to explain some incomplete project analysis left on the CFO’s desk. Below are the two mutually exclusive projects under consideration. Year Project A Project B 0 (171,000.00) (198,000.00) 1

- 5. 46,000.00 55,000.00 2 79,000.00 34,000.00 3 51,000.00 120,000.00 4 65,000.00 25,000.00 5 23,000.00 75,000.00 IRR 17.82% 16.22% While a marketing genius, the CEO has very little experience in finance, and would like to simply choose ‘Project A’ because “it earns a higher return for the company.” a. Explain (in words and graphically) why the CEO’s reasoning could be flawed.

- 6. b. If your firm has a cost of capital of 8%, how much value will the firm lose out on by choosing the project with the highest IRR? 10) Wind Power Systems has 20-year, semi-annual bonds outstanding with a 5 percent coupon. The face amount of each bond is $1,000. These bonds are currently selling for 114 percent of face value. What is the company's pre-tax cost of debt? If the company has a 38% marginal tax rate, what is its after tax cost of debt? 11) National Home Rentals has a beta of 1.24, a stock price of $22, and recently paid an annual dividend of $0.94 a share. The dividend growth rate is 4.5 percent. The market has a 10.6 percent rate of return and a risk premium of 7.5 percent. What is the firm's cost of equity? 12) The Daily News had net income of $121,600 of which 40

- 7. percent was distributed to the shareholders as dividends. During the year, the company sold $75,000 worth of common stock. What is the cash flow to stockholders? 13) Phillips Equipment has 80,000 bonds outstanding with a par value of $1,000 each and a quoted price of 103. The bonds carry a 7.75% coupon that is payable semiannually and mature in 25 years. The company also has 750,000 shares of 7 percent preferred stock and 2.5 million shares of common stock outstanding. The preferred stock sells for $65 a share. The common stock has a beta of 1.34 and sells for $42 a share. The U.S. Treasury bill is yielding 2.8 percent and the return on the market is 11.2 percent. The corporate tax rate is 38 percent. What is the firm's weighted average cost of capital?

- 8. 14) Consider a project that costs $100,000 to start and has cash flows of $45,000 in year 1, $65,000 in year 2, and $34,000 in year 3. a. If your firm’s cost of capital is 10%, what is the NPV and IRR for this project? b. What is this projects payback period? c. Now assume that you have calculated annual net income figures of $11,666 in year 1, $51,666 in year 2, and $-19,333 in year 3 for this project. If the average book value of the project is $50,000, what is the Average Accounting Return? 15) R.S. Green has 250,000 shares of common stock outstanding at a market price of $28 a share. Next year's annual dividend is expected to be $1.55 a share. The dividend growth rate is 2

- 9. percent. The firm also has 7,500 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 7.5 years. The bonds are selling at 98 percent of face value. The company's tax rate is 34 percent. What is the firm's weighted average cost of capital? 16) MacLeod Manufacturing Company is trying to calculate its cost of capital for use in making capital budgeting decisions. Mr. Bailey, the vice-president of finance, has given you the following information and has asked you to compute the weighted average cost of capital. The company currently has outstanding a bond with a 10.6% coupon rate and another bond with an 8.2% coupon rate. The firm as been informed by its investment banker that bonds of equal risk and credit rating are now selling to yield 11.5%. The common stock has a price of $60 and an expected dividend of $1.95 per share. The last four per share dividends paid by the company have been $1.80, $1.64, $1.49, and $1.35. The preferred stock is selling for $80 per share and pays a dividend of $7.60 per share. The corporate tax rate is 30%, and the target (or optimal) capital structure is 25% debt, 10% preferred stock, and 65% common stock. What is MacLeod’s weighted average cost of capital?

- 10. 17) R.S. Green has 250,000 shares of common stock outstanding at a market price of $28 a share. Next year's annual dividend is expected to be $1.55 a share. The dividend growth rate is 2 percent. The firm also has 7,500 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 7.5 years. The bonds are selling at 98 percent of face value. The company's tax rate is 34 percent. What is the firm's weighted average cost of capital?

- 11. 18) You want to buy a house for $350,000. The bank will loan you 85% of the purchase price. The mortgage terms are “30 years, monthly payments, and 9% APR.” a. How much will your monthly mortgage payments be? b. In order to purchase the house you have to come up with a down payment (i.e. portion of the house price that the bank will not lend you). Despite saving for a few years, you are forced to borrow half of the down payment from your parents. You and your parents agree to the following terms for the loan 3% APR, paid back in 10 years with monthly payments. What are the monthly payments you will make to your parents? c. Over the next 30 years, assuming that you stay in the house, how much will you have paid, in total, for the house?

- 12. 19) When projects have large costs associated with wrapping them up (i.e. a mine or nuclear power plant, etc…) it is possible to calculate multiple IRRs (i.e. two discount rates that result in an NPV of $0.00). Your boss just emailed you the NPV profile for a proposed copper mine project, but he is confused about what it tells us. (3) What should you tell your boss about how to interpret the above curve? 20) Travis & Sons has a capital structure which is based on 40

- 13. percent debt, 5 percent preferred stock, and 55 percent common stock. The pre-tax cost of debt is 7.5 percent, the cost of preferred is 9 percent, and the cost of common stock is 13 percent. The company's tax rate is 39 percent. The company is considering a project that is equally as risky as the overall firm. This project has initial costs of $325,000 and annual cash inflows of $87,000, $279,000, and $116,000 over the next three years, respectively. What is the projected net present value of this project? NPV Profile 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 -4000 0 3299.73114106711 3274.1830259823182 1941.2294238683389 0 -2818.6499610819592 - 5694.9686132888019 Spring 2013 Due Wed May. 15 by 4pm (my office) 1) Describe (in detail) the three forms of underwriting. 2) You want to set up an education trust for a relative starting in 2014. The trust will pay $25,000 a year starting in year 2022 and ending in year 2025. The stated annual percentage rate is 8% compounded annually. a. How much will you have to invest in 2010 to achieve your objective?

- 14. b. How much will you have to invest each year from 2012 – 2017 to achieve your objective? 3) Samuelson Plastics has 7.5 percent preferred stock outstanding. Currently, this stock has a market value per share of $52 and a book value per share of $38. What is the cost of preferred stock? 4) Tidewater Fishing has a current beta of 1.21. The market risk premium is 8.9 percent and the risk-free rate of return is 3.2 percent. By how much will the cost of equity increase if the company expands its operations such that the company beta rises to 1.50? 5) Penn Corporation does not currently pay dividends. It is expected to begin paying dividends in year three (3) with a $2.50 dividend. This dividend is expected to grow at a rate of 14% for three years and then 6% every year after that forever. The required return on Penn’s stock is 16%. Calculate the price of Penn’s stock today.

- 15. 6) Suppose Primerica has just paid a dividend of $1.75 per share. Sales and profits for Primerica are expected to grow at a rate of 5% per year. Its dividend is expected to grow by the same amount. If the required return is 12%, what is the value of a share of Primerica in 6 years? 7) IPOs typically experience underpricing. Describe (1) what is underpricing, (2) the evidence that underpricing occurs (be sure to include real world numbers/examples), and (3) why does underpricing occur. 8) Adelson's Electric had beginning long-term debt of $42,511 and ending long-term debt of $48,919. The beginning and

- 16. ending total debt balances were $84,652 and $78,613, respectively. The interest paid was $4,767. What is the amount of the cash flow to creditors? 9) You arrived at work today to see the CFO, COO and most of the company’s top management team taken away in handcuffs. The only executive who was not arrested was the newly appointed CEO. Before you can even reach your cube, the CEO calls you into his office to explain some incomplete project analysis left on the CFO’s desk. Below are the two mutually exclusive projects under consideration. Year Project A Project B 0 (171,000.00) (198,000.00) 1 46,000.00 55,000.00 2 79,000.00 34,000.00 3 51,000.00 120,000.00 4 65,000.00 25,000.00

- 17. 5 23,000.00 75,000.00 IRR 17.82% 16.22% While a marketing genius, the CEO has very little experience in finance, and would like to simply choose ‘Project A’ because “it earns a higher return for the company.” a. Explain (in words and graphically) why the CEO’s reasoning could be flawed. b. If your firm has a cost of capital of 8%, how much value will the firm lose out on by choosing the project with the highest IRR?

- 18. 10) Wind Power Systems has 20-year, semi-annual bonds outstanding with a 5 percent coupon. The face amount of each bond is $1,000. These bonds are currently selling for 114 percent of face value. What is the company's pre-tax cost of debt? If the company has a 38% marginal tax rate, what is its after tax cost of debt? 11) National Home Rentals has a beta of 1.24, a stock price of $22, and recently paid an annual dividend of $0.94 a share. The dividend growth rate is 4.5 percent. The market has a 10.6 percent rate of return and a risk premium of 7.5 percent. What is the firm's cost of equity? 12) The Daily News had net income of $121,600 of which 40 percent was distributed to the shareholders as dividends. During the year, the company sold $75,000 worth of common stock. What is the cash flow to stockholders? 13) Phillips Equipment has 80,000 bonds outstanding with a par

- 19. value of $1,000 each and a quoted price of 103. The bonds carry a 7.75% coupon that is payable semiannually and mature in 25 years. The company also has 750,000 shares of 7 percent preferred stock and 2.5 million shares of common stock outstanding. The preferred stock sells for $65 a share. The common stock has a beta of 1.34 and sells for $42 a share. The U.S. Treasury bill is yielding 2.8 percent and the return on the market is 11.2 percent. The corporate tax rate is 38 percent. What is the firm's weighted average cost of capital? 14) Consider a project that costs $100,000 to start and has cash flows of $45,000 in year 1, $65,000 in year 2, and $34,000 in year 3. a. If your firm’s cost of capital is 10%, what is the NPV and IRR for this project?

- 20. b. What is this projects payback period? c. Now assume that you have calculated annual net income figures of $11,666 in year 1, $51,666 in year 2, and $-19,333 in year 3 for this project. If the average book value of the project is $50,000, what is the Average Accounting Return? 15) R.S. Green has 250,000 shares of common stock outstanding at a market price of $28 a share. Next year's annual dividend is expected to be $1.55 a share. The dividend growth rate is 2 percent. The firm also has 7,500 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 7.5 years. The bonds are selling at 98 percent of face value. The company's tax rate is 34 percent. What is the firm's weighted average cost of capital?

- 21. 16) MacLeod Manufacturing Company is trying to calculate its cost of capital for use in making capital budgeting decisions. Mr. Bailey, the vice-president of finance, has given you the following information and has asked you to compute the weighted average cost of capital. The company currently has outstanding a bond with a 10.6% coupon rate and another bond with an 8.2% coupon rate. The firm as been informed by its investment banker that bonds of equal risk and credit rating are now selling to yield 11.5%. The common stock has a price of $60 and an expected dividend of $1.95 per share. The last four per share dividends paid by the company have been $1.80, $1.64, $1.49, and $1.35. The preferred stock is selling for $80 per share and pays a dividend of $7.60 per share. The corporate tax rate is 30%, and the target (or optimal) capital structure is 25% debt, 10% preferred stock, and 65% common stock. What is MacLeod’s weighted average cost of capital? 17) R.S. Green has 250,000 shares of common stock outstanding

- 22. at a market price of $28 a share. Next year's annual dividend is expected to be $1.55 a share. The dividend growth rate is 2 percent. The firm also has 7,500 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 7.5 years. The bonds are selling at 98 percent of face value. The company's tax rate is 34 percent. What is the firm's weighted average cost of capital? 18) You want to buy a house for $350,000. The bank will loan you 85% of the purchase price. The mortgage terms are “30 years, monthly payments, and 9% APR.” a. How much will your monthly mortgage payments be?

- 23. b. In order to purchase the house you have to come up with a down payment (i.e. portion of the house price that the bank will not lend you). Despite saving for a few years, you are forced to borrow half of the down payment from your parents. You and your parents agree to the following terms for the loan 3% APR, paid back in 10 years with monthly payments. What are the monthly payments you will make to your parents? c. Over the next 30 years, assuming that you stay in the house, how much will you have paid, in total, for the house?

- 24. 19) When projects have large costs associated with wrapping them up (i.e. a mine or nuclear power plant, etc…) it is possible to calculate multiple IRRs (i.e. two discount rates that result in an NPV of $0.00). Your boss just emailed you the NPV profile for a proposed copper mine project, but he is confused about what it tells us. (3) What should you tell your boss about how to interpret the above curve? 20) Travis & Sons has a capital structure which is based on 40 percent debt, 5 percent preferred stock, and 55 percent common stock. The pre-tax cost of debt is 7.5 percent, the cost of preferred is 9 percent, and the cost of common stock is 13 percent. The company's tax rate is 39 percent. The company is considering a project that is equally as risky as the overall firm. This project has initial costs of $325,000 and annual cash inflows of $87,000, $279,000, and $116,000 over the next three years, respectively. What is the projected net present value of this project?

- 25. NPV Profile 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 -4000 0 3299.73114106711 3274.1830259823182 1941.2294238683389 0 -2818.6499610819592 - 5694.9686132888019