Embed presentation

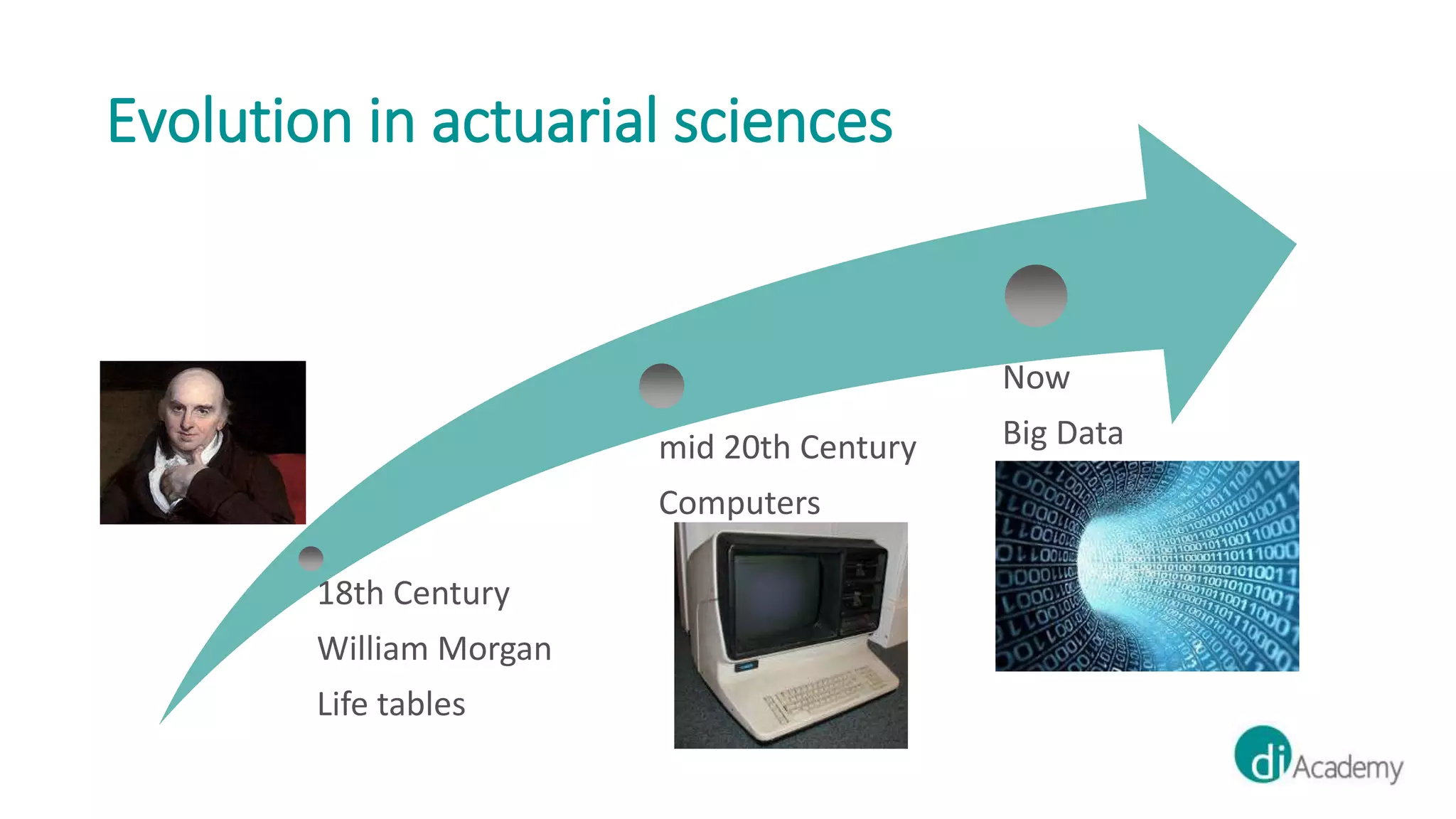

The document discusses how data science is revolutionizing the fintech and insurtech sectors through advancements such as big data, telematics, and predictive analytics. It highlights the evolution of actuarial sciences and the growing demand for data scientists, emphasizing the need for specialized training programs. Additionally, it mentions various applications of data science, including fraud detection and unstructured data analysis.