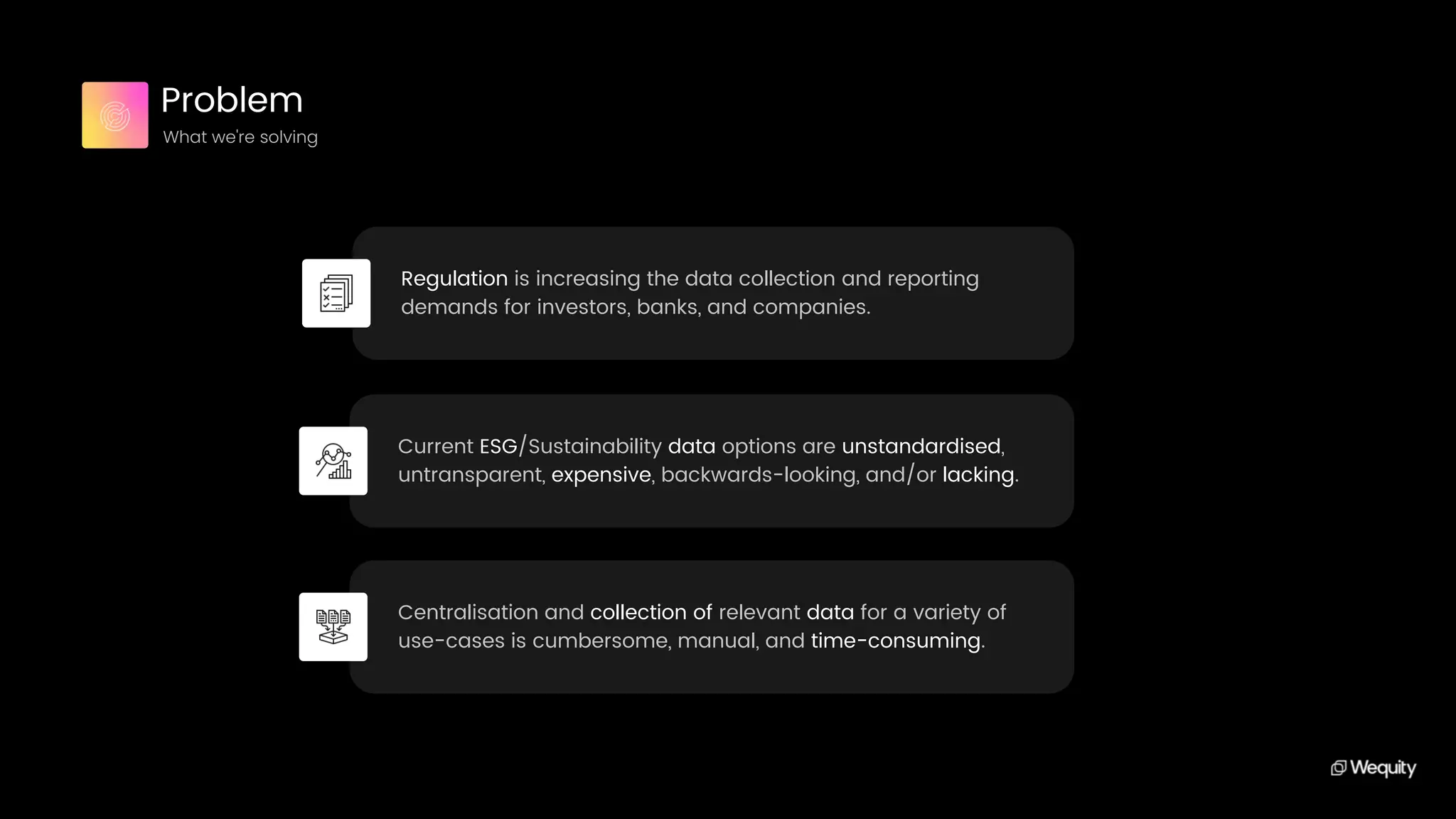

Wequity offers an AI-powered, no-code ESG data platform that enables companies and financial institutions to efficiently collect, centralize, and visualize ESG data, catering to various reporting and monitoring needs. The platform simplifies the ESG data management process with pre-built templates and can be integrated with existing data systems, significantly reducing the time and costs associated with traditional solutions. The market for ESG data is projected to grow, with Wequity targeting a total addressable market of €2.4 billion by offering a user-friendly and customizable tool for ESG insights.