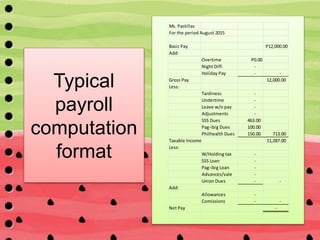

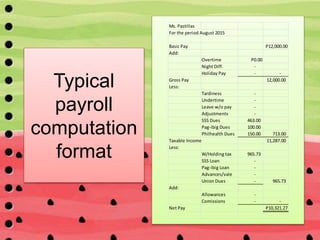

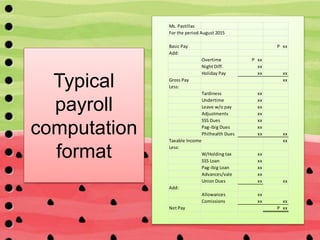

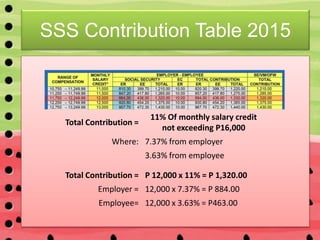

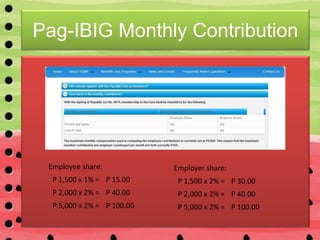

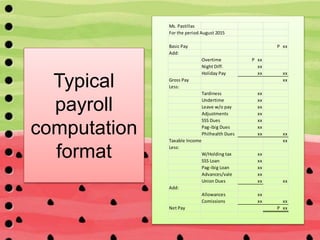

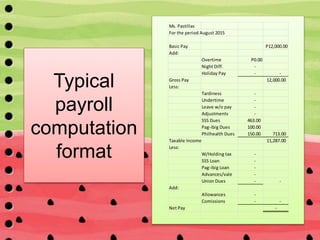

The document outlines the payroll computation format for Ms. Pastillas for the period of August 2015. It details her basic pay of 12,000 pesos and deductions for SSS, Pag-IBIG, and Philhealth contributions totaling 713 pesos. Her taxable income is calculated to be 11,287 pesos. After applying the withholding tax table, her withholding tax is calculated to be 965.73 pesos. Her net pay for the period is 10,321.27 pesos.

![Withholding Tax Tables

Withholding Tax =

[(Taxable Income - Bracket or Exemption) x %over]

+ Bracket Tax or Base Tax

= [(P11,287 – 10,000) x 20%] + 708.33

= [(1,287) x 20%] + 708.33

= [257.40] + 708.33

= P 965.73](https://image.slidesharecdn.com/computesalary-151015093842-lva1-app6892/85/How-to-Compute-your-Salary-14-320.jpg)