Measuring the return from pharmaceutical innovation 2014

•

1 like•6,219 views

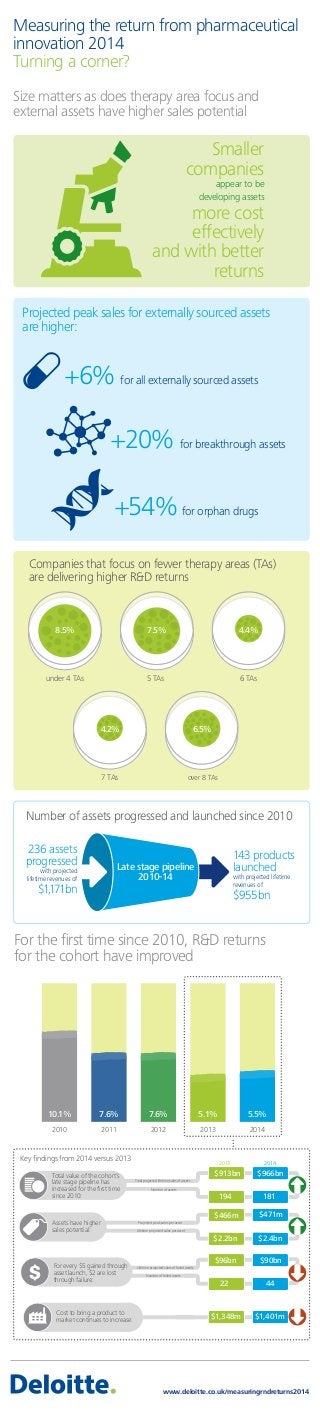

The fifth annual study of the pharmaceutical industry’s performance in generating a return from its significant investment in R&D. The report allows industry leaders to understand the drivers of successful R&D strategies that are tangible and, most importantly, actionable. Read the full report at www.deloitte.co.uk/measuringrndreturns2014

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

More from Deloitte UK

More from Deloitte UK (20)

The COVID-19 crisis: Economic impact and policy responses

The COVID-19 crisis: Economic impact and policy responses

Recently uploaded

Models Call Girls In Hyderabad 9630942363 Hyderabad Call Girl & Hyderabad Esc...

Models Call Girls In Hyderabad 9630942363 Hyderabad Call Girl & Hyderabad Esc...GENUINE ESCORT AGENCY

🌹Attapur⬅️ Vip Call Girls Hyderabad 📱9352852248 Book Well Trand Call Girls In...

🌹Attapur⬅️ Vip Call Girls Hyderabad 📱9352852248 Book Well Trand Call Girls In...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Recently uploaded (20)

Manyata Tech Park ( Call Girls ) Bangalore ✔ 6297143586 ✔ Hot Model With Sexy...

Manyata Tech Park ( Call Girls ) Bangalore ✔ 6297143586 ✔ Hot Model With Sexy...

Call Girls Hyderabad Just Call 8250077686 Top Class Call Girl Service Available

Call Girls Hyderabad Just Call 8250077686 Top Class Call Girl Service Available

Call Girls Rishikesh Just Call 8250077686 Top Class Call Girl Service Available

Call Girls Rishikesh Just Call 8250077686 Top Class Call Girl Service Available

Russian Call Girls Service Jaipur {8445551418} ❤️PALLAVI VIP Jaipur Call Gir...

Russian Call Girls Service Jaipur {8445551418} ❤️PALLAVI VIP Jaipur Call Gir...

Jogeshwari ! Call Girls Service Mumbai - 450+ Call Girl Cash Payment 90042684...

Jogeshwari ! Call Girls Service Mumbai - 450+ Call Girl Cash Payment 90042684...

Call Girl in Indore 8827247818 {LowPrice} ❤️ (ahana) Indore Call Girls * UPA...

Call Girl in Indore 8827247818 {LowPrice} ❤️ (ahana) Indore Call Girls * UPA...

(Low Rate RASHMI ) Rate Of Call Girls Jaipur ❣ 8445551418 ❣ Elite Models & Ce...

(Low Rate RASHMI ) Rate Of Call Girls Jaipur ❣ 8445551418 ❣ Elite Models & Ce...

Premium Call Girls In Jaipur {8445551418} ❤️VVIP SEEMA Call Girl in Jaipur Ra...

Premium Call Girls In Jaipur {8445551418} ❤️VVIP SEEMA Call Girl in Jaipur Ra...

Coimbatore Call Girls in Coimbatore 7427069034 genuine Escort Service Girl 10...

Coimbatore Call Girls in Coimbatore 7427069034 genuine Escort Service Girl 10...

Mumbai ] (Call Girls) in Mumbai 10k @ I'm VIP Independent Escorts Girls 98333...![Mumbai ] (Call Girls) in Mumbai 10k @ I'm VIP Independent Escorts Girls 98333...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Mumbai ] (Call Girls) in Mumbai 10k @ I'm VIP Independent Escorts Girls 98333...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Mumbai ] (Call Girls) in Mumbai 10k @ I'm VIP Independent Escorts Girls 98333...

VIP Hyderabad Call Girls Bahadurpally 7877925207 ₹5000 To 25K With AC Room 💚😋

VIP Hyderabad Call Girls Bahadurpally 7877925207 ₹5000 To 25K With AC Room 💚😋

Models Call Girls In Hyderabad 9630942363 Hyderabad Call Girl & Hyderabad Esc...

Models Call Girls In Hyderabad 9630942363 Hyderabad Call Girl & Hyderabad Esc...

Call Girls Service Jaipur {8445551418} ❤️VVIP BHAWNA Call Girl in Jaipur Raja...

Call Girls Service Jaipur {8445551418} ❤️VVIP BHAWNA Call Girl in Jaipur Raja...

🌹Attapur⬅️ Vip Call Girls Hyderabad 📱9352852248 Book Well Trand Call Girls In...

🌹Attapur⬅️ Vip Call Girls Hyderabad 📱9352852248 Book Well Trand Call Girls In...

Call Girls Hosur Just Call 9630942363 Top Class Call Girl Service Available

Call Girls Hosur Just Call 9630942363 Top Class Call Girl Service Available

Call Girls Raipur Just Call 9630942363 Top Class Call Girl Service Available

Call Girls Raipur Just Call 9630942363 Top Class Call Girl Service Available

Call Girl In Pune 👉 Just CALL ME: 9352988975 💋 Call Out Call Both With High p...

Call Girl In Pune 👉 Just CALL ME: 9352988975 💋 Call Out Call Both With High p...

Premium Bangalore Call Girls Jigani Dail 6378878445 Escort Service For Hot Ma...

Premium Bangalore Call Girls Jigani Dail 6378878445 Escort Service For Hot Ma...

Top Rated Hyderabad Call Girls Erragadda ⟟ 9332606886 ⟟ Call Me For Genuine ...

Top Rated Hyderabad Call Girls Erragadda ⟟ 9332606886 ⟟ Call Me For Genuine ...

Coimbatore Call Girls in Thudiyalur : 7427069034 High Profile Model Escorts |...

Coimbatore Call Girls in Thudiyalur : 7427069034 High Profile Model Escorts |...

Measuring the return from pharmaceutical innovation 2014

- 1. Size matters as does therapy area focus and external assets have higher sales potential Measuring the return from pharmaceutical innovation 2014 Turning a corner? Companies that focus on fewer therapy areas (TAs) are delivering higher R&D returns 8.5% under 4 TAs 7.5% 5 TAs 4.4% 6 TAs 4.2% 7 TAs 6.5% over 8 TAs Number of assets progressed and launched since 2010 143 products launched with projected lifetime revenues of $955bn Late stage pipeline 2010-14 236 assets progressed with projected lifetime revenues of $1,171bn For the first time since 2010, R&D returns for the cohort have improved Key findings from 2014 versus 2013 2010 2011 2012 2013 2014 10.1% 7.6% 7.6% 5.1% 5.5% Cost to bring a product to market continues to increase: $1,348m $1,401m $96bn $90bn 22 44 For every $5 gained through asset launch, $2 are lost through failure: Assets have higher sales potential: Projected peak sales per asset Lifetime projected sales of failed assets Lifetime projected sales per asset Number of failed assets $466m $471m $2.2bn $2.4bn 20142013 Total value of the cohort’s late stage pipeline has increased for the first time since 2010: Total projected lifetime sales of assets Number of assets $913bn 194 $966bn 181 Smaller companies appear to be developing assets more cost effectively and with better returns Projected peak sales for externally sourced assets are higher: +6% for all externally sourced assets +20% for breakthrough assets +54% for orphan drugs www.deloitte.co.uk/measuringrndreturns2014