BULLISH METAL PRICE LIFTS METALLIC PRODUCTION VALUE BY 14.11%

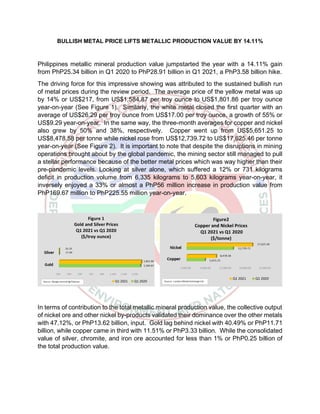

- 1. BULLISH METAL PRICE LIFTS METALLIC PRODUCTION VALUE BY 14.11% Philippines metallic mineral production value jumpstarted the year with a 14.11% gain from PhP25.34 billion in Q1 2020 to PhP28.91 billion in Q1 2021, a PhP3.58 billion hike. The driving force for this impressive showing was attributed to the sustained bullish run of metal prices during the review period. The average price of the yellow metal was up by 14% or US$217, from US$1,584.87 per troy ounce to US$1,801.86 per troy ounce year-on-year (See Figure 1). Similarly, the white metal closed the first quarter with an average of US$26.29 per troy ounce from US$17.00 per troy ounce, a growth of 55% or US$9.29 year-on-year. In the same way, the three-month averages for copper and nickel also grew by 50% and 38%, respectively. Copper went up from US$5,651.25 to US$8,478.58 per tonne while nickel rose from US$12,739.72 to US$17,625.46 per tonne year-on-year (See Figure 2). It is important to note that despite the disruptions in mining operations brought about by the global pandemic, the mining sector still managed to pull a stellar performance because of the better metal prices which was way higher than their pre-pandemic levels. Looking at silver alone, which suffered a 12% or 731 kilograms deficit in production volume from 6,335 kilograms to 5,603 kilograms year-on-year, it inversely enjoyed a 33% or almost a PhP56 million increase in production value from PhP169.67 million to PhP225.55 million year-on-year. In terms of contribution to the total metallic mineral production value, the collective output of nickel ore and other nickel by-products validated their dominance over the other metals with 47.12%, or PhP13.62 billion, input. Gold lag behind nickel with 40.49% or PhP11.71 billion, while copper came in third with 11.51% or PhP3.33 billion. While the consolidated value of silver, chromite, and iron ore accounted for less than 1% or PhP0.25 billion of the total production value.

- 2. Nickel ore continued to enjoy the upbeat price of nickel, as it posted significant advances both in volume and value, by 48% and 106% respectively from 2,406,973 dry metric tons with an estimated value of PhP2.87 billion to 3,570,374 dry metric tons with an estimated value of PhP5.92 billion year-on-year. The average price of nickel in Q1 2020 was US$12,739.72 per tonne while in Q1 2021 it was at US$17,625.46 per tonne, up by US$4,886 per tonne year-on-year. Out of the 30 nickel projects, only 14 reported production. The remaining 16 with zero production was due to unfavorable weather conditions/intermittent rains; under care/maintenance status; and suspended operations. Noteworthy, a nickel mining operation, being surface mining, is always at the mercy of the weather condition. Dub as the nickel hub of the country, the CARAGA Region, generally experience rains during the first-quarter and fourth-quarter of the year, with January being the wettest month. About 19 nickel projects are located in CARAGA. Other Regions with reported nickel production include MIMAROPA and Central Luzon in the provinces of Palawan and Zambales, respectively. In terms of production distribution, MIMAROPA led accounting for 48% or 1,718,374 dry metric tons; followed by CARAGA with 40% or 1,426,557 dry metric tons; and Central Luzon accounted for the remaining 12% or 425,443 dry metric tons. In addition, mixed nickel-cobalt sulfide production volume and value were down by 10% and 1%, respectively from 22,493 dry metric tons with an estimated value of PhP7.66 billion to 20,239 dry metric tons with an estimated value of PhP7.61 billion year-on-year. For gold production, Philippines Gold Processing and Refining Corporation in Masbate led with 1,789 kilograms with an estimated value of PhP5.01 billion while in far second was Runruno Gold-Molybdenum Project of FCF Minerals in Nueva Vizcaya with 577 kilograms valued at PhP1.61 billion, closely followed by Mindanao Mineral Processing and Refining Corporation in Agusan del Sur with 571 kilograms valued at PhP1.58 billion. Total production volume and value went up by 3% and 10%, respectively from 4,098 kilograms valued at PhP10.66 billion to 4,212 kilograms valued at PhP11.71 billion year- on-year. Copper production volume and value was lackluster in Q1 2021 from 65,538 dry metric tons with an estimated value PhP3.69 billion to 44,050 dry metric tons with an estimated value of PhP3.33 billion, down by 33% and 10% respectively. Although the Philippines

- 3. is richly endowed with copper having an estimated resource of 8.52 billion metric tons and reserve of 2.01 billion metric tons, the country has yet to fully realize it’s potential. Currently the country has only two copper producers Carmen Copper Corporation (CCC) in Cebu and Philex Mining Corporation (PMC) in Benguet. CCC accounted for 70% or 28,874 dry metric tons with estimated value of PhP2.03 billion while PMC contributed 30% or 15,176 dry metric tons with estimated value of PhP1.30 billion. We have yet to see the comeback of OceanaGold (Phils) Incorporated in Nueva Vizcaya to the production-scene. Said company was a major copper producer in the past and can be a game changer to the country’s overall standing as copper producer and exporter. On the local front, mining operations continued to face the new-normal brought about by the COVID-19 pandemic, reduced operating hours and manpower in the mining area in compliance to social distancing are some of the measures being taken by mining companies to curtail the spread of this virus. In extreme situations concerned Local Government Unit(s) also issue lockdowns if circumstances warrant it. This will naturally restrict/limit economic activity in the area thereby affecting the course of mining operations. On the development of the minerals industry, it is important to note that being a capital- intensive business, in order for this industry to thrive, policies in relation to ease-of-doing- business; direct investment; and tax reform programs/measures are of utmost importance. Some mineral/mining related policies issued that is in line with the President’s Economic Agenda on ease of doing business include Administrative Order No. 2018-13, Lifting of the Moratorium on the Acceptance, Processing and/or Approval of Application for Exploration Permit under DENR Memorandum Order No. 2016-01; and MGB Memorandum Order No. 2020-007, Interim Guidelines on Online Filing of Application/Request for Services Rendered by the Mines and Geosciences Bureau. Central Office and the Acceptance of Payments thereof through Alternative Payment Scheme. On the direct investment aspect, the recently issued Executive Order No. 130 which amends Section 4 of Executive Order No. 79 of 2012 wherein the Government may now enter into new mineral agreements, subject to compliance with the Philippine Mining Act of 1995 and other applicable laws, rules, and regulations is seen as a policy booster to attract and increase investors’ confidence in mining. With the anticipated increased investment, higher revenue collection, and generation of employment both direct and indirect in mining will certainly follow. Also to be highlighted is the economic activities that will be created in the far-flung areas where mining projects will operate. The progress this will bring to the host and neighboring communities in terms of various infrastructures that will be built and livelihood that will be created is undeniable. And finally, in relation to the tax reform program, we saw the passage of the RA 10963-Tax Reform for Acceleration and Inclusion (TRAIN) Law, wherein the government imposed a 4-percent excise tax on minerals, where previously it was only at 2-percent. This more or less doubles the revenue collection of the government from excise tax alone. On the update of Executive Order No. 130, the Mines and Geosciences Bureau is meticulously crafting its Implementing Rules and Regulations.

- 4. On the international scene, mineral analysts are optimistic that the favorable metal price that began in 2020 and continued to trickle down in Q1 2021 will most likely follow this track. The big appetite of China for copper and nickel for its robust stainless and electric vehicle battery supply industries will still be the very backbone of the strong demand. China leads the world when it comes to nickel and copper consumption. On the supply side, because of the COVID pandemic, the very likelihood of disruptions in mining production worldwide due to forced lockdowns and cut- down operating hours still loom. Tight supply vis-à-vis strong demand will certainly drive prices to increase. TABLE 1 PHILIPPINES METALLIC PRODUCTION Q1 2021 VS Q1 2020 Quantity Value Quantity Value Quantity Value Gold KGS. 4,212 11,705,708,329 4,098 10,659,277,431 3 10 Silver KGS. 5,603 225,552,303 6,335 169,667,685 (12) 33 Copper Concentrate DMT 44,050 3,327,164,339 65,538 3,686,665,017 (33) (10) Copper Metal Equivalent MT 10,294 16,035 (36) Mixed Nickel-Cobalt Sulfide DMT 20,239 7,613,171,758 22,493 7,660,265,057 (10) (1) Mixed Nickel-Cobalt Sulfide (Metal) MT 11,774 12,993 (9) Scandium Oxalate Dry-Kg 3,605 91,145,043 3,394 90,156,352 6 1 Nickel Direct Shipping Ore DMT 3,570,374 5,919,996,258 2,406,973 2,869,343,945 48 106 Nickel Content of Ore MT 44,252 31,071 42 Chromite DMT 4,720 29,371,102 4,927 53,566,179 (4) (45) Iron Ore DMT 0 0 33,660 147,301,101 (100) (100) TOTAL 28,912,109,133 25,336,242,766 14.11 JAN-MAR, 2020 Mineral Commodity Unit Used % Change JAN-MAR, 2021