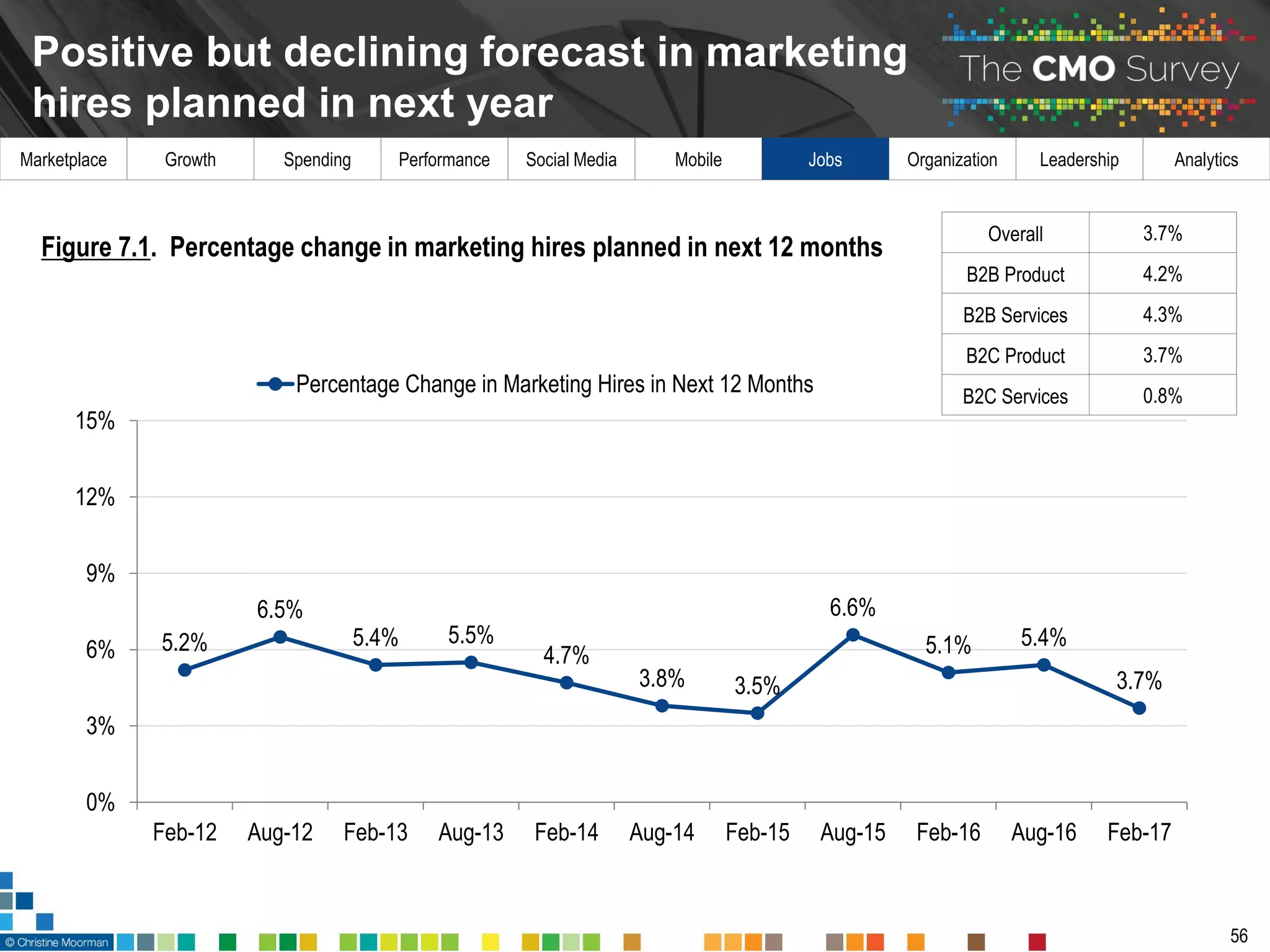

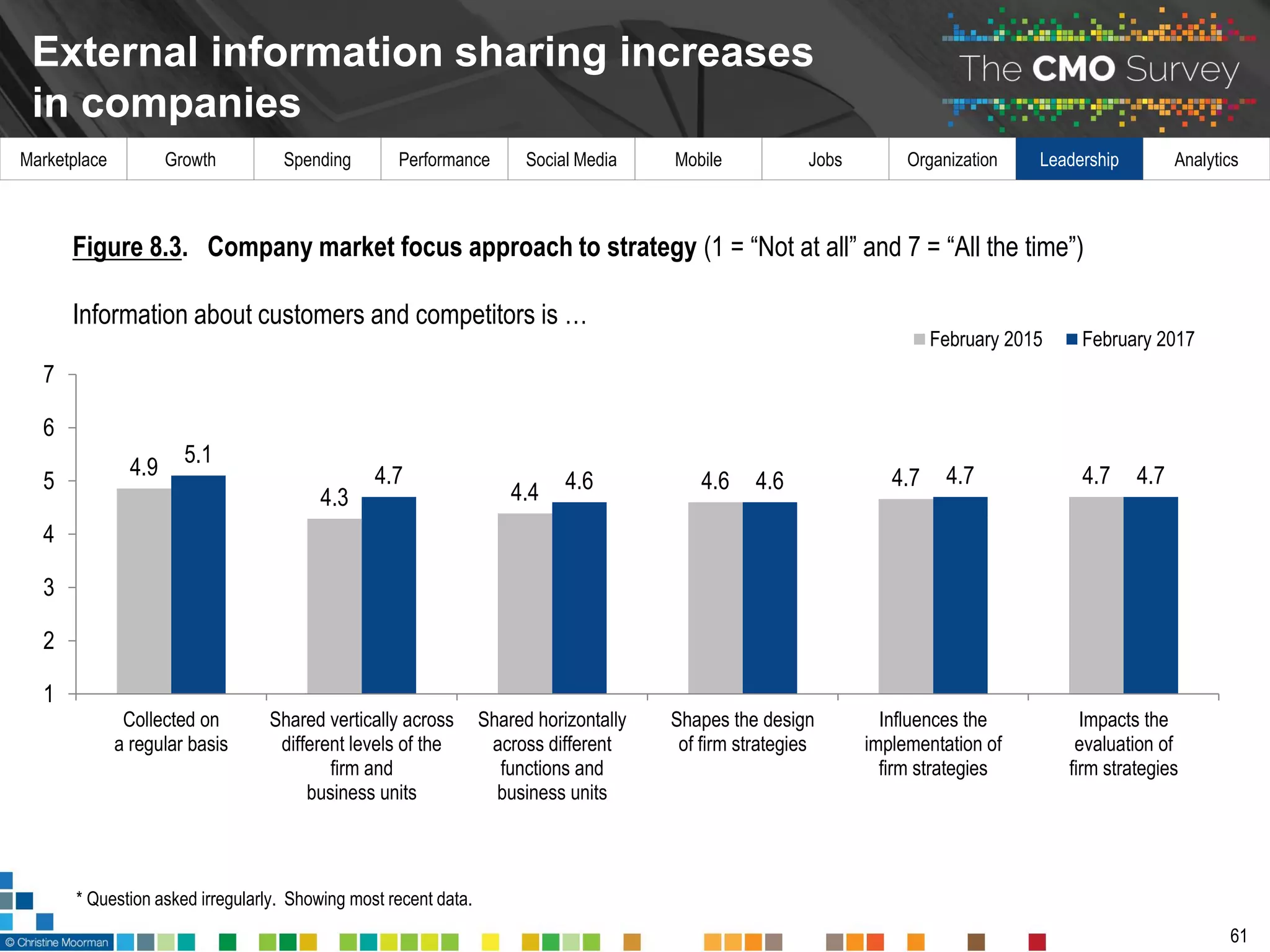

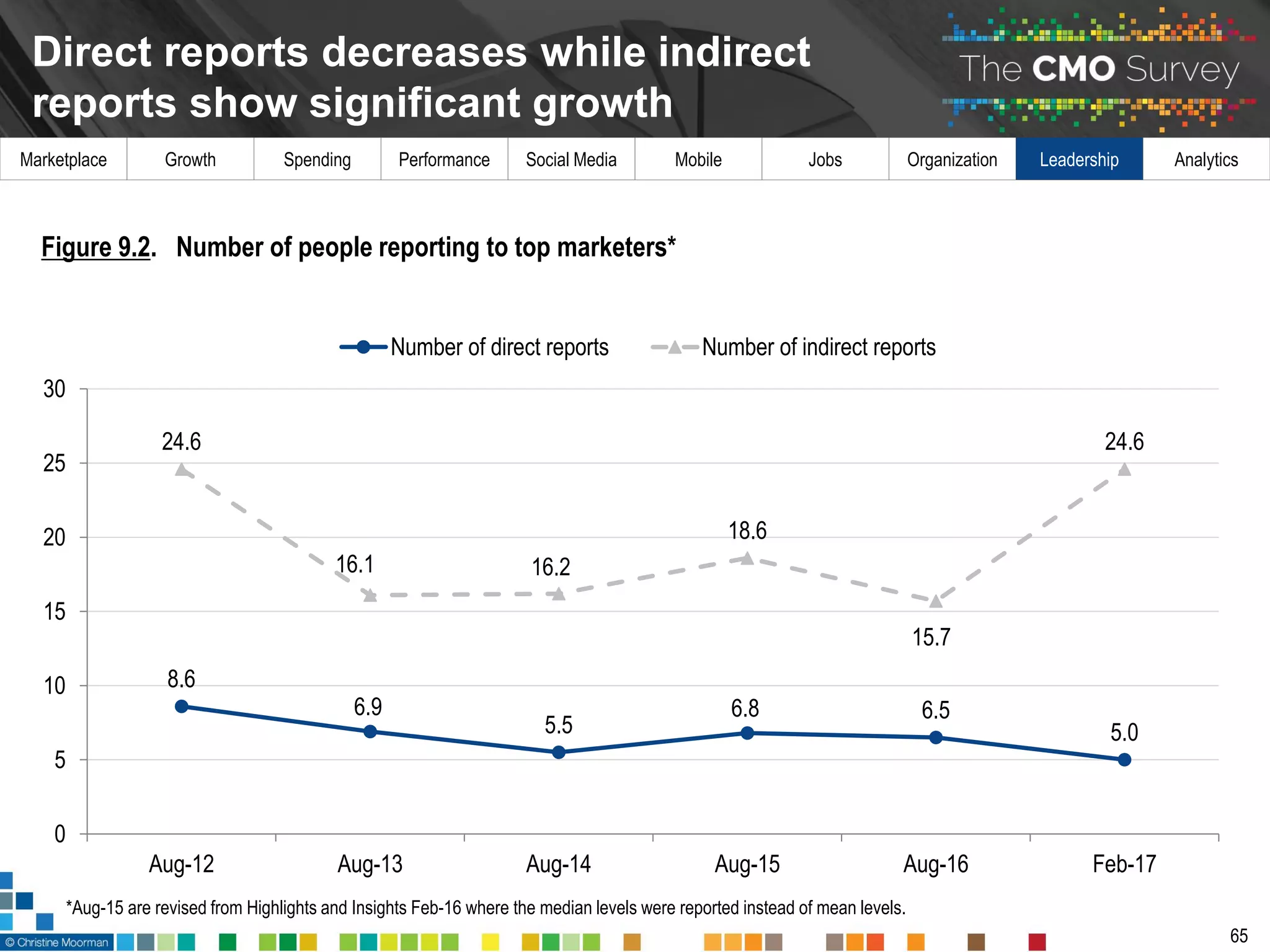

The CMO Survey is administered twice a year via an Internet survey to collect and disseminate the opinions of top marketers. It aims to predict market trends and improve marketing value. The February 2017 survey was the 18th administration, with 388 respondents out of 2813 marketers contacted, a 13.8% response rate. Results are reported in aggregate form or by industry/firm characteristics. The survey covers topics like the economy, growth strategies, marketing spending, performance, social media, mobile, jobs, leadership and analytics.