Clarity on Tax || Rupee denominated Bonds

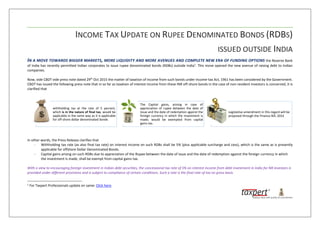

- 1. INCOME TAX UPDATE ON RUPEE DENOMINATED BONDS (RDBS) ISSUED OUTSIDE INDIA IN A MOVE TOWARDS BIGGER MARKETS, MORE LIQUIDITY AND MORE AVENUES AND COMPLETE NEW ERA OF FUNDING OPTIONS the Reserve Bank of India has recently permitted Indian corporates to issue rupee denominated bonds (RDBs) outside India1 . This move opened the new avenue of raising debt to Indian companies. Now, vide CBDT vide press note dated 29th Oct 2015 the matter of taxation of income from such bonds under Income-tax Act, 1961 has been considered by the Government. CBDT has issued the following press note that in so far as taxation of interest income from these INR off-shore bonds in the case of non-resident investors is concerned, it is clarified that In other words, the Press Release clarifies that - Withholding tax rate (as also final tax rate) on interest income on such RDBs shall be 5% (plus applicable surcharge and cess), which is the same as is presently applicable for offshore Dollar Denominated Bonds. - Capital gains arising on such RDBs due to appreciation of the Rupee between the date of issue and the date of redemption against the foreign currency in which the investment is made, shall be exempt from capital gains tax. With a view to encouraging foreign investment in Indian debt securities, the concessional tax rate of 5% on interest income from debt investment in India for NR investors is provided under different provisions and is subject to compliance of certain conditions. Such a rate is the final rate of tax on gross basis. 1 For Taxpert Professionals update on same: Click here. withholding tax at the rate of 5 percent, which is in the nature of final tax, would be applicable in the same way as it is applicable for off-shore dollar denominated bonds The Capital gains, arising in case of appreciation of rupee between the date of Issue and the date of redemption against the foreign currency in which the investment is made; would be exempted from capital gains tax. Legislative amendment in this regard will be proposed through the Finance Bill, 2016

- 2. Following may be noteworthy that: - Currently, the concessional rate of 5% on RDBs is available only to Foreign Portfolio Investors (FPIs). Refer the text box. - For other NRs, the 5% rate is available on foreign currency bonds only. - The concessional rate of 5% is lower than the tax rates prescribed in most DTAA’s (double taxation avoidance agreements) - If the concessional rate is not available, the normal rate of tax on interest on debt as per the Income Tax Act, 1961, for NRs shall be much higher. For complete text on the RBI notification on issue of RDBs by Indian Companies is provided below: External Commercial Borrowings (ECB) Policy - Issuance of Rupee denominated bonds overseas Vide RBI/2015-16/193 A.P. (DIR Series) Circular No.17 dated September 29, 2015 In order to facilitate Rupee denominated borrowing from overseas, RBI has decided to put in place a framework for issuance of Rupee denominated bonds overseas within the overarching ECB policy. The broad contours of the framework are as follows: i. Eligible borrowers: Any corporate or body corporate as well as Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs). ii. Recognised investors: Any investor from a Financial Action Task Force (FATF) compliant jurisdiction. iii. Maturity: Minimum maturity period of 5 years. iv. All-in-cost: All in cost should be commensurate with prevailing market conditions. v. Amount: As per extant ECB policy. vi. End-uses: No end-use restrictions except for a negative list. The detailed guidelines for issuance of Rupee denominated bonds overseas are as follows: Sr. No. ECB parameter Framework 1. Eligibility of borrowers Any corporate or body corporate is eligible to issue Rupee denominated bonds overseas. Presently, Indian companies may issue bonds to overseas investors (with no restrictions) if the investors register in India as foreign portfolio investors and invest domestically in listed bonds. There is a concessional rate of withholding tax for this purpose. These bonds are bonds issued in India – hence, there are no restrictions on the end-use. Leaving aside some exceptions, these bonds have to be listed bonds, in order to make them eligible for subscription by FPIs. The RDBs, on the other hand, are subscribed to by overseas investors directly and there are not many restrictions imposed by RBI on the issue hence, already RDBs provided efficient way of fund raising and with this clarity on the withholding tax the RDB shall come out as one of the best option of funding.

- 3. Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) coming under the regulatory jurisdiction of the Securities and Exchange Board of India are also eligible. 2. Type of instrument Only plain vanilla bonds issued in a Financial Action Task Force (FATF) compliant financial centres; either placed privately or listed on exchanges as per host country regulations. 3. Recognised investors Any investor from a FATF compliant jurisdiction. Banks incorporated in India will not have access to these bonds in any manner whatsoever. Indian banks, however, can act as arranger and underwriter. In case of underwriting, holding of Indian banks cannot be more than 5 per cent of the issue size after 6 months of issue. Further, such holding shall be subject to applicable prudential norms. 4. Maturity Minimum maturity period of 5 years. The call and put option, if any, shall not be exercisable prior to completion of minimum maturity. 5. All-in-cost The all-in-cost of such borrowings should be commensurate with prevailing market conditions. This will be subject to review based on the experience gained. 6. End-uses The proceeds can be used for all purposes except for the following: Real estate activities other than for development of integrated township / affordable housing projects; Investing in capital market and using the proceeds for equity investment domestically; Activities prohibited as per the foreign direct investment (FDI) guidelines; On-lending to other entities for any of the above objectives; and Purchase of land. 7. Amount Automatic Route: Under the automatic route the amount will be equivalent of USD 750 million per annum. Approval Route: Cases beyond this limit will require prior approval of the Reserve Bank. 8. Conversion rate The foreign currency - Rupee conversion will be at the market rate on the date of settlement for the purpose of transactions undertaken for issue and servicing of the bonds. 9. Hedging The overseas investors will be eligible to hedge their exposure in Rupee through permitted derivative products with AD Category - I banks in India. The investors can also access the domestic market through branches / subsidiaries of Indian banks abroad or branches of foreign bank with Indian presence on a back to back basis. 10. Leverage The leverage ratio for the borrowing by financial institutions will be as per the prudential norms, if any, prescribed by the sectoral regulator concerned.

- 4. All other provisions of extant ECB guidelines regarding reporting requirements (including obtaining Loan Registration Number (LRN) through submission of Form 83 where type of ECB is to be specifically mentioned as borrowing through issuance of Rupee denominated bonds overseas), parking of bond proceeds, security / guarantee for the borrowings, conversion into equity, corporates under investigation, etc., not appearing above will be applicable for borrowing by issuance of Rupee denominated bonds overseas. What is Rupee denominated debt Rupee denominated debt refers to that part of India’s total external debt that is denominated in India’s domestic currency, the Rupee. In contrast to foreign currency denominated external debt, in case of rupee denominated debt the currency risk is borne by the giver and not by the borrower. The contractual liability is settled in foreign currency. TAXPERT PROFESSIONALS IS A CONGLOMERATION OF MULTI-DIVERGED PROFESSIONALS KNOWN FOR PROVIDING CONCENTRATED SERVICES IN RELATION TO TAXATION AND CORPORATE LAWS ADVISORY IN A SEAMLESS MANNER. TAXPERT PROFESSIONALS BELIEVE IN THE CREATION OF VALUE THROUGH ADVISING AND ASSISTING THE BUSINESS. THE POOL OF PROFESSIONALS FROM DIFFERENT SPECTRUM LIKE TAX, ACCOUNTANCY, LEGAL, COSTING, MANAGEMENT FACILITATE THE CONVERSION OF KNOWLEDGE INTO BENEFICIAL TRANSACTION. WE CAN HELP YOU SORT YOUR FUNDING NEEDS. DO GET IN TOUCH WITH US AT FOR ANY FURTHER DISCUSSION: WWW.TAXPERTPRO.COM || INFO@TAXPERTPRO.COM || 09769134554 || 09769033172