Asset Class Correlations & Volatilities: End of July 2017

•Download as PPTX, PDF•

1 like•16,348 views

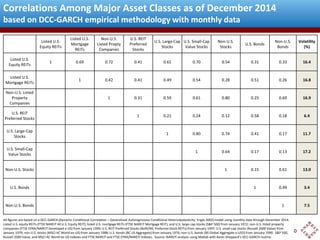

This chart shows correlations and volatilities for nine asset classes based on data through July 2017. For example, the correlation between exchange-traded U.S. Equity REITs and U.S. large-cap stocks is just 0.59, indicating strong diversification benefits. The chart also shows the latest volatilities. I update these figures every month. Questions? Contact me at bcase@nareit.com.

Report

Share

Report

Share

Recommended

Empirical Research on Performance of Private and Public Real Estate Investments

Empirical Research on Performance of Private and Public Real Estate InvestmentsBrad Case, PhD, CFA, CAIA

Updated Summary of Academic Research on Performance of Private Equity Investm...

Updated Summary of Academic Research on Performance of Private Equity Investm...Brad Case, PhD, CFA, CAIA

Recommended

Empirical Research on Performance of Private and Public Real Estate Investments

Empirical Research on Performance of Private and Public Real Estate InvestmentsBrad Case, PhD, CFA, CAIA

Updated Summary of Academic Research on Performance of Private Equity Investm...

Updated Summary of Academic Research on Performance of Private Equity Investm...Brad Case, PhD, CFA, CAIA

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

More Related Content

Recently uploaded

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Recently uploaded (20)

Dharavi Russian callg Girls, { 09892124323 } || Call Girl In Mumbai ...

Dharavi Russian callg Girls, { 09892124323 } || Call Girl In Mumbai ...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

High Class Call Girls Nagpur Grishma Call 7001035870 Meet With Nagpur Escorts

High Class Call Girls Nagpur Grishma Call 7001035870 Meet With Nagpur Escorts

Pooja 9892124323 : Call Girl in Juhu Escorts Service Free Home Delivery

Pooja 9892124323 : Call Girl in Juhu Escorts Service Free Home Delivery

Call US 📞 9892124323 ✅ Kurla Call Girls In Kurla ( Mumbai ) secure service

Call US 📞 9892124323 ✅ Kurla Call Girls In Kurla ( Mumbai ) secure service

Call Girls Service Nagpur Maya Call 7001035870 Meet With Nagpur Escorts

Call Girls Service Nagpur Maya Call 7001035870 Meet With Nagpur Escorts

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Independent Call Girl Number in Kurla Mumbai📲 Pooja Nehwal 9892124323 💞 Full ...

Independent Call Girl Number in Kurla Mumbai📲 Pooja Nehwal 9892124323 💞 Full ...

20240429 Calibre April 2024 Investor Presentation.pdf

20240429 Calibre April 2024 Investor Presentation.pdf

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

Featured

Featured (20)

Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage Engineerings

How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental Health

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Asset Class Correlations & Volatilities: End of July 2017

- 1. Correlations Among Major Asset Classes at end of July 2017 based on DCC-GARCH empirical methodology with monthly data All figures are based on a DCC-GARCH (Dynamic Conditional Correlation – Generalized Autoregressive Conditional Heteroskedasticity: Engle 2002) model using monthly data through July 2017. Listed U.S. equity REITs (FTSE NAREIT All U.S. Equity REIT), listed U.S. mortgage REITs (FTSE NAREIT Mortgage REIT), and U.S. large-cap stocks (Russell 1000) from January 1972; non-U.S. listed property companies (FTSE EPRA/NAREIT Developed x-US) from January 1990; U.S. REIT Preferred Stocks (BofA/ML Preferred Stock REITs) from January 1997; U.S. small-cap value stocks (Russell 2000 Value) from January 1979; non-U.S. stocks (MSCI AC World ex-US) from January 1988; U.S. bonds (BC US Aggregate) from January 1976; non-U.S. bonds (BS Global Aggregate x-USD) from January 1990. Source: NAREIT analysis using Matlab with Kevin Sheppard’s DCC-GARCH routine. Listed U.S. Equity REITs Listed U.S. Mortgage REITs Non-U.S. Listed Property Companies U.S. REIT Preferred Stocks U.S. Large-Cap Stocks U.S. Small-Cap Value Stocks Non-U.S. Stocks U.S. Bonds Non-U.S. Bonds Volatility (%) Listed U.S. Equity REITs 1 0.56 0.68 0.49 0.59 0.53 0.47 0.31 0.29 12.8 Listed U.S. Mortgage REITs 1 0.52 0.42 0.50 0.55 0.29 0.30 0.13 14.4 Non-U.S. Listed Property Companies 1 0.37 0.64 0.52 0.82 0.26 0.66 15.0 U.S. REIT Preferred Stocks 1 0.20 0.26 0.29 0.67 0.49 6.6 U.S. Large-Cap Stocks 1 0.76 0.75 0.15 0.15 10.5 U.S. Small-Cap Value Stocks 1 0.42 0.11 0.10 16.2 Non-U.S. Stocks 1 0.16 0.42 12.9 U.S. Bonds 1 0.58 3.2 Non-U.S. Bonds 1 8.0 0