Pdf file

•

0 likes•12 views

Hunter and Thompson are a London UK job recruitment agency. Our approach is simple, which is to help local and national companies of sizes locate great candidates.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

Similar to Pdf file

Similar to Pdf file (20)

Manufacturing - Customer KYC - ERP Master Data Form - Ver1.0

Manufacturing - Customer KYC - ERP Master Data Form - Ver1.0

Presentation of NTN, STRN & Efiling (2) - Copy.pptx

Presentation of NTN, STRN & Efiling (2) - Copy.pptx

Monthly Returns for Ecommerce dealers in Rajasthan

Monthly Returns for Ecommerce dealers in Rajasthan

Registration of MVAT (Maharashtra Value Added Tax)

Registration of MVAT (Maharashtra Value Added Tax)

Recently uploaded

Recently uploaded (10)

Expect On a Voodoo Cemetery Tour in New Orleans.pptx

Expect On a Voodoo Cemetery Tour in New Orleans.pptx

What Should I Know Before Booking A Catamaran In Aruba

What Should I Know Before Booking A Catamaran In Aruba

Everything you need to know about adventure tourism in Nepal

Everything you need to know about adventure tourism in Nepal

Jackrabbit Limousine - Your Fast And Reliable Ride

Jackrabbit Limousine - Your Fast And Reliable Ride

Taxi Bambino is a service providing clients with taxis with car seats for the...

Taxi Bambino is a service providing clients with taxis with car seats for the...

Book A Romantic Honeymoon Trip to the Andaman Islands

Book A Romantic Honeymoon Trip to the Andaman Islands

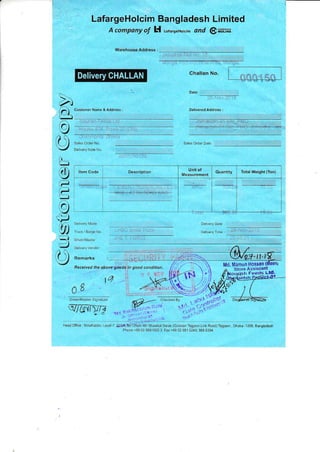

Pdf file

- 2. ..,'" Government of the People's Republic of Bangladesh National Board of Revenue, Dhaka VAT CHALLAN As per [Rule 16 (1)] Second copy VAT 11 Ghallan No. ii.ix fr;. ffi [tu Name of the Company Address VAT registration No Buyer Name Address VAT Registration Nol Final Destination of Goods/Sef Type ofTransport & No Date of Challan lssue3 Time of Challan lssue3 Date & Time of delivery3 Jhinaidha, Jessore Sales Order No I 1. 2 3. 4. For sales of goods or services to registered buyer only, the name, address and VAT registration No. of the buyer should be filled in. Applicable only when ultimate destination of goods rs different from buyers address. Date & time of delivery should be mentioned both in words and figure. ln case of direct or indirect export, export L/C or internal back to back L/C or for local/international tender, work order no, and date (including bank name) etc informalion need to be mentioned along with the information of column No. 2 In this column, the quantity should be mentioned in figures and beneath it in words. Signature of Seller & Date st No. Name of Goods / Servicesa Quantity5 Value chargeable to supplementary duty Amount of Supplementary Duty VAT Chargeable Value t(4)+(s)I Amount of VAT Total Value including VAT & Supplementary Duty I 2 3 4 5 6 7 8 MENT;SJPERCRE CEMIIB,L42.5N;57 BAG 300.00 't500.00 3725.00 105225"00 Total: {REE HUNT TED BAGS )15CI0.00 3725.00 105225.00 rotarin words0NE FIUNnRED FIVE THOUSANil TWCI HUNDRED TId}ENTY FIVE *NLY : LafargeHolcim Bangladesh Limited .r'- /,..,