Report on Natural Gas- Distribution and Pricing.pdf

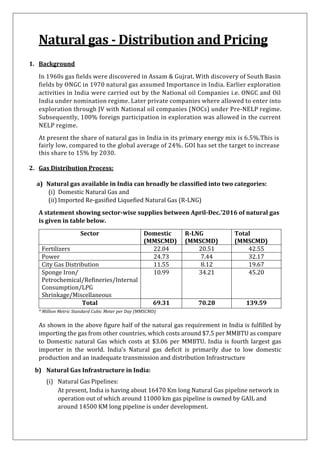

- 1. Natural gas - Distribution and Pricing 1. Background In 1960s gas fields were discovered in Assam & Gujrat. With discovery of South Basin fields by ONGC in 1970 natural gas assumed Importance in India. Earlier exploration activities in India were carried out by the National oil Companies i.e. ONGC and Oil India under nomination regime. Later private companies where allowed to enter into exploration through JV with National oil companies (NOCs) under Pre-NELP regime. Subsequently, 100% foreign participation in exploration was allowed in the current NELP regime. At present the share of natural gas in India in its primary energy mix is 6.5%.This is fairly low, compared to the global average of 24%. GOI has set the target to increase this share to 15% by 2030. 2. Gas Distribution Process: a) Natural gas available in India can broadly be classified into two categories: (i) Domestic Natural Gas and (ii) Imported Re-gasified Liquefied Natural Gas (R-LNG) A statement showing sector-wise supplies between April-Dec.’2016 of natural gas is given in table below. Sector Domestic (MMSCMD) R-LNG (MMSCMD) Total (MMSCMD) Fertilizers 22.04 20.51 42.55 Power 24.73 7.44 32.17 City Gas Distribution 11.55 8.12 19.67 Sponge Iron/ Petrochemical/Refineries/Internal Consumption/LPG Shrinkage/Miscellaneous 10.99 34.21 45.20 Total 69.31 70.28 139.59 * Million Metric Standard Cubic Meter per Day (MMSCMD) As shown in the above figure half of the natural gas requirement in India is fulfilled by importing the gas from other countries, which costs around $7.5 per MMBTU as compare to Domestic natural Gas which costs at $3.06 per MMBTU. India is fourth largest gas importer in the world. India’s Natural gas deficit is primarily due to low domestic production and an inadequate transmission and distribution Infrastructure b) Natural Gas Infrastructure in India: (i) Natural Gas Pipelines: At present, India is having about 16470 Km long Natural Gas pipeline network in operation out of which around 11000 km gas pipeline is owned by GAIL and around 14500 KM long pipeline is under development.

- 2. The spread of pipeline network of different transporter/ Distributor is given as under: Sr.NO Transporter/Distributor Length in KMs % Share 1. GAIL 11092 67.34% 2. RGTIL 1784 10.83% 3. GSPL 2613 15.87% 4. AGCL/OIL/DNPL 817 4.96% 5. IOCL 140 0.85% 6. ONGC 24 0.15% Total 16470 100% (ii) R-LNG terminals: An LNG terminal is a facility for re-gasifyng the liquefied natural gas (LNG) shipped in by LNG tanker from the production zones. At present, 4 LNG terminals with total regasification capacity of 26.3 MMTPA are operational on the western coast of the country. (iii) City Gas Distribution (CGD) Infrastructure: City gas distribution (CGD) sector offers a way to improve the availability of natural gas to the industrial, domestic and commercial segments of a region. CGD sector has two distinct segments – Compressed Natural Gas (CNG) predominantly used as auto-fuel, and Piped Natural Gas (PNG) used in in domestic, commercial and Industrial segments .At present, there are 31 CGD entities which are developing and operating in 81 Geographical Areas in 20 states/UTs. Following are the major players in the CGD area: • Indraprastha Gas Limited • Mahanagar Gas Limited (MGL) • Gail Gas Limited (wholly owned subsidiary of GAIL (India)) • Gujarat State Petronet Ltd. • Adani Gas Limited • Central U.P. Gas Limited City Gas Distribution network is regulated by Petroleum and Natural Gas Regulatory Board (PNGRB). PNGBR was established by Ministry of Petroleum & Natural Gas (MoPNG) in 2007 under the PNGRB Act 2006 to have conducive regulatory environment for CGD network development, PNGRB grants the authorizations to interested entities through a competitive bid selection process for laying a CGD network (PNG network) in a specified Geographical Area (GA) of the country. Currently the CGD segment constitutes 15 percent of the total gas consumption in India and is expected to reach a share of 20 percent by FY20.

- 3. ONGC & Oil India are the major producer of Domestic natural gas in India about 80% of natural gas is produces by ONGC and Oil India and rest 20% is produced by JVs and private companies. Distribution of Gas is done mainly by GAIL as around 11000 KM gas pipeline out of 16000 KM is operated and maintained by GAIL. 3. Gas Pricing Mechanism To meet with the challenges of low Investment in domestic gas exploration and low domestic gas production and to minimize the dependency on expensive import of LNG from different countries, Govt of India has time to time introduced different Gas pricing regimes to make the Domestic Gas exploration and Production an attractive investment option for National and International Investors and Companies. Before November 2014, all the market prices for gas in India are regulated i.e. wellhead, wholesale and retail. There were multiple gas pricing regimes in India. These can be divided into the following: a) Administered Pricing Mechanism (APM) APM Gas Pricing: The price of APM gas was set by the Government principally on a cost-plus basis. This mechanism covers the initial gas fields which was allotted on nomination basis to National oil companies i.e. ONGC and Oil India. In Past, Government has revised the APM prices from time to time basic on different factors and recommendation by different committees. APM Gas pricing has continued till November 2014 before the implementation of New gas pricing policy. b) Non- Administered Pricing Mechanism: Further Non-APM gas is divided into two categories: (i) Price of Imported LNG: Petronet LNG Limited (PLL) was incorporated on 2 April 1998 to import LNG and to sell the same in the domestic market The prices of LNG Gas Exploration and Production Imported Liquefied Natural Gas (R-LNG) R-LNG terminals- Dhabola, Kochi, Hazira Domestic Natural Gas- ONGC, Oil India, RIL, Cairn Natural gas Pipeline- Gail, RIL etc Fertilizer industry Power plants City Gas Distribution

- 4. imported under Long term contract from countries like Qatar is governed by the Sale & Purchase agreements (SPA) between the LNG seller and LNG Buyer and the Spot cargos are purchased on mutually agreeable commercial terms. (ii) Domestic gas pricing: - • Pricing of Pre-NELP Gas: IN 1991 certain blocks were discovered by National oil companies (NOCs) which was auctioned under a Production Sharing Contract (PSC) to Private sector E&P companies to overcome the funding constraints. Gas prices are determined on the basic of formula specified in the PSC. All the gas produced is sold to GAIL which was nominated by the Government at the time of bidding for the Pre NELP fields. • Pricing of Gas under NELP: In 1997, Govt of India announced the New Exploration Licensing policy (NELP) which provided level playing field to both private and public sector in upstream petroleum sector. Under this price of gas is determined on the basis of arm’s length prices (Market prices), subject to the government approval, and is controlled by production sharing contract (PSC) terms. It was introduced to boost the private investment in the domestic gas exploration. The pricing was valid till November 2014. After this, a new pricing mechanism come into force. c) New Domestic Natural Gas Pricing Guidelines In effort to incentivizing domestic gas exploration and production, Govt of India has introduced the New domestic natural gas pricing formula in November 2014. In the new formula the weighted average of price in USA, Canada, Russia and Europe is taken for price indexation. The formula is as mentioned below: P = VHH∗PHH+VAC∗PAC+VNBP∗PNBP+VR∗PR VHH+VAC+NVBP+VR Where, • VHH = Total annual volume of natural gas consumed in USA and Mexico. • VAC = Total annual volume of natural gas consumed in Canada. • VNBP = Total annual volume of natural gas consumed in EU and FSU, excluding Russia • VR = Total annual volume of natural gas consumed in Russia. • PHH and PNBP are the annual average of daily prices at Henry Hub (HH) and National Balancing Point (NBP) less the transportation and treatment charges. • PAC and PR are the annual average of monthly prices at Alberta Hub and Russia respectively less the transportation and treatment charges. Note: The periodicity of price determination/notification shall be half yearly. The price and

- 5. volume data used for calculation of applicable price shall be the trailing four quarter data with one quarter lag. The price would be determined on the basis of price prevailing between July 1, 2016, and June 30, 2017. This price would come into effect from November 1, 2017, and would be valid till March 31, 2018. Thereafter, it would be revised for the period April 1, 2018, to September 30, 2018, on the basis of prices prevalent between January 1, 2017, and December 31, 2017, i.e. with the lag of a quarter and so on. A statement showing the revision of Gas price after the implementation of the New Gas pricing formula Sr.NO Time Period Price (MMBTU) 1. Nov 14 – March 15 $5.05 2. April 15 – Sept 15 $4.66 3. Oct 15 – March 16 $3.82 4. April 16 – Sept 16 $3.06 5. Oct 16 – March 17 $2.50 6. April 17 – Sept 17 $2.48 7. October 17 – March 18 $2.89 8. April 18 – Sept 18 $3.06 *Note Domestic Natural gas Price ($/million metric British thermal unit) Observation and Comment: 5.05 4.66 3.82 3.06 2.5 2.48 2.89 3.06 0 1 2 3 4 5 6 Nov 14 – March 15 April 15 – Sept 15 Oct 15 – March 16 April 16 – Sept 16 Oct 16 – March 17 April 17 – Sept 17 October 17 – March 18 April 18 – Sept 18 PRICE IN $ PER MMBTU PERIOD Gas Price Trend in India Price Trend Line

- 6. In an effort to make Upstream investment attractive and to meet the huge unmet demand of gas at reasonable cost, Govt has introduced the New gas pricing policy. However, since that decision was made, global oil and gas prices have fallen significantly, impacting the attractiveness of the upstream sector to potential investors. Domestic gas prices have now fallen below the average cost of production for many companies, say ONGC and Oil India Limited, which have an average cost of production of $3.59 per MMBTU. These producers and others have been hit hard by the price decline, which will adversely impact new gas development projects. 4. Gas Exchange and Trading Hub In July 2017, when Domestic natural gas price has fallen to $2.48 MMBTU, Oil Minister Mr Dharmendar Pradhan has announced in annual World Petroleum Congress (WPG) that India is Building the Gas Trading hub. In December of same year Ministry of petroleum and natural gas (MoPNG) has designated the Oil Industry Development Board (OIDB) to engage a consultant for carrying out the detailed study on the current state of Indian gas sector, government priorities and to recommend further course of action for establishment of a Gas Trading Hub or Exchange in the country. OIDB submits its report in MOPNG in February 2018. March 2018, it is announced that PNGRB is set to take up the role of market regulatory for the natural gas trading hub. 28th march, PNGRB issues the tender for hiring the consultant to help develop a regulatory framework for operating the Gas trading hub. May 29 2018, PNGRB appoints Crisil to assist the regulatory and government in framing rules for the exchange and it is expected to be functional by October 2018. Author: Date: 2018 Ashish Goel