The Treasurer & President of Brigade Metropolis – Anil Agarwal and Anil Danti, the former a CA himself, took stage.

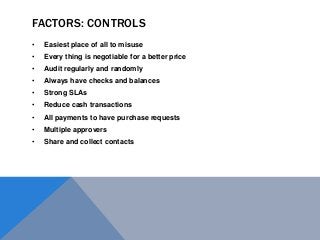

The learning from Brigade Metropolis - a 1600 apartment community were many, and served as a great case study of Treasurers with no prior knowledge of Accounting or Financial Governance doing a great job adding Value to their Public Funds, with their Personal Commitment and a Transparent System.

This Slideshare helps in understanding the Financial Planning & Expense Control systems of 1600 Apartment Complex in Bangalore.

To get a clear insight check the link below:

http://apartmentadda.com/blog/blog/2013/10/11/workshop-for-treasurers-2/