Benefitsselling201611 dl

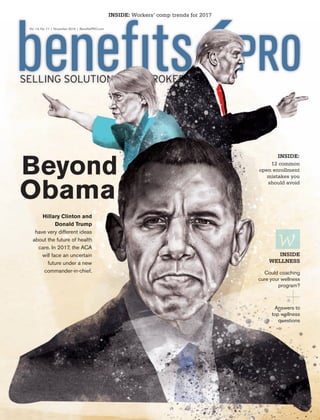

- 1. Beyond Obama Hillary Clinton and Donald Trump have very different ideas about the future of health care. In 2017, the ACA will face an uncertain future under a new commander-in-chief. Selling solutions for brokers INSIDE: Workers’ comp trends for 2017 12 common open enrollment mistakes you should avoid inside: Could coaching cure your wellness program? inside wellness Answers to top wellness questions Vol. 14, No. 11 | November 2016 | BenefitsPRO.com BPRO 11.16 cover.indd 2 10/26/16 2:42 PM

- 2. Meet the bigger, brighter Sun Life. Want to bring more value to your clients? Consider Sun Life. We support accounts of all sizes with new workplace productivity solutions, cost-containment strategies, and more. Our expanded portfolio includes America’s second-largest dental network* and a full range of Voluntary offerings. And our analytics tools help you build plans that inspire confidence. We’ve got scale. We’ve got products. We’ve got your back. Ask your Sun Life rep for details. YOUR BEST PARTNER HAS YOUR BACK LIFE | DISABILITY | DENTAL/VISION | VOLUNTARY | STOP-LOSS Life’s brighter under the sun * The Ignition Group, LLC. Data as of September 2015, based on unique dentist count. For more information, please visit www.netminder.com. Group insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) and by Union Security Insurance Company (USIC) (Kansas City, MO) in all states except New York. Insurance products underwritten by Union Security Insurance Company (USIC) (Kansas City, MO) are administered by Sun Life Assurance Company of Canada (SLOC) (Wellesley Hills, MA). In New York, group insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) and Union Security Life Insurance Company of New York (Fayetteville, NY). Insurance products underwritten by Union Security Life Insurance Company of New York (Fayetteville, NY) are administered by Sun Life and Health Insurance Company (U.S.) (SLHIC) (Lansing, MI). Product offerings may not be available in all states and may vary depending on state laws and regulations. © 2016 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life Financial and the globe symbol are registered trademarks of Sun Life Assurance Company of Canada. Visit us at www.sunlife.com/us. BRAD-6103a SLPC 27571 07/16 (exp. 12/16) SunLife.indd 1 09/08/16 4:19 PMSunLife.indd 1 21/09/16 8:23 PM

- 3. What is Craftsmanship? To be crafted is to meet exacting standards. It’s the human touch that combines art and science to create something unique. We tend to think about craftsmanship in terms of physical things: fine wine, classic cars, custom furniture and iconic structures. But what about crafting workplace benefit solutions that help your clients provide added security and financial peace of mind to their employees? And the expertise and experience you need to confidently deliver these programs? For brokers, agents and consultants. For employers. For employees. People who need a particular kind of protection and service. The kind that workplace benefits from Chubb provide. Not just coverage. Craftsmanship. Not just insured. new.chubb.com © 2016 Chubb. Coverages underwritten by one or more subsidiary companies. Not all coverages available in all jurisdictions. Chubb®, its logo, Not just coverage. Craftsmanship. and all its translations, and Chubb. Insured. are protected trademarks of Chubb. Combined.indd 1 17/08/16 8:38 PMCombined.indd 1 21/09/16 8:15 PM

- 4. november 20162 c o n t e n t s BenefitsPro Magazine BenefitsPRO™ (ISSN #1942-3551) is published monthly by ALM Media, LLC, 4157 Olympic Blvd Ste. 225, Erlanger, KY 41018-3510. Subscriptions are available by request. Periodical Postage paid at Covington, KY and additional mailing offices. POSTMASTER: Send address correction to BenefitsPRO™, PO Box 3136, Northbrook, IL 60065. Phone (800)458-1734. Fax (847)763-9587 Email benefitspro@ halldata.com. For change of address include old address as well as new address with both ZIP codes. Allow four to six weeks for change of address to become effective. Please include current mailing label when writing about your subscription. Vol. 14, No. 11 November Copyright © 2016 by ALM Media, LLC. All rights reserved. No part of this magazine may be reproduced in any form without consent. 25 27 Could coaching cure your wellness program? By Elizabeth Thompson 30 Your wellness program questions answered By Dr. Rajiv Kumar 6 Opening dialogue by Paul Wilson 8 Plot points by Gil Lowerre and Bonnie Brazzell 15 Navigating retirement By Christopher Carosa 16 What works by Marty Traynor 32 Paradigm shift by David Contorno 40 Action reaction by Paul Wilson Vol. 14 Issue 11 November 2016 17 Technology with a human touch by Alan Goforth 20 12 common mistakes you should avoid during open enrollment by Alan Goforth 34 Workers’ comp trends for 2017 38 2016 Reader’s Choice Awards When the new president takes the oath of office in January, the Affordable Care Act will face its first test under a new commander- in-chief. By Kim Buckey Cover illustration by Paul Ryding cover story: 17 10 20 11.16 TOC.indd 2 10/19/16 12:21 PM

- 5. BSM-0716 • For agent use only. Policies and any associated riders underwritten by Assurity Life Insurance Company of Lincoln, Nebraska. Policy and rider availability, rates, provisions and features may vary by state. Critical Illness | Disability Income | Hospital Indemnity | Accident Expense Cancer Expense | Term Life | Whole Life | Universal Life Call (800) 276-7619, Ext. 8963, today! Email: worksitesales@assurity.com www.assurityatwork.com ìUnderstanding the best benefits for my employees isn’t really a priority.î (Said no one ever.) Expert Worksite Assurity at Work® When you present Assurity at Work to employers, you’re not just offering outstanding benefit designs, but the knowledge that comes from experience. Grow your business from the service, support and commitment to excellence that’s the hallmark of the relationships we build. Recoup lost income due to the ACA. Enjoy flexibility that makes worksite easy. Benefit from responsive, single-point service. Try our “never fail” billing. Half way is not our way. Experience the Assurity difference today! Assurity.indd 1 17/08/16 8:36 PMAssurity.indd 1 21/09/16 8:13 PM

- 6. November 20164 BenefitsPRO magazine Editorial Editor-In-Chief Paul Wilson pwilson@benefitspro.com Managing Editor Erin Moriarty-Siler emoriarty@benefitspro.com BenefitsPro Managing Editor Caroline Marwitz cmarwitz@alm.com Contributing Writers Christopher Carosa, David Contorno, Marty Traynor, Kevin Trokey, Alan Goforth, Nathan Solheim, Katie Kuehner-Hebert, Scott Wooldridge, Amber Taufen Group Publisher Tamara Patterson tpatterson@benefitspro.com Advertising Sales Account Executive Mariana Rosario- Gonzalez mrosario@benefitspro.com Account Executive Alicia Robledo arobledo@benefitspro.com Marketing eMarketing Community Manager Jamie Snow jsnow@alm.com Marketing Manager Jill Sheckels jsheckels@alm.com Design & Production Design Lead Joe Schlue jschlue@alm.com Client Services Manager Ashley Craft acraft@alm.com Director of Manufacturing Steve Johnston sjohnston@alm.com President/CEO Bill Carter President/Finance and Insurance Groups Matt Weiner Chief Content Officer Molly Miller Chief Financial Officer Debra Mason President, ALM Intelligence Andrew Neblett Chief Digital Officer David Saabye General Counsel Dana Rosen Senior Vice President, Global Events John Stuttard Something to talk about A new study shows a growing number of companies are giving employees access to centers of excellence—organizations that have high quality ratings in specialties such as cardiac or orthopedic services and infertility. In 2015, just 37 percent of employers gave their employees access to COEs; in 2016, however, 45 percent did so. Check out BenefitsPRO.com to find out which employers are turning to COEs to help contain health care costs. Comment of the month “Once again, they cut out the agents who have helped these people through the process and fail to fix the problem.” – flinsurance man, “Obama administration to pick ACA plans for displaced customers” According to recent data from Aflac, millennials are lost when it comes to understanding health insurance. The survey of 1,900 U.S. employees found: .com Featured blogs 5 steps to better care at lower costs for your sickest employees By Cindi A. Slater, M.D. facebook.comBenefitsPRO twitter.comBenefitsPRO BenefitsPRO Conversation piece 70% of millennial employees say reading about their benefits is “long, complicated or stressful” 1 in 3 feel confused or anxious just thinking about annual benefits enrollment 60% say they expect their employer to provide major medical coverage 3 in 10 would rather give up the internet or social media for a day than enroll in benefits 7 in 10 millennials say they waste nearly $750 due to benefits mistakes made during open enrollment Untreated mental health conditions: the staggering costs By Donovan Wong Health-care costs ate your pay raises By Barry Ritholtz Why brokers should focus on communication this open enrollment season By Randy Stram BPRO mast 11.16.indd 4 10/19/16 12:28 PM

- 7. PetersenPetersenPetersenInternationalUnderwritersInternationalUnderwritersInternationalUnderwriters (800) 345-8816 F www.piu.org F piu@piu.org Guaranteed-Issue Disability Insurance: With benefit limits up to $100,000 per person per month, this new product will be sure to capture the attention of a board of directors. Supplemental disability insurance that addresses the deficiencies of not only group coverage, but individual disability income policies as well. THREE LIFE MINIMUM Disability • Life • Medical • Contingency Petersen.indd 1 15/10/16 2:16 AM

- 8. november 20166 One way or another, it’s almost over. It seems wrong to feel that way about the culmination of our nation’s democratic process, but I’m sure I’m not the only one who’s ready for the end of this election cycle. Clear back in July, Americans were already suffering from election coverage fatigue, evidenced by a Pew Research study. At that time, 59 percent of Americans said they felt exhausted by the amount of election coverage. But fatigue might be the least of our election-related problems, at least according to Dr. Robert Glatter. In a recent Forbes column, he asks, “Is the election making you sick?” After all, he writes, prolonged stress, such as that caused by vitriolic political opinions and an unrelenting news cycle fueled by constant news alerts and tweets, can cause elevated blood pressure, a key factor in everything from strokes and heart attacks to hypertension. The solution? “If you are feeling overwhelmed by the 24/7 media blitz, it’s recommended that you unplug to limit media exposure and help you decompress,” he says. Now that’s advice I can get on board with, even when it’s not election season. But it’s one thing to tune out for a while and take a deep breath; it’s another to disconnect completely. And it seems that a growing number of Americans could be doing just that. A September survey from Gallup found an increasing percentage of U.S. adults are unsure if they’ll even vote for president this year. Just 69 percent of Americans rate their chances of voting as a “10” on a 1-to-10 scale, down from 76 percent in 2012 and 80 percent in 2008. And the lag is relatively bipartisan, which doesn’t say a lot for either candidate’s popularity, does it? Speaking of the candidates, this month’s cover story (page 10) takes a closer look at what our next president, whoever that might be, will mean for the future of health care. And for more industry insights, check out page 40, where benefits professionals take a crack at predicting how the election’s outcome could affect our industry. In a recent Twitter poll, we asked readers which candidate they trust more when it comes to health care reform. The majority (53 percent) touted Trump, while 28 percent backed Clinton and 16 percent said they didn’t trust either. Based on that, many of you might not be too happy as I write this, since momentum seems to be tilting back in Clinton’s favor, but if there’s one thing this election cycle has taught us, it’s to never assume anything. Either way, there’s a silver lining. Say it with me: It’s almost over. The home stretch opening dialogue by Paul Wilson “If there’s one thing this election cycle has taught us, it’s to never assume anything.” WARREN BENOIT Benoit & Associates TOM BLOMBERG BCS Financial JIM CHRISTENSON Allstate susan combs Combs & Company David Contorno Lake Norman Benefits, Inc Aaron davis NextLogical Benefit Strategies Jani De La Rosa Heffernan Insurance Brokers CARROLL FADAL Texas Life brian latkowski New Benefits BOB MORHAUSER National Guardian Life Insurance Group Mark Parabicoli ARAG Legal BRIAN ROBERTSON Fringe Benefit Group Brandon Scarborough Power Group Cos. advisory board 11.16 opening dialogue.indd 6 19/10/16 12:44 PM

- 9. Uncover inventive ways brokers are succeeding in the dynamic benefits industry. Access new perspectives on how to adapt. Get an in-depth view of top emerging business models. Visit The Lab Today! benefitspro.com/TheLab broker innovation lab Secure the future for you and your business Broker Innovation Lab House BIL.indd 1 20/07/16 5:18 PM

- 10. November 20168 BenefitsPRO magazine A recent Eastbridge survey of employers found that the use of private exchanges continues to be minimal among all size categories and that a positive correla- tion remains between use and employer size (with use increas- ing as employer size increases). Many times, it is the broker who influences these employers to adopt the exchange model, and to offer more options to their employees or to move to a defined contribution approach. Since brokers are often the ones suggesting an exchange for their clients, it makes sense that most employers (74 per- cent) continue to use a broker for their employee benefits after implementing a private exchange. Only 19 percent of the employers no longer utilize broker services. While use has been low, em- ployers that have implemented an exchange believe their employees’ experience with the private exchange has been positive. Forty percent indi- cated the experience was not only positive, but easier than previous enrollments, and 52 percent said it was positive, but not signifi- cantly different from previous enrollments. The survey also pointed to fu- ture interest by employers in pri- vate exchanges. Over one-quarter of the employers that are not us- ing a private exchange today are open to using this concept in the future, and another one-quarter are still undecided. Whether or not to offer a pri- vate exchange is a decision that should be based on many fac- tors. Nonetheless, it is important for brokers to at least consider broaching the subject with em- ployer clients—or risk the chance that some other broker will. The fact that most employers rate the exchange process positively should provide comfort to those considering this approach to benefits. “Only 19 percent of employers no longer utilize broker services.” Gil Lowerre and Bonnie Brazzell, Eastbridge Consulting Group, Inc. Private exchange use low, but positive plot points By Gil Lowerre and Bonnie Brazzell Broker Usage Since Implementing a Private Exchange 7% 74% 19% No longer using brokers Still using brokers Never used a broker Openness to Using Private Exchanges For Benefits Employee Experience with Private Exchange Open for core and voluntary Core only Voluntary only Not interested in or open to PEX Don’t know 22% 5% 4% 40% 28% Very positive and easier than previous enrollments Postive, but not that different than previous enrollments Negative, more difficult for EES to enroll Don’t know 52% 40% 2% 6% Plot points 11.16.indd 8 10/19/16 12:30 PM

- 11. APS-2704 AmericanPublic.indd 1 15/10/16 2:10 AM

- 12. November 201610 BenefitsPRO magazine Beyond Obama➥ 11.16 cover story.indd 10 19/10/16 12:48 PM

- 13. BenefitsPRO.com November 2016 11 When the 45th president of the United States takes the oath of office on January 20, 2017, the Affordable Care Act will face its first test under a new commander-in-chief. By Kim Buckey The ACA Under Clinton Trump or Illustrations by Paul Ryding 11.16 cover story.indd 11 10/19/16 12:58 PM

- 14. November 201612 BenefitsPRO magazine Democratic presidential nominee Hillary Clinton and Republican presi- dential nominee Donald Trump have very differ- ent approaches to the future of health care reform, with Clinton promising to “protect” the ACA, and Trump calling for a full repeal. The truth for both sides is somewhere in between. Whether the executive branch remains blue or turns red, the ACA will have had nearly seven years to mature since it was signed into law. A full repeal is not realistic for many reasons—perhaps the most obvious being that several provisions are popular with both employers and the pub- lic and enjoy bipartisan support. And while each candi- date has a vision for the future of health care, the fate of that vision and of the ACA itself will depend heavily on the partisan makeup of Congress. While Trump’s promise to repeal the ACA and replace it with “something ter- rific” is not realistic, replacing significant pieces is possible if Trump is elected and the House and Senate remain under Republican control. Trump’s health care plan falls into three buckets: The ACA Under Trump 1. More choice, lower costs, greater flexibil- ity — Expand access to health spending accounts to inspire movement toward consumer-directed health plans (CDHPs). This also supports greater health insur- ance portability, which includes subsidies for purchase of health insurance, private exchange options, a repeal of the individual and employee man- dates and a change to the definition of a full- time employee. A major point to consider is the tax treatment of employer- sponsored insurance. Currently, the value of benefits is excluded from income. Trump is calling for a cap on this exclusion as an alternative to the Cadillac Tax (which he says he’ll repeal). This also supports insurers operating across state lines and pooling for small businesses. 2. Protecting and strengthening cover- age options for all Americans — Supports insurance market reform, includ- ing many provisions already established in the ACA, such as no pre-existing condition exclusions, allowing children on parents’ plan through age 26, no lifetime limita- tions on coverage, no rescissions, guaran- teed renewability and continuing coverage protections. This supports ad- ditional state funding for high-risk pools and a one-time open enrollment, which, as long as consumers maintain continu- ous health insurance coverage throughout their lives, would prohibit an insurer from re-rating its plan based on medical condition. 3. Protecting Medicare and Medicaid for future generations — Advocates mod- ernizing a premium support model for Medicare that would guarantee every enrollee an income- adjusted contribution toward a plan of their choice, with cata- strophic protection. This also imposes no changes for persons 55 or older. Beyond Obama “This legislation ... has resulted in runaway costs, websites that don’t work, greater rationing of care, higher premiums, less competition and fewer choices.” 11.16 cover story.indd 12 10/19/16 12:58 PM

- 15. BenefitsPRO.com November 2016 13 The ACA Under ClintonThere are five key elements of Clinton’s health care plan that support employer-sponsored insurance (ESI) and do not support a single-payer system, a solution her opponent in the primaries, Bernie Sanders, made a central part of his campaign. 1. Expand access — Proposes a government plan option for cov- erage on each state’s public exchange, which would compete against commer- cial plans. Also wants to allow individuals to opt into Medicare at age 55 and expand primary care funding at federally qualified health centers from $20 million to $40 million. 2. “Protect” the ACA — Op- poses any efforts to cut back or repeal the ACA. To offset rising premiums on the public exchange, suggests sub- sidy increases. Would work with governors in the 19 states who have not taken up ACA Medic- aid expansion to change their minds. 3. Control health care costs — Be- lieves that work- ers should share in the slower growth of na- tional health care spending through lower premiums, deductibles and copays, but seeks to limit out-of- pocket costs for the insured and to enhance government au- thority to reject “excessive” pre- mium increases. 4. Reduce prescription drug costs — Suggests limits on out-of-pocket costs for prescrip- tion drugs, spe- cifically through government programs like the exchanges, Medicare and Medicaid. 5. Support “value” in health care — Supports initiatives to promote value- driven health care programs established by President Obama, including the Medicare Access and CHIP Reau- thorization Act of 2015 (MA- CRA), the Center for Medicare & Medicaid Innova- tion (CMMI) and accountable care organizations (ACOs). “As we see more consolidation in health care, among both providers and insurers, I’m worried that the balance of power is moving too far away from consumers.” 11.16 cover story.indd 13 10/19/16 12:59 PM

- 16. November 201614 BenefitsPRO magazine Uncertainty puts benefits communication at forefront Potential revisions to the ACA, whether they are incremental or substantial, will require strategic, thoughtful benefits communications to prepare plan partici- pants for the impact on their plans and, ultimately, on them and their families. We already know from multiple studies and surveys that plan participants do not have a good grasp of how health insurance works and, in fact, don’t think about their coverage until they actually have to use it. Anything brokers and their clients can do to provide context for potential plan design changes will go a long way toward increasing acceptance and understanding of those changes when the time comes. Whether Clinton or Trump is elected, com- panies that employ or outsource knowledge- able benefits commu- nication expertise will be better equipped to navigate changes to the ACA and have the best chance of engag- ing and retaining a productive workforce. The political and economic backlash from suddenly ending health care coverage for an estimated 20 million Americans would be too great for full repeal to truly be an option. Beyond Obama ESI future looks bright With neither candidate proposing a viable replacement, the future of employer-based in- surance is strong. The timeline for a transi- tion to a single-payer system (or Trump’s pro- posal of portable and non-employer binding coverage) is likely de- cades rather than years away, and employers will be reluctant to eliminate any program that will give them an edge in recruiting and retaining talent. Con- gress and the current administration also see the value in ESI, a per- spective which contrib- uted to postponement of the Cadillac Tax to 2020. Clearly, the gov- ernment does not want to push employers into decreasing or dropping coverage entirely. That said, the ESI market will continue to evolve from both a product and service perspective in response to employer and employee needs and changing regulations. Full repeal is not an option The political and economic backlash from suddenly ending health care coverage for an estimated 20 million Americans would be too great for full repeal to truly be an option. Insurers have invested mil- lions of dollars in systems to support ACA environments and would incur additional costs to retool or replace what they’ve put in place. Employ- ers would face similar chal- lenges, nullifying in-house and consulting investments to comply with new, revised or disbanded ACA provisions. While many of Trump’s pro- visions are similar to what is already included in the ACA, there are operational differ- ences that rely on a principle of conservative governance. As an example, while ACA subsidies increase as premi- ums increase, Trump’s plan calls for subsidies to remain flat, encouraging competi- tion as a way to drive down premiums and make insur- ance more affordable. Promot- ing private exchange options in addition to the public exchange could, in the spirit of competition, bring down prices. Neither of those out- comes will occur, of course, unless changes are made that bring insurers back into the marketplace, after the exodus we’ve seen in past months. A recurrence of the full- blown ACA debate of 2009- 2010 is not realistic. Instead, new health care legislation will emerge in the context of incremental changes that might even contain some ele- ments of bipartisanship. 11.16 cover story.indd 14 10/19/16 1:00 PM

- 17. BenefitsPRO.com november 2016 15 It’s been 10 years since we saw a rare convergence of the indus- try, regulations, and academ- ics with the signing of the Pension Protection Act (PPA) in 2016. Among the gems included in this legislation is the encouragement of the use of auto-enrollment. This “nudge” con- cept, advocated in part by strong academic studies, shifts the default from opting-in to opting-out. This takes advantage of the native decision-making inertia all too often exhibited by humans—that is, not making a decision. The fruits of this reframing have been borne out by increased partici- pation rates. According to the U.S. Bureau of Labor Statistics, signifi- cantly more employees participate in 401(k) plans with auto-enrollment versus those that participate in 401(k) plans without auto-enroll- ment. This outcome matches the intention of the 2016 PPA. Perhaps “matches” wasn’t the best word to use. Theorists feared auto-enrollment would remove the need for companies to offer a matching incentive to employees. Indeed, based on the mean data, this appears to be the case. The mean maximum match of 3.5 per- cent for plans without auto-enroll- ment is nearly 10 percent higher than the mean maximum match for plans without auto-enrollment. By itself, this fact is merely triv- ia. The important thing, though, is the reaction of employees. It turns out matching incentives work. A larger percentage of employees max out on their company match- ing in 401(k) plans without auto- enrollment than do in plans with auto-enrollment. The quick interpretation of these figures is that, while employees in auto-enrollment plans may, in general, be bet- ter off, those who participate in plans without auto-enroll- ment may have a better sav- ings strategy. In other words, although auto-enrollment brings more people into the plan, higher matching incentives lead to greater savings rates among participants in plans without auto-enrollment. Which brings us to the bottom- line: It’s the savings strategy that matters, not just the simple act of saving. Auto-enrollment succeeds because it removes decision pa- ralysis from the equation. It does this by creating a new inertia. In auto-enrollment, no decision means doing the right thing (i.e., saving for retirement). Here’s the problem: This new inertia of default investing has a downside. Because it removes the need to make decisions, it also removes the necessary delibera- tion required when making deci- sions. Employees are too tempted to leave everything on autopilot. That’s fine when you’re midflight and the course is already set; it becomes an issue when unantici- pated winds cause you to veer off course—and let’s not even talk about takeoff and landing. Getting started in a 401(k) is not a strategic decision, but it is a critical first step. Auto-enrollment has proven to be an effective nudge for this. Beyond that first step, employees need a savings strategy, even when auto-escala- tion is used. That decision cannot be delegated or nudged. Make sure your savings strat- egy isn’t a turkey. “It’s the savings strategy that matters, not just the simple act of saving.” Christopher Carosa, CTFA, is chief contributing editor for Fiduciary News.com and author of the new book, “401(k) Fiduciary Solutions.” Is your retirement strategy a turkey? navigating retirement By Christopher Carosa 67% vs. 77% Participation rate in 401(k) plans without auto-enrollment versus those with auto- enrollment.* 72% vs. 65% Company match rates in 401(k) plans without auto-enrollment versus those with auto- enrollment.* *Source: U.S. Bureau of Labor Statistics: “Automatic enrollment employee match rates and employee compensation in 401(k) plans,” Monthly Labor Review, May, 28, 2015 3.5% vs. 3.2% Mean maximum match incentive in 401(k) plans without auto-enrollment versus those with auto- enrollment.* nav ret 11.16.indd 15 10/19/16 1:02 PM

- 18. November 201616 BenefitsPRO magazine A couple of months ago, I fi- nally read “The Big Short: Inside the Doomsday Machine” by Mi- chael Lewis. The book delves into the 2008 financial crisis, which was fueled by ethical failures on many fronts. While both the book and the subse- quent movie may not be perfect, they provide an interesting look at the role of integrity in business. As I contemplated the ethical lapses described in the book, more examples appeared in the news. Let’s consider some of these events. Recent news of yet another major bank scandal (and the corporate and personal income that goes along with it) has called attention to business ethics yet again. While unethical behavior seems to be perpetrated by those who think of themselves as “good people,” the bank’s leadership seems to be tone deaf when it comes to the results their actions have on the rest of us. Their excuse is that cross- selling is part of their culture, but they never intended to incentivize falsifying accounts. Meanwhile, the company officials responsible for creating the culture cite misinterpretation of their customer-centered goals by some misguided associates. And then there is the EpiPen pric- ing controversy, yet another exam- ple of companies taking advantage of both customers and a medical insurance system that masked the price increases on the product until they finally hit a level that got the attention of the masses. What about our business, and spe- cifically voluntary benefits? Are we treating customers in the way they deserve? Do we get credit for doing things right for our customers, or are we incented to take advantage of the employees, treating them in a way that maximizes income and profits for us in place of maximizing value for them? A recent email sent to me by a broker/advisor illustrates the value of integrity in action. Pamela Whitfield was prompt- ed by a previous column to share her story with me. She moved from Washington state to Anchorage, Alaska, and has built a very successful voluntary practice in a short period of time (last year increasing voluntary sales to over $2 million). Pamela attributes her success to “doing the right thing day in and day out.” The very first account she enrolled had a poor experience with another company, including heavy- handed overselling of employees. One individual was paying $578 a month for voluntary coverage, includ- ing some coverage that duplicated employer-paid benefits. She “unsold” unnecessary voluntary plans as ap- propriate, taking the ethical approach rather than taking advantage of the income she could have had from continuing the overselling process. Pamela’s advice to employee benefit agency owners is to build success based on “the standards they set for their organization.” She created her business in a market where she had virtually no contacts, but she had a vi- sion for success and combined it with “a commitment to provide this market with the honesty and service-focused team that they would be proud to work with.” Pamela’s story tells us that building a winning voluntary benefit practice does not require overselling, misrep- resenting, or corner cutting. Winning with employer and employee custom- ers comes down to doing things right by always acting with integrity. That’s the key to happy customers who stay with us, tell their friends, and ulti- mately create value for all. “What are the odds that people will make smart decisions about money if they don’t need to make smart decisions— if they can get rich making dumb decisions? The incentives on Wall Street were all wrong; they’re still all wrong.” — Michael Lewis, “The Big Short: Inside the Doomsday Machine” Integrity still matters What works By Marty Traynor Marty Traynor is vice president voluntary benefits and group products at Mutual of Omaha. He may be reached at marty. traynor@ mutualo- fomaha. com What Works 11.16.indd 16 10/19/16 1:04 PM

- 19. BenefitsPRO.com november 2016 17 technology human touch with a Technology alone can’t provide a magic solution to one of the major chal- lenges facing brokers and their clients during open enrollment—but it certainly helps. Learn to bridge the communications gap By Alan Goforth BPRO 11.16 enrollment tech.indd 17 19/10/16 12:52 PM

- 20. november 201618 BenefitsPRO magazine “Our biggest chal- lenge is communica- tion,” says Linda Garcia, vice president of human resources for Rooms to Go, a furniture retailer based just outside Tam- pa. Her company has 7,500 employees work- ing at 160 retail outlets and seven distribu- tion centers across the Southeast and Texas. “We simply don’t have the resources to send an HR person to every store,” Garcia says. “We are taking advantage of technol- ogy, and we are combin- ing the best of old- and new-school tactics. All employees receive printed materials; we hold as many in-person meetings as we can; and we broadcast those meetings to our distri- bution centers. Technol- ogy really has helped us reach our employees with a more consistent message.” This high-tech, high- touch strategy also resonates with Kathy O’Brien, vice president of voluntary benefits and national client group services for Unum in Chattanooga, Tennes- see. “Technology contin- ues to grow and be a big part of enrollment— much more than in the past,” she says. “We probably get more ques- tions about technology from employers than any other topic. “However, every employee is different. technology We want to spend time with brokers and clients to build customized plans for each employer. That may include old- fashioned paper and group meetings, as well as technology such as self-service enrollment or a kiosk with assisted enrollment.” Industry experts agree that hassle-free enrollment requires that everyone in the chain— carrier, broker, employer and employee—adopt appropriate technology and then thoroughly explain options and pro- cedures to every stake- holder. Turning to tech Technology, if properly selected and implement- ed, can greatly stream- line the enrollment process. What’s more, it can significantly reduce the risk of errors that comes with manually in- putting information from printed forms. Besides enabling enrollment, technology equips employers to com- municate with employees about benefit options and how to navigate the process. “In addition to send- ing out informational emails to everyone in the company, we also send information to personal email ad- dresses and personal cellphones,” says Gar- cia. “Because we are furniture stores with TV monitors in all loca- tions, we have recently started streaming infor- Experts recommend evaluating several steps for implementing technology: • Training employees on using the automated system • Outlining data that needs to be captured • Creating a workflow using integrated technology in relevant departments • Developing an electronic approval process • Planning for data management and analysis • Automating deadlines with notifications • Appointing personnel for issues • Sending this information to carriers BPRO 11.16 enrollment tech.indd 18 10/19/16 1:05 PM

- 21. BenefitsPRO.com november 2016 19 mation about benefits and open enrollment for employees before our stores open. It includes voice-over PowerPoints and videos that we pro- duce. Every day, we use a different approach. “The feedback I have gotten from our HR people is that employ- ees really like it. The only stumbling block is that occasionally, the technology doesn’t work well in the stores. But you expect a few glitch- es when trying some- thing for the first time.” Brokers and carriers step up One misconception dat- ing back to the science fiction movies of the 1950s is that technology will eventually reduce the importance of real people. But if anything, technology is making the roles of brokers and carriers even more important. “We rely heavily on our broker, who conducts meetings with the material we provide,” Garcia says. Carriers are also plac- ing greater responsibili- ty on brokers, especially given the explosion of voluntary benefits in recent years. “Brokers now have a lot more carriers in voluntary benefits than they did several years ago,” O’Brien says. “They have to be very knowledgeable about the carrier, what they will do to meet the needs of their clients and what types of ser- vice they offer, not just in enrollment but also in plan administration; how they will deliver the services, how they will pay and handle bill- ing information.” Colonial Life of Co- lumbia, South Carolina utilizes cutting-edge technology, but 80 per- cent to 90 percent of its business is still broker- driven, says Heather Lozynski, assistant vice president of premier cli- ent management. “We definitely are seeing more demand, not just for products and services, but for exper- tise,” she says. “We and our brokers take a holistic approach to the customer’s enrollment program, from benefits communications to personalized benefits education and counsel- ing, as well as ongoing, dedicated service. This allows the employer to then focus on other aspects of their benefits process.” Rooms to Go counts on this value-added service. “Colonial is defi- nitely a major part of our open enrollment,” Garcia says. “They actu- ally produce our written materials and videos for us. Our communications managers go to Colonial to produce the video, which is terrific for us. They also take care of the personal emails to our associates. They offer three ways to en- roll—online, by phone, or personal meetings with carrier representa- tives who go to our loca- tions and sit down with employees.” What does it take for brokers to succeed in today’s environment? “One important thing for brokers to do is listen to their clients, to really know and under- stand what their clients want and need,” O’Brien says. “There are a lot of different technologies, and all offer similarities and differences. Brokers must understand their clients’ needs, not just for enrollment but also throughout the year.” Despite the great strides technology has made, it can become a distraction. “Technology is so prevalent in the enrollment space today, but watch out for rely- ing on technology as the one thing that will make or break enrollment,” she says. “Technology is great for capturing data, but it won’t solve every problem and doesn’t change the importance of all of the other work you need to do.” So which is it, tech- nology or people? “Technology and old- fashioned service are equally important,” Lo- zynski says. “We begin planning for reenroll- ment six to nine months out, and then determine how best to use technol- ogy and people. We help customers understand what is important to them, where the biggest pain points are, and better understand the business.” Do the homework, implement the technol- ogy and communicate, communicate, commu- nicate. “If you don’t have all of the details to give to your associates, they can’t make good deci- sions,” Garcia says. “Make use of all of the tools you have available, from printed materi- als to videos and text messages. One thing I learned very early on is that communications is critical.” “Hassle-free enrollment requires that everyone in the chain— carrier, broker, employer and employee— adopt appropriate technology and then thoroughly explain options and procedures to every stakeholder.” BPRO 11.16 enrollment tech.indd 19 19/10/16 12:53 PM

- 22. november 201620 BenefitsPRO magazine 20 enrollment mistakes.indd 20 19/10/16 12:56 PM

- 23. BenefitsPRO.com november 2016 21 By Alan Goforth The dirty dozen Experience is the best teacher, but its lessons often come at a high price. Every employer or human resources professional has made mistakes during open enrollment. Trying to ac- commodate the diverse needs of the workforce in a short time frame against the backdrop of increasing options and often bewildering regulations can be a challenge, even in the best-run companies. Avoiding mistakes is impossible, but learning from them is not. Although the list may be limitless, here are a dozen of the most common pratfalls during open enrollment and how to avoid them. Avoid these 12 common traps during open enrollment 1. FAILING TO COMMUNICATE “What we’ve got here… is failure to communicate.” – Cool Hand Luke This mistake likely has topped the list since open enrollment first came into existence, and it will probably continue to do so. That’s be- cause enrollment is a complex procedure, and few challenges are greater that making sure employers, employees, brokers and carriers are on the same page. Employers have both a stick and a carrot to encourage them to communicate as well as possible. The stick is the Affordable Care Act, which requires all employers subject to the Fair Labor Standards Act to communicate with employees about their health care coverage, regardless of whether they offer benefits. As a carrot, an Aflac study found that 80 percent of employees agree a well-communicated benefits package would make them less likely to leave their jobs. NEGLECTING TECHNOLOGY The integration of new technol- ogy is arguably the most significant innovation in the enrollment pro- cess in recent years. This is espe- cially important as younger people enter the work- force. Millennials repeatedly express a preference for receiving and analyzing benefits information by computer, phone or other electronic devices. The challenge is to make the use of technology as seamless as possible, both for employees who are tech-savvy and for those who are not. Carriers and brokers are making this a point of empha- sis, and employers should lean on them for practical advice. 2. 20 enrollment mistakes.indd 21 10/19/16 1:08 PM

- 24. november 201622 BenefitsPRO magazine CUTTING TOO MANY CORNERS One of the most difficult financial decisions employers make each year is deciding how much money to allocate to employee benefits. Spending too much goes straight to the bottom line and could result in having to lay off the very employees they are trying to help. Spending too little, however, can hurt employee retention and recruiting. Voluntary benefits offer a win-win solution. Employees, who pick up the costs, have more options to tailor a program that meets their own needs. In a recent study of small businesses, 85 percent of workers consider voluntary benefits to be part of a comprehensive benefits package, and 62 percent see a need for voluntary benefits. OVER-RELIANCE ON TECHNOLOGY SUCCUMBING TO INERTIA It can be frustrating to invest sub- stantial time and effort into employ- ee benefit education, only to have most of the staff do nothing. Yet that is what happens most of the time. Just 36 per- cent of workers make any changes from the previous enrollment, and 53 percent spend less than one hour making their selections, according to a LIMRA study. One reason may be that employees don’t feel as- sured they are making the right decisions. Only 10 percent felt confident in their enrollment choices when they were done, according to a VSP Vision Care study. One good strategy for overcoming in- ertia is to attach dollar values to their choices and show where their existing selections may be leaving money on the table. NOT THINKING HOLISTICALLY “Holistic” is not just a description of an employee wellness program; it also describes how employ- ers should think about employee benefit packages. The bread-and-butter benefits of life and health insurance now may include such voluntary options as dental, vision and critical illness. Employers and workers alike need to understand how all of the benefits mesh for each individual. Businesses also need to think broadly about their ap- proach to enrollment “Overall, we take a holistic approach to the customer’s enrollment program, from benefits communication to personalized benefits edu- cation and counseling, as well as ongoing, dedicated service,” says Heather Lozynski, assistant vice president of premier client manage- ment for Colonial Life in Columbia, South Carolina. “This allows the employer to then focus on other aspects of their benefits process.” 3. 4. 5. 6. enrollment traps At the other end of the spec- trum is the temptation to rely on technology to do things it was never meant to do. “Technology is so preva- lent in the enrollment space today, but watch out for relying on technology as the one thing that will make or break enroll- ment,” says Kathy O’Brien, vice president of voluntary benefits and nation client group services for Unum in Chattanooga, Tennes- see. “Technology is great for capturing data, but it won’t solve every problem and doesn’t change the importance of the other work you need to do.” 20 enrollment mistakes.indd 22 10/19/16 1:12 PM

- 25. BenefitsPRO.com november 2016 23 UNBALANCED BENEFITS MIX Employee benefits have evolved from plain vanilla to 31 (or more) flavors. As the job market rebounds and competition for talented employees increases, workers will demand more from their employers. Benefits that were once considered add-ons are now considered mandatory. Round out the benefits package with an appealing mix of standard features and voluntary options with the objective of attracting, retaining and protecting top-tier employees. INCOMPLETE DOCUMENTATION Employee satisfaction is a worthy objective—and so is keeping government regula- tors happy. The Affordable Care Act requires employers who self- fund employee health care to report information about minimum essential cover- age to the IRS, at the risk of penalties. Even if a company is not required by law to offer compliant coverage to part- time employees, it is still re- sponsible for keeping detailed records of their employment status and hours worked. As the old saying goes, the job is not over until the paperwork is done. FORGETTING THE FAMILY The Affordable Care Act has affected the options available to employers, workers and their families. Many businesses are dropping spousal health insurance coverage or adding surcharges for spouses who have access to employer-provided insurance at their own jobs. Also, adult children can now remain on their parents’ health policies until they are 26. Clearly communicate company policies regard- ing family coverage, and try to include affected family members in informational meetings. Get to know more about employees’ families—it will pay dividends long after open enrollment. LIMITING ENROLLMENT OPTIONS Carriers make no secret about their emphasis on electronic benefits education and enrollment. All things considered, it is simpler and less prone to copying and data-entry errors. It would be a mistake, however, to believe that the high-tech option is the first choice of every employee. Be sure to offer the options of old-fashioned paper documents, phone registration and face-to-face meetings. One good compromise is an on-site enroll- ment kiosk where a real person provides electronic enrollment assistance. 7. 8. 9. 10. The close of enrollment is a critical time to observe by soliciting feedback from employees, brokers and carriers. 20 enrollment mistakes.indd 23 10/19/16 1:12 PM

- 26. november 201624 BenefitsPRO magazine Statement of Ownership, Management, and Circulation 1. Title: BenefitsPRO 2. Publication No.: 1942-3551 3. Filing Date: September 15, 2016 4. Frequency: Monthly 5. No. of Issues Published Annually: 12 6. Annual Subscription Price $80 U.S. 7. Mailing Address: 4157 Olympic Blvd., Suite 225, Erlanger KY 41018; Contact Person: Lynn Kruetzkamp, Telephone: (859) 692-2256 8. Business Office: 120 Broadway, 5th floor, New York, NY 10271 9. Names and addresses of Publisher and Editor and Managing Editor: Publisher: Tamara Patterson, 7009 S. Potomac St., Ste. 200, Centennial, CO. 80112 Editor: Paul Wilson, 7009 S. Potomac St., Ste. 200, Centennial, CO. 80112 Managing Editor: Erin Moriarty-Siler, 7009 South Potomac St, Ste. 200, Centennial, CO 80112 10. Owner: ALM Media, LLC. 120 Broadway, 5th floor, New York, NY 10271 11. The known bondholders, mortgagees, and other security holders owning or holding 1 percent or more of the total amount of bonds, mortgages, or other securities are: None 12. Tax Status: N/A 13. Publication Title: BenefitsPRO 14. Issue Date for Circulation Data Below: September 2016 15. Extent and Nature of Circulation I certify that all information furnished on this form is true and complete. Sheila Hyland, Finance Director. 9/15/16 A. Total No. Copies (press run) 42,944 41,338 B. Paid and/or Requested Circulation 1. Paid/Requested Outside- County Mail Subscriptions Stated on Form 3541 42,428 40,808 2. Mailed In-County Subscriptions Stated on PS Form 3541 0 0 3. Paid Distribution Outside the Mails Including Sales Through Dealers and Carriers, Street Vendors, Counter Sales, and Other Non-USPS Paid Distribution 1 1 4. Paid Distribution by Other Classes of Mail Through the USPS 0 0 C. Total Paid and/or Requested Circulation 42,429 40,810 D. Nonrequested Distribution by Mail 1. Nonrequested Outside-County Copies as Stated on Form 3541 0 0 2. Nonrequested In-County as Stated on Form 3541 0 0 3. Nonrequested Copies Mailed at Other Classes Through the USPS 0 0 4. Nonrequested Distribution Outside the Mail 515 528 E. Total Nonrequested Distribution 515 528 F. Total Distribution 42,944 41,338 G. Copies Not Distributed 0 0 H. Total Sum 42,944 41,338 I. Percent Paid and/or Requested 98.80% 98.72% Avg. No. Copies Each Issue During Preceding 12 Months No. Copies of Single Issue Published Nearest to Filing Date LETTING BENEFITS GO UNUSED A benefit is beneficial only if the em- ployee uses it. Too many employees will sign up for benefits this fall, forget about them and miss out on the advan- tages they offer. Periodically remind employees to review and evaluate their available benefits throughout the year so they can take advantage of ones that work and drop those that do not. In addition to health and wellness benefits, also make sure they are taking advantage of accrued vacation and personal days. Besides maximizing the return on their benefit investment, it will periodically remind them that the employer is look- ing out for their best interests. enrollment traps 11. PREMATURELY CLOSING THE OODA LOOP Col. John Boyd of the U.S. Air Force was an ace fighter pilot. He summarized his success with the acronym OODA: Observe, Orient, Decide and Act. Many successful businesses are adopting his approach. After the stress of open enrollment, it’s tempting to breathe a sigh of relief and focus on something else until next fall. However, the close of enrollment is a critical time to observe by soliciting feedback from employees, brokers and carriers. What worked this year, and what didn’t? What types of communications were most effective? And how can the process be improves in 2017? “Make sure you know what is working and what is not,” says Linda Garcia, vice president for human resources at Rooms to Go, a furniture retailer based just outside Tampa. “We are doing a communications survey right now to find out the best way to reach each of our 7,500 employees. We also conduct quarterly benefits surveys and ask for their actual com- ments instead of just checking a box.” 12. 20 enrollment mistakes.indd 24 10/19/16 1:13 PM

- 27. November 2016 Expert Wellness programs have proliferated in recent years, with more than 80 percent of large employers now offering some type of program to their employees. But the rapid growth has been accompanied by significant backlash from skeptics questioning everything from relevance to ROI. ¶ Amidst a sea of conflicting opinions and a deluge of data points, how can brokers help employers best engage, implement and drive success with wellness plans? The value of AdviceA 11.16 Wellness frontis.indd 25 10/19/16 1:20 PM

- 28. Order your reprints as published in BenefitsPRO. Contact 877.257.3382 • reprints@alm.com Maximize Your Recognition In PrInt, DIgItal anD IntegrateD MeDIa Reprints & Licensing www.ALMReprints.com May 2016 | Benefits Selling | BenefitsPro.com 14 The finalists for the 2016 Benefits Selling Broker of the Year all have a few things in common. They work hard for their clients. They think strategically. They encourage long-term planning. They don’t let regulations get in the way of success. They give credit to the people who work with them.Indeed, they’ve all done more than just survive today’s uncertain and unpredictable business climate. They’ve thrived. TReed Smith’s formula forsuccess consists of a few keyingredients that set him apartfrom other brokers and agents.For starters, he doesn’t just sitdown with a client and reviewa spreadsheet to see wherehe can save them money.He takes it a couple stepsfurther by devising a strategyfor his clients to compete intheir marketplace. Like otherbrokers and agents, he hasbeen a leader in encouragingconsumer-driven health care.But in order to do so, Smithhas embraced technology toengage employees and reducecosts. When the AffordableCare Act (ACA) was passed,Smith conducted webinars forhis clients to learn about thelaw. During those webinars,more than a few employersrealized that Smith was wayahead of the game. Those are just a few reasonswhy Smith, a senior vicepresident and practice leader atCoBiz Insurance in Denver, isBenefits Selling’s 2016 Broker ofthe Year. “He’s got a lot of greatstrengths,” says Todd McLean,president of CoBiz Insurance. “He’s a passionate championfor employee benefits and howthey impact people. He’s alsoan exceptional team player; hegoes 24-7 and will be anywherefor his team and his clients. Hegives great guidance to the team,he’s articulate and he has all thequalities you want to see fromsomeone in control. He’s ourpractice lead to the entire teamand he’s an individual everyoneon the team feels comfortablegoing to.” The 37-year-old Smithjoined CoBiz in 2009 and hashelped grow the company’semployee benefits businessfrom $2 million at that time to$6 million last year. Smith workswith about 50 small- to mid-sizecompanies, and his strategieshave helped CoBiz’s clientskeep their health care costssignificantly below inflation forfour years running.“We are always pushingourselves to think about thehelp our clients need to makesure they’re outperformingthe national average and theircompetitors in attracting andretaining talent because theyhave a better benefits plan that ismore cost effective,” Smith says. Actionable intelligenceWhile he’s helped his clients manage health care costs, Smith sees his role as much more than acting as a spreadsheet analyst. He talks with his clients about health insurance and benefits packages in competitive terms. The way Smith sees it, helping clients attract and retain top employee talent enables them to beat their competition.“We spend a lot of time in up-front discussions with new clients, talking about how we can align benefits strategy with their business strategy,” Smith says. “We use analytics, employee education and long-term strategic planning—that’s not how insurance and benefits are managed in a lot of places. So when we talk to a new client about whether there are any disparities between their business and how they manage their health care benefits, we tell them we want to be the company that lives in the benefits world and brings them actionable intelligence.”Smith has worked with Cochlear—an international manufacture of implantable hearing devices with offices in Centennial, Colorado—for the past four years. Kim Coleman, a senior director of human resources with the company, points toward Smith’s understanding of her company’s culture and business objectives as attributes that have set him apart from other brokers and agents. In fact, Smith’s contributions to Cochlear were deemed so valuable that CoBiz was able to retain the company as a client after the company changed CEOs.“He looks at and listens for what’s going on in the market and what’s going on in the organization— what we’re trying to achieve from a benefits perspective,” Coleman says. “We have a very close partnership to align Cochlear’s benefits strategy with what’s going on in the local and national market.” “We’re very fortunate to have a base in Colorado,” Smith says, “which is continually recognized as one of the fastest growing economies and one of the best places in the country to live and work, so employers are moving here all the time. There are huge national employers that are building infrastructure here, but we also have these small and mid-size clients who are competing for talent. We tell employers—whether you’re a customer today or a future customer—that if you don’t view health care as an advantage today, it will become a disadvantage down the road.” of the year broker BSL 5.16 cover story.indd 14 19/04/16 6:42 PM April 2016 | Benefits Selling | BenefitsPro.com3 of the year broker “It’s easier now to change than it ever has been.” Selling SolutionS for brokerS Volume 14, No. 5 | May 2016 BenefitsPro.com reed smith Digital license logo license glossy Prints Wooden Plaque 2016 broker of the year House reprints.indd 1 20/07/16 6:46 PM

- 29. BenefitsPRO.come November 2016 27 By Elizabeth Thompson be the cure for your wellness program? Not long ago, a client said to me, “It’s all about coaching.” They wanted us to help them enroll more employees into a coaching program. For them, the results were adding up: engaged, activated employees; wellness success stories; downward trending health costs; more productive employees; and a positive wellness program experience overall. But not every employer has the same experience. Consequently, over the last decade, wellness programs have taken a beating by skeptics who deny that wellness offers any reliable return on investment. Still, when more than 80 percent of large employers nationally are offering wellness programs, something must be going right. Turns out, it’s not about whether a wellness program can deliver results—plenty of big groups have published their data proving their own ROI—it’s really about what kind of wellness program can deliver results for your individual group’s profile. And wellness programs that offer health coaching may have a leg up when it comes to getting results. Coaching provides the personal, one-on-one guidance, inspiration and motivation that can help convert non-participants to active, empowered participants who, over time, can make real life changes. I’ve seen it happen time and again. So what does an evidence-based health coaching program look like? Here are the essential elements: coaching Could WL coaching.indd 27 10/19/16 1:36 PM

- 30. November 201628 BBenefitsPRO magazine Two-pronged approach Health coaching should cover a broad health continuum Too many wellness programs focus only on the prevention of future illness, when, in reality, the highest costs—current chronic conditions— are already draining the bottom line. A good health coaching program should include interventions that: 1. Manage the immediate high risk members who are already incurring high health costs from existing conditions and co-morbidities at all acuity levels, including: hypertension, coronary artery disease, heart failure, cancer, chronic low back pain, diabetes mellitus, asthma, hypercholesterolemia, metabolic syndrome, and chronic musculoskeletal pain; 2. Slow or derail the progress of members who display lifestyle health risk factors propelling them toward ill health, such as tobacco use, a lack of physical activity, poor nutrition, overweight or obesity, sleep deficit and stress. This two-pronged approach provides a logical, systematic and progressive approach for corralling uncontained and voracious health risks, claims and costs. Touch points Health coaching should target members based on stage of disease and care gaps, using a range of professionals and modalities A comprehensive wellness program engages members in multi-dimensional health coaching appropriate to their needs and in line with their comfort levels. This may require lifestyle coaches, disease management coaches and/ or nurse coaches, who each bring a different set of skills to the coaching dynamic. The coaching program must be available to members in various modalities, from live telephone calls, to video or chat, to email and text messaging. As consumer technologies continue to advance, a good coaching program will keep abreast of these changes, implementing touch points that appeal across all generations, from millennials to boomers. Different paths Health coaching should use a holistic approach A holistic approach is built on the foundation that there is no one “right way” to coach an individual. Coaches must be able to “meet the member where they are” in order to understand how we can help them determine and achieve their goals. One member may be just beginning to consider making lifestyle changes, while another may have tried and failed in the past, and need a very different type of support. Your coaching program should incorporate coaches trained to help each member find his or her own path. Effective tools Health coaching must be science- backed and evidence-based Coaching as a discipline and science is very powerful. It’s not just about creating a human connection. Coaches are just “friends” unless they have the proven tools and skills that produce positive outcomes. Some of the most effective tools used in evidence-based coaching today include: 1. Activation, a process to assess an individual’s knowledge, skills and confidence for managing his or her own health and health care, and thus determine methods to further empower them. 2. Motivational interviewing, which theorizes that as much as someone may recognize good reasons to change habits, ambivalence is a factor in the change process. Resolving the ambivalence is a major part of helping someone change. Sustained change happens when people tap into their own reasons for change and marshal their strengths to make change happen. WL coaching.indd 28 10/19/16 1:39 PM

- 31. BenefitsPRO.come November 2016 29 Motivational interviewing is designed to help people resolve the ambivalence that often holds them back. It’s about transforming the “Yes, but …” into a convincing “Yes!” 3. Trans-theoretical model of behavior change, which assesses an individual’s readiness to act on a new, healthier behavior and provides strategies to do so. 4. Social cognitive theory, which provides a framework for understanding, predicting and changing human behavior. 5. Positive psychology, or the scientific study of strengths and virtues that enable individuals to thrive instead of just survive. 6. Sustainability and relapse prevention, which is a cognitive-behavioral approach with the goal of identifying and preventing high-risk health behaviors. When such techniques are used, successful health coaching programs can facilitate behavior changes such as: • Greater member activation: gaining the knowledge, skills and confidence to get involved with and play a more active role in their health. • Enhanced condition self-care: gaining the knowledge about their condition and steps for how to best improve it. • Medication adherence: understanding the important role their medication plays in their health maintenance or improvement and why adherence to the medication dosage is vital. • Adoption of lifestyle behaviors that enhance health and well- being. Super glue Coaches must receive continuous training No matter how many puzzle pieces a coaching program offers to help members see the big picture, that picture can fall apart if it’s rattled or shaken. Your picture must have super-glue to keep the pieces together—because life does rattle and shake us. Coaches are the super- glue. They not only connect the pieces for your members and help them see the big picture, but they keep the pieces in place. What helps coaches to become this essential super-glue? Effective initial and ongoing training, which should include the following: • Quality of education: Professional coaching programs hire coaches who understand the discipline and science behind coaching. They provide many hours of on- the-job training to reinforce concepts such as motivational interviewing and social cognitive theory. And they provide ongoing training and share successful techniques as a team. • Coach mentors: New coaches ramp up faster when they are mentored by the best of the best. It’s a small but significant difference between good coaching programs and great ones. • Member safety quality assurance: Wellness coaching isn’t just about whether Joe worked out at the gym five days this week, or Sally stopped smoking. Today’s employees are dealing with stress, depression, lack of sleep, financial pressures and any number of other problems that can spiral out of control. Your coaching program had better be equipped to handle those crises. In any given week, our coaches may encounter three to four members who display behaviors that we consider “red flags,” which may signal a mental health or medical compliance crisis. A great coaching program has procedures in place to alert the appropriate mental health professionals or nurses who can make sure members with critical issues are given the right tools to cope. If your coaching program doesn’t offer that safety net, you’re missing an important element of member safety. The cure? Could coaching be the cure for your wellness program? Dare I quote our client again who said to us, “It’s all about coaching”? From my perspective, there is a great truth in that statement. Employers must realize they cannot make employees live healthier lifestyles with incentives or penalties alone. Employees must buy into wellness, and to do that, they must first buy into the fact that they can change, they want to change, they are empowered to change, and they have an advocate in their corner who can cheer them on when they achieve, and inspire them when they fail. That’s all each of us really wants and needs in life, isn’t it? Whether our goals are good health, a good performance review, or to be a better parent—support is fundamental to our success. And a superior coaching program provides all that, with the science to back it up. w WL coaching.indd 29 10/19/16 1:40 PM

- 32. November 201630 BBenefitsPRO magazine program questions answered As the line between personal- and work-life blurs, employees are often left feeling overwhelmed, depleted, and disengaged. Workplace wellness and well-being programs help employees manage both their office and personal lives, contributing to marked increases in employee engagement, workplace morale, productivity, and overall satisfaction, which all have an impact on business performance. To get a better understanding on how well-being programs can help employers and employees, Dr. Rajiv Kumar answered some questions from BenefitsPRO on how best to engage, implement, and drive success with well-being plans. Dr. Kumar is the president and chief medical officer at Virgin Pulse, a company focused on designing technologies to breed healthy lifestyle choices for employees. Thinkstock wellness your WL questions.indd 30 10/19/16 2:07 PM

- 33. BenefitsPRO.come November 2016 31 Implementation What is the most complicated factor in implementing a well-being program? The most complex aspect to implementing a successful well- being program is designing a program that reflects and reinforces an organization’s unique culture. Well-being shouldn’t be a one-size-fits-all bolt-on program, but rather an integrated and personalized component of an organization’s culture. This requires an organization to define who they are, what their mission is, and what values they want to proliferate across the company to support the achievement of that mission. Well- being programs that are embedded into the culture of an organization see stronger enrollment, higher participation rates, and greater long-term sustainability—which leads to higher overall employee engagement. Perks What are the top ‘perks’ employees want in a well-being program? If the program doesn’t have it, how does that affect morale surrounding the program? Rather than focusing on perks or rewards, we have found that employees are simply looking for effective, relevant and engaging programs that will help them meet their personal goals, overcome challenges, and be successful at work and in their personal lives. That means having access to personalized tools, benefits information and programs that focus on the whole employee by spanning a variety of well-being topics—financial, mental, physical, emotional, and social. Employee populations are diverse. No single program, perk, or reward will resonate across all demographics. In fact, the most successful well- being programs are those that take into account all of the varied factors that contribute to health, engagement, and satisfaction in and beyond the workplace. Health or employee retention? Is the purpose of an employer- sponsored well-being program more to benefit employee health or employee retention? I believe well-being programs that reflect and promote an organization’s culture drive an even greater value: employee engagement. We know that employee engagement is a critical business success factor and an indication that your workforce feels supported and cared for. When employee engagement is high, businesses thrive. Research shows a strong connection between employee well-being and engagement. There’s a significant value-on-investment here—by investing in programs and benefits that enhance employee well-being, employers reap the benefits of improved workplace culture, higher employee retention, and better overall performance. Metrics How can employers measure success in a well-being program? Success metrics will vary and tend to be tied to specific company values, goals and opportunities. We help clients measure VOI, or value- on-investment, as they evaluate the success of their well-being investments. This approach looks at well- being’s impact on broader business outcomes, including productivity, absenteeism, employee satisfaction, recruitment, and retention. It also includes health outcomes, which can Dr. Rajiv Kumar is the president and chief medical officer at Virgin Pulse WL questions.indd 31 10/19/16 1:43 PM

- 34. November 201632 BBenefitsPRO magazine translate to lower health care costs. Finally, there are the metrics that are specifically aligned with individual businesses. For example, we have clients who have measured a decrease in workplace safety incidents after the implementation of their well-being program. Others have tied well-being investments to higher customer satisfaction. While desired business outcomes vary by company and industry, well-being’s value as a driver of key business outcomes is becoming more apparent and, thanks to advances in analytics, increasingly measurable. Cultural buy-in What are some of the shortcomings of a well-being program? Investing in employee well-being is a critical step towards creating an engaged workforce. For well-being programs to reach their full potential, they must be rooted in culture and have executive and managerial buy- in, from the highest levels of the organization down to departmental supervisors. Without vocal, visible support from company leaders, well-being investments will not yield the best results. Employees must know that their participation is encouraged and supported by leadership. Technology-enabled platforms can recruit, engage, and support employees in their well-being journey, but technology alone cannot change culture. Well-being must have clear support from leaders throughout the business. Generational gaps What do different generations want from a well-being program? Regardless of generation, employees generally share the same overarching goal: a desire to be successful, balanced, and fulfilled, both at work and at home. That said, there are differences in priority depending on age. People often have different financial well- being goals at various points in their lives: creating a budget, saving for a child’s education, or planning for retirement. The same is true for physical well-being. Younger employees may be more interested in using activity tracking devices to chart their progress than older workers. Generations also vary in their affinity for technology. While millennials are accustomed to using smartphone apps to interact with programs, baby boomers may prefer a web-based portal. All of these varying preferences, concerns, and needs confirm my belief in well-being programs that support the whole person. The best, most engaging, and most effective programs appeal to broad cross-sections of employees and are accessible across multiple technology platforms. In addition, well-being programs that include social networking capabilities—the ability to share progress, advice, and motivation—can unite a diverse workforce, bridging generational gaps through shared interests, goals, and journeys. w “Well-being shouldn’t be a one-size-fits-all bolt-on program, but rather an integrated and personalized component of an organization’s culture.” WL questions.indd 32 10/19/16 1:44 PM

- 35. BenefitsPRO.com November 2016 33 At my core, I am a salesper- son. I can be easily distracted by new technologies, innova- tive ideas, and data analyt- ics. For many years, I was relegated to getting my in- novation fix in places outside my industry. But times, they are a-changing. At industry events, booths for- merly sponsored by carriers have been replaced by tech vendors, new transparency tools, wellness strategies, and tax schemes de- signed to reduce tax liability and used to fund other products. For the last five years or so, an innovative, successful consultant could gain clients by bringing new ideas to the table, but now, some consultants are losing business by bringing too many or unproven ideas to their customers. This is a warning to not be distracted by all the “new ideas,” but still be careful enough to bring the right ideas to clients. Paralysis by analysis is the state of many benefits profes- sionals. Unsure how to pro- ceed when it comes to offering benefit administration, HR technology, ACA reporting and more to their clients results in a state of doing nothing. Paradox of choice, as laid out by Barry Schwartz, reminds us that the more choices we have, the worse decisions we make, some- times making no decision at all. The difficulty in evaluating all of these tools and technologies is that we can easily be swayed to just continue on our present path. Our current vendors would prefer that, and in a larger sense, so would the carriers. Despite being negatively impacted by the status quo, even employ- ers can be very hesitant to change. I spoke on a panel about transparency this past April. I said “consumer-driven” health plans are a farce and mis- nomer. Going to a high-deductible health plan does absolutely no good for driving consumer- ism when the employer doesn’t combine it with powerful tools for accurately comparing costs and quality, as well as educating employees on how to do that. If a patient cannot accurately shop price and quality, they cannot be a good consumer, which leads to delaying care, resulting in larger claims, more pressure on the rates, and therefore, decisions to further dilute benefits. It’s a vi- cious cycle. After the talk, a VP of HR ap- proached me. She said they were considering going to all HDHP plans because their current con- sultant suggested it alone would drive consumerism. Apparently, my scenario resonated and we continued to chat after the confer- ence ended. She was the right person at the right time to hear the ideas I was talking about. Finding the right audience is very important. At some point, however, you also need to take a chance. Once you have evaluated as best you can, figured out the message and results you ex- pect, and have in hand the best available tool to help you deliver that, at some point, you just need to take a leap and go all in. “Paradox of choice reminds us that the more choices we have, the worse decisions we make.” David C. Contorno is president and CEO of Lake Norman Benefits, Inc. Paralysis by analysis paradigm shift by David Contorno 11.16 contorno.indd 33 10/19/16 1:47 PM

- 36. November 201634 BenefitsPRO magazine Workers comp.indd 34 10/19/16 1:50 PM

- 37. BenefitsPRO.com november 2016 35 By Scott Wooldridge Rising premiums, evolving strategies for cost containment Workers’ Comp trends for 2017 Workers’ compensation continues to be a major concern for employers, and while some industries have more claims than others, all have concerns about the associated costs. Workers comp.indd 35 10/19/16 1:50 PM