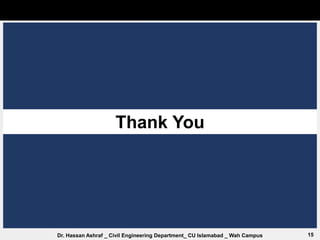

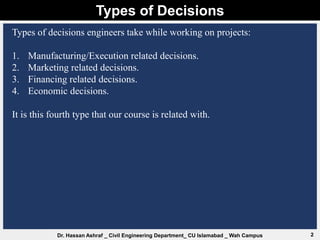

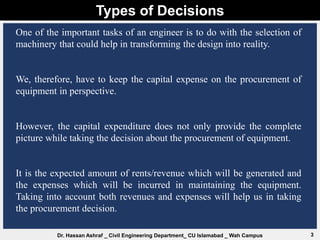

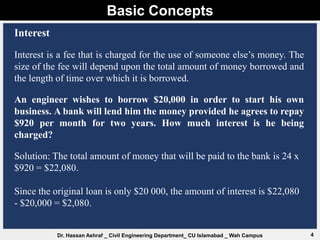

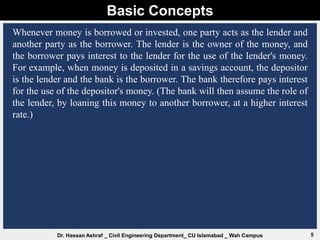

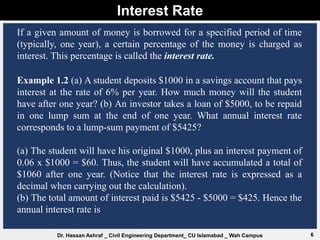

The document discusses basic concepts in engineering economics including types of decisions engineers make, interest, simple interest, compound interest, and time value of money. It provides examples to illustrate key points such as how to calculate simple and compound interest, future and present worth. The author is Dr. Hassan Ashraf from the Civil Engineering Department at Capital University Islamabad, Wah Campus. He is teaching a course on engineering economics that covers economic decisions engineers must make.

![Simple Interest

9

Dr. Hassan Ashraf _ Civil Engineering Department_ CU Islamabad _ Wah Campus

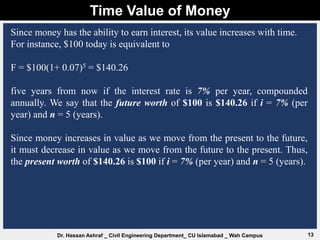

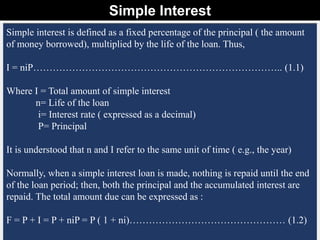

Example 1.3 student borrows $3000 from his uncle in order to finish

school. His uncle agrees to charge him simple interest at the rate of 5.5%

per year. Suppose the student waits two years and then repays the entire

loan. How much will he have to repay?

Using the equation above:

F = $3000[1+ (2)(0.055)] = $3330.](https://image.slidesharecdn.com/01basicconcepts15092022-230302045120-9968f1c0/85/01_Basic-Concepts_15_09_2022-pptx-9-320.jpg)

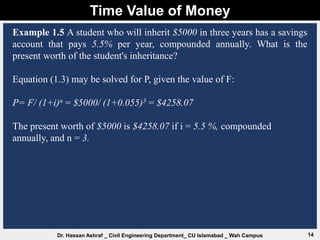

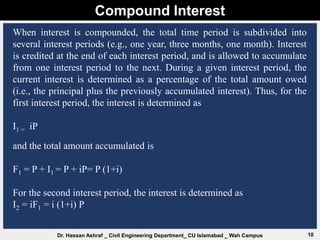

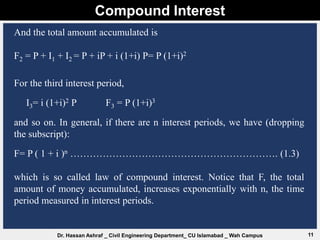

![Compound Interest

12

Dr. Hassan Ashraf _ Civil Engineering Department_ CU Islamabad _ Wah Campus

Example 1.4

A student deposits $1000 in a savings account that pays interest at the rate of

6% per year, compounded annually. If all of the money is allowed to

accumulate, how much will the student have after 12

years? Compare this with the amount that would have accumulated if simple

interest had been paid.

F = $1000(1+ 0.06)12 = $2012.20

Thus, the student's original investment will have more than doubled over the

12-year period.

If simple interest had been paid, the total amount that would have

accumulated is determined by (1.2) as

F = $1000[1+ (12)(0.06)] = $1720.00](https://image.slidesharecdn.com/01basicconcepts15092022-230302045120-9968f1c0/85/01_Basic-Concepts_15_09_2022-pptx-12-320.jpg)