02 Difference between Mfg co and Banking Co.docx

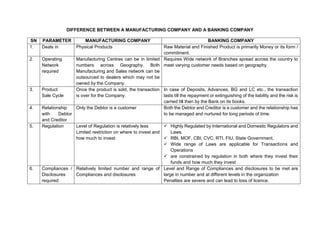

- 1. DIFFERENCE BETWEEN A MANUFACTURING COMPANY AND A BANKING COMPANY SN PARAMETER MANUFACTURING COMPANY BANKING COMPANY 1. Deals in Physical Products Raw Material and Finished Product is primarily Money or its form / commitment. 2. Operating Network required Manufacturing Centres can be in limited numbers across Geography. Both Manufacturing and Sales network can be outsourced to dealers which may not be owned by the Company. Requires Wide network of Branches spread across the country to meet varying customer needs based on geography. 3. Product Sale Cycle Once the product is sold, the transaction is over for the Company. In case of Deposits, Advances, BG and LC etc., the transaction lasts till the repayment or extinguishing of the liability and the risk is carried till then by the Bank on its books. 4. Relationship with Debtor and Creditor Only the Debtor is a customer Both the Debtor and Creditor is a customer and the relationship has to be managed and nurtured for long periods of time. 5. Regulation Level of Regulation is relatively less Limited restriction on where to invest and how much to invest Highly Regulated by International and Domestic Regulators and Laws. RBI, MOF, CBI, CVC, RTI, FIU, State Government, Wide range of Laws are applicable for Transactions and Operations are constrained by regulation in both where they invest their funds and how much they invest 6. Compliances / Disclosures required Relatively limited number and range of Compliances and disclosures Level and Range of Compliances and disclosures to be met are large in number and at different levels in the organization Penalties are severe and can lead to loss of licence.

- 2. SN PARAMETER MANUFACTURING COMPANY BANKING COMPANY 7. Risks Involved – Type and Level of Risk Relatively the risks are limited and can be better managed. Banks are subject to a wide range of Risks which includes – Credit Risk, Market Risk, Operational Risk, Capital Risk, Reputation Risk, Forex Risk, Money Laundering Risk, Concentration Risk, Interest Rate Risk, HR Risk, Technology Risk, Country Risk, Compliance Risk, Liquidity risk, Systemic Risk, Strategic Risk, Settlement Risk, Legal Risk, Maturity Risk, etc. and Hence Structured Risk Management on ongoing basis is required. Risks are highly Dynamic Risk levels are High in terms of Intensity and Frequency Risks have to be managed at every level : International, National, Regulator, Bank HQ, RO, Branch, Transaction 8. Assets Mainly physical assets comprising fixed assets (Land, bldg., plant and machinery) and current assets ( Stocks, Debtors) Mainly financial assets comprising Bonds, equities, Mutual funds, CP, CD, Loans, BG, LC, 9. Future income Assets and Liabilities of mfg concern generate income for current periods from sale of goods and services Deposits and Loans created with varying maturities are sources of future expenditure and income. The major source of income is interest and fees. 10. Accounting standards Major portion of the assets are not marked to market Significant portion of the assets of a financial service firms are marked to market 11. Provisions Provisions are based on actual losses and buffers are not created for future losses. Banks usually create provisions for losses that average out losses over time and charge this amount against earnings every year.

- 3. SN PARAMETER MANUFACTURING COMPANY BANKING COMPANY 12. Characteristics of assets and liabilities in balance sheet No of items, Size, timing, flow, mix, volatility, value, cost, yield of assets are liability items in balance sheet are limited relative to a bank Assets and liability items are large, varying and dynamic in terms of - No of items, Size, timing, flow, mix, volatility, value, cost, yield 13. Leverage The leverage of a mfg. company is in the range of 1:2 to 1:5 Basel Committee recommends Risk weighted CRAR of 8% which works out to leverage of 1: 12.50. The leverage prescribed by Basel 3 is 3% without risk weighting and netting which works out to a leverage of 1:33 Banks are therefore highly leveraged. 14. Liquidity Mfg. companies are relatively liquid considering the nature of its current assets and current liabilities. Assets can be liquidated at short notice. By its very nature of business, Banks are illiquid since the loans granted for varying periods (which are the major components of assets) cannot be liquidated at short notice. 15. Involvement of Public Money The public money in Mfg. companies is restricted to Share Capital, Bonds and Fixed deposits raised if any. Since depositor’s money is the raw material, the entire Banking business rests on Public Money which has to be repaid in time irrespective of recovery from the borrowers. 16. Off-Balance Sheet Size and Range The no, range and quantum of Off- Balance sheet items is limited relatively. The no, range and quantum of Off-Balance sheet items for BG, LC, Forward Contracts, Derivatives etc is high and hence the relative risks remain in Banks books and have to be managed actively 17. Impact of failure Impact of failure is limited. Impact of failure is direct and large which may lead to disturbances in the economy affecting all depositors and shaking Public Confidence. Provisions have to be made in BS for existing and anticipated losses & Capital has to be provided accordingly. 18. Profit Margin Profit margins are high compared to the extent of money deployed Profit margins in Banking Companies are low compared to the extent of money deployed

- 4. SN PARAMETER MANUFACTURING COMPANY BANKING COMPANY 19. Impact of External Factors Impact of External factors is limited to the industry in which the Mfg. company is operating. Since Banks have exposure to wide range of Industries and Sectors and Countries any change in External Factor or Policy or Price fluctuation impacts the Banking quickly. 20. Employee Skills Limited range of Employee skills Lot of judgement in decision making for Loans is involved Wide range of Employee skills including specialized skills are required which have to be updated. HR Risk is high. Attrition rates are higher and constant recruitment and training have to be ensured. 21. Capital Requirements Limited capital requirements based on the size of business. If production is scaled up the capital requirements are not proportionately to be increased. Banks are capital intensive and without capital growth of business is not possible. For increase in advances and off-balance sheet business proportionate capital is required. Hence capital is required to be raised on an ongoing basis. 22. Loss Losses arise due to pricing, inability to market at competitive rates, quality etc Loss due to frauds is limited in number and amount Losses arise due to bad debts (NPA), Trading / Inv losses, etc. Frauds in Banks are frequent and across all products and services and can emanate from any branch or business unit. 100% provision has to be made for frauds and bad debts (loss assets) 23. Competition Competition is not as fierce as for Banks since number of competitors are limited in number. Competition is fierce. Banks have to compete with PSBs, Pvt Sector Banks, Small finance bank, Co-operative Banks, Chit Funds, and Co-operative Credit Societies etc. Capital Market Instruments such as equity, MF, Debentures, Corporate Fixed Deposits, NBFCs, Housing Finance Companies, Informal Sector Money Lenders, State Financial Institutions, 24. Data Intensity Manufacturing business is not as data Intensive as banking business Banking Business is highly data intensive with voluminous daily addition to data which is dynamic in nature and wide ranging covering various types of transactions. 25. Conflict of Interest Conflicts of Interest is limited Conflicts of interest is wide ranging across the organization and across all processes.

- 5. SN PARAMETER MANUFACTURING COMPANY BANKING COMPANY 26. Economic aspect They form the real economy producing goods and services They support the economy by providing money – oil that lubricates and enables manufacturing companies to run 27. Funding Banks fund the fixed assets and working capital Capital, Long term borrowing and Deposits constitute the major source of funding for a bank 28. Mergers and acquisitions Manufacturing companies are generally product specific and hence mergers take place in the same line such as vehicles, pharmaceuticals etc. Groups like TATA can have different products under the same overall Group management. Banking companies can cater to specific areas such as Regional Rural banks, Investment banks, Commercial banks, Cooperative Banks, Development banks, NBFCs, Housing Finance companies, Small Finance banks, PACS – Primary Agricultural Cooperative societies, Urban Cooperative banks. 29. Product range Generally limited to limited product range under one specific segment with different models such as cars Banks undertake various types of business and provide wide range of products and services such as deposits, loans, BG, LC, Derivatives, Lockers, Demat services, as well as third party cross- selling such as MF, Insurance, Share trading, etc 30. Business restriction No restrictions on holding level by promoters or fit and proper criteria for promoting a manufacturing company. Promoter holding levels are restricted by RBI along with voting power of promoters. Promoters / Promoter Group should have a past record of sound credentials and integrity as a part of ‘Fit and Proper’ criteria Risk Management is required and essential in Banks because of the following reasons: 1. Range of risks are wide, high, frequent, dynamic and remains over long periods of time both for on-balance sheet and off- balance sheet items as well as intangible items such as HR. 2. Being Capital intensive, Capital optimization is possible only with proper Risk management. 3. External and Internal Factors impact banks including frauds. 4. Public money has to be protected 5. Technology changes are frequent and products and services have to be delivered through Technology.