Savillsresearch briefing-brisbane-industrial-q2-2019

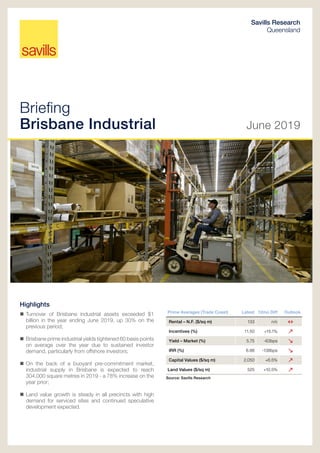

- 1. Briefing Brisbane Industrial June 2019 Savills Research Queensland Highlights Turnover of Brisbane industrial assets exceeded $1 billion in the year ending June 2019, up 30% on the previous period; Brisbane prime industrial yields tightened 60 basis points on average over the year due to sustained investor demand, particularly from offshore investors; On the back of a buoyant pre-commitment market, industrial supply in Brisbane is expected to reach 304,000 square metres in 2019 - a 78% increase on the year prior; Land value growth is steady in all precincts with high demand for serviced sites and continued speculative development expected. Prime Averages (Trade Coast) Latest 12mo Diff Outlook Rental – N.F. ($/sq m) 133 n/c Incentives (%) 11.50 +15.1% Yield – Market (%) 5.75 -63bps IRR (%) 6.88 -138bps Capital Values ($/sq m) 2,050 +6.5% Land Values ($/sq m) 525 +10.5% Source: Savills Research

- 2. June 2019 savills.com.au/research 2 Savills Research | Briefing Notes – Brisbane Industrial Report Contents Executive Summary 2 Leasing Activity & Demand 3 Rents and Developments 5 Sales Activity 6 Infrastructure & Outlook 8 Precinct Map 9 Key Indicators 10 Key Contacts 12 Executive Summary Improving economic conditions in Queensland stimulated by a rebound in the mining sector, coupled with road infrastructure investment is likely to see continued positive effects on the industrial sector in Brisbane. There has been a 49% increase in industrial leases year on year, with a record of approximately 863,000 square metres of industrial space absorbed in Brisbane. However, rental growth is not yet universal through the market as new prime industrial facilities, which charge a higher premium, are diminishing. The Brisbane industrial market has seen a significant boost in sales volumes with $1.13 billion of assets transacting over the 12-month period to June 2019, representing the second highest volume of sales on record over the past 10 years. Offshore investors were the most dominant purchaser type, accounting for 27% of total industrial assets transacted in this period. The core market yields (Trade Coast 5.8%; Southside 5.9%) demonstrate the premium that offshore buyers are prepared to pay to enter the Brisbane market. Average yields have compressed 60 basis points for the year to June 2019. Supply is expected to accelerate in 2019 to 304,000 square metres including new developments and stock under construction which is due for completion in 2019. Land values across all precincts have generally trended upwards. The average land value for the year on year to June 2019 increased by 15%, to $356 per square metre. The reclassification of industrial areas to alternative uses as outlined in the ‘Brisbane City Council Industrial Strategy 2019’ will continue to place upward pressure on land values. Brisbane Markets Summary - Prime Warehouse Precincts N.F. Rent ($/sq m) Market Yield (%) IRR (%) Cap. Value ($/sq m) Land Value ($/sq m) BRI – Southside* 118 (n/c) 5.88 (-50 bps) 7.00 (-150 bps) 1,750 (+1.4%) 313 (+5.0%) BRI – Northside* 125 (+4.2%) 6.13 (-63 bps) 7.00 (-100 bps) 1,975 (+12.9%) 363 (+7.4%) BRI - Trade Coast* 133 (n/c) 5.75 (-63 bps) 6.88 (-138 bps) 2,050 (+6.5%) 525 (+10.5%) BRI - M1 / Logan Cor.* 113 (n/c) 5.88 (-63 bps) 7.00 (-163 bps) 1,750 (+2.9%) 313 (+19.0%) BRI – West* 110 (+4.8%) 6.13 (-50 bps) 7.25 (-138 bps) 1,650 (+8.2%) 268 (+32.1%) Source: Savills Research. NB: 12 month change shown in brackets, n/c = no change *Savills metrics includes marketable commercial industrial buildings within defined precinct boundaries, generally inclusive of an improved building area of between 1,000 and 20,000 square metres. Land values reflect ‘serviced & benched’ sites (3,000 - 5,000 sq m). For our latest national reports, visit savills.com.au/research To join Savills Research mailing list, please email research@savills.com.au Research & Consultancy Tracy Tam ttam@savills.com.au Head of Research Research & Consultancy Phil Montgomerie pmontgomerie@savills.com.au

- 3. June 2019 savills.com.au/research 3 Savills Research | Briefing Notes – Brisbane Industrial - 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 BRI-West BRI-Southside BRI-Northside BRI-Trade Coast BRI-Non-Metro Wholesale - 252,670sqm - 29.3% Transport & Logistics - 197,227sqm - 22.9% Manuf/Engineering - 54,976sqm - 6.4% Property & Business Services - 32,603sqm - 3.8% Construction, Mining & Agri - 26,670sqm - 3.1% 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 Direct - New Direct - Existing Prelease Precommit Renewal In the 12 months to June 2019, Savills Research identified approximately 862,688 square metres of industrial leases (>1,000 square metres) in Brisbane. This was a 49% increase on the 12 months prior (577,394 square metres) and a 29% increase on the 10-year average (668,937 square metres). The Wholesale category was the most dominant, accounting for 29% (or 252,670 square metres) of total leasing activity. Transport & Logistics followed closely behind with 23% (or 197,227 square metres) of total leasing activity. The majority of leases were transacted in Brisbane’s ‘Southside’ precinct where 283,855 square metres (33%) of total leasing activity was done. The ‘Southside’ precinct was also notable for the total number of leases, as smaller occupiers took advantage of more affordable leasing conditions. The historically strong ‘Trade Coast’ precinct made up only 27% of total leasing volumes due to a lack of available properties. Pre-commitments dominated the industrial stock leased in the 12 months to June 2019, accounting for approximately 33% of total leasing activity. Direct leases to new, and existing buildings followed, comprising 31% and 29% respectively. There was a solid commitment to speculative space and pre-commitments to new stock, with 230,070 square metres recorded in this sector. The most significant pre- commitment in the current 12-month period was Coles 66,000 square metre lease in Goodman’s Redbank Motorway Estate, followed by 48,824 square metres by Australia Post in the same estate. Source: Savills Research - 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 BRI-West BRI-Southside BRI-Northside BRI-Trade Coast BRI-Non-Metro Wholesale - 252,670sqm - 29.3% Transport & Logistics - 197,227sqm - 22.9% Manuf/Engineering - 54,976sqm - 6.4% Property & Business Services - 32,603sqm - 3.8% Construction, Mining & Agri - 26,670sqm - 3.1% 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 Direct - New Direct - Existing Prelease Precommit Renewal Leasing Activity by Lease Type Source: Savills Research Leasing Activity by Precinct Leasing Activity by Industry Type Source: Savills Research - 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 BRI-West BRI-Southside BRI-Northside BRI-Trade Coast BRI-Non-Metro Wholesale - 252,670sqm - 29.3% Transport & Logistics - 197,227sqm - 22.9% Manuf/Engineering - 54,976sqm - 6.4% Property & Business Services - 32,603sqm - 3.8% Construction, Mining & Agri - 26,670sqm - 3.1% 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 Direct - New Direct - Existing Prelease Precommit Renewal Leasing Activity & Demand

- 4. June 2019 savills.com.au/research 4 Savills Research | Briefing Notes – Brisbane Industrial There has been a reduction in the state’s logistics job advertisements over the 12 months to April 2019, after double digit growth annually over the past three years. Even though logistics job advertisements is regarded as a lead indicator, it is important to take into consideration the increasing popularity of automated facilities among logistics service providers, food manufacturers, and distribution centres in Queensland. This new generation of automation, which increases cost effectiveness and ensures timely and accurate delivery, is now a key consideration for many industrial operators. Recent Notable Leases (by Area Leased) Property Tenant Deal Date | Area Leased (sq m) Type | Rent | Term 1-2 Robert Smith St, Redbank Coles Jan-19 | 66,000 p | n.a. | 20 1-2 Robert Smith St, Redbank Australia Post Jul-18 | 48,824 p | 136 | 15 338 Bradman St, Acacia Ridge Woolworths Mar-19 | 44,600 r | 96 | 7.4 238-260 Gilmore Rd, Berrinba Mitre 10 Jul-18 | 35,000 p | 100 | 10 88 Moreton St, Heathwood CUB Apr-19 | 21,800 r | 111 | 12 Future Port Expansion Area, Port of Brisbane Silk Contract Logistics Aug-18 | 15,250 p | 170 | 12 628 Kingston Rd, Loganlea M3 Logistics Aug-18 | 14,088 d-e | 78 | 4 616 Boundary Rd, Richlands Border Express Aug-18 | 13,763 d-e | 95 | 3 692 Curtin Ave, Pinkenba Enviro Pipes Aug-18 | 13,736 d-n | 127 | 7 Cnr Arthur Dixon & Pearson Rd, Yatala Reward Supply Co Sep-18 | 13,527 p | 103 | 7 64-74 Lahrs Rd, Ormeau Wet Fix Holdings Jul-18 | 13,331 d-e | 95 | 10 5a Viola Pl, Brisbane Airport CEVA Logistics Sep-18 | 12,971 d-e | 120 | 2 Australand Dr, Berrinba Pinnacle Hardware Nov-18 | 12,313 p | 105 | 5 1979 Ipswich Rd, Rocklea Hi-Trans Oct-18 | 12,204 d-e | 61 | 3.5 28 Brickworks Pl, Rochedale Keppel Logistics Jun-19 | 10,481 d-n | 115 | 5 29-51 Wayne Goss Dr, Berrinba CTI Logistics Oct-18 | 10,455 d-e | 107 | 5 Lot 3a, Saltwater Cres, Narangba Tambavale (QLD) Pty Ltd Mar-19 | 10,300 d-e | 90 | 12 30 Industrial Cres, Willawong Automotive Brands Apr-19 | 9,712 d-e | 105 | 5 55 Tonka St, Luscombe ATCO Structures Oct-18 | 9,170 p | 222 | 10 250 South Pine Rd, Brendale Modern Teaching Aid May-19 | 8,304 d-e | 100 | 7 -8.1% -6.1% -5.8% -5.2% -0.7% 1.1% 4.2% 13.4% 27.0% NT QLD NSW SA AUS ACT VIC WA TAS Source: DOE / Savills Research Logistics Job Advertisements (12 mo Growth % to Apr-19) Source: Savills Research; Leasing Types: p = Pre-commitment, d-n = Direct – New, d-e = Direct – Existing, pl = Pre-Lease, s = Sub-Lease, r = Renewal

- 5. June 2019 savills.com.au/research 5 Savills Research | Briefing Notes – Brisbane Industrial Rents Growth in prime industrial net face rents has been modest in the 12 months to June 2019. The Trade Coast precinct remained the most expensive area to lease, typically ranging from $115 to $150 per square metre per annum (or an average $133 per square metre on a net face basis). By comparison, the average rate for the Southside and Northside precincts remain lower, at $118 and $125 respectively. Competitive rentals offered by developers in the pre- commitment market are also holding back Brisbane’s rental growth, with a large number of tenant inquires receiving competitive rental rates along with attractive incentives. 110 115 120 125 130 135 BRI - Southside BRI - Northside BRI - Trade Coast 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 Completed Under Construction Plans Submitted Early Planning DA Average Prime Net Face Rents by Precinct ($/sq m) Source: Savills Research Savills Research recorded 138,468 square metres of new or additional industrial space in the first half of 2019, with another 165,785 square metres currently under construction, due for completion in 2019. A total of 304,253 square metres of new supply is expected during 2019, an increase of 78% from the 2018 figure of 171,383 square metres. Total supply in 2019 will be driven by solid pre-commitment of major users at the top end of the market. Australia Post (48,824 square metres), Toll (10,250 square metres), and UK-based Hilton Foods Group (39,454 square metres) in partnership with Woolworths, all pre-committed to new space in 2019. With competitive rentals being offered by developers in the pre-commitment market, development of new supply is expected to remain strong as tenants seeking new space take advantage of favourable rents and attractive incentives. Supply / Industrial Development 110 115 120 125 130 135 BRI - Southside BRI - Northside BRI - Trade Coast 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 Completed Under Construction Plans Submitted Early Planning DA Completed Development and Pipeline (sq m) Source: Cordell/Savills Research NB: includes new/addition speculative, precommitment, owner occupier development types.

- 6. June 2019 savills.com.au/research 6 Savills Research | Briefing Notes – Brisbane Industrial Savills Research recorded $1.13 billion of reported industrial property transactions (> $5 million) in the 12 months to June 2019, an increase of 30% on the $875 million recorded in the year prior and an increase of 45% on the ten-year average of $783 million. Over the current 12-month period, a total of 63 properties were transacted, down on the previous 12-month total of 67. Investment appetite from offshore investors on industrial assets remained strong, accounting for 27% of total reported sales – representing the most active purchaser type in the year ending June 2019. Active buyers include; DWS Group (Germany), Mapletree (Singapore), Blackstone (USA), and Ascendas REIT (Singapore). The most significant single transaction for the 12-month period was the sale of a 50% interest in the Coles Distribution Centre at 99 Sandstone Place, Parkinson, purchased by DWS Group from Frasers Logistics Trust for $134.2 million representing an initial yield of 5.78%. Based on the equivalent price for a 100% interest, this sale represents the largest individual industrial asset transaction by value in Australian history. On 15.53 hectares, the site comprises a significant 54,245 square metre cold store distribution centre, fully leased to Coles with a 13.1 year WALE. Australian trusts have long sought to increase their exposure in Brisbane industrial market, accounting for 16% of total reported sales in the 12-month period. Charter Hall Long WALE REIT and Charter Hall Social Infrastructure Limited jointly purchased the Brisbane City Council Bus Network Terminal at 40 Schneider Road in Eagle Farm, for $102.5 million on an initial yield of 5.08%. $0m $200m $400m $600m $800m $1,000m $1,200m $1,400m $5m - $50m $50m - $100m >$100m 0% 20% 40% 60% 80% 100% Purchasers Vendors Fund Trust Developer Owner Occupier Government Syndicate Foreign Investor Private Investor Other % 2% 4% 6% 8% 10% 12% 10yr Bond Rate Average Prime Yield Average Prime IRR Source: Savills Research Yield Spread to Bond & IRR – Brisbane $0m $200m $400m $600m $800m $1,000m $1,200m $1,400m $5m - $50m $50m - $100m >$100m 0% 20% 40% 60% 80% 100% Purchasers Vendors Fund Trust Developer Owner Occupier Government Syndicate Foreign Investor Private Investor Other % 2% 4% 6% 8% 10% 12% 10yr Bond Rate Average Prime Yield Average Prime IRR $0m $200m $400m $600m $800m $1,000m $1,200m $1,400m $5m - $50m $50m - $100m >$100m 0% 20% 40% 60% 80% 100% Purchasers Vendors Fund Trust Developer Owner Occupier Government Syndicate Foreign Investor Private Investor Other % 2% 4% 6% 8% 10% 12% 10yr Bond Rate Average Prime Yield Average Prime IRR Sales Activity by Price Source: Savills Research Vendor & Purchaser Composition Source: RBA/Savills Research Sales Activity

- 7. June 2019 savills.com.au/research 7 Savills Research | Briefing Notes – Brisbane Industrial Brisbane prime industrial yields as at June 2019 range between 5.25% and 6.75%, tightening 60 basis points on average over the year. Brisbane’s Trade Coast continues to have the tightest investment yields at an average of 5.80%. Prime industrial capital values as at June 2019 are estimated between $1,475 and $2,025 per square metre in the Southside, $1,650 and $2,300 per square metre in the Northside, and, $1,775 and $2,325 per square metre in the Trade Coast. The Trade Coast continues to record the highest average capital value with $2,050 per square metre as at June 2019. The Northside recorded the highest year on year increase in capital value, at 13.0%. High demand has led to steady growth in land values across all precincts. Average industrial land values in the Trade Coast precinct remained the highest at $525 per square metre as at June 2019. Land values in the western precinct grew by 32%, continuing to outperform other precincts. The South East is rebounding with an average industrial land value of $313 per square metre. Source: Savills Research Prime Average Market Yield (%) by Precinct Property Type Price ($m) | Date | GLA Yield | Type | $/sq m 99 Sandstone Pl, Parkinson (50%) Cold Storage 134.20 | Jun-19 | 54,245 5.78 | i | 4,948 44 Stradbroke St, Heathwood Warehouse 105.00 | Oct-18 | 55,739 5.83 | i | 1,883 40 Schneider Rd, Eagle Farm Infrastructure 102.50 | May-19 | 6,508 5.08 | i | 15,751 102 Trade St, Lytton Cold Storage 55.00 | Nov-18 | 14,479 6.10 | i | 3,798 80 Mccotter St, Acacia Ridge Warehouse 44.65 | Oct-18 | 13,224 5.25 | i | 3,376 134-160 Ingram Rd & 220-240 Bradman St, Acacia Ridge Factory 42.08 | Feb-19 | 37,958 7.84 | i | 1,108 71 Charles Ulm Pl, Eagle Farm Warehouse 35.50 | Jul-18 | 21,100 5.89 | i | 1,682 1035-1051 Nudgee Rd, Banyo Warehouse 34.25 | Nov-18 | 18,116 5.98 | i | 1,891 56 Lavarack Ave, Eagle Farm Warehouse 33.50 | Aug-18 | 8,321 7.21 | i | 4,026 Lot 102 Wayne Goss Dr, Berrinba Warehouse 31.10 | Aug-18 | 19,486 6.76 | i | 1,617 149 Kerry Rd, Archerfield Warehouse 30.55 | Dec-18 | 13,774 6.50 | i | 2,218 1-7 Wayne Goss Dr, Berrinba Warehouse 30.00 | Sep-18 | 17,880 v | 1,678 425-479 Freeman Rd, Richlands Land 26.50 | Aug-18 | 91,619# dev | 289 Lot 5, Hoepner Rd, Bundamba Warehouse 24.36 | Apr-19 | 11,008 5.86 | i | 2,213 60 Stapylton-Jacobs Well Rd, Stapylton Land 22.55 | Dec-18 | 642,400# dev | 35 Recent Notable Sales (by Sale Price) Source: Savills Research; i = Initial, v = Vacant, dev = development; #Land Area 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% BRI - Southside BRI - Northside BRI - Trade Coast

- 8. June 2019 savills.com.au/research 8 Savills Research | Briefing Notes – Brisbane Industrial The completed Gateway Upgrade North involved the widening of the motorway from four to six lanes between Nudgee and Bracken Ridge. The project was jointly funded by the Federal Government and the State Government at a total cost of $1.143 billion. The Kingsford Smith Drive Upgrade connects Brisbane CBD to the Port of Brisbane, and Australia TradeCoast. The project will involve the widening of Kingsford Smith Drive from four to six lanes between Theodore Street at Eagle Farm and Cooksley Street in Hamilton, as well as road improvement works between Cooksley Street and Breakfast Creek Road in Albion. The $650 million project commenced in mid-2016, and is anticipated to be completed in 2019. Inland Rail is a proposed 1,700 kilometre rail freight route between Melbourne and Brisbane via regional Victoria, New South Wales, and Queensland. It is to be constructed by Australian Rail Track Corporation (ARTC). The development of the rail route will include 700 kilometres of existing track, an upgrade of 400 kilometres of track, and construction of 600 kilometres of new track. The Australian Government, through the ARTC, is delivering the multi-billion dollar infrastructure project in partnership with the private sector. The Government has committed $8.4 billion, on top of the previously funded $900 million. Works commenced in 2017, and based on the 10-year delivery schedule developed in 2015, the first train is expected to operate in 2024-25. Project Est. Cost Status Completion Gateway Upgrade North $1.14bn Completed Mar-19 Kingsford Smith Drive Upgrade $650m U/C 2019 Inland Rail $9.3bn Planning 2025 Dedicated Freight Rail Corridor TBC Studying 30 years+ w Key Infrastructure Project Summary - Brisbane The ‘Dedicated Freight Rail Corridor’ (DFRC) is a proposed preservation of a dedicated/segregated freight rail corridor to the Port of Brisbane, which links with the Inland Rail. As highlighted in the recent release of the ‘SEQ City Deal Proposition’ by the State Government, a South East Queensland Trade and Enterprise Spine between the Toowoomba Trade Gateway and the Australia TradeCoast, is proposed to connect by Inland Rail to the Port of Brisbane. This would ease traffic congestion, create safer roads, and increase trade volumes through reduced transport costs. The project is still at the initial study stage, in which the Federal Government and the State Government have jointly funded $1.5 million. Outlook Demand fundamentals are positive with solid investment in road infrastructure, as well as population growth which continues to support industrial activities in Brisbane. The revised 2018 population projections show growth of 20% for Greater Brisbane over the forecast period to 2036. Population growth forecasts underlie sustained future demand for industrial facilities. The proposed Inland Rail and Dedicated Freight Rail Corridor which further links the Inland Rail to the Port of Brisbane will have great effect on the Brisbane industrial market, as industrial operators are set to benefit from efficiencies in supply chain, and support for future expansion. According to Deloitte Access Economics, Queensland’s economic growth and industrial production, forecast at 3.6% (2018 – 2022) is due to outperform other states in Australia over the next decade. The value of Queensland’s industrial production increased 6.6% in 2018, and this upward trend is anticipated to continue over the next decade. Sales and leasing activities recorded a significant increase in the 12-month period, we expect the trend will continue in the second half of 2019 as Brisbane industrial assets gain in popularity, and tenant demand increases. Yields are expected to be tightened due to sustained investor demand. Source: QLD-Department of Infrastructure, Local Government and Planning Infrastructure

- 9. June 2019 savills.com.au/research 9 Savills Research | Briefing Notes – Brisbane Industrial Brisbane Industrial Precinct PACIF ICMOTORWAY MOUNT LINDESAYHIGHWAY M1 CORRIDOR NORTHERN PRECINCT SOUTH TRADE COAST FUTURE GROWTH FUTURE GROWTH WEST GATEWAYMOTORWAY BRISBANEVALLEYMOTORWAY CUNNINGHAMHIGHW AY LO G A N MOTORW AY BRUCEHIGHWAY M2 M2 M7 A7 A5 M5 M3 M7 A3 M3 M1 M1 M2 M1 M1 M1 M1

- 10. June 2019 savills.com.au/research 10 Savills Research | Briefing Notes – Brisbane Industrial Brisbane Industrial Key Indicators (Q2-2019) Northside (Zillmere, Geebung, Northgate, Banyo, Virginia, Morayfield, Caboolture, Brendale, Strathpine, Petrie, North Lakes, Burpengary, Deception Bay and Narangba) Northside Prime Secondary Low High Low High Rental Net Face ($/sq m) 110 140 65 100 Incentives (%) 8 15 8 15 Yield - Market (%) 5.50 6.75 7.00 8.00 IRR (%) 6.75 7.25 7.75 8.75 Outgoings - Total ($/sq m) 20.00 25.00 15.00 20.00 Capital Values ($/sq m) 1,650 2,300 1,150 1,450 Land Values 3,000 - 5,000 sq m ($/sq m) 450 (high) 275 (low) Land Values 10,000 - 50,000 sq m ($/sq m) 275 (high) 200 (low) Trade Coast (Hendra Eagle Farm, Pinkenba, de, Murarrie, Hemmant, Lytton, Fisherman Island, Tingalpa, Wakerley, Cannon Hill) Trade Coast Prime Secondary Low High Low High Rental Net Face ($/sq m) 115 150 90 110 Incentives (%) 5 18 8 12 Yield - Market (%) 5.25 6.25 7.00 8.00 IRR (%) 6.50 7.25 6.75 7.50 Outgoings - Total ($/sq m) 20.00 25.00 17.00 23.00 Capital Values ($/sq m) 1,775 2,325 1,150 1,450 Land Values 3,000 - 5,000 sq m ($/sq m) 650 (high) 400 (low) Land Values 10,000 - 50,000 sq m ($/sq m) 375 (high) 300 (low) Southside Prime Secondary Low High Low High Rental Net Face ($/sq m) 105 130 65 100 Incentives (%) 13 18 10 15 Yield - Market (%) 5.50 6.25 7.25 8.25 IRR (%) 6.75 7.25 7.75 8.75 Outgoings - Total ($/sq m) 20.00 25.00 15.00 20.00 Capital Values ($/sq m) 1,475 2,025 900 1,300 Land Values 3,000 - 5,000 sq m ($/sq m) 375 (high) 250 (low) Land Values 10,000 - 50,000 sq m ($/sq m) 300 (high) 225 (low) Land Values 10 ha and above ($/sq m) 200 (high) 100 (low) Southside (Yeerongpilly, Salisbury, Rocklea, Archerfield, Willawong, Acacia Ridge, Coopers Plains, Eight Mile Plains, Rochedale, Seventeen Mile Rocks, Sumner, Darra, Oxley, Wacol, Carole Park, Richlands, Shailer Park, Slacks Creek, Springwood, Underwood) Source: Savills Research *Savills metrics includes marketable commercial industrial buildings within defined precinct boundaries, generally inclusive of an improved building area of between 1,000 and 20,000 square metres. Land values reflect ‘serviced & benched’ sites (3,000 - 5,000 sq m and 10,000 – 50,000 sq m) and ‘englobo’ sites (10 ha and above).

- 11. June 2019 savills.com.au/research 11 Savills Research | Briefing Notes – Brisbane Industrial South East (M1 / Logan Motorway Corridor) (Crestmead, Marsden, Browns Plains, Meadowbrook, Berrinba, Loganlea, Loganholme, Heathwood, Larapinta, Parkinson, Yatala, Stapylton, Kingston, Beenleigh, Eagleby, Hillcrest) South East (M1 / Logan Motorway Corridor) Prime Secondary Low High Low High Rental Net Face ($/sq m) 105 120 70 95 Incentives (%) 10 20 10 15 Yield - Market (%) 5.50 6.25 7.50 8.00 IRR (%) 6.75 7.25 7.75 8.75 Outgoings - Total ($/sq m) 15.00 25.00 15.00 20.00 Capital Values ($/sq m) 1,575 1,925 1,000 1,300 Land Values 3,000 - 5,000 sq m ($/sq m) 350 (high) 275 (low) Land Values 10,000 - 50,000 sq m ($/sq m) 275 (high) 225 (low) Land Values 10 ha and above ($/sq m) 120 (high) 80 (low) West (Goodna, Springfield, Redbank, Bremer, Ebenezer, Willowbank, Mutdapilly, Purga, Swanbank, Ipswich, New Chum, Wulkuraka, Amberley, Bundamba, Raceview, West Ipswich) West Prime Secondary Low High Low High Rental Net Face ($/sq m) 100 120 50 85 Incentives (%) 12 17 10 15 Yield - Market (%) 5.75 6.50 8.00 8.75 IRR (%) 7.00 7.50 8.25 9.00 Outgoings - Total ($/sq m) 15.00 20.00 15.00 20.00 Capital Values ($/sq m) 1,475 1,825 900 1,300 Land Values 3,000 - 5,000 sq m ($/sq m) 295 (high) 240 (low) Land Values 10,000 - 50,000 sq m ($/sq m) 225 (high) 150 (low) Land Values 10 ha and above ($/sq m) 200 (high) 100 (low) Source: Savills Research *Savills metrics includes marketable commercial industrial buildings within defined precinct boundaries, generally inclusive of an improved building area of between 1,000 and 20,000 square metres. Land values reflect ‘serviced & benched’ sites (3,000 - 5,000 sq m and 10,000 – 50,000 sq m) and ‘englobo’ sites (10 ha and above).

- 12. June 2019 savills.com.au/research 12 Savills Research | Briefing Notes – Brisbane Industrial Key State Office Contacts Savills is a leading global property service provider listed on the London Stock Exchange. Trusted since 1855, we have extensive experience across the Asia Pacific, with over 50 offices, and in Australia, we have over 800 staff focused on meeting all your property needs. Disclaimer This comunciation has been prepared by Savills (Aust) Pty Ltd’s Research Team (“Savills”) for general information only and is not intended to be relied upon in any way. Information, projections and images Information contained in this communication has been obtained from materials and sources believed to be reliable at the date of publication, however Savills has not taken steps to verify or certify its accuracy or completeness. Opinions, projections and forecasts in this communication depend on the accuracy of any information and assumptions on which they are based, and on prevailing market conditions, for which Savills does not accept responsibility. No representations or warranties of any nature are given, intended or implied by Savills about this communication, any information, opinions and forecasts contained within this communication or the accuracy or enforceability of any material referred to in this communication. Savills (including its employees, officers and agents) any of the employees of Savills referenced in the communication will not be liable, including in negligence, for any direct, indirect, special, incidental or consequential losses or damages arising out of or in any way connected with use of or reliance on anything in this communication. For the avoidance of doubt, Savills (including its employees, officers and agents) will not be liable for any investment decision based in whole or in part on the information or projections contained herein. All images are only for illustrative purposes. Given the above, Savills strongly advises all recipients of this communication to exercise caution and to conduct their own due diligence on the relevance, accuracy, completeness and currency of the information in this communication. This communication does not form part of or constitute an offer or contract. GST Unless otherwise expressly stated, all amounts, prices, values or other sums stated in this document are exclusive of GST. Confidentiality This communication is the confidential information of Savills and is strictly for the intended recipient. This communication must not be disclosed to any other party without the prior written consent of Savills. Copyright This communication is copyright material owned by Savills. Permission to use any part of this document must be sought directly from Savills. The Savills Research & Consultancy team has years of experience, and is supported by our extensive agency, property management and valuation professionals. For national-level consultancy or subscription requirements please contact: Capital Strategy & Research Phil Montgomerie +61 (0) 2 8215 8971 pmontgomerie@savills.com.au Research & Consultancy Phil Montgomerie +61 (0) 2 8215 8971 pmontgomerie@savills.com.au Asset Management Phillip Dunn +61 (0) 7 3002 8831 pdunn@savills.com.au Research & Consultancy Tracy Tam +61 (0) 7 3002 8859 ttam@savills.com.au Sunshine Coast Scott Gardiner +61 (0) 7 5313 7514 sgardiner@savills.com.au Industrial & Business Services Callum Stenson +61 (0) 7 3002 8832 cstenson@savills.com.au Gold Coast Kevin Carmody +61 (0) 7 5509 1700 kcarmody@savillsgc.com.au Valuations Leigh Atkinson +61 (0) 7 3002 8852 latkinson@savills.com.au Project Management Ken Ng +61 (0) 7 3018 6705 kng@savills.com.au