2008 - 2010 STK PICKS-1 Performance '09

•

0 likes•148 views

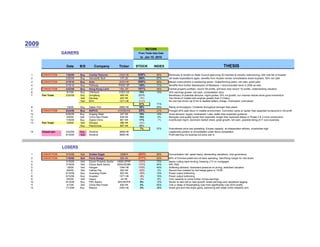

This document summarizes 12 stock trades from 2009, listing the ticker, date, and return for each. It includes both winning and losing trades, grouped by gainer and loser categories. The top three gaining trades were Comba Telecom, Vanceinfo Tech, and Anta, returning 528%, 285%, and 206% respectively. The biggest losing trades were Golden Eagle, Ports Design, and Singapore property sector stocks, falling 263%, 211%, and 127% respectively. Overall the gaining trades significantly outperformed the market indices.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Featured

Featured (20)

Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage Engineerings

How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental Health

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

2008 - 2010 STK PICKS-1 Performance '09

- 1. 2009 GAINERS Date B/S Company Ticker STOCK INDEX 1 CONVICTION 1/26/09 Buy Comba Telecom 2342 HK 528% 65% Revenues to double on State Council approving 3G licenses & industry restructuring; ride coat tail of Huawei 2 2/25/09 Buy Vanceinfo Tech VIT US 285% 67% Q4 beats expectations again, benefits from Huawei vendor consolidation,share buyback, 50% net cash 3 CONVICTION 2/19/10 Buy Anta 2020 HK 206% 66% Margin improvement in weakening sector. Outperforming peers, net cash, great yield 4 2/10/10 Buy Parkway PWAY SP 140% 71% Benefits from further liberalization of Medisave. I recommended stock in 2008 as well. 5 CONVICTION 4/22/09 Buy Hong Kong Land HKL SP 101% 46% Central property portfolio, record '09 profits, will have near record '10 profits, undemanding valuation 6 6/1/09 Buy CNinsure CISG US 75% 15% 30% earnings grower, net cash, consolidation story 7 Pair Trade 2/20/09 Buy Dongfeng 489 HK 257% Beneficiary of potential stimulus, mgmt guides 10% vol growth, our channel checks show good momentum Sell Denway 203 HK -78% Two-thirds of models with engines greater than 2.0 liters. Sell BYD 1211 HK -313% No one has driven car 8 hrs to deplete battery charge. Overhyped, overvalued 61% 71% 8 1/8/09 Buy Dalian Port 2880 HK 58% 50% Rising oil throughput. Container throughput stronger than peers 9 CONVICTION 6/24/09 Buy KEPCO 015760 KS 25% 21% Thought 20% safe return in volatile environment. Conviction came w/ earlier than expected turnaround in 2Q profit 10 6/26/09 Buy Angang Steel 347 HK 19% 16% Good demand, supply constrained. Later, better than expected guidance 11 9/8/09 Sell China Res Power 836 HK 19% 3% Mongolia coal quality worse than expected, longer than expected delays in Phase 2 & 3 mine construction 12 11/6/09 Buy Digital China 861 HK 17% -7% Incentivized mgmt, dominant market share, great growth, net cash, possible listing of IT svcs business 13 Pair Trade 2/9/09 Sell Sinopec 386 HK -42% Buy PetroChina 857 HK 49% 7% 57% Downstream price war spreading. Excess capacity at independent refiners. Inventories high 14 Closed psn 4/22/09 Buy Sinotruk 3808 HK Leadership position is consolidated under fierce competition 6/19/09 Sell Sinotruk 3808 HK Profit warning not surprise but price war is LOSERS 1 CONVICTION 3/10/09 Sell Golden Eagle 3308 K -263% 85% Concentration risk, asset heavy, demanding valuations, corp govenance 2 CONVICTION 1/16/09 Sell Ports Design 589 HK -211% 63% 60% of Chinese polled will cut back spending. Sacrificing margin for mkt share 3 3/19/09 Sell S'pore Property Sector HKMLSPRP -127% 75% Banks cutting back lending, lowering LTV on mortgages 4 3/19/09 Sell S'pore Bank Sector MSNJSGBK -117% 84% NPL Risk 5 1/6/09 Sell Hengan 1044 HK 115% 40% Softening demand, downward pressure on prcing, stretched valuation 6 8/6/09 Sell Cathay Pac 293 HK -23% 4% Record loss masked by fuel hedge gains in 1H'09 7 6/15/09 Buy Huaneng Power 902 HK -16% 16% Power output bottoming 8 6/15/09 Buy Huadian 1071 HK -9% 16% Power output bottoming 9 8/5/09 Sell Haeco 44 HK -2% 6% Over capacity to come further crimps earnings 10 6/12/09 Buy PRC Banks MXCNOFN 9% 15% Sector re-rate call on loan growth; street earnings and valuations lagging 11 4/1/09 Sell China Res Power 836 HK 4% 60% One yr delay of Wujiangfang coal mine significantly cuts 2010 profits 12 7/13/09 Buy Wasion 3393 HK 4% 26% Smart grid and mkt share gains, partnering with State Grid's researhc arm THESIS From Trade Idea Date to Jan 15. 2010 RETURN