Recommended

More Related Content

What's hot

What's hot (20)

The importance of being diligent graphic booklet (n.3 petters)

The importance of being diligent graphic booklet (n.3 petters)

December 13 quarterly: Is this too good to be true?

December 13 quarterly: Is this too good to be true?

[EN] To be or not to be invested - Fixed-Income Market Intelligence![[EN] To be or not to be invested - Fixed-Income Market Intelligence](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[EN] To be or not to be invested - Fixed-Income Market Intelligence](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

[EN] To be or not to be invested - Fixed-Income Market Intelligence

Similar to Marketocracyxxx

Similar to Marketocracyxxx (20)

Jeff Pesta, LUTCF – Proactive Advisor Magazine – Volume 5 Issue 11

Jeff Pesta, LUTCF – Proactive Advisor Magazine – Volume 5 Issue 11

Seminar Presentation Actions You Can Take In A Volatile Market

Seminar Presentation Actions You Can Take In A Volatile Market

Stocks Go From Great to Good as the Bull Turns Five

Stocks Go From Great to Good as the Bull Turns Five

Marketocracyxxx

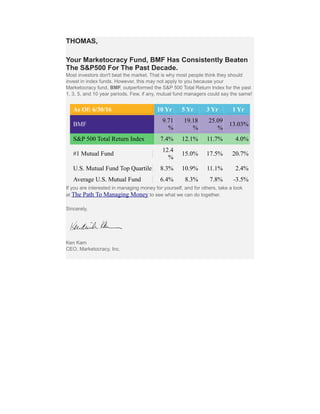

- 1. THOMAS, Your Marketocracy Fund, BMF Has Consistently Beaten The S&P500 For The Past Decade. Most investors don't beat the market. That is why most people think they should invest in index funds. However, this may not apply to you because your Marketocracy fund, BMF, outperformed the S&P 500 Total Return Index for the past 1, 3, 5, and 10 year periods. Few, if any, mutual fund managers could say the same! As Of: 6/30/16 10 Yr 5 Yr 3 Yr 1 Yr BMF 9.71 % 19.18 % 25.09 % 13.03% S&P 500 Total Return Index 7.4% 12.1% 11.7% 4.0% #1 Mutual Fund 12.4 % 15.0% 17.5% 20.7% U.S. Mutual Fund Top Quartile 8.3% 10.9% 11.1% 2.4% Average U.S. Mutual Fund 6.4% 8.3% 7.8% -3.5% If you are interested in managing money for yourself, and for others, take a look at The Path To Managing Money to see what we can do together. Sincerely, Ken Kam CEO, Marketocracy, Inc.