Income under chapter via

•

0 likes•179 views

Income under Chapter VIA - Common mistakes in filling of Income Tax Return (ITR) form - AY 2014-15

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Mistakes to avoid while e filing your income tax return

Mistakes to avoid while e filing your income tax return

Viewers also liked

Deductions from gross total income under section 80C to 80 U of income tax ac...

Deductions from gross total income under section 80C to 80 U of income tax ac...Dr. Sanjay Sawant Dessai

Viewers also liked (8)

Deductions section 80 d, 80-dd ,80-ddb 80-e and 80-gg of it act.bose

Deductions section 80 d, 80-dd ,80-ddb 80-e and 80-gg of it act.bose

Deductions from gross total income under section 80C to 80 U of income tax ac...

Deductions from gross total income under section 80C to 80 U of income tax ac...

Similar to Income under chapter via

Points to Consider while Filing Income Tax Return to Avoid Notices from Depar...

Points to Consider while Filing Income Tax Return to Avoid Notices from Depar...CA Shiv Kumar Sharma

Similar to Income under chapter via (20)

All about Section 44AD of the Income Tax Act | Sana Baqai

All about Section 44AD of the Income Tax Act | Sana Baqai

efg thnrgbtnthbdfv e rgnethnrfrjdshrsfsmjrthgbbdsbdbdfg aefghsethdfhrshjrsf

efg thnrgbtnthbdfv e rgnethnrfrjdshrsfsmjrthgbbdsbdbdfg aefghsethdfhrshjrsf

Points to Consider while Filing Income Tax Return to Avoid Notices from Depar...

Points to Consider while Filing Income Tax Return to Avoid Notices from Depar...

Special provisions of presumptive taxation under income tax act 1961

Special provisions of presumptive taxation under income tax act 1961

Salaried individuals for ay 2021 22 income tax department

Salaried individuals for ay 2021 22 income tax department

More from Taxfreemart

More from Taxfreemart (9)

Recently uploaded

Call Girls In Saket Delhi 9953056974 (Low Price) Escort Service Saket Delhi

Call Girls In Saket Delhi 9953056974 (Low Price) Escort Service Saket Delhi9953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

Book Call Girls in Anand Vihar Delhi 8800357707 Escorts Service

Book Call Girls in Anand Vihar Delhi 8800357707 Escorts Service

FULL ENJOY Call Girls In Gurgaon Call 8588836666 Escorts Service

FULL ENJOY Call Girls In Gurgaon Call 8588836666 Escorts Service

9643097474 Full Enjoy @24/7 Call Girls in Paschim Vihar Delhi NCR

9643097474 Full Enjoy @24/7 Call Girls in Paschim Vihar Delhi NCR

Call Girls in Lahore || 03081633338 || 50+ ❤️ Sexy Girls Babes for Sexual - vip

Call Girls in Lahore || 03081633338 || 50+ ❤️ Sexy Girls Babes for Sexual - vip

Call Girls In Sector 85 Noida 9711911712 Escorts ServiCe Noida

Call Girls In Sector 85 Noida 9711911712 Escorts ServiCe Noida

Call Girls In {Laxmi Nagar Delhi} 9667938988 Indian Russian High Profile Girl...

Call Girls In {Laxmi Nagar Delhi} 9667938988 Indian Russian High Profile Girl...

Call Girls In Sector 29, (Gurgaon) Call Us. 9711911712

Call Girls In Sector 29, (Gurgaon) Call Us. 9711911712

▶ ●─Cash On Delivery Call Girls In ( Sector 63 Noida )꧁❤⎝8375860717⎠❤꧂

▶ ●─Cash On Delivery Call Girls In ( Sector 63 Noida )꧁❤⎝8375860717⎠❤꧂

Call Girls in Majnu ka Tilla Delhi 💯 Call Us 🔝9711014705🔝

Call Girls in Majnu ka Tilla Delhi 💯 Call Us 🔝9711014705🔝

Call Us ≽ 9643900018 ≼ Call Girls In Lado Sarai (Delhi)

Call Us ≽ 9643900018 ≼ Call Girls In Lado Sarai (Delhi)

(9818099198) Call Girls In Noida Sector 88 (NOIDA ESCORTS)

(9818099198) Call Girls In Noida Sector 88 (NOIDA ESCORTS)

Book Call Girls In Mahipalpur Delhi 8800357707 Hot Female Escorts Service

Book Call Girls In Mahipalpur Delhi 8800357707 Hot Female Escorts Service

Call Girls in Chattarpur Delhi 💯 Call Us 🔝9667422720🔝

Call Girls in Chattarpur Delhi 💯 Call Us 🔝9667422720🔝

Call Us ☎97110√14705🔝 Call Girls In Mandi House (Delhi NCR)

Call Us ☎97110√14705🔝 Call Girls In Mandi House (Delhi NCR)

Call Girls In Majnu-ka-Tilla 9711800081 Low Cheap Price ...

Call Girls In Majnu-ka-Tilla 9711800081 Low Cheap Price ...

Call Girls In {Green Park Delhi} 9667938988 Indian Russian High Profile Girls...

Call Girls In {Green Park Delhi} 9667938988 Indian Russian High Profile Girls...

Call Girls In Saket Delhi 9953056974 (Low Price) Escort Service Saket Delhi

Call Girls In Saket Delhi 9953056974 (Low Price) Escort Service Saket Delhi

Income under chapter via

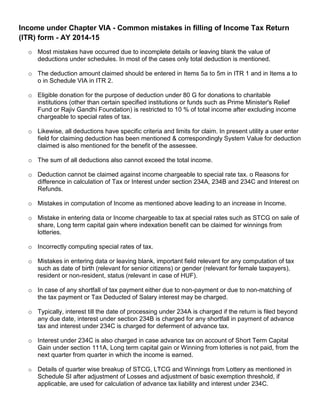

- 1. Income under Chapter VIA - Common mistakes in filling of Income Tax Return (ITR) form - AY 2014-15 o Most mistakes have occurred due to incomplete details or leaving blank the value of deductions under schedules. In most of the cases only total deduction is mentioned. o The deduction amount claimed should be entered in Items 5a to 5m in ITR 1 and in Items a to o in Schedule VIA in ITR 2. o Eligible donation for the purpose of deduction under 80 G for donations to charitable institutions (other than certain specified institutions or funds such as Prime Minister's Relief Fund or Rajiv Gandhi Foundation) is restricted to 10 % of total income after excluding income chargeable to special rates of tax. o Likewise, all deductions have specific criteria and limits for claim. In present utility a user enter field for claiming deduction has been mentioned & correspondingly System Value for deduction claimed is also mentioned for the benefit of the assessee. o The sum of all deductions also cannot exceed the total income. o Deduction cannot be claimed against income chargeable to special rate tax. o Reasons for difference in calculation of Tax or Interest under section 234A, 234B and 234C and Interest on Refunds. o Mistakes in computation of Income as mentioned above leading to an increase in Income. o Mistake in entering data or Income chargeable to tax at special rates such as STCG on sale of share, Long term capital gain where indexation benefit can be claimed for winnings from lotteries. o Incorrectly computing special rates of tax. o Mistakes in entering data or leaving blank, important field relevant for any computation of tax such as date of birth (relevant for senior citizens) or gender (relevant for female taxpayers), resident or non-resident, status (relevant in case of HUF). o In case of any shortfall of tax payment either due to non-payment or due to non-matching of the tax payment or Tax Deducted of Salary interest may be charged. o Typically, interest till the date of processing under 234A is charged if the return is filed beyond any due date, interest under section 234B is charged for any shortfall in payment of advance tax and interest under 234C is charged for deferment of advance tax. o Interest under 234C is also charged in case advance tax on account of Short Term Capital Gain under section 111A, Long term capital gain or Winning from lotteries is not paid, from the next quarter from quarter in which the income is earned. o Details of quarter wise breakup of STCG, LTCG and Winnings from Lottery as mentioned in Schedule SI after adjustment of Losses and adjustment of basic exemption threshold, if applicable, are used for calculation of advance tax liability and interest under 234C.