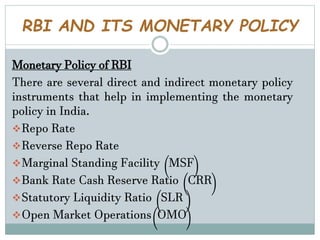

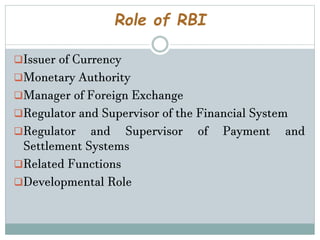

This document discusses central banking and the functions of central banks. It notes that central banks manage a country's currency and money supply. The key functions of central banks include regulating currency, advising governments, overseeing commercial banks, managing foreign exchange reserves, acting as a lender of last resort, and controlling credit. For India, the central bank is the Reserve Bank of India (RBI) which implements monetary policy using tools like repo rates, reverse repo rates, cash reserve ratios, and open market operations. The RBI also issues currency, regulates financial systems and payment systems, and plays a developmental role.