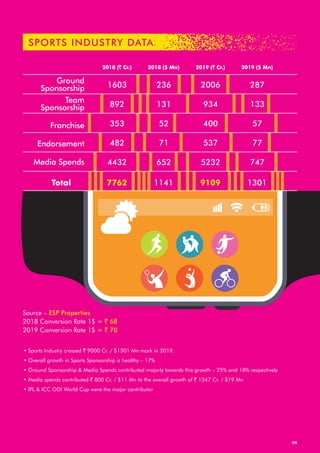

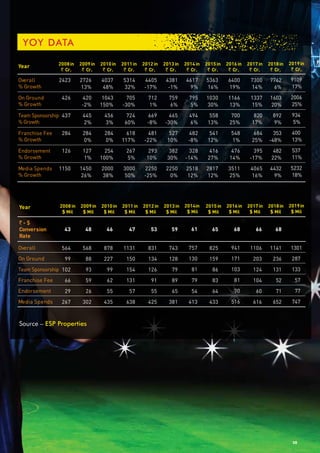

The document outlines the growth of the Indian sports sponsorship market in 2019, reporting a 17% increase driven primarily by cricket-related events such as the ICC World Cup and IPL, leading to significant revenue in ground sponsorships and media spends. It highlights the dominance of cricket in endorsement deals, with players like Virat Kohli and MS Dhoni accounting for a major share of endorsement value, while also noting success across other sports and a rise in digital media engagement. Overall, it presents a positive outlook for the sports industry in India, emphasizing continued investment and interest from brands.