SAVING AVENUES IN INDIA

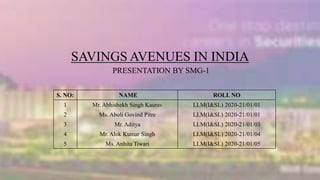

- 1. SAVINGS AVENUES IN INDIA PRESENTATION BY SMG-1 S. NO: NAME ROLL NO 1 Mr. Abhishekh Singh Kaurav LLM(I&SL) 2020-21/01/01 2 Ms. Aboli Govind Pitre LLM(I&SL) 2020-21/01/01 3 Mr. Aditya LLM(I&SL) 2020-21/01/03 4 Mr. Alok Kumar Singh LLM(I&SL) 2020-21/01/04 5 Ms. Anhita Tiwari LLM(I&SL) 2020-21/01/05

- 2. INTRODUCTION In India we all Indian follow some saving habits in our day to day life since centuries and these traditional practice of saving money by people helped the country up to some extent to withstand the global financial crisis many times. The savings habit of Indians in risk-free investment model is a product of the family system, that’s why from past we used to save our money in the form of Gold & Real Estate. To commensurate the effects of 20th century’s robust economic development Indians also show their interest in new dynamic saving avenues along with their traditional saving models. In India we all Indian follow some saving habits in our day to day life since centuries and these traditional practice of saving money by people helped the country up to some extent to withstand the global financial crisis many times. The savings habit of Indians in risk-free investment model is a product of the family system, that’s why from past we used to save our money in the form of Gold & Real Estate. To commensurate the effects of 20th century’s robust economic development Indians also show their interest in new dynamic saving avenues along with their traditional saving models. List of some widely accepted saving avenues: 1.Bank Saving & Fix Deposit. 2.Post office Deposits. (Like RD, NSC, Postal Bank etc.) 3.Public Provident Fund. 4.Insurance Products. (Like ULIP, Annuity, Pension Sch. etc.) 5.Corporate Investment(Like Equity, Preference, Debenture etc) 6.Bonds Govt.& Institutional.(Like Gold, Infra, RBI Bonds etc) 7.Mutual Funds.

- 3. CONCEPT OF SAVING AND INVESTMENT Saving is setting aside money you don’t spend now for emergencies or for a future purchase. It’s money you want to be able to access quickly, with little or no risk, and with the least amount of taxes. Financial institutions offer a number of different savings options. Investing is buying assets such as stocks, bonds, mutual funds or real estate with the expectation that your investment will make money for you. Investments usually are selected to achieve long-term goals. Generally speaking, investments can be categorized as income investments or growth investments. SELECTION OF SAVING AVENUES Selection of India we all Indian follow some saving habits in our day to day life since centuries and these Traditional practice of saving money by people helped the country up to some extent to withstand the global financial crisis many times. The savings habit of Indians in risk-free investment model is a product of the family system, that’s why from past we used to save our money in the form of Gold & Real Estate. To commensurate the effects of 20th century’s robust economic development Indians also show their interest in new dynamic saving avenues along with their traditional saving models.es

- 4. INVESTMENT IN BANKING SECTOR 1.Savings Accounts 2.High-Yield Savings Accounts 3.Fix Deposit (FD) 4.Certificates of Deposit (CDs) 5.Money Market Funds 6.Money Market Deposit Accounts 7.Treasury Bills and Notes

- 5. GOVERNMENT SCHEMES NATIONAL PAYMENT SCHEME Govt backed scheme started for govt employee in 2004 but opened to all in 2009. • Feature: 1.Any citizen (18-60y old) 2.market linked scheme 3.Managed by professional fund manager 4.Locking period : till the age of retirement 5.Corpus growth continues via market linked return 6.PFRDA is regulating authority. • Advantage 1. A retirement plan 2. Systematic Plan 3. Exemption in tax SUKANYA SAMRIDHI SCHEME A scheme launched by govt under “Beti Bachao Beti Pdhao” campaign. • Feature 1.Not more than 2 girl child in a family 2.Age of child should not exceeded 10y. 3.One need to Deposit every year till completion of 15y 4.Scheme will mature after the completion of 21 yeas 5.Amount: 250 to 1.5 Lakh 6.Rate of interest: 8.1% • Advantage 1.Save for girl’s education and marriage expenses 2.Govt backed Scheme 3.3x Tax exemption

- 6. GOVERNMENT SCHEMES (Continued……) PUBLIC PROFIDENT FUND • Feature 1.Locking in period: 15y 2.3*tax exemption 3.Fixed Rate: Quarterly decide by govt (7.9%) 4.Amount: 500 to 5 Lakh • Advantage 1.Encourage saving 2.Govt backed Scheme 3.Tax exemption NATIONAL SAVINGS CERTIFICATE A fixed income investment scheme that can open with any post office • Feature 1. Maturity Period: 5y 2. Amount: starting from 100 3. Interest rate: 6.1% • Advantage 1.Govt backed Scheme 2.Tax exemption: upto 1.5 lakh investment

- 7. COMPANY DEPOSITS Definition under 2(31) of Companies Act,2013 read with Companies(Acceptance of Deposit) Rules 2014; Bank Fixed Deposits v. Company Fixed Deposits Similarities: principal amount, fixed term, fixed rate of interest, unsecured, mortgage-able Dissimilarities: • offered by companies (Section 73 and 76 ) • higher rate of interest, • higher risk (no guarantee, compliance under Rules) • usually non-cumulative, Tax Implications Suitability: Senior Citizens and Low Income group Things to access: Credit Rating, Past performance of the Companies, Repayment history Pre- maturity withdrawal

- 8. INSURANCE RELATED SCHEMES LIFE INSURANCE, GENERAL INSURANCE • Concept of insurance, assurance v. insurance, • 80C Exemption (time min 2 yrs., premium value 10%, family), Heath Insurance under 80D (family and parents except in-laws and non dependant children) ULIP(UNIT LINKED INSURANCE PLAN) • Combines Life Insurance with Investment • Types : I (higher of assured or fund value), II (aggregate of fund and assured value) • Exemption under 80C of IT Act.

- 9. ANNUITY or PENSION SCHEMES • Premium: intervals or lumpsum • Immediate or deferred annuity • Repayment: after an age: fixed(low return), variable(high risk, investment through a sub account) or indexed(min pay+ rest linked with an index’s performance). • Taxed as regular income tax rate, not as long term capital gain which is usually lower • Regulated by PFRDA and IRDA • Flexible vesting age • APS NPS SSY covered under 80CCD, additional deduction of 50000 allowed for NPS, 60% maturity amount is tax exempt • Payment term • Saving habits and fixed return INSURANCE RELATED SCHEMES (Continued…..)

- 10. SHARES: EQUITY AND PREFERANCE Every shareholder is a part owner of the company. A company has its own capital structure: • Share Capital • Debt Funds • Reserves and Surplus • Shares can be of different types: • Equity & Preference Share Capital

- 11. DIFFERENCE : EQUITYAND PREFERANCE SHARES EQUITY SHARES PREFERENCE SHARES It raises fund. It cannot be converted to preference shares. It promises the holder a preference over equity shares. It can be converted to equity No right to receive dividend. Rate of dividend fluctuates. Cumulative or non-cumulative are entitled to dividend. Rate of dividend is fixed. Voting Rights in general meeting. Do not have voting rights Ordinary shares. No Types. Convertible & Non-convertible: Cumulative & Non- cumulative During liquidation, shareholders will have residual right over the asset even after the repayment to preference shares. The shareholders will have first right after the repayment. Primarily responsible for the management of the company. Do not have participation rights in the management.

- 12. BONDS AND DEBENTURES BONDS DEBENTURES Bonds are secure in nature Debentures can be secure and unsecured. It is of corporation, govt-agencies or financial institution. Debentures are issued by private companies. Bonds are less risky comparatively. Debentures are at high risk. At liquidity bonds are at first priority. At liquidity, it can be paid after bondholders. Bonds gives low interest but depends on the issuing body totally. Debentures give high interest.

- 13. MUTUAL FUNDS TYPES Based on structure- 1.Open ended - No maturity date, Investor can enter and exit the Fund as and when he wants 2.Close ended- Can be bought only at NFO (New Fund offer)- Later mandatorily listed on stock exchange- has fixed maturity period 3.Interval Funds- mix of open ended and close ended- can redeem only in interval given- listed Based on securities in which fund is invetsed- Equity, debt, balance, derivatives, fund of funds, bonds, et cetera.

- 14. RETURN ON MUTUAL FUNDS Dividend Appreciation in value of NAV (Net Asset Value) Advantage- Professionally Managed, Well regulated Disadvantage- No direct control over amount invested Tax- Equity Funds- LTCG- 10% STCG- IT slab Debt Funds- LTCG- 20% (after indexation), STCG- IT slab MUTUAL FUNDS (Continued…..)

- 15. SOVEREIGN GOLD BONDS Government bonds denominated in grams of gold • Alternative to hold physical gold- in demat • Person Resident in India, HUFs, trusts, universities and charitable institutions can invest (per Individual min 1 gram and maximum 4 KG, • Trust and similar entities- 20 KG Max.) • Maturity Period- 8 years, Interest- 2.50% p.a. Tax Interest Taxable as per IT Slabs Individual- CG- fully exempt

- 16. THANK YOU!