CBRE Cambodia MarketView Q3 2014

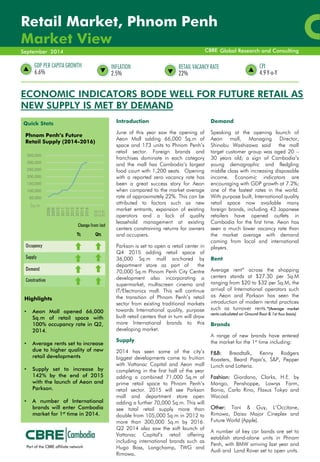

- 1. 1 Global Research and Consulting Quick Stats Retail Market, Phnom Penh Market View ECONOMIC INDICATORS BODE WELL FOR FUTURE RETAIL AS NEW SUPPLY IS MET BY DEMAND Introduction June of this year saw the opening of Aeon Mall adding 66,000 Sq.m of space and 173 units to Phnom Penh’s retail sector. Foreign brands and franchises dominate in each category and the mall has Cambodia’s largest food court with 1,200 seats. Opening with a reported zero vacancy rate has been a great success story for Aeon when compared to the market average rate of approximately 22%. This can be attributed to factors such as new market entrants, expansion of existing operators and a lack of quality leasehold management at existing centers constraining returns for owners and occupiers. Parkson is set to open a retail center in Q4 2015 adding retail space of 36,000 Sq.m mall anchored by department store as part of the 70,000 Sq.m Phnom Penh City Centre development also incorporating a supermarket, multiscreen cinema and IT/Electronics mall. This will continue the transition of Phnom Penh’s retail sector from existing traditional markets towards International quality, purpose built retail centers that in turn will draw more International brands to this developing market. Supply 2014 has seen some of the city’s biggest developments come to fruition with Vattanac Capital and Aeon mall completing in the first half of the year adding a combined 71,000 Sq.m of prime retail space to Phnom Penh’s retail sector. 2015 will see Parkson mall and department store open adding a further 70,000 Sq.m. This will see total retail supply more than double from 105,000 Sq.m in 2012 to more than 300,000 Sq.m by 2016. Q2 2014 also saw the soft launch of Vattanac Capital’s retail offering including international brands such as Hugo Boss, Longchamp, TWG and Rimowa. Demand Speaking at the opening launch of Aeon mall, Managing Director, Shinobu Washizawa said the mall target customer group was aged 20 – 30 years old; a sign of Cambodia’s young demographic and fledgling middle class with increasing disposable income. Economic indicators are encouraging with GDP growth at 7.2%; one of the fastest rates in the world. With purpose built, International quality retail space now available many foreign brands, including 43 Japanese retailers have opened outlets in Cambodia for the first time. Aeon has seen a much lower vacancy rate than the market average with demand coming from local and international players. Rent Average rent* across the shopping centers stands at $27.30 per Sq.M ranging from $20 to $32 per Sq.M, the arrival of International operators such as Aeon and Parkson has seen the introduction of modern rental practices such as turnover rents.*(Average market rents calculated on Ground floor & 1st floor basis) Brands A range of new brands have entered the market for the 1st time including: F&B: Breadtalk, Kenny Rodgers Roasters, Beard Papa’s, S&P, Pepper Lunch and Lotteria. Fashion: Giordano, Clarks, H.E. by Mango, Penshoppe, Lowrys Farm, Bonia, Carlo Rino, Flaxus Tokyo and Wacoal. Other: Toni & Guy, L’Occitane, Rimowa, Daiso Major Cineplex and Future World (Apple). A number of key car bands are set to establish stand-alone units in Phnom Penh, with BMW arriving last year and Audi and Land Rover set to open units. September 2014 GDP PER CAPITA GROWTH 6.6% INFLATION 2.5% RETAIL VACANCY RATE 22% Phnom Penh’s Future Retail Supply (2014-2016) Highlights • Aeon Mall opened 66,000 Sq.m of retail space with 100% occupancy rate in Q2, 2014. • Average rents set to increase due to higher quality of new retail developments • Supply set to increase by 142% by the end of 2015 with the launch of Aeon and Parkson. • A number of International brands will enter Cambodia market for 1st time in 2014. CPI 4.9 Y-o-Y CBRE - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 2015 (F) 2016 (F) Sq.m

- 2. 2 2013 CBRE Cambodia |MarketView overthecourseof2014.TheLuckyDepartmentStoreclosedonMonrieth,Levi’srelocatedtoCityMallontheothersideofthestreet,CamporeGroupopenedmultibrandCentralMallatCentralMarket. FutureSupply PhnomPenhwillseemajorincreasesinsupplyofretailspaceoverthenexttwoyearswithgrossfloorareaforpurposebuiltmulti-tenantedretailsettoincreasebymorethan150%bytheendof2014withanadditionalsupplyinthepipelinethroughto2017withdevelopmentsOlympiabyOCICandTheBridgebyOxleyunderconstructionwithasecondAeonmallnowinearlystagesofdiscussion.Parksonconfirmed2additionalprojects,LionCityandabovementionedTheBridgebyOxleywheretheywillmanagetheretailcomponent.WithestablishedretaildevelopersAeon,ParksonandHongkongLandresponsibleforthisnewsupplythequalityofspaceandmanagementissettoincreasepromptinganupliftinaveragerents; competitionfromtheseestablishedshoppingcenteroperatorsislikelytoweighfurtheronperformanceofoldercentersalreadywitnessingloweroccupancyandcustomerfootfallintheircenters. Overview Cambodiahasayoungpopulationwithover30%undertheageof15andafurther21%aged15-24.GDPpercapitagrowthwaslastrecordedat6.6%andalthoughlargelyaruralpopulationthereisanurbanizationrateof3.25%perannum.Thisisademographicpicturethatbodeswellforfutureretaildemandwithayouthfulworkforce,andgrowingurbanpopulation.Incomesarerisingfast;albeitfromalowbasebutdiscretionaryincomeisbecomingachievableformanyfamiliesforthefirsttime.ArecentreportcalculatedtheCambodiaGNIat$950percapita;fastapproachingtheWorldBankdefinitionofamiddleincome-economyat$1,045. RetailsupplyissettogrowincomingyearsbutCBREfeelthiswillbemetbydemandduetoimprovedqualityofretailspace, internationalmanagementandthesectorsgrowthpotential.2014hasseenanumberofInternationalbrandsenterCambodiaforthefirsttimeandthisisatrendsettocontinueasthecountryenjoysimprovedpoliticalstabilityand,increasedlocaldemand. CONTACTS For more information about this MarketView, please contact: www.cbre.com.kh +855 97 230 0000 cambodia@cbre.com GlobalResearchandConsulting ThisreportwaspreparedbytheCBRECambodiaResearchTeamwhichformspartofCBREGlobalResearchandConsulting–anetworkofpreeminentresearchersandconsultantswhocollaboratetoproviderealestatemarketresearch, econometricforecastingandconsultingsolutionstorealestateinvestorsandoccupiersaroundtheglobe. Disclaimer CBRELimitedconfirmsthatinformationcontainedherein,includingprojections,hasbeenobtainedfromsourcesbelievedtobereliable.Whilewedonotdoubttheiraccuracy,wehavenotverifiedthemandmakenoguarantee,warrantyorrepresentationaboutthem.Itisyourresponsibilitytoconfirmindependentlytheiraccuracyandcompleteness.ThisinformationispresentedexclusivelyforusebyCBREclientsandprofessionalsandallrightstothematerialarereservedandcannotbereproducedwithoutpriorwrittenpermissionofCBRE. CBRE Cambodia Research Thida Ann Associate Director CBRE Cambodia 9thFloor Phnom Penh Tower, #445 Monivong Boulevard, Boeung Prolet Quarter, 7 Makara District, Phnom Penh t:+855 89 777 308 e:thida.ann@cbre.com Laszlo Fulop Senior Retail Consultant CBRE Cambodia 9thFloor Phnom Penh Tower, #445 Monivong Boulevard, Boeung Prolet Quarter, 7 Makara District, Phnom Penh t:+84 972 058 444 e:laszlo.fulop@cbre.com CBREGroup,Inc.(NYSE:CBG),aFortune500andS&P500companyheadquarteredinLosAngeles,istheworld’slargestcommercialrealestateservicesfirm.TheCompanyhasapproximately31,000employees(excludingaffiliates),andservesrealestateowners,investorsandoccupiersthroughmorethan300offices(excludingaffiliates)worldwide. CBREhasundertakenworkinCambodiasince1993andestablishedapermanentofficein2008.CBREiscurrentlyCambodia’sindependentmarketleaderinrealestatesales,lettings,research,valuationandpropertymanagementwithproventrackrecords.WehaveateamofdedicatedpropertyprofessionalslocatedinPhnomPenh,withregionalofficesprovidingsupportandexpertise.Formoreinformation,visitthecompany'swebsiteatwww.cbre.com.kh. Chris Hobden Surveyor CBRE Cambodia 9thFloor Phnom Penh Tower, #445 Monivong Boulevard, Boeung Prolet Quarter, 7 Makara District, Phnom Penh t:+855 95 777 484 e:chris.hobden@cbre.com