QNBFS Daily Market Report November 19, 2018

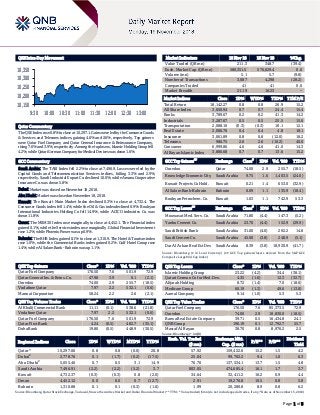

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.8% to close at 10,297.1. Gains were led by the Consumer Goods & Services and Telecoms indices, gaining 4.6% and 2.6%, respectively. Top gainers were Qatar Fuel Company and Qatar General Insurance & Reinsurance Company, rising 7.6% and 3.9%, respectively. Among the top losers, Islamic Holding Group fell 4.2%, while Qatari German Company for Medical Devices was down 1.6%. GCC Commentary Saudi Arabia: The TASI Index fell 2.2% to close at 7,496.9. Losses were led by the Capital Goods and Telecommunication Services indices, falling 3.3% and 2.9%, respectively. Saudi Industrial Export Co. declined 10.0%, while Amana Cooperative Insurance Co. was down 5.8%. Dubai: Market was closed on November 18, 2018. Abu Dhabi: Market was closed on November 18, 2018. Kuwait: The Kuwait Main Market Index declined 0.3% to close at 4,732.4. The Consumer Goods index fell 1.4%, while the Oil & Gas index declined 0.9%. Boubyan International Industries Holding Co fell 14.9%, while ACICO industries Co. was down 11.8%. Oman: The MSM 30 Index rose marginally to close at 4,452.1. The Financial index gained 0.1%, while the Services index rose marginally. Global Financial Investment rose 1.2%, while Phoenix Power was up 0.9%. Bahrain: The BHB Index gained 0.1% to close at 1,310.9. The Hotel & Tourism index rose 1.0%, while the Commercial Banks index gained 0.2%. Gulf Hotel Group rose 1.4%, while Al Salam Bank - Bahrain was up 1.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Company 176.50 7.6 501.9 72.9 Qatar General Ins. & Reins. Co. 47.98 3.9 0.1 (2.1) Ooredoo 74.00 2.9 255.7 (18.5) Vodafone Qatar 7.97 2.2 532.1 (0.6) Mannai Corporation 58.24 2.2 2.6 (2.1) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Al Khalij Commercial Bank 11.11 (0.1) 538.6 (21.8) Vodafone Qatar 7.97 2.2 532.1 (0.6) Qatar Fuel Company 176.50 7.6 501.9 72.9 Qatar First Bank 4.24 (0.5) 482.7 (35.1) Doha Bank 19.80 (0.5) 448.9 (30.5) Market Indicators 18 Nov 18 15 Nov 18 %Chg. Value Traded (QR mn) 211.3 348.7 (39.4) Exch. Market Cap. (QR mn) 580,351.5 576,629.4 0.6 Volume (mn) 5.1 5.7 (9.8) Number of Transactions 3,087 4,298 (28.2) Companies Traded 41 41 0.0 Market Breadth 21:19 16:23 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,142.27 0.8 0.8 26.9 15.2 All Share Index 3,050.94 0.7 0.7 24.4 15.4 Banks 3,789.67 0.2 0.2 41.3 14.2 Industrials 3,287.67 0.5 0.5 25.5 15.6 Transportation 2,088.10 (0.3) (0.3) 18.1 12.1 Real Estate 2,006.76 0.4 0.4 4.8 18.1 Insurance 3,061.89 0.8 0.8 (12.0) 18.2 Telecoms 986.75 2.6 2.6 (10.2) 40.0 Consumer 6,999.86 4.6 4.6 41.0 14.3 Al Rayan Islamic Index 3,886.68 0.7 0.7 13.6 15.2 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Ooredoo Qatar 74.00 2.9 255.7 (18.5) Knowledge Economic City Saudi Arabia 9.75 1.6 1,403.5 (24.0) Kuwait Projects Co Hold. Kuwait 0.21 1.4 653.0 (32.9) Al Salam Bank-Bahrain Bahrain 0.09 1.1 135.9 (18.4) Boubyan Petrochem. Co. Kuwait 1.03 1.1 742.9 53.3 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Mouwasat Med. Serv. Co. Saudi Arabia 71.80 (4.4) 147.3 (5.2) Yanbu Cement Co. Saudi Arabia 23.70 (4.4) 152.9 (29.9) Saudi British Bank Saudi Arabia 31.00 (4.0) 292.2 14.8 Saudi Cement Co. Saudi Arabia 45.00 (3.8) 248.9 (5.1) Dar Al Arkan Real Est Dev Saudi Arabia 8.39 (3.8) 18,920.9 (41.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 23.22 (4.2) 34.4 (38.1) Qatari German Co for Med. Dev. 4.35 (1.6) 12.3 (32.7) Alijarah Holding 8.72 (1.4) 7.0 (18.6) Medicare Group 60.19 (1.3) 49.6 (13.8) Aamal Company 9.14 (1.0) 5.3 5.3 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Fuel Company 176.50 7.6 85,373.5 72.9 Ooredoo 74.00 2.9 18,830.0 (18.5) Barwa Real Estate Company 39.71 0.5 16,434.8 24.1 QNB Group 196.19 0.1 12,792.7 55.7 Masraf Al Rayan 38.70 0.8 8,976.2 2.5 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,297.06 0.8 0.8 (0.0) 20.8 57.92 159,422.6 15.2 1.5 4.2 Dubai# 2,778.76 0.1 (1.7) (0.2) (17.5) 25.04 99,702.2 9.4 1.0 6.3 Abu Dhabi# 5,055.46 0.7 0.5 3.1 14.9 76.70 137,534.1 13.7 1.5 4.8 Saudi Arabia 7,496.91 (2.2) (2.2) (5.2) 3.7 803.05 474,685.4 16.1 1.7 3.7 Kuwait 4,732.37 (0.3) (0.3) 0.8 (2.0) 34.64 32,411.2 16.2 0.9 4.4 Oman 4,452.12 0.0 0.0 0.7 (12.7) 2.91 19,276.8 10.5 0.8 5.8 Bahrain 1,310.88 0.1 0.1 (0.3) (1.6) 1.99 20,280.8 8.9 0.8 6.2 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of November 15, 2018) 10,150 10,200 10,250 10,300 10,350 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index rose 0.8% to close at 10,297.1. The Consumer Goods & Services and Telecoms indices led the gains. The index rose on the back of buying support from Qatari and non-Qatari shareholders despite selling pressure from GCC shareholders. Qatar Fuel Company and Qatar General Insurance & Reinsurance Company were the top gainers, rising 7.6% and 3.9%, respectively. Among the top losers, Islamic Holding Group fell 4.2%, while Qatari German Company for Medical Devices was down 1.6%. Volume of shares traded on Sunday fell by 9.8% to 5.1mn from 5.7mn on Thursday. Further, as compared to the 30-day moving average of 5.6mn, volume for the day was 9.0% lower. Al Khalij Commercial Bank and Vodafone Qatar were the most active stocks, contributing 10.5% and 10.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases Company Market Currency Revenue (mn) 3Q2018 % Change YoY Operating Profit (mn) 3Q2018 % Change YoY Net Profit (mn) 3Q2018 % Change YoY Abdullah A. M. Al-Khodari Sons Co. Saudi Arabia SR 63.7 -50.0% – – -4.9 N/A Source: Company data, DFM, ADX, MSM, TASI, BHB. News Qatar Qatar’s CPI inflation edges down in October – Qatar's consumer price index (CPI) inflation declined 0.25% YoY in October, despite higher expenses towards education, transport, health, clothing and furniture, according to official data. The CPI-based cost of living was up a marginal 0.07% on a monthly basis, mainly owing to costlier food and beverage, communication and restaurants, according to the Ministry of Development Planning and Statistics. Highlighting that headline inflation remains subdued; the International Monetary Fund (IMF), after its officials concluded their visit to Qatar, said the proposed restructuring in the fiscal space, including taxation, may slightly lift price levels in the future. The IMF, in its latest Article IV consultation with Qatar, viewed that inflation is expected to peak at 3.9% in 2018, before easing to 2.2% in the medium term. The index of housing, water, electricity and other fuels, with a weight of 21.89% in the CPI basket, fell 2.97% YoY in October 2018 and 0.43% on a monthly basis. (Gulf- Times.com) Around 21,000 new firms registered since siege began until August end – HE the Chairman of Qatar Chamber (QC), Sheikh Khalifa bin Jassim Al-Thani said the number of new companies registered with QC since the beginning of the siege until the end of August 2018 reached about 21,000. In an interview with Qatar News Agency (QNA), he stressed this shows the attractive investment climate in Qatar, which has not been affected by the siege imposed on the country. QC’s Chairman praised Qatar's flexible and multifaceted economic strategy, which is in line with the Qatar National Vision 2030, making the country achieve significant economic development over the past years. He made special mention of the growth of the oil and non-oil sectors, where the contribution of the private sector to the GDP increased significantly, especially with support given by the wise leadership and the remarkable governance. In this context, Sheikh Khalifa added that the leadership wants the private sector to play a greater role in economic development, and to pave the way for its participation in the State's projects, the government has issued a number of decisions. He said the private sector has succeeded in taking a prominent position in the Qatari economy, especially during the siege, taking advantage of the government initiatives that paved the way for it to be a true partner in economic growth. (Gulf-Times.com) Taxes on tobacco products and aerated drinks will go up in Qatar very soon – Taxes on tobacco products and aerated drinks will go up in Qatar very soon, according to the Director of Public Health at Ministry of Public Health, Sheikh Mohamed bin Hamad Al-Thani. “There is a plan accepted by the Ministry of Finance to raise the taxes on tobacco to the same levels as in the neighboring countries. Qatar is waiting for the right time to implement it and it can happen any time soon. The final decision on the implementation will be taken by the cabinet and the Ministry of Finance. They will decide on the timing and calculate the taxes depending on the prevailing circumstances,” Sheikh Mohamed said. (Gulf-Times.com) Qatar-US trade increases nearly 22% to QR6.48bn in 3Q2018 – Within the first nine months of this year, Qatar and the US traded goods worth more than that was exchanged during the whole year of 2017. The combined value of Qatar-US trade in goods during the first nine months of 2018 reached QR16.53bn, which is higher compared to QR15.73bn for the full year in 2017. On quarterly basis, the bilateral trade volume in goods between Qatar and the world’s largest economy rose to QR6.48bn in 3Q2018, up 21.9% compared to QR5.31bn recorded Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 49.87% 58.53% (18,301,250.52) Qatari Institutions 24.88% 15.68% 19,442,980.68 Qatari 74.75% 74.21% 1,141,730.16 GCC Individuals 1.02% 1.51% (1,045,136.11) GCC Institutions 1.02% 2.84% (3,856,689.19) GCC 2.04% 4.35% (4,901,825.30) Non-Qatari Individuals 9.44% 11.55% (4,452,786.64) Non-Qatari Institutions 13.77% 9.88% 8,212,881.78 Non-Qatari 23.21% 21.43% 3,760,095.14

- 3. Page 3 of 5 in the previous quarter. When compared with the same quarter of last year the trade volume in goods increased by 45.9% against QR4.44bn registered in 3Q2017. The value of total US exports to Qatar until September 2018 touched QR12.01bn and imports from Qatar stood at QR4.47bn, latest online data released by the US Census Bureau showed. (Peninsula Qatar) International UK business morale hits lowest since at least 2009 – Bruised by uncertainty about Brexit, British businesses are now more pessimistic about the outlook than at any time since at least 2009, a survey showed. Plans for hiring and investment across both manufacturing and services firms sagged, according to a quarterly report from data firm, IHS Markit, which also compiles the closely watched purchasing managers’ indexes. The survey, conducted over the second half of October, showed firms cited political uncertainty as the biggest factor weighing on confidence. Prime Minister, Theresa May last week published a draft divorce deal with the European Union (EU) that has drawn the ire of Eurosceptics in her party, raising questions about her future as leader and sending the Pound sharply lower. The net balance of companies expecting business activity to rise in the next 12 months fell to 32% from 39% in the previous survey, marking the lowest reading since the IHS Markit Business Outlook Survey started in 2009. (Reuters) Nearly half of German firms expect growing trade strains with US – Forty-four percent of German firms expect a further escalation of trade tensions between Europe and the US, which is likely to continue to dampen new investments, the RND newspaper chain reported, citing a survey by the IW economic institute. Thirty-four percent do not see trade ties growing more strained, RND reported. It stated 41% of firms surveyed considered it unlikely that the US and the EU would reach an agreement on a transatlantic trade agreement. US President, Donald Trump and European Commission’s President, Jean- Claude Juncker struck an agreement in July that should shield European firms from US auto tariffs, while the two sides continue to work on trade issues. (Reuters) Japan's exports rebound in October, driven by US car imports – Japan’s exports rebounded in the year to October, reversing from the prior month’s surprise drop as US-bound car shipments grew, although slowing global demand and the intensifying US- China trade war cloud the outlook for export-reliant Japan. Ministry of Finance (MoF) data showed exports rose 8.2% in October from a year before, slightly below a 9.0% gain expected by economists in a Reuters poll. The export growth followed a revised 1.3% annual drop in September, which analysts say was caused by natural disasters that forced a closure of an international airport and crimped factory output, distribution of goods and inbound tourism. The November 19 trade news followed GDP data issued last week that showed Japan’s economy, the world’s third largest, shrank more than expected in the third quarter, hit by natural disasters and sluggish exports. While the economy is expected to return to growth this quarter as temporary effects from natural disasters fade, Japanese policymakers remain wary about the overall economic impact of global trade friction and slowing external demand. (Reuters) Former Finance Minister: China should cut income taxes to spur growth – China should cut corporate and personal income taxes to support the slowing economy amid a trade dispute with the US, former Chinese Finance Minister, Lou Jiwei said. Facing the nation’s weakest economic growth since the global financial crisis, Chinese policymakers are fast-tracking road and rail projects, pushing banks to increase lending, and cutting taxes to ease strains on businesses. China in October raised the threshold for collecting individual income tax to CNY5,000 per month from CNY3,500, hoping to boost consumption. The government has also been cutting value-added taxes and fees for companies, but it has yet to lower a corporate income tax rate of 25%. China should not launch another round of large- scale infrastructure investment to spur growth given that such a move could worsen the country’s debt risks, Lou said. (Reuters) Regional All members to attend Riyadh GCC Summit – Kuwaiti Deputy Foreign Minister, Khaled Al Jarallah affirmed that the next Gulf summit will be held in Riyadh, Saudi Arabia, in December and will be attended by all Gulf countries. “I am optimistic that the level of representation is expected to be high and reflects the keenness of GCC leaders to maintain this pioneering experience,” Al Jarallah said. The Ministerial Committees have been meeting in Kuwait and thus ensure that the GCC mechanism is maintained, effective and continuous. He stressed that this summit represents a ray of hope in reviving the efforts aimed at containing the Gulf dispute. (Peninsula Qatar) Saudi Arabia plans to build over 19,000 residential units – Saudi Arabia has announced a major housing development program under which more than 19,000 residential units will be built in major areas of the Kingdom for beneficiaries of its Sakani scheme. The Housing Ministry, represented by the Sakani program, has already signed five agreements with four real estate development companies for setting up of these villas and townhouses, reported Arab News. Under this program, a total of 19,359 housing units will be set up in Riyadh, Jeddah, Buraidah and Alkhobar for Sakani beneficiaries, the report noted. Of the five projects, Murooj Jeddah will include 10,000 housing units, while Luluat Al Bahar in Jeddah will have 8,000 housing units, Tanal in Riyadh will have around 1,008 housing units, Areen in Alkhobar will have 273 housing units and Basateen Al Qassim in Buraidah will have around 78 housing units. The projects will include dedicated sites for mosques, parks and government agencies, it added. (GulfBase.com) DP World’s Chairman says trade tensions will make 2019 challenging – Global ports operator, DP World believes that international trade tensions such as those between the US and China will make 2019 challenging, but not unmanageable, its Chairman said. The Dubai government-controlled ports operator cautioned in August about geopolitical risks and changes in trade policies as first-half profit fell 2.1%. DP World’s Chairman, Sultan Ahmed bin Sulayem told Reuters that he believed the psychological impact of trade tensions involving the US were starting to translate into reality. Financial institutions were becoming increasingly cautious and

- 4. Page 4 of 5 taking measures such as tightening lending in reaction to trade tensions, he said in an interview. (Reuters) Kuwait Oil Company in $1.3bn deal to import drilling towers – Kuwait Oil Company has signed contracts worth over $1.3bn to import drilling towers, the company’s CEO, Jamal Jaafer told Kuwait's al-Anba newspaper. The contracts have tenure of three years and can be renewed for another two years, he said. (Zawya)

- 5. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of November 15, 2018) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Oct-14 Oct-15 Oct-16 Oct-17 Oct-18 QSE Index S&P Pan Arab S&P GCC (2.2%) 0.8% (0.3%) 0.1% 0.0% 0.7% 0.1% (2.7%) (1.8%) (0.9%) 0.0% 0.9% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi# Dubai# Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,221.50 0.7 1.0 (6.3) MSCI World Index 2,031.76 0.3 (1.5) (3.4) Silver/Ounce 14.41 0.8 1.8 (14.9) DJ Industrial 25,413.22 0.5 (2.2) 2.8 Crude Oil (Brent)/Barrel (FM Future) 66.76 0.2 (4.9) (0.2) S&P 500 2,736.27 0.2 (1.6) 2.3 Crude Oil (WTI)/Barrel (FM Future) 56.46 0.0 (6.2) (6.6) NASDAQ 100 7,247.87 (0.2) (2.1) 5.0 Natural Gas (Henry Hub)/MMBtu 4.30 (8.3) 12.3 21.5 STOXX 600 357.71 0.7 (1.5) (12.7) LPG Propane (Arab Gulf)/Ton 80.00 3.6 9.6 (18.2) DAX 11,341.00 0.7 (0.9) (16.7) LPG Butane (Arab Gulf)/Ton 81.50 6.5 6.2 (22.8) FTSE 100 7,013.88 0.2 (2.5) (13.5) Euro 1.14 0.8 0.7 (4.9) CAC 40 5,025.20 0.7 (0.9) (10.2) Yen 112.83 (0.7) (0.9) 0.1 Nikkei 21,680.34 (0.1) (1.7) (5.0) GBP 1.28 0.5 (1.1) (5.0) MSCI EM 986.30 0.6 1.0 (14.9) CHF 1.00 0.7 0.6 (2.5) SHANGHAI SE Composite 2,679.11 0.4 3.4 (24.0) AUD 0.73 0.8 1.5 (6.1) HANG SENG 26,183.53 0.3 2.3 (12.7) USD Index 96.47 (0.5) (0.5) 4.7 BSE SENSEX 35,457.16 0.6 2.0 (7.4) RUB 65.98 0.1 (3.1) 14.5 Bovespa 88,515.27 4.3 3.3 2.3 BRL 0.27 1.1 (0.3) (11.5) RTS 1,134.93 0.3 1.2 (1.7) 75.5 74.8 73.2