QNBFS Daily Market Report March 15, 2017

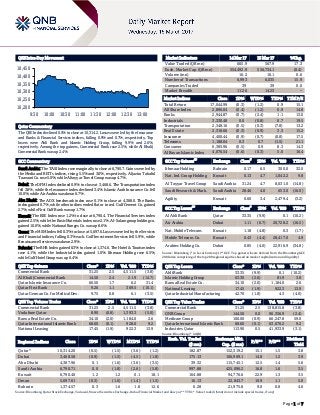

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.5% to close at 10,314.2. Losses were led by the Insurance and Banks & Financial Services indices, falling 0.9% and 0.7%, respectively. Top losers were Ahli Bank and Islamic Holding Group, falling 9.9% and 2.6%, respectively. Among the top gainers, Commercial Bank rose 2.5%, while Al Khalij Commercial Bank was up 2.4%. GCC Commentary Saudi Arabia: The TASI Index rose marginally to close at 6,790.7. Gains were led by the Media and REITs indices, rising 5.5% and 3.0%, respectively. Aljazira Takaful Taawuni Co. rose 5.0%, while Altayyar Travel Group was up 4.7%. Dubai: The DFM Index declined 0.9% to close at 3,468.6. The Transportation index fell 3.8%, while the Insurance index declined 3.4%. Islamic Arab Insurance Co. fell 10.0%, while Air Arabia was down 6.7%. Abu Dhabi: The ADX benchmark index rose 0.1% to close at 4,388.0. The Banks index gained 0.7%, while other indices ended flat or in red. Gulf Cement Co. gained 2.7%, while First Gulf Bank was up 1.7%. Kuwait: The KSE Index rose 1.2% to close at 6,790.4. The Financial Services index gained 2.5%, while the Basic Materials index rose 2.1%. Al-Salam group holding co. gained 10.0%, while National Ranges Co. was up 8.6%. Oman: The MSM Index fell 0.3% to close at 5,697.6. Losses were led by the Services and Financial indices, falling 0.3% each. Gulf Investment Services fell 5.9%, while Renaissance Services was down 2.9%. Bahrain: The BHB Index gained 0.3% to close at 1,374.6. The Hotel & Tourism index rose 4.1%, while the Industrial index gained 1.0%. Ithmaar Holding rose 6.5%, while Gulf Hotel Group was up 6.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Commercial Bank 31.25 2.5 4,511.5 (3.8) Al Khalij Commercial Bank 14.50 2.4 21.9 (14.7) Qatar Islamic Insurance Co. 66.50 1.7 6.2 31.4 Qatar First Bank 9.26 1.1 369.5 (10.1) Qatar German Co. for Medical Dev. 9.75 0.8 6.1 (3.5) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Commercial Bank 31.25 2.5 4,511.5 (3.8) Vodafone Qatar 8.90 (0.8) 1,393.3 (5.0) Barwa Real Estate Co. 34.10 (2.0) 1,184.0 2.6 Qatar International Islamic Bank 68.60 (0.1) 928.0 9.2 National Leasing 17.45 (1.9) 922.3 13.9 Market Indicators 14 Mar 17 13 Mar 17 %Chg. Value Traded (QR mn) 665.9 567.9 17.3 Exch. Market Cap. (QR mn) 554,492.9 556,734.1 (0.4) Volume (mn) 16.2 16.1 0.6 Number of Transactions 6,993 6,035 15.9 Companies Traded 39 39 0.0 Market Breadth 11:26 14:23 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,044.99 (0.3) (1.2) 0.9 15.1 All Share Index 2,896.04 (0.4) (1.2) 0.9 14.8 Banks 2,944.87 (0.7) (2.4) 1.1 13.0 Industrials 3,330.48 0.0 (0.8) 0.7 19.5 Transportation 2,348.16 (0.5) (0.3) (7.8) 13.2 Real Estate 2,318.66 (0.3) (0.9) 3.3 15.2 Insurance 4,400.44 (0.9) (0.7) (0.8) 17.5 Telecoms 1,188.04 0.3 0.7 (1.5) 21.1 Consumer 6,385.96 (0.5) 0.9 8.3 14.3 Al Rayan Islamic Index 4,076.54 (0.6) (0.3) 5.0 16.4 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Ithmaar Holding Bahrain 0.17 6.5 300.0 32.0 Nat. Ind. Group Holding Kuwait 0.13 4.7 1,042.2 9.8 Al Tayyar Travel Group Saudi Arabia 31.24 4.7 8,031.0 (14.8) Saudi Research & Mark. Saudi Arabia 28.46 4.0 653.0 (16.0) Agility Kuwait 0.60 3.4 2,479.4 (3.2) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Ahli Bank Qatar 33.35 (9.9) 0.1 (10.2) Air Arabia Dubai 1.11 (6.7) 20,728.2 (16.5) Nat. Mobile Telecom. Kuwait 1.18 (4.8) 0.3 (1.7) Mobile Telecom. Co. Kuwait 0.43 (4.4) 28,417.0 4.9 Arabtec Holding Co. Dubai 0.85 (4.0) 22,916.9 (34.8) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ahli Bank 33.35 (9.9) 0.1 (10.2) Islamic Holding Group 63.30 (2.6) 81.9 3.8 Barwa Real Estate Co. 34.10 (2.0) 1,184.0 2.6 National Leasing 17.45 (1.9) 922.3 13.9 Qatar Industrial Manufacturing 42.70 (1.8) 4.3 (4.0) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Commercial Bank 31.25 2.5 138,815.8 (3.8) QNB Group 144.50 0.0 96,356.9 (2.4) Medicare Group 100.00 (0.9) 66,247.8 59.0 Qatar International Islamic Bank 68.60 (0.1) 63,670.2 9.2 Industries Qatar 113.90 0.5 41,933.9 (3.1) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,314.20 (0.5) (1.5) (3.6) (1.2) 182.87 152,319.2 15.1 1.5 3.8 Dubai 3,468.58 (0.9) (1.5) (4.5) (1.8) 175.13 106,909.1 14.8 1.2 3.9 Abu Dhabi 4,387.96 0.1 (1.6) (3.6) (3.5) 39.32 115,745.1 12.5 1.4 5.6 Saudi Arabia 6,790.71 0.0 (1.8) (2.6) (5.8) 997.88 425,096.2 16.8 1.6 3.5 Kuwait 6,790.40 1.2 1.2 0.1 18.1 164.88 94,776.6 22.9 1.3 3.5 Oman 5,697.61 (0.3) (1.6) (1.4) (1.5) 16.13 22,843.7 10.9 1.1 5.0 Bahrain 1,374.57 0.3 1.6 1.8 12.6 6.28 21,975.8 9.0 0.8 4.6 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,200 10,250 10,300 10,350 10,400 10,450 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.5% to close at 10,314.2. The Insurance and Banks & Financial Services indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Ahli Bank and Islamic Holding Group were the top losers, falling 9.9% and 2.6%, respectively. Among the top gainers, Commercial Bank rose 2.5%, while Al Khalij Commercial Bank was up 2.4%. Volume of shares traded on Tuesday rose by 0.6% to 16.2mn from 16.1mn on Monday. Further, as compared to the 30-day moving average of 10.6mn, volume for the day was 52.3% higher. Commercial Bank and Vodafone Qatar were the most active stocks, contributing 27.9% and 8.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2016 % Change YoY Operating Profit (mn) 2016 % Change YoY Net Profit (mn) 2016 % Change YoY Al-Jouf Agricultural Dev. Co.* Saudi Arabia SR – – 78.1 6.7% 77.7 7.3% Anaam Int. Holding Group* Saudi Arabia SR – – 2.0 -90.2% 3.7 -82.3% Middle East Specialized Cables Co.* Saudi Arabia SR – – 27.4 N/A 79.8 N/A Source: Company data, DFM, ADX, MSM, TADAWUL (*FY2016) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/14 Germany German Federal Statistical Office CPI MoM February 0.6% 0.6% 0.6% 03/14 Germany German Federal Statistical Office CPI YoY February 2.2% 2.2% 2.2% 03/14 India India Central Statistical Organization CPI YoY February 3.7% 3.6% 3.2% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of board meeting No. of days remaining Status AHCS Aamal Company 15-Mar-17 0 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 24.96% 28.62% (24,383,483.33) Qatari Institutions 28.86% 41.57% (84,635,054.21) Qatari 53.82% 70.19% (109,018,537.54) GCC Individuals 0.49% 0.17% 2,158,633.27 GCC Institutions 7.05% 8.94% (12,599,600.35) GCC 7.54% 9.11% (10,440,967.08) Non-Qatari Individuals 6.52% 5.55% 6,441,435.86 Non-Qatari Institutions 32.13% 15.15% 113,018,068.76 Non-Qatari 38.65% 20.70% 119,459,504.62

- 3. Page 3 of 7 News Qatar AKHI reports net loss of QR5.3mn in 4Q2016 – Al Khaleej Takaful Group (AKHI) reported net loss of QR5.3mn in 4Q2016 as compared to net profit of QR3.8mn in 3Q2016. EPS amounted to QR0.52 in 2016 as compared to QR1.70 in 2015. The board of directors recommended distribution of cash dividend of 6% of the nominal share value (amounting to QR0.60 per share). (QSE) MRDS’ bottom-line slips 95% QoQ in 4Q2016 – Mazaya Qatar Real Estate Development Company’s (MRDS) bottom-line declined 95.4% QoQ (down 97.0% YoY) to QR0.6mn in 4Q2016. EPS amounted to QR0.68 in 2016 as compared to QR1.02 in 2015. Meanwhile, the company’s board of directors proposed to the general assembly to distribute bonus shares of 5% (i.e. 5 shares for each 100 shares). (QSE) QFBQ reports net loss of QR265.6mn in 2016 – Qatar First Bank (QFBQ), the leading Shari’ah compliant bank, reported net loss of QR265.6mn in 2016, resulting mainly from the downward revision of the valuations of some of its investments across several markets. Despite the write-down of the investment book, the bank’s total assets did not decline and closed at ~QR6bn at the end of December 31, 2016, mainly driven by the increase in financing assets. QFBQ said the investment portfolio continued to generate healthy dividends of QR13mn. Additionally, financing assets increased by 33%, and will generate recurring income during the coming years. QFBQ’s Sukuk book continued to generate positive returns close to QR30mn. The bank’s income from placement with financial institutions has tripled mainly from cash deployment in Shari’ah compliant money market funds. QFBQ’s CEO Ziad Makkawi said, “Our private equity portfolio had consistently generated significant returns over the last six years. Our Turkish investments are still 47% higher than their acquisition price and will continue to grow in sales and profitability and occupy leading positions in their respective industries of healthcare and retail. Our UK investments are still significantly above our acquisition costs, both in pounds and riyals. However, the ongoing global political and economic conditions continue to weigh on our markets, and as a consequence, on our overall profitability. Our 2016 revenues have been significantly affected by reversals of previous years’ fair value gains on our private equity investments, specifically in Turkey and the UK, resulting in overall losses of QR265.6mn, the majority of which are unrealized.” (Gulf-Times.com) QSE announces trading suspension in the shares of QNNS on March 15 – Qatar Stock Exchange (QSE) announced trading suspension of the shares of Qatar Navigation Company (QNNS) on March 15, 2017 due to its AGM and EGM being held on the day. (QSE) DBIS announces the closure of nominations for board membership – Dlala Brokerage and Investment Holding Company (DBIS) announced the closing of the nomination for membership of the board of directors. The nominees for the board membership of six vacancies are HE Sheikh Abdul Rahman Bin Hamad Al Thani, HE Sheikh Suhaim Bin Khalid Al Thani, Mr. Ali Hussein Al Sada, Mr. Jabir Hajjaj Al Shahwani, Mr. Ahmed Mohamed Al Asmakh and Mr. Mohamed Mubarak Al Khater representing Armed Forces Investment Fund. As well as three members representing the incorporators, Ms. Moza Mohamed Al Sulaiti representing Pension Fund, Mr. Walid Raslan Al Abdullah representing Qatar Foundation Fund and Mr. Khalid Abdullah Al Sowaidi representing Qatar Investment Authority. (QSE) UDCD’s AGM endorses items listed on its agenda and approves the distribution of 12.5% cash dividend – United Development Company (UDCD) announced the resolutions of Annual General Assembly Meeting (AGM) held on March 13, 2017 and endorsed the recommendation of the board of directors to distribute cash dividends of 12.5%, equivalent to QR1.25 per share. (QSE) MARK to hold AGM on April 2 – Masraf Al Rayan’s (MARK) board of directors announced that the Ordinary General Assembly Meeting (AGM) will be held on April 2, 2017. If the quorum is not met, the alternate date will be April 9, 2017. (QSE) QFBQ to hold AGM on April 6 – Qatar First Bank (QFBQ) board of directors announced the Ordinary General Assembly Meeting (AGM) will be held on April 6, 2017. (Peninsula Qatar) Qatargas to double LNG supplies to Poland – Qatar will double the supply of liquefied natural gas (LNG) to Poland to 2mn tons per annum as part of efforts to strengthen the bilateral economic and trade relations between the two countries. Qatargas has signed a side agreement to the existing sale and purchase agreement (SPA) with Polish Oil and Gas Company (PGNiG). The new agreement will come into effect on January 1, 2018 and run until June 2034. Qatargas Chairman and Qatar Petroleum President and Chief executive Saad Sherida al-Kaabi said, “We are very pleased that we have signed this agreement, which marks another milestone for us in Qatar as we continue to meet the requirements of our customers worldwide.” (Gulf- Times.com) Qatar to expand ties with Kyrgyzstan – Minister of Economy and Commerce, HE Sheikh Ahmed bin Jassim Al Thani, stressed the need to further strengthen economic relations between Qatar and Kyrgyzstan. He was addressing the first session of the Qatari-Kyrgyz Joint Committee on Economic, Commercial and Technical Cooperation, held in Doha over two days. The first session was chaired by Minister of Economy and Trade of Kyrgyzstan Kojoshev Arzybek. During the session, the two sides held official talks and reviewed aspects of co-operation in various sectors of mutual interest for both countries. In his speech, the Minister said the organization of this meeting reflects the mutual keenness of the two countries to cement bilateral relations and push them to new heights in all fields to meet the joint aspirations and serve the common interests of the two countries. (Peninsula Qatar) Qatar chamber explores investment opportunities in Turkmenistan – Deputy Chairman of the Turkmenistan Cabinet of Ministers Batyr Atdayev urged Qatari businessmen to invest in Turkmenistan and to make use of the various opportunities and facilities provided by the Turkmen government to foreign investors. In an economic forum held at Qatar chamber (QC) for a Turkmen delegation of officials and businessmen, Atdayev said that his country has inaugurated multiple free zones and facilities for the foreign investors. There are a number of equal

- 4. Page 4 of 7 investment opportunities for Qataris on the private and public sector, he added. He presented Turkmen's important economic indicators and the encouraging environment, highlighting that the textile industry is one of the most important sectors in the country, where 70 factories produce environmentally friendly cotton that is then exported as fabric to almost 30 countries around the world. (Bloomberg) Ooredoo to offer cloud-based device security solution – Ooredoo will become the first across its market to offer an individual cloud-based device security solution for all of its 138mn users. The new security service will protect Ooredoo customers against viruses, dangerous files and harmful websites across their connected smart devices, fixed and business accounts. The Ooredoo security service will work by automatically blocking harmful downloads or files and alerting customers via SMS. The security service will be provided by German security specialist ‘Secucloud’, who recently signed a strategic partnership agreement with Ooredoo Group at its headquarters in Doha. (Gulf-Times.com) International US producer prices rise broadly, point to firming inflation – US producer prices increased more than expected in February as the cost of services such as hotel accommodation pushed higher and the YoY gain was the largest in nearly five years, pointing to steadily rising inflation pressures. Firming inflation, together with a tightening labor market, which is expected to generate strong wage growth, could allow the Federal Reserve to raise interest rates. The Labor Department said that its producer price index for final demand increased 0.3% last month after rising 0.6% in January. Economists polled by Reuters had forecast a 0.1% uptick. In the 12 months through February, the PPI jumped 2.2%, the biggest advance since March 2012 and ahead of the 2.0% gain forecast in the Reuters poll. It followed a 1.6% increase in January. (Reuters) Eurozone industry output rises less than expected in January – Eurozone industrial output increased less than expected in January as firms' higher investment in machinery was partially offset by a drop in the production of consumer goods, estimates from the European Union statistics office showed. Eurostat said industrial production in the 19-country single currency bloc rose in January by 0.9% compared to the previous month, and by 0.6% YoY. Both figures were lower than market expectations. A Reuters poll of economists had forecast an average monthly rise of 1.3% and a 0.9% YoY increase. The lower-than-expected January figures were partly counterbalanced by upwardly revised data for December when industrial production fell by 1.2% on the month, less than the 1.6% drop initially estimated by Eurostat. On a yearly basis output went up by 2.5% in December, more than the 2.0% rise previously estimated. The monthly output rise in January was mostly due to a surge in production of capital goods, like machinery, which went up by 2.8%, fully offsetting an equal drop in the previous month, in a sign of firms' improved prospects of future sales. (Reuters) German investor morale improves less than expected in March – The mood among German investors improved less than expected in March, a survey showed, as uncertainties about the outcome of major European elections and their effect on the growth outlook for Europe's biggest economy remained high. Mannheim-based ZEW said its monthly survey showed its economic sentiment index rose to 12.8 from 10.4 points in the previous month. This undershot the Reuters consensus forecast for rise to 13.1. A separate gauge measuring investors' assessment of the economy's current conditions edged up to 77.3 points from 76.4 in February. This was also slightly weaker than the Reuters consensus forecast which predicted a reading of 78.0. ZEW President Achim Wambach said the fact that sentiment only improved slightly reflected the current uncertainty surrounding future economic development. (Reuters) New China indicator shows service sector grows 8.2% YoY in early 2017 – China's services sector expanded 8.2% YoY in January-February, the statistics bureau said, unveiling a new growth indicator amid the country's transition from an industrial to services-led economy. The pace of service growth in early 2017 is basically the same as at the start of last year, the National Bureau of Statistics (NBS) said. The new monthly indicator measuring services output was published for the first time as China looks to provide more insight into a sector that now accounts for more than half of the economy and most of its growth. (Reuters) China's economy gets off to strong start in 2017 as investment rebounds – China issued a raft of upbeat data showing the economy got off to a strong start to 2017, supported by strong bank lending, a government infrastructure spree and a much- needed resurgence in private investment. Solid growth is welcome news for China's policymakers as they turn their focus to containing risks from a sharp build-up in debt ahead of a major leadership reshuffle later this year. But economists are not sure how long the pace can be sustained as the central bank takes a tighter stance on credit and exporters brace for a surge in US protectionism. Fixed-asset investment expanded more strongly than expected in the first two months of the year as growth in private investment more than doubled from 2016, while surging demand for steel for new roads, bridges and homes lifted factory output. That added to readings last week showing robust imports, particularly of commodities such as iron ore, and a sharp rise in producer prices which is boosting industrial profits. (Reuters) Regional Arab cooperative insurance market hits $33bn – The cooperative insurance sector in Arab countries has grown to $33bn, with the six members of the Gulf Co-operation Council accounting for 25% or $9bn. The Islamic financing sector has grown by 15 to 20% per annum since 2000 to reach $2tn by the end of 2015. An integrated part of the international financial system, the Islamic financing sector has been evolving since 1960 and now it includes banks, insurance and capital markets. The sector is expected to grow at a fast pace, especially due to increasing demand on its Shari’ah-compliant finance services. (GulfBase.com) MENA power and utilities green solutions investment valued at $8.7bn – According to the Ernst & Young (EY), mergers and acquisitions in the renewable sector picked up in 2016 across the Middle East and Africa (MENA) after a long period of slow activity. Greenfield activities continue to dominate power and

- 5. Page 5 of 7 utility transactions in the region, attracting $8.7bn of investment last year. Key investment announcements in 4Q2016 included the Kuwait Fund for Arab Economic Development has coordinated a debt financing of $115.5mn to set up a desalination plant in Egypt. The UAE also saw new projects across coal, nuclear, and solar, funded by both local and Asian investors, to support its raised renewable energy target from 24% to 26% to help fight climate change. (GulfBase.com) OPEC says oil stocks still increasing, Saudi Arabia raise output – Organization of the Petroleum Exporting Countries (OPEC) said oil inventories have risen despite a global deal to cut supply and raised its forecast of production in 2017 from outside the group, suggesting complications in an effort to clear a glut and support prices. OPEC also said its biggest producer Saudi Arabia increased output in February by 263,000 barrels per day to 10mn bpd, after in January making a larger cut than required by the OPEC accord to ensure strong initial compliance. OPEC is curbing its output by about 1.2mn barrels per day (bpd) from January 1, the first reduction in eight years. (Reuters) Saudi Arabia can achieve budget surplus by 2019 – According to the Al-Rajhi Capital, if all the reforms outlined in the fiscal balance program are implemented within the set timeline, Saudi Arabia could achieve a budget surplus by 2019. The fiscal balance program, unveiled after the announcement of the 2017 budget, comprises rationalizing government expenditure, cost savings from energy and water-price reform partially offset by household allowance pay-outs, new non-oil revenue sources and enabling private sector growth. Analysts at Al-Rajhi Capital said the government has identified value-added tax (VAT), an expat levy, a municipal fee, an excise tax on harmful products and luxury tariffs as major avenues for generating non-oil revenue. In the conservative scenario (assuming lower oil prices, execution delays in water/energy price reforms etc.), the budget surplus will be achieved by 2020, they added. (GulfBase.com) Consumer confidence in Saudi Arabia is rising – Over four in 10 local respondents expect the business conditions in Saudi Arabia to improve within the next year, the latest results from the Middle East Consumer Confidence Index survey carried out by Bayt.com. 43% of respondents in Saudi Arabia believe that the country’s economy has either improved or remained at the same level during the past six months. When asked about future expectations, 36% of Saudi respondents said that they are optimistic about the economy improving. 23% of respondents expect the economy to remain the same. When it comes to current business conditions, a quarter of respondents believe that the business conditions are either good or very good, 35% believe that the conditions are average. Saudi respondents are quite optimistic about business conditions within the next year, where 43% of them believe that the conditions will improve. 22% expect business conditions to remain the same. (GulfBase.com) CMA received interest from GCC firms keen to list on its SME market – Saudi Arabia's Capital Market Authority (CMA) has received enquiries from companies from the Gulf Cooperation Council (GCC) considering listing on its new parallel market. Yarub Awadh Albadi, Head of CMA's IPO unit said that the companies were in the process of appointing advisers to support their potential listings. The Nomu market is designed for small and medium sized businesses, requiring a market value of at least SR10mn, minimum shareholder size of 35-50 shareholders, and an offering of at least 20% of its shares. (Reuters) Stricter UAE bank rules against money laundering hurt SME borrowing – According to the accountancy firm KPMG, anti- money laundering regulations that are increasingly being strengthened by UAE banks are making it more difficult for small and medium-sized businesses to tap debt. Small & Medium Enterprises (SMEs) have struggled to get financing in recent years as banks become more particular about who they give loans to after a spate of defaults left gaping holes in many a bank’s balance sheet. Now lenders not only ask for assets to back loans but also more information about the businesses they finance, often to the chagrin of business owners and to detriment of the wider economy that is reliant on small enterprises. Banks were notified in December that anti-money laundering rules had been amended with stricter regulations that prevent customers from opening accounts with assumed names, and the physical checking of forms of identification. (GulfBase.com) IATA: UAE airlines likely to see falling profits in 2017 – The Head of IATA said that the profitability of airlines based in the UAE is likely to fall in 2017 amid limited growth in demand. The UAE is home to Emirates, which flies more passengers’ long haul than any other airline, as well as rapidly expanding Etihad Airways and low cost carriers’ flydubai and Air Arabia. IATA said that Middle East airlines are likely to see profits fall to $300mn in 2017 from $900mn in 2016 in part due to high capacity and limited demand growth, but did not give specifics on UAE carriers at that time. (Gulf-Times.com) Deyaar is working on four projects worth AED2.7bn – Deyaar’s CEO, Saeed Al Qatami said that Deyaar Development is currently working on developing four projects in the residential and hospitality sector for a total cost of up to AED2.7bn, adding that two of these projects, Mont Rose and Atria, are expected to be handed over by the end of 2017. Al Qatami pointed that the company is currently working on the engineering designs of 3 new projects in Business Bay, Dubai Silicon Oasis and Dubai South which would add 5.7mn square feet of build-up area to the company’s balance of achievements. (GulfBase.com) Kuwait's $8bn bonds trade near Abu Dhabi after debut issue – Kuwait’s $8bn debut international bond issue traded close to Abu Dhabi bonds in the secondary market, suggesting the Gulf's gold standard for sovereign debt now has competition for investors' attention. Kuwait's government sold $3.5bn of five- year bonds and $4.5bn of 10-year debt. Orders for the issue totaled a massive $29bn. The five-year bond had tightened to yield 2.85%, compared to 2.88% at issuance, while the 10-year was yielding 3.56% against an initial 3.62%. That put Kuwait inside the secondary market yields of similar bonds issued by Qatar's government and only slightly wide of Abu Dhabi, which was previously considered the safest credit in the region. (Reuters) GFH starts work on $150mn Bahrain waterfront project – GFH Real Estate (GFH) said it has officially started work on its $150mn Harbour Row, a new residential and commercial destination in the heart of Bahrain’s capital city Manama and

- 6. Page 6 of 7 located on the waterfront of the iconic Bahrain Financial Harbour. Harbour Row has been envisioned by GFHRE to bring to market world-class amenities, prestigious lifestyle brands and global citizens together in a vibrant development which will include some 475 residential units across six buildings. Besides, it will also boast a broad range of expected retail outlets and other related facilities which offers similar facilities to other financial hubs around the world such as London Docklands, South Beach Miami and Sydney. (GulfBase.com) Bahrain's Arcapita buys Dubai warehousing facilities for $150mn – Bahrain-based investment firm Arcapita said it had bought a group of warehousing facilities in Dubai for about $150mn, raising the total value of its logistics portfolio in the UAE to $250mn. Most of the new assets are in Dubai Investments Park, which is owned by Dubai Investments. Martin Tan, Arcapita’s Chief Investment Officer, said in a statement that he believed his company had the option of eventually exiting its investment by listing a real estate investment trust on one of the region's bourses. (Reuters)

- 7. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 QSE Index S&P Pan Arab S&P GCC 0.0% (0.5%) 1.2% 0.3% (0.3%) 0.1% (0.9%) (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,199.01 (0.4) (0.5) 4.1 MSCI World Index 1,842.98 (0.4) (0.2) 5.2 Silver/Ounce 16.87 (0.7) (1.0) 6.0 DJ Industrial 20,837.37 (0.2) (0.3) 5.4 Crude Oil (Brent)/Barrel (FM Future) 50.92 (0.8) (0.9) (10.4) S&P 500 2,365.45 (0.3) (0.3) 5.7 Crude Oil (WTI)/Barrel (FM Future) 47.72 (1.4) (1.6) (11.2) NASDAQ 100 5,856.82 (0.3) (0.1) 8.8 Natural Gas (Henry Hub)/MMBtu 3.04 (0.6) 1.9 (17.5) STOXX 600 373.46 (0.7) (0.4) 4.1 LPG Propane (Arab Gulf)/Ton 67.25 (1.5) 1.5 (6.3) DAX 11,988.79 (0.4) (0.2) 5.2 LPG Butane (Arab Gulf)/Ton 71.00 (0.7) (1.4) (26.8) FTSE 100 7,357.85 (0.7) 0.2 1.5 Euro 1.06 (0.5) (0.6) 0.8 CAC 40 4,974.26 (0.9) (0.8) 3.0 Yen 114.75 (0.1) (0.0) (1.9) Nikkei 19,609.50 (0.0) 0.2 4.4 GBP 1.22 (0.5) (0.1) (1.5) MSCI EM 939.97 0.2 1.5 9.0 CHF 0.99 (0.3) 0.1 0.9 SHANGHAI SE Composite 3,239.33 0.1 0.8 4.9 AUD 0.76 (0.2) 0.2 4.9 HANG SENG 23,827.95 (0.0) 1.1 8.1 USD Index 101.70 0.4 0.4 (0.5) BSE SENSEX 29,442.63 2.9 2.9 14.3 RUB 59.20 0.7 0.4 (3.8) Bovespa 64,699.46 (1.5) (0.4) 10.3 BRL 0.32 (0.5) (0.9) 2.6 RTS 1,063.69 (0.5) 0.7 (7.7) 118.2 99.2 97.8