QNBFS Daily Market Report January 4, 2016

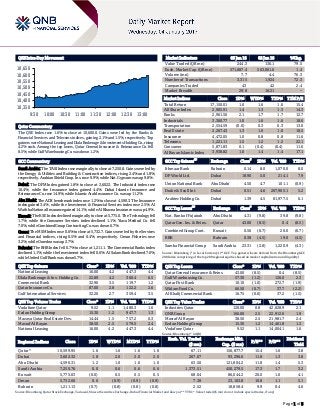

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.6% to close at 10,600.0. Gains were led by the Banks & Financial Services and Telecoms indices, gaining 2.1% and 1.5%, respectively. Top gainers were National Leasing and Dlala Brokerage & Investments Holding Co., rising 4.2% each. Among the top losers, Qatar General Insurance & Reinsurance Co. fell 8.5%, while Gulf Warehousing Co. was down 1.2%. GCC Commentary Saudi Arabia: The TASI Index rose marginally to close at 7,250.8. Gains were led by the Energy & Utilities and Building & Construction indices, rising 2.4% and 1.8%, respectively. Arabian Shield Coop. Ins. rose 9.9%, while Nat. Gypsum was up 9.8%. Dubai: The DFM Index gained 1.8% to close at 3,602.3. The Industrial index rose 10.4%, while the Insurance index gained 4.4%. Dubai Islamic Insurance and Reinsurance Co. rose 14.9%, while Islamic Arab Insurance Co. was up 11.2%. Abu Dhabi: The ADX benchmark index rose 1.2% to close at 4,590.3. The Insurance index gained 3.4%, while the Investment & Financial Services index rose 2.5%. Al Wathba National Insurance gained 14.1%, while Al Khazna Insurance was up 4.9%. Kuwait: The KSE Index declined marginally to close at 5,775.0. The Technology fell 1.7%, while the Consumer Services index declined 1.1%. Yiaco Medical Co. fell 7.0%, while Combined Group Contracting Co. was down 6.7%. Oman: The MSM Index rose 0.6% to close at 5,732.7. Gains were led by the Services and Financial indices, rising 0.5% and 0.4%, respectively. Oman Fisheries rose 3.2%, while Ooredoo was up 2.7%. Bahrain: The BHB Index fell 0.7% to close at 1,211.1. The Commercial Banks index declined 1.1%, while the Investment index fell 0.6%. Al Salam Bank declined 7.0%, while United Gulf Bank was down 5.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% National Leasing 16.00 4.2 447.3 4.4 Dlala Brokerage & Inv. Holding Co. 22.89 4.2 360.4 6.5 Commercial Bank 32.90 3.5 119.7 1.2 Qatar Insurance Co. 87.00 2.8 122.2 2.6 Gulf International Services 32.20 2.7 359.4 3.5 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 9.52 1.1 1,480.3 1.6 Ezdan Holding Group 15.30 1.2 947.7 1.3 Mazaya Qatar Real Estate Dev. 14.44 1.5 757.2 0.3 Masraf Al Rayan 38.50 2.5 579.5 2.4 National Leasing 16.00 4.2 447.3 4.4 Market Indicators 03 Jan 16 02 Jan 16 %Chg. Value Traded (QR mn) 244.3 136.1 79.5 Exch. Market Cap. (QR mn) 571,087.4 563,061.0 1.4 Volume (mn) 7.7 4.4 76.3 Number of Transactions 3,315 1,924 72.3 Companies Traded 43 42 2.4 Market Breadth 29:8 16:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,150.01 1.6 1.6 1.6 15.4 All Share Index 2,905.91 1.4 1.3 1.3 14.3 Banks 2,961.56 2.1 1.7 1.7 12.7 Industrials 3,360.77 1.0 1.6 1.6 18.6 Transportation 2,554.59 (0.0) 0.3 0.3 13.0 Real Estate 2,267.43 1.3 1.0 1.0 18.5 Insurance 4,472.05 1.0 0.8 0.8 11.6 Telecoms 1,221.11 1.5 1.2 1.2 22.1 Consumer 5,871.83 0.1 (0.4) (0.4) 11.6 Al Rayan Islamic Index 3,938.82 1.0 1.4 1.4 17.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Ithmaar Bank Bahrain 0.14 8.0 1,070.0 8.0 DP World Ltd. Dubai 18.90 5.0 214.1 7.9 Union National Bank Abu Dhabi 4.50 4.7 101.1 (0.9) Drake & Scull Int. Dubai 0.51 4.6 207,905.1 5.2 Arabtec Holding Co. Dubai 1.39 4.5 81,977.5 6.1 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Nat. Bank of Fujairah Abu Dhabi 4.31 (9.8) 39.8 (9.8) Qatar Gen. Ins. & Reins. Qatar 43.00 (8.5) 0.4 (8.5) Combined Group Cont. Kuwait 0.56 (6.7) 20.0 (6.7) BBK Bahrain 0.38 (4.5) 19.0 (4.5) Samba Financial Group Saudi Arabia 23.31 (2.8) 1,220.9 (4.3) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Insurance & Reins. 43.00 (8.5) 0.4 (8.5) Gulf Warehousing Co. 57.30 (1.2) 126.0 2.3 Qatar First Bank 10.10 (1.0) 272.7 (1.9) Widam Food Co. 66.50 (0.7) 37.7 (2.2) Al Khalij Commercial Bank 16.75 (0.6) 37.2 (1.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 120.00 0.8 42,628.9 2.1 QNB Group 166.00 2.5 22,912.0 1.9 Masraf Al Rayan 38.50 2.5 21,981.7 2.4 Ezdan Holding Group 15.30 1.2 14,461.8 1.3 Vodafone Qatar 9.52 1.1 14,004.1 1.6 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,599.95 1.6 1.6 1.6 1.6 67.11 156,877.7 15.4 1.6 3.8 Dubai 3,602.32 1.8 2.0 2.0 2.0 267.07 93,296.6 11.8 1.3 3.8 Abu Dhabi 4,590.31 1.2 1.0 1.0 1.0 63.50 121,804.2 11.8 1.4 5.3 Saudi Arabia 7,250.76 0.0 0.6 0.6 0.6 1,373.51 450,279.5 17.3 1.7 3.2 Kuwait 5,775.03 (0.0) 0.5 0.5 0.5 68.04 86,044.2 20.0 1.0 4.1 Oman 5,732.66 0.6 (0.9) (0.9) (0.9) 7.38 23,103.8 10.8 1.1 5.1 Bahrain 1,211.13 (0.7) (0.8) (0.8) (0.8) 2.52 18,858.4 9.9 0.4 4.6 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,350 10,400 10,450 10,500 10,550 10,600 10,650 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index rose 1.6% to close at 10,600.0. The Banks & Financial Services and Telecoms indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. National Leasing and Dlala Brokerage & Investments Holding Co. were the top gainers, rising 4.2% each. Among the top losers, Qatar General Insurance & Reinsurance Co. fell 8.5%, while Gulf Warehousing Co. was down 1.2%. Volume of shares traded on Tuesday rose by 76.3% to 7.7mn from 4.4mn on Monday. However, as compared to the 30-day moving average of 9.1mn, volume for the day was 15.5% lower. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 19.2% and 12.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 01/03 US Markit Markit US Manufacturing PMI December 54.3 54.2 54.2 01/03 UK Markit Markit UK PMI Manufacturing SA December 53.6 53.3 53.4 01/03 Germany German Federal Statistical Office CPI YoY December 1.7% 1.4% 0.8% 01/03 Germany German Federal Statistical Office CPI MoM December 0.7% 0.6% 0.1% 01/03 France National Statistics Office CPI MoM December 0.3% 0.5% 0.0% 01/03 France National Statistics Office CPI YoY December 0.6% 0.8% 0.5% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar KCBK to hold board meetings on January 18 – Al Khalij Commercial Bank (KCBK) announced that its board of directors will meet on January 18, 2017 to approve the financial results ending on December 31, 2016. (QSE) DOHI to hold board meetings on January 30 – Doha Insurance Company (DOHI) announced that its board of directors will be holding a meeting on January 30, 2017 to discuss and approve the financial statements ending December 31, 2016. The company also announced that it will convene its AGM on March 07, 2017 In case the required quorum is not maintained, an alternate meeting to be scheduled on March 19, 2017. (QSE) QIGD discloses the judgment in the case no. 2698 – The external law firm informed the judgment for case number 2698 of the year 2016 filed by Al-Ruba Al-Khali Trading & Services (Ezdan Holdings) against some Qatari Investors Group (QIGD) board members, requesting them the amount of QR3mn as compensation for material and moral damages suffered by not disclosing the case plus compel them to pay the legal expenses (The Court ruled to dismiss the case and compel the plaintiffs (Ezdan Holdings) to pay all expenses). (QSE) Qatar's new budget adds to optimism in construction sector – Construction companies and experts in Qatar reacted favorably to the 2017 budget, which has sustained spending in key sectors including health, education, infrastructure and transport. According to the latest budget, infrastructure, health and education will account for almost half of all expenditures at QR87bn and will include building projects for the FIFA World Cup 2022. Country Director of Oxford Business Group, Izabela Kruk said, "Our recent GCC CEO survey indicated that business sentiment across the region remains broadly positive, despite the current challenging economic climate. Qatar, in particular, has continued to perform well across the economic sectors. The country's ambitious project pipeline and major events, led by the FIFA World Cup in 2022, will support national efforts to maintain the shift away from a reliance on oil and gas." (Qatar Tribune) Tripartite agreement for 'Jahiz l' funding – As a precursor to the expected launch of its Jahiz I initiative – a program dedicated to supporting a number of industrial sectors- Qatar Development Bank (QDB) signed a Memorandum of Understanding (MoU) with QNB Group and Qatar Islamic Bank to finance the developmental scheme through the framework of Al Dhameen indirect loan guarantee facility. The industrial sectors that are expected to benefit from the Jahis I initiative include chemicals, plastics, wood materials, and electronics. As provided in the MoU, small and medium-sized enterprises(SMEs) participating in the Jahiz I initiative may now access finances up to 70% of the project value with a maximum limit of up to QR15mn per project. Moreover, the participating companies can now obtain the required funding within 10 working days at competitive financing rates. The partner banks will also extend lending to SMEs by providing adequate safeguards through the existing Al Dhameen indirect loan guarantee facility. (Peninsula Qatar) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 33.69% 53.27% (47,830,090.93) Qatari Institutions 18.65% 16.66% 4,859,859.06 Qatari 52.34% 69.93% (42,970,231.87) GCC Individuals 0.74% 0.81% (161,914.86) GCC Institutions 4.13% 6.63% (6,117,715.23) GCC 4.87% 7.44% (6,279,630.09) Non-Qatari Individuals 9.37% 11.87% (6,089,670.54) Non-Qatari Institutions 33.41% 10.76% 55,339,532.50 Non-Qatari 42.78% 22.63% 49,249,861.96

- 3. Page 3 of 5 International US manufacturing, construction sectors shine as year ended – US factory activity accelerated to a two-year high in December amid a surge in new orders and rapidly rising raw material prices, indicating that some of the drag on manufacturing from prolonged dollar strength and a slump in oil prices was fading. Other data showed US construction spending hit a 10-1/2-year high in November, providing a boost to a fourth-quarter economic growth estimate. The reports suggested President- elect Donald Trump would inherit a strong economy, with a labor market that is near full employment, from the Obama administration. The Institute for Supply Management (ISM) said its index of national factory activity rose 1.5 percentage points to 54.7 last month, the highest level since December 2014. A reading above 50 indicates an expansion in manufacturing, which accounts for about 12% of the US economy. A gauge of new orders jumped 7.2 percentage points to its highest level since November 2014. Twelve industries, including petroleum, electrical equipment, appliances and components and machinery, reported growth in new orders last month. Export orders also rose, but order backlogs were unchanged. A measure of factory employment hit its highest since June 2015 and the production sub-index rose 4.3 percentage points. (Reuters) PMI: UK manufacturing growth unexpectedly hits 2-1/2-year high – British manufacturing growth climbed to a two-and-a- half-year high last month, fuelled by new orders from both home and abroad and adding to signs the economy ended 2016 strongly, a survey showed. The Markit/CIPS UK Manufacturing Purchasing Managers Index (PMI) rose to 56.1, the strongest reading since June 2014, from 53.6 in November. That exceeded all forecasts in a Reuters poll, which pointed to a decline to 53.1. Britain's economy has fared much better than many economists predicted in the aftermath of June's vote to leave the European Union, with consumer spending strong and companies continuing to perform well. The manufacturing PMI showed domestic and export order books grew, but so did cost pressures facing factories - something that will increasingly feed into consumer prices next year. Survey compiler IHS Markit said the survey was consistent with manufacturing output rising at a quarterly pace of around 1.5%. (Reuters) German unemployment falls more than expected in December – German unemployment fell more than expected in December, keeping the jobless rate in Europe's biggest economy at a record low, data from the Federal Labor Office showed. Head of the Federal Labor Office Frank-Juergen Weise said, "The positive development related to unemployment continued at the end of the year." He added, "The strong increase in employment that has been going on for a long time slowed since the summer months, but demand for new workers remains at a high level." The seasonally adjusted jobless total fell by 17,000 to 2.638mn, the Labor Office said. That was more than threefold the 5,000 forecast in a Reuters poll. The adjusted unemployment rate remained at 6.0%, the lowest level since German reunification in 1990. (Reuters) PMI: Japan December manufacturing activity expands at fastest pace in a year – Japanese manufacturing activity expanded at the fastest pace in a year in December as orders picked up, a private survey showed on Wednesday, in an encouraging sign that the struggling economy may be regaining momentum. The Final Markit/Nikkei Japan Manufacturing Purchasing Managers Index (PMI) rose to 52.4 in December on a seasonally ajudted basis, higher than a preliminary reading of 51.9 and a final 51.3 in November. The index remained above the 50 threshold that separates expansion from contraction for the fourth consecutive month and showed activity expanded at the fastest pace since December 2015. The final output component of the PMI index also rose to a one-year high of 53.8 in December from 52.4 in November. The preliminary reading for December was 53.1. The final index for new orders, which measures both domestic and external demand, rose to a one- year high of 53.2, versus a preliminary 52.8 and 51.1 in the previous month. (Reuters) China central bank injects $124.9bn in December – China's central bank injected a total of $124.90bn via short- and medium-term liquidity tools in December, its data showed, as it continues to support credit expansion and the economy. December liquidity injections were up 13.2% from November, according to Reuters' calculations based on central bank data. The People's Bank of China said in a statement on its website that it lent 733bn Yuan to financial institutions via its medium- term lending facility (MLF) in December. The bank lent 358bn Yuan for six months and 375bn Yuan for one year. Outstanding MLF was 3.457tn Yuan at the end of December compared with 2.736tn Yuan at the end of November, implying a net injection of 721.5bn Yuan. The PBOC said it also extended 135.75bn Yuan of loans to local financial institutions in December via its standing lending facility (SLF). (Reuters) Regional Fed-driven higher borrowing costs bode well for GCC fixed income market – Higher bank borrowing costs in the Gulf Cooperation Council (GCC), in view the 0.25% hike in the US Federal Reserve interest rate, amid greater funding needs of sovereign and corporate, lend support to brighter prospects for the GCC fixed income market in 2017. Kamco Investment Company said “The rate hikes announced by the GCC countries as a response to the 25 bps rate hike in US Fed funds rate in December 2016 could push up cost of bank debt in the GCC.” Prospects for the regional bond issuances in 2017 appears bright based on further funding requirement in the region by both sovereigns and corporate as well as rising interest rates that would make bank lending costlier. (Gulf-Times.com) Oil climbs to 18-month high as Kuwait and Oman fulfill OPEC cuts – Oil prices hit 18-month highs, the first trading day of 2017, buoyed by hopes that a deal between OPEC and other big oil exporters to cut production, which kicked in, will drain a global supply glut. Benchmark Brent crude jumped more than 2% to a high of $58.37, up $1.55 a barrel and its highest since July 2015. (Peninsula) Saudi Arabia to raise February term crude prices to Asia – Top oil exporter Saudi Arabia is expected to raise prices for all grades of crude it sells to Asia in February, tracking strength in the Dubai price benchmark and robust refining margins, traders. According to Reuter’s survey, official selling price (OSP) for flagship Arab Light crude could rise by at least 50 cents a barrel for February. The respondents expect bigger price hikes for

- 4. Page 4 of 5 heavier grades in February, pushed up by the strongest fuel oil cracks in five years. (Reuters) Saudi Aramco signs two offshore contracts with L&T – Saudi Aramco, the biggest oil company in world, has signed two awards involving Engineering, Procurement, Construction and Installation (EPCI) contracts with India’s L&T Hydrocarbon Engineering (LTHE) in consortium with Emas Chiyoda Subsea. The contract is awarded to supply and install four wellhead decks in the Safaniya field and another award to upgrade on 17 platforms in various offshore fields in the Arabian Sea off the coast of Saudi Arabia. (GulfBase.com) Localization of industrial parts' production to save cost, generate Saudi Arabia jobs – Reverse engineering could solve the problem of most plants in the Kingdom who have approximately a third of their spare parts outdated and that are faced with high costs of replacing systems. Most plants in the Kingdom are over 25 years old with aging equipment and lack engineering drawings necessary to draw the spare parts locally. Localization of spare parts not only saves cost of 10 to 15% but also saves time which manufacturers take months. It has the potential to generate jobs for Saudi Arabia’s as well. (Bloomberg) Dubai Financial Market planning to allow short-selling – Dubai Financial Market (DFM), the Gulf's only listed stock exchange, said that it planned to introduce covered short-selling, a move that could increase trading liquidity. DFM is planning implementation of regulated short-selling on a selected list of eligible securities in accordance with international recommendations under local market conditions in the coming months, subject to regulatory approvals of its rules. The exchange has completed consultations on the operating model and is now working on technical enhancements of its planned short-selling system. (Reuters) Dubai mortgage lender Amlak renegotiates part of 2014 debt deal – Dubai's Amlak Finance said that it had renegotiated parts of a debt restructuring which the Islamic mortgage provider agreed with creditors following the local property market crash of 2008. Amlak, in which Dubai's biggest developer Emaar Properties owns a 45% stake, reached a debt restructuring deal in 2014 following a government cash injection and six years of negotiations with creditors. At the time, Amlak did not give the size of the debt being restructured, but bankers estimated it at about $2.7bn. (Reuters) Al Jaber: ADNOC Group to continue its transformation – According to the Group Chief Executive Officer, Dr. Sultan Ahmed Al Jaber, following a year of major changes at the Abu Dhabi National Oil Company, ADNOC, and its group of companies, further improvement lies ahead. He also added that “Under the guidance of the Abu Dhabi leadership, we have collectively decided that ADNOC has to evolve to simply meet the realities of the paradigm shift we have experienced in the energy sector. We cannot be in denial about the changes taking place.” (Bloomberg) Alimtiaz Investment unit secures OMR13.3mn contract – Alimtiaz Investment Group Co. secures OMR13.3mn contract from Kuwait National Petroleum Co. for maintenance works at Mina Abdullah Refinery. (Reuters) Excise tax on beverages, tobacco to buoy Oman revenues in 2017 – Omani government revenues are expected to be bolstered in 2017 by the introduction of, among other things, excise tax on tobacco, alcohol, carbonated beverages and potentially even energy drinks. Ashok Hariharan, Partner and Head of Tax, KPMG Lower Gulf, said the new levy is part of a host of revenue-enhancing measures incorporated in the 2017 State Budget aimed at offsetting the steep fall in export earnings resulting from the decline in oil prices. He also added “Commodities like tobacco and alcohol are likely to be taxed at 100% and soft drinks at 50% based on announcements made by the Saudi Arabia government.” (GulfBase.com) Oman seeks banks' proposals for dual-tenor international bond issue – The government of Oman has approached banks for an international bond issue with tranches of five and 10 years as the country plugs a budget deficit caused by lower oil prices, banking sources familiar with the situation. The Sultanate has asked international lenders to submit proposals for a US dollar debt transaction likely to be around $1bn or more. Banks are expected to submit their proposals by the end of this week. (Reuters) Al Baraka banking group obtain a license to establish a new bank in Morocco – The Bahrain based leading Islamic banking group, Al Baraka Banking Group (ABG) announced that it obtained the approval of the Bank Al Maghrib (the central bank of Morocco) to establish a new bank in Morocco. Thus, the Group completed its presence in all the countries of the Maghreb, where it now owns banking subsidiaries in Algeria, Tunisia, Libya and Morocco, as well as the African continent in Egypt, Sudan and South Africa. (Bahrain Bourse)

- 5. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns; # Market closed on January 3, 2016) 80.0 100.0 120.0 140.0 160.0 180.0 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 QSEIndex S& PPanA rab S& PGCC 0.0% 1.6% (0.0%) (0.7%) 0.6% 1.2% 1.8% (1.0%) 0.0% 1.0% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,158.79 0.6 0.6 0.6 MSCI World Index 1,757.99 0.3 0.4 0.4 Silver/Ounce 16.30 2.3 2.4 2.4 DJ Industrial 19,881.76 0.6 0.6 0.6 Crude Oil (Brent)/Barrel (FM Future) 55.47 (2.4) (2.4) (2.4) S&P 500 2,257.83 0.8 0.8 0.8 Crude Oil (WTI)/Barrel (FM Future) 52.33 (2.6) (2.6) (2.6) NASDAQ 100 5,429.08 0.9 0.9 0.9 Natural Gas (Henry Hub)/MMBtu 3.39 (7.9) (7.9) (7.9) STOXX 600 365.71 0.3 0.0 0.0 LPG Propane (Arab Gulf)/Ton 70.75 (1.4) (1.4) (1.4) DAX 11,584.24 (0.5) (0.2) (0.2) LPG Butane (Arab Gulf)/Ton 93.50 (3.6) (3.6) (3.6) FTSE 100 7,177.89 (0.2) (0.2) (0.2) Euro 1.04 (0.5) (1.1) (1.1) CAC 40 4,899.33 (0.0) (0.4) (0.4) Yen 117.75 0.2 0.7 0.7 Nikkei# 19,114.37 0.0 0.0 0.0 GBP 1.22 (0.3) (0.8) (0.8) MSCI EM 868.44 0.8 0.7 0.7 CHF 0.97 (0.4) (0.8) (0.8) SHANGHAI SE Composite 3,135.92 0.9 0.9 0.9 AUD 0.72 0.5 0.2 0.2 HANG SENG 22,150.40 0.7 0.7 0.7 USD Index 103.21 0.4 1.0 1.0 BSE SENSEX 26,643.24 (0.2) (0.5) (0.5) RUB 60.92 (0.4) (1.0) (1.0) Bovespa 61,813.83 4.6 2.5 2.5 BRL 0.31 0.0 (0.4) (0.4) RTS 1,189.32 3.2 3.2 3.2 123.2 107.7 103.9