QNBFS Daily Market Report December 2, 2018

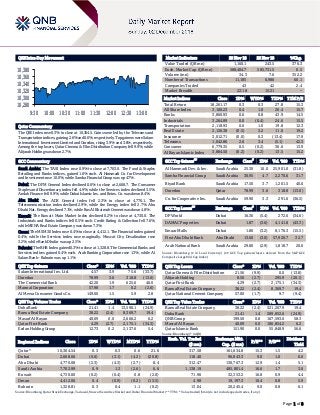

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.3% to close at 10,364.5. Gains were led by the Telecoms and Transportation indices, gaining 2.6% and 0.6%, respectively. Top gainers were Salam International Investment Limited and Ooredoo, rising 3.9% and 3.6%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.9%, while Alijarah Holding was down 2.7%. GCC Commentary Saudi Arabia: The TASI Index rose 0.9% to close at 7,703.0. The Food & Staples Retailing and Banks indices, gained 1.6% each. Al Hammadi Co. for Development and Investment rose 10.0%, while Samba Financial Group was up 4.7%. Dubai: The DFM General Index declined 0.6% to close at 2,668.7. The Consumer Staples and Discretionary index fell 4.9%, while the Services index declined 3.5%. Amlak Finance fell 9.9%, while Dubai Islamic Ins. and Reins. Co. was down 8.4%. Abu Dhabi: The ADX General index fell 2.3% to close at 4,770.1. The Telecommunication index declined 2.9%, while the Energy index fell 2.7%. Abu Dhabi Nat. Energy declined 7.1%, while Ras Al Khaimah Cement was down 4.8%. Kuwait: The Kuwait Main Market Index declined 0.2% to close at 4,730.0. The Industrials and Banks indices fell 0.5% each. Credit Rating & Collection fell 7.6%, while MENA Real Estate Company was down 7.3%. Oman: The MSM 30 Index rose 0.4% to close at 4,412.1. The Financial index gained 0.4%, while the Services index rose marginally. Muscat City Desalination rose 3.2%, while Bank Dhofar was up 2.5%. Bahrain: The BHB Index gained 0.3% to close at 1,328.8. The Commercial Banks and Services indices gained 0.4% each. Arab Banking Corporation rose 1.3%, while Al Salam Bank - Bahrain was up 1.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 4.57 3.9 75.6 (33.7) Ooredoo 78.99 3.6 318.8 (13.0) The Commercial Bank 42.20 1.9 625.6 46.0 Mannai Corporation 57.98 1.7 0.2 (2.6) Al Meera Consumer Goods Co. 149.00 1.5 5.9 2.8 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Doha Bank 21.41 1.4 13,590.1 (24.9) Barwa Real Estate Company 38.22 (2.4) 8,369.7 19.4 Masraf Al Rayan 40.09 0.0 2,666.2 6.2 Qatar First Bank 4.29 (2.7) 2,175.1 (34.3) Ezdan Holding Group 12.73 0.2 2,137.6 5.4 Market Indicators 29 Nov 18 28 Nov 18 %Chg. Value Traded (QR mn) 1,160.1 243.5 376.3 Exch. Market Cap. (QR mn) 588,404.7 585,731.5 0.5 Volume (mn) 34.3 7.6 352.2 Number of Transactions 11,185 6,986 60.1 Companies Traded 43 42 2.4 Market Breadth 22:18 15:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,261.17 0.3 0.3 27.8 15.3 All Share Index 3,100.23 0.4 1.0 26.4 15.7 Banks 3,860.93 0.6 0.8 43.9 14.5 Industrials 3,264.89 0.0 (0.4) 24.6 15.5 Transportation 2,118.93 0.6 1.0 19.8 12.3 Real Estate 2,126.38 (0.5) 3.2 11.0 19.2 Insurance 3,012.71 (0.0) 0.3 (13.4) 17.9 Telecoms 1,042.86 2.6 3.4 (5.1) 42.3 Consumer 6,779.35 0.5 (0.2) 36.6 13.9 Al Rayan Islamic Index 3,884.50 (0.2) (0.2) 13.5 15.2 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Hammadi Dev. & Inv. Saudi Arabia 25.30 10.0 25,901.0 (31.8) Samba Financial Group Saudi Arabia 30.95 4.7 2,270.6 31.7 Riyad Bank Saudi Arabia 17.50 3.7 1,201.5 40.0 Ooredoo Qatar 78.99 3.6 318.8 (13.0) Co. for Cooperative Ins. Saudi Arabia 59.90 3.3 291.6 (36.5) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% DP World Dubai 16.36 (5.4) 272.6 (34.6) DAMAC Properties Dubai 1.87 (3.6) 4,141.8 (43.3) Emaar Malls Dubai 1.80 (3.2) 8,176.3 (15.5) First Abu Dhabi Bank Abu Dhabi 13.60 (3.0) 57,920.7 32.7 Arab National Bank Saudi Arabia 29.80 (2.9) 1,818.7 20.6 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 21.56 (9.9) 0.0 (13.8) Alijarah Holding 8.56 (2.7) 295.9 (20.1) Qatar First Bank 4.29 (2.7) 2,175.1 (34.3) Barwa Real Estate Company 38.22 (2.4) 8,369.7 19.4 Qatar National Cement Company 57.00 (1.7) 9.7 (9.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Company 38.22 (2.4) 321,267.9 19.4 Doha Bank 21.41 1.4 289,852.6 (24.9) QNB Group 199.50 0.8 167,593.0 58.3 Masraf Al Rayan 40.09 0.0 106,854.2 6.2 Qatar Islamic Bank 151.90 0.0 55,848.9 56.6 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,364.54 0.3 0.3 0.6 21.6 317.58 161,634.8 15.3 1.5 4.2 Dubai 2,668.66 (0.6) (3.1) (4.2) (20.8) 118.40 96,843.3 9.0 1.0 6.6 Abu Dhabi 4,770.08 (2.3) (4.3) (2.7) 8.4 312.47 130,767.3 12.9 1.4 5.1 Saudi Arabia 7,702.99 0.9 1.3 (2.6) 6.6 1,138.19 485,801.4 16.6 1.7 3.6 Kuwait 4,730.00 (0.2) (0.4) 0.8 (2.0) 71.96 32,353.2 16.8 0.9 4.4 Oman 4,412.06 0.4 (0.9) (0.2) (13.5) 4.98 19,197.3 10.4 0.8 5.9 Bahrain 1,328.81 0.3 0.4 1.1 (0.2) 13.04 20,245.4 9.0 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,280 10,300 10,320 10,340 10,360 10,380 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index rose 0.3% to close at 10,364.5. The Telecoms and Transportation indices led the gains. The index rose on the back of buying support from GCC and non-Qatari shareholders despite selling pressure from Qatari shareholders. Salam International Investment Limited and Ooredoo were the top gainers, rising 3.9% and 3.6%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 9.9%, while Alijarah Holding was down 2.7%. Volume of shares traded on Thursday rose by 352.2% to 34.3mn from 7.6mn on Wednesday. Further, as compared to the 30-day moving average of 6.8mn, volume for the day was 407.0% higher. Doha Bank and Barwa Real Estate Company were the most active stocks, contributing 39.6% and 24.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/29 US Department of Labor Initial Jobless Claims 24-November 234k 220k 224k 11/29 US Department of Labor Continuing Claims 17-November 1,710k 1,663k 1,660k 11/29 US Bloomberg Bloomberg Consumer Comfort 25-November 60.6 – 61.3 11/29 UK Bank of England Mortgage Approvals October 67.1k 64.6k 65.7k 11/29 UK Bank of England Money Supply M4 MoM October 0.7% – -0.3% 11/29 UK Bank of England M4 Money Supply YoY October 1.0% – 0.9% 11/29 UK GfK NOP (UK) GfK Consumer Confidence November -13 -11 -10 11/29 EU European Commission Economic Confidence November 109.5 109.1 109.7 11/29 EU European Commission Business Climate Indicator November 1.09 0.96 1.01 11/29 EU European Commission Industrial Confidence November 3.4 2.5 3 11/29 EU European Commission Services Confidence November 13.3 13.1 13.3 11/29 EU European Commission Consumer Confidence November -3.9 -3.9 -3.9 11/30 EU Eurostat Unemployment Rate October 8.1% 8.0% 8.1% 11/30 EU Eurostat CPI Core YoY November 1.0% 1.1% 1.1% 11/30 EU Eurostat CPI Estimate YoY November 2.0% 2.0% 2.2% 11/29 Germany Deutsche Bundesbank Unemployment Claims Rate SA November 5.0% 5.1% 5.1% 11/29 Germany German Federal Statistical Office CPI MoM November 0.1% 0.2% 0.2% 11/29 Germany German Federal Statistical Office CPI YoY November 2.3% 2.4% 2.5% 11/29 France INSEE GDP QoQ 3Q2018 0.4% 0.4% 0.4% 11/29 France INSEE GDP YoY 3Q2018 1.4% 1.5% 1.5% 11/30 France INSEE PPI MoM October 0.4% – 0.4% 11/30 France INSEE PPI YoY October 3.9% – 3.7% 11/30 France INSEE CPI MoM November -0.2% -0.2% 0.1% 11/30 France INSEE CPI YoY November 1.9% 2.0% 2.2% 11/30 Japan Ministry of Internal Affairs & Comm. Jobless Rate October 2.4% 2.3% 2.3% 11/30 Japan Economic and Social Research Ins. Consumer Confidence Index November 42.9 43.2 43 11/30 China China Federation of Logistics Non-manufacturing PMI November 53.4 53.8 53.9 11/30 China China Federation of Logistics Manufacturing PMI November 50 50.2 50.2 11/30 China China Fed. of Logistic & Purchasing Composite PMI November 52.8 – 53.1 11/30 India India Central Statistical Org. GDP YoY 3Q2018 7.1% 7.5% 8.2% 11/30 India India Central Statistical Org. Eight Infrastructure Industries October 4.80% – 4.30% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 7.94% 17.21% (107,569,145.61) Qatari Institutions 9.85% 6.91% 34,101,730.56 Qatari 17.79% 24.12% (73,467,415.05) GCC Individuals 0.36% 0.17% 2,165,789.57 GCC Institutions 1.49% 1.38% 1,241,639.34 GCC 1.85% 1.55% 3,407,428.91 Non-Qatari Individuals 2.75% 2.60% 1,799,884.82 Non-Qatari Institutions 77.62% 71.74% 68,260,101.32 Non-Qatari 80.37% 74.34% 70,059,986.14

- 3. Page 3 of 8 News Qatar Qatar’s central bank’s total reserves rise to QR102.9bn in October – Qatar’s central bank’s total reserves increased to QR102.9bn in October 2018 as compared to QR62.2bn in the year ago period, according to data on its website. (Bloomberg) Qatar’s non-oil exports up 16.2% YoY in October 2018 – Qatar’s non-oil exports registered strong growth in October 2018, with a combined value reaching QR1.98bn or a 16.2% YoY increase, and QR1.7bn higher MoM, according to figures released by Qatar Chamber. The report was issued by the Chamber’s Department of Research, Studies and Management of Member Affairs based on the 3,213 certificates of origin issued in October, including 2,859 general model certificates, 153 unified certificates for the GCC countries (industrial), 178 unified Arab certificates of origin, 21 certificates of origin for preferences, and two unified certificates of Singapore. The report also recorded 61 countries importing non-oil products from Qatar in October, as opposed to the 60 importing countries registered in the previous month. (Gulf-Times.com) Qatar’s fiscal surpluses to continue, says Fitch Solutions report – Qatar’s budget balance “re-entered positive territory” in the first half of this year, Fitch Solutions stated and noted it expects “persistent surpluses” over the quarters ahead, as a result of higher hydrocarbon prices. Hydrocarbons still account for the vast majority of Qatar’s fiscal revenues, an estimated 82.7% of the total in 2017, Fitch Solutions stated. Fitch Solutions analysts have revised down their forecast for hydrocarbon prices on the back of the recent market volatility and the US’ softening approach to sanctions on Iran, expecting the Brent to average $73 a barrel in 2018 and $75 in 2019. This compares to $74.5 and $81 previously. We note that the impact of hydrocarbon price fluctuations on Qatari revenues takes some time to register, as the hydrocarbon investment income is transferred with some lag, and given that Qatari gas exports are priced against a Brent average of up to six months,” Fitch Solutions stated. According to Fitch Solutions, Qatar “looks set to move ahead with selected measures” to diversify its revenues away from hydrocarbons in the coming quarters. (Gulf-Times.com) Qatar offers e-commerce market worth almost $1.5bn in 2019, notes Fitch Solutions – Qatar offers e-commerce market worth almost $1.5bn in 2019, Fitch Solutions noted in a report. The Middle East and North Africa (MENA) region is projected to record e-commerce sales growth of 21.4% to reach $28.5bn next year, it stated. This growth rate, Fitch Solutions noted, “marks a slight pickup” from the 20% in 2018, and the region is projected to have the fastest e-commerce sales growth globally, projected to average 18% annually over the medium term (2018-2022). “This robust growth can largely be attributed to e- commerce sales growing from a low base. For example, the growth outperformer in the region, with an annual increase of 22% in its e-commerce sales for 2019 is Morocco, which we project will reach an e-commerce sales value of $522mn for the year,” Fitch Solutions stated. (Gulf-Times.com) QFMA presents unified listing rules, new governance code for QSE-listed funds – The Qatar Financial Markets Authority (QFMA) has presented "unified listing rules and a new governance code" for funds listed on Qatar Stock Exchange (QSE) for consultation to all concerned parties via its official website. QFMA’s CEO, Nasser Ahmad Al-Shaibi said, "We continue to strengthen our regulations to meet investors’ needs along with adopting the best international practices and their local needs in respect of investment funds and their governance. “This step is of great importance to the capital market sector in the country, where the QFMA seeks to develop the Qatari capital market and strengthen the elements that attract local and international funds to be listed on the QSE." Al-Shaibi added, "The review of listing rules and governance code will provide a clear framework for local and international fund management companies to be listed on QSE and encourage the development of asset management in the State of Qatar." (Gulf-Times.com) Al Jaida: Qatar reaffirmed its economic resilience in 2018 – Developing a strong business hub for Qatar Financial Centre (QFC) firms is crucial for QFC Authority. It not only creates an invaluable sense of community, but a solid network, which is fundamental to taking business to newer heights, QFC Authority’s CEO, Yousuf Mohamed Al Jaida said. Addressing QFC’s 17th business and networking event and the inaugural Qatar Business Awards, Al Jaida said the year 2018 has seen Qatar reaffirming its economic resilience repeatedly. Across all industries, local and international indicators point to Qatar’s remarkable stability, and to its impressive projected development. Citing the IMF’s latest reports, Al Jaida added that Qatar’s GDP is projected to grow by 2.4% in 2018. That comes alongside the 2018 United Nations report that noted a 27% increase in FDI inflows to Qatar between 2016 and 2017. These figures are undeniable proof of Qatar’s economic strength and why it is certainly one of the world’s most dynamic economies. (Peninsula Qatar) Finance Minister, QCB’s Governor to address Euromoney Qatar Conference – The Euromoney Qatar Conference in Doha on December 9 and 10 will focus on Qatar’s post blockade strategy and its development as a sustainable economy. The event will be held under the patronage of HE the Prime Minister and Minister of Interior, Sheikh Abdullah bin Nasser bin Khalifa Al- Thani. Co-hosted by the Qatar Central Bank (QCB), the conference’s keynote speakers include HE the Minister of Finance, Ali Sherif Al-Emadi, and HE the QCB’s Governor, Sheikh Abdulla bin Saoud Al-Thani. The two-day conference will provide a vast and detailed overview on strategy and finances in a series of workshops, talks, interviews and panel discussions. (Gulf-Times.com) Qatar takes part in GCC transport ministers' meeting – Qatar took part in the 21st meeting of the Ministers of Transport in the Gulf Co-operation Council (GCC), held in Kuwait. HE the Minister of Transport and Communications, Jassim bin Seif Al- Sulaiti headed the Qatari delegation to the meeting. During the meeting, the ministers discussed a number of key topics including the GCC railway project, the memorandum of understanding on the Joint Data Center for the Remote Ship Tracking System and the latest updates regarding the Manual on Uniform Traffic Control Devices. The meeting raised the recommendations necessary for the implementation of the

- 4. Page 4 of 8 decisions of the Supreme Council on the mechanism of work for the completion of studies and strategic projects for the transport and communications sector, which will deepen the economic integration between the GCC States. (Gulf- Times.com) QP announces petrol prices reduction of over 12% this month – Qatar Petroleum (QP) announced the diesel and petrol prices for the month of December 2018. Price of super grade petrol has been set at QR1.85 per liter, which is 12.2% lower than the November price of QR2.10 per liter. The price of premium grade petrol has been set at QR1.80 per liter in December compared to QR2.05 per liter in November, a decline of about 12.2%. QP set the diesel price at QR2 per liter for December compared to QR2.05 per liter in November, a decline of 2.4%. (Peninsula Qatar) MCCS’ board to meet on December 17, 2018 to discuss progress of the company’s business – Mannai Corporation (MCCS) announced that its board of directors will meet on December 17, 2018. The meeting will discuss progress of the business of the company. (QSE) QIMD participates in the ‘Gulf Glass Factory’ as a founding partner with a participation of 50% of its capital – Qatar Industrial Manufacturing Company (QIMD) announced that the company will participate in the ‘Gulf Glass Factory’ as a founding partner with a participation of 50% of its capital. The project is specialized in the production of various glass containers. The design capacity of the project in the first phase will be 200 tons per day and in the second phase, 450 tons per day. The project uses locally washed sand, as the main raw material and natural gas as energy source for melting raw materials. The total cost of the first phase of the project is estimated at QR238mn. It will be financed by a local bank. It is estimated that the profitability of the project will be about 14% (IRR), and the payback period will be about six and a half years from the start of production. (QSE) International US, China agree trade war ceasefire after Trump, Xi summit – China and the US agreed to a ceasefire in their bitter trade war after high-stakes talks in Argentina between the US President, Donald Trump and Chinese President, Xi Jinping, including no escalated tariffs on January 1, 2019. Trump will leave tariffs on $200bn worth of Chinese imports at 10% at the beginning of the new year, agreeing to not raise them to 25% at this time, the White House stated in a statement. “China will agree to purchase a not yet agreed upon, but very substantial, amount of agricultural, energy, industrial, and other products from the US to reduce the trade imbalance between our two countries. China has agreed to start purchasing agricultural product from our farmers immediately,” it stated. The two leaders also agreed to immediately start talks on structural changes with respect to forced technology transfers, intellectual property protection, non-tariff barriers, cyber intrusions and cyber theft, services and agriculture, the White House stated. (Reuters) US consumer spending rises strongly, inflation moderates – US consumer spending increased by the most in seven months in October, but underlying price pressures slowed, with an inflation measure tracked by the Federal Reserve posting its smallest annual increase since February. The strong consumer spending reported by the Commerce Department probably keeps the US’ central bank on track to raise interest rates next month for the fourth time this year. However moderating inflation, if sustained, could temper expectations on the pace of rate hikes in 2019. Consumer spending, which accounts for more than two-thirds of US economic activity, jumped 0.6% last month as households spent more on prescription medication and utilities, among other goods and services. Data for September was revised down to show spending rising 0.2% instead of the previously reported 0.4% gain. Economists polled by Reuters had forecast consumer spending increasing 0.4% in October. (Reuters) UK’s consumer lending growth slows to new three-year low, mortgage approvals jump – Lending to British consumers slowed again last month to its weakest rate in more than three years, but there was a pick-up in the housing market with a jump in mortgage approvals, Bank of England’s (BoE) data showed. The BoE figures showed the annual growth rate in unsecured consumer lending fell to 7.5% in October, its weakest since May 2015 from 7.9% in September, when there was a sharp drop in new car purchases. Other economic data in recent months have mostly shown slower consumer demand since an unexpectedly robust summer, as shoppers rein in purchases and express concern about how leaving the European Union in March next year will affect them. (Reuters) UK’s consumer confidence slides to 11-month low ahead of Brexit – British consumers’ confidence fell to its lowest level in almost a year as their view of the economic outlook for the next 12 months sank to its weakest since shortly after 2016’s Brexit vote, a survey showed. The GfK consumer sentiment index fell to -13 in November from -10 in October, the lowest reading since December 2017 and below economists’ average forecast in a Reuters poll. (Reuters) Eurozone’s inflation falls back, core figures below expectations – Eurozone’s inflation slowed as expected in November, as food and energy price hikes eased, while core inflation readings were below market expectations. Consumer prices in the 19 countries sharing the Euro rose by 2.0% YOY in November after a six-year high of 2.2% in October, the EU’s statistics agency Eurostat stated. The decline matched the average expectation in a Reuters poll of economists. Eurostat stated that energy prices rose by 9.1% YoY, from 10.7% in October, while unprocessed food prices were up 1.8%, compared to a 2.1% increase last month. Inflation excluding those two volatile components - the core indicator that the European Central Bank watches in its policy decisions - also fell to 1.1%, against expectations of a slight increase. Another core inflation reading often watched by economists, which removes all food, energy, alcohol and tobacco prices, also dropped to 1.0%. Forecasts were for it to be unchanged at 1.1%. (Reuters) Eurozone’s sentiment eases in November, but less than expected – Eurozone’s economic sentiment continued to deteriorate in November but less than predicted, thanks to an unexpected rise in optimism in industry, data showed. Economic sentiment in the 19 countries sharing the Euro eased to 109.5 in November from 109.7 in October, the European Commission stated, continuing a trend of falls every month this year. Economists polled by Reuters had expected a deeper fall to

- 5. Page 5 of 8 109.0, but a surge of optimism in industry, which took the index to 3.4 in November from 3.0 in October against expectations of a decline to 2.5, cushioned the fall. Sentiment in services, a sector which produces two thirds of the Eurozone’s GDP, was unchanged at 13.3 in November against October while optimism among consumers fell to -3.9 from -2.7. A separate business climate indicator, which helps point to the phase of the business cycle, rebounded slightly in November to 1.09 from 1.01 in October after falling from 1.21 in September and August. (Reuters) Germany’s inflation remains above ECB target in November – Germany’s annual inflation accelerated at a slower pace in November but stayed above the European Central Bank’s (ECB) target, supporting the central bank’s case for gradually rolling back its massive stimulus in the Eurozone. Germany’s consumer prices, harmonized to make them comparable with inflation data from other European Union countries, rose by 2.2% YoY after an increase of 2.4% in the previous month, the Federal Statistics Office stated. The ECB targets inflation of close to but below 2% for the single-currency bloc as a whole. (Reuters) Germany’s retail sales rise at strongest rate in almost 1-1/2 years – Germany’s annual retail sales rose at their strongest rate in almost 1-1/2 years in October but monthly sales dropped for the fourth consecutive month, sending mixed signals about the state of household spending in Europe’s largest economy. Spending by German shoppers rose by 5.0% on the year in real terms in October, data from the Federal Statistics Office showed. That was the highest rise since May 2017 and compared with a Reuters consensus forecast for an increase of 2.7%. On the month, retail sales decreased by 0.3%, confounding the Reuters consensus forecast for a 0.3% increase. Retail sales are a volatile indicator often subject to revision. The data comes after a GfK survey showed the mood among German shoppers deteriorated more than expected heading into December. (Reuters) Germany's BDI slashing 2018 growth forecast to 1.5% from 2% – Germany’s BDI industry association is cutting its 2018 growth forecast for Europe’s largest economy to around 1.5% from roughly 2%, a newspaper reported. A BDI spokeswoman confirmed the newspaper report, but declined to give any details. (Reuters) France’s inflation slips to seven-month low of 2.2% in November – France’s inflation eased in November to a seven- month low in line with expectations, according to preliminary EU-harmonized data from the INSEE statistics agency. INSEE stated consumer prices fell 0.2% in November from October, giving a 12-month rate of 2.2%, the lowest rise since April and spot on economists’ average expectation in a Reuters poll. Inflation was lower across the board, with price growth slowing for energy, food and services while prices of manufactured goods fell marginally less than the previous month. Separately, INSEE stated that producer prices rose 0.4% in October from September, which translated into a 12-month rate of 3.9%. (Reuters) Greece’s September retail sales rise 3.3% – Greece’s reek retail sales by volume rose 3.3% in September compared to the same month last year after an upwardly-revised 3.6% increase in August, statistics service ELSTAT stated. Retail sales were led higher by supermarkets, books, apparel and footwear, the data showed. Greece's economy expanded for a sixth straight quarter in the April-June period but at a slower pace than the quarter before, mainly because of weak investment spending. Gross domestic product grew 0.2% in the second quarter compared with an upwardly revised 0.9% in January-to-March. (Reuters) Japan’s factory output expands the most since 2015 – Japan’s factory output grew the most in October since 2015, rebounding from a fall in the prior month caused by natural disasters, though manufacturers face a tough road ahead in the face of increasing risks from global trade frictions. The 2.9% rise in output handily beat a median market forecast of 1.2% increase, led by items such as factory conveyors, smartphone parts and cars. It followed a revised 0.4% drop in the previous month, posting the fastest MoM gain since January 2015. Manufacturers surveyed by the Ministry of Economy, Trade and Industry (METI) expect output to rise 0.6% in November and increase 2.2% in December, data showed. Economists expect factory output to rebound this quarter as supply constraints caused by natural disasters that crimped production and physical distribution taper off, paving the way for a recovery from a contraction in the third-quarter. (Reuters) China reports weakest factory growth in over two years on eve of US trade talks – Growth in China’s vast manufacturing sector stalled for the first time in over two years in November as new orders slowed, piling pressure on Beijing ahead of crucial trade talks between Presidents Xi Jinping and Donald Trump. The official Purchasing Managers’ Index (PMI), released by the National Bureau of Statistics (NBS), fell to 50 in November, missing market expectations and down from 50.2 in October. It was the weakest reading in 28 months. Analysts surveyed by Reuters had forecast little change from October’s already marginal growth levels. The 50-point mark is considered neutral territory, indicating no expansion in activity or contraction on a monthly basis. (Reuters) India's April-October fiscal deficit crosses full year target – India’s April-October fiscal deficit stood at INR6.49tn or 103.9% of the budgeted target for current fiscal year, government data showed. Net tax receipts in the first seven months of the fiscal year that ends in March 2019 were INR6.61tn. The government has stated it was confident of meeting its fiscal deficit target of 3.3% of GDP in the 2018-19 fiscal year. India’s economic growth fell to a worse-than-expected 7.1% in the July-September quarter, dragged down by a slower consumer spending and farm growth, in a setback for Prime Minister Narendra Modi who faces a national election by May. India’s growth is still faster than China’s 6.5% in the same quarter, but the figures were a come-down from the more than two-year high of 8.2% set in the June quarter. A Reuters poll of economists had forecasted growth of 7.4% for the quarter. (Reuters) Regional Saudi Arabia and UAE cover most of Iran oil loss, a Reuters survey showed – OPEC oil supply fell in November from a two- year high due to US sanctions on Iran, a Reuters survey found, although most of the output gap left by Iran was plugged by Saudi Arabia and the UAE in response to calls from the US President, Donald Trump. The 15-member OPEC pumped

- 6. Page 6 of 8 33.11mn bpd last month, the survey found, down 160,000 bpd from October, which was the highest by OPEC as a group since December 2016. The survey adds to indications that OPEC output remains ample despite US sanctions imposed on Iran this month. Oil prices have slid 30% since early October on worries a new glut may emerge. OPEC and its allies including Russia meet on December 6-7 to discuss cutting supply. (Gulf- Times.com) OPEC advisory committee said to recommend oil production cut – OPEC needs to cut oil production to avoid an oversupplied market in 2019, according to the group’s main advisory board. OPEC’s board told ministers that they need to trim output by 1.3mn barrels a day from the October 2018 level to bring supply and demand into balance next year, a delegate said. The board’s recommendations are only advisory and the OPEC ministers, who will meet on December 6, often choose a different path. Yet the view that the oil market is oversupplied is a signal the cartel is laying the groundwork for an output cut. (Bloomberg) Russia accepts need for oil cuts, ‘bargains with Saudi Arabia on timing, volume’ – Russia is becoming increasingly convinced it needs to reduce oil output in tandem with OPEC but is still bargaining with the producer group’s leader, Saudi Arabia, over the timing and volume of any reduction, sources told Reuters. The Russian Energy Ministry held a meeting with the heads of domestic oil producers, ahead of a gathering in Vienna of the OPEC and its allies on December 6-7. “The idea at the meeting was that Russia needs to reduce. The key question is how quickly and by how much. Most people agreed that we cannot reduce immediately, it needs to be a gradual process like last time,” sources said. OPEC and its allies led by Russia have been restraining production under a pact reached in late 2016 to prop up oil prices. Moscow agreed to curb output by 300,000 bpd, or one sixth of the overall cut of 1.8mn bpd, but Russian companies took several months to reach that level of reduction. Now, Saudi Arabia has suggested that OPEC and its allies reduce output by 1mn bpd from January 2019 to arrest a price decline as Brent crude fell below $59 a barrel last week from as high as $85 in October due to concerns about a possible glut. (Gulf-Times.com) Reuters: Eni is in talks to grow presence in Oman and UAE – Italy’s Eni is in talks to expand its footprint in Oman and the UAE in an effort to build its asset base in the Gulf region and taper its dependence on Africa, Reuter’s reported. “Eni is in talks with Oman for various opportunities,” sources told Reuters, adding that recent geopolitical tensions in the area had not curbed its interest. Eni submitted an expression of interest for a minority stake in ADNOC’s refinery business. “Eni is also interested in other downstream opportunities,” sources said. (Bloomberg) Saudi Fransi Capital announce dividend distribution to Bonyan REIT Fund’s unit holders – Saudi Fransi Capital announced the distribution of a cash dividend to Bonyan REIT Fund’s unit holders for the period from 19 Shawl 1439 H corresponding to July 3, 2018 (Fund Inception date) to 22 Safar 1440 H corresponding to October 31, 2018 as follows: Total dividends of SR39,905,869.50. Cash distributions will be based on the 162,881,100 existing units. Distributed dividends amount is SR0.245 per unit, and its ratio to the initial price of the unit is 2.45%, equivalent to 7.35% annual return. The distribution ratio amounts to 2.45% of net asset value as of the fund inception date. (GulfBase.com) Saudi contractor said to have defaulted on almost $2bn of debt – One of Saudi Arabia’s major contractors defaulted on almost $2bn after a falling out among its owners and delays in payments from the government, according to sources. Saudi Arabia’s unit of Cyprus-based Joannou & Paraskevaides Group defaulted on about $1.9bn in bank loans about two months ago. The defaults are largely the result of problems with getting paid by the Ministry of Interior. Lenders, which include Arab National Bank, Alawwal Bank, Banque Saudi Fransi, Emirates NBD, Saudi British Bank and Samba Financial Group, don’t expect to recover much of the money, sources added. (Gulf- Times.com) UAE’s inflation eases to 1.6% in October – The UAE’s annual inflation rate eased to 1.6% in October of 2018 from 3.1% in September 2018. It was the lowest inflation rate since October 2017. On a monthly basis, consumer prices went down 0.5% in October 2018, after 0.6% fall in September 2018. Drop in prices were driven by drop in housing costs, transport and household goods figures from the National Bureau of Statistics showed. Prices fell 5.2% for housing & utilities in October, compared to 4.4% drop in September, while prices for food & beverages fell 2.1% in October from 3.2% in September; cost of transport fell 9.3% from 12.9% in September; cost of education fell 2.4% from 4.3% in September. (GulfBase.com) ADNOC moving ahead with plans to expand CO2 capture – Abu Dhabi National Oil Company (ADNOC) announced that it is moving ahead with plans to expand the capture, storage and utilization of carbon dioxide (CO2), produced from either the Habshan-Bab gas processing facilities or the Shah gas plant. A decision on which plant to capture the CO2 from first will be taken in 2019. The project will be engineered so as not to interrupt ongoing production from either facility. The additional CO2 capture will reduce ADNOC’s carbon footprint - which is among the lowest in the industry - and liberate natural gas, previously used for oil field injection, for other more valuable purposes, while simultaneously addressing growing global demand for oil by boosting recovery from its maturing reservoirs. (GulfBase.com) Moody's affirms ‘A3’ insurance financial strength rating of Kuwait Insurance Company with a ‘Stable’ outlook – Moody's Investors Service (Moody's) affirmed the ‘A3’ insurance financial strength rating (IFSR) of Kuwait Insurance Company. The outlook for KIC remains ‘Stable’. Kuwait Insurance Company's strong position in the domestic market with an established brand and a good reputation for service and its good and strengthening capitalization with a gross underwriting leverage (GUL) of 1.4x as at 2017 from 1.7x as at 2016 and its sustained strong underwriting profitability with the five year average combined ratio (COR) of 86.5% at 2017, albeit overall profitability remains exposed to volatility from the high risk investment portfolio as seen in 2016 results. These strengths are partially constrained by the investment strategy that introduces income statement volatility with high risk assets (HRA), mostly equity, equating to 95.3% of shareholders' equity as at YE 2017. Furthermore, Kuwait Insurance Company

- 7. Page 7 of 8 remains exposed to the high levels of price competition in the Kuwaiti property and casualty (P&C) insurance market which pressures profitable growth. (Moody’s) Kuwait Petroleum Corporation renews contract to supply Lebanon with gas oil – Kuwait Petroleum Corporation (KPC) renewed its contract with Lebanon’s Energy Ministry to supply Lebanon’s state electricity company with gas oil for a year at international market prices, Kuwait News Agency (KUNA) reported. KPC has supplied Lebanon’s power stations with gas oil since 2005 under an official deal, which is renewed annually. (Reuters) Bahrain’s long-term foreign currency debt rating affirmed at ‘B+’ by S&P – Bahrain's long-term foreign currency debt rating was affirmed at ‘B+’ by Standard & Poor’s (S&P). The outlook for the long term foreign currency debt rating remains ‘Stable’. (Bloomberg) Bahrain to roll out VAT system in stages before official launch – Bahrain wants large companies to register for the 5% value added tax (VAT) ahead of its official rollout in January. Companies with an annual turnover exceeding $13.26mn are being asked to register for the VAT on all goods and services before the system is officially launched at the beginning of the year, according to Bahrain’s finance ministry. Bahrain will be the third GCC country after the UAE and Saudi Arabia to introduce the tax. Oman, Kuwait and Qatar are expected to follow shortly. (Bloomberg)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Oct-14 Oct-15 Oct-16 Oct-17 Oct-18 QSE Index S&P Pan Arab S&P GCC 0.9% 0.3% (0.2%) 0.3% 0.4% (2.3%) (0.6%) (3.0%) (2.0%) (1.0%) 0.0% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,222.50 (0.1) (0.1) (6.2) MSCI World Index 2,041.36 0.3 3.4 (3.0) Silver/Ounce 14.18 (0.9) (0.7) (16.3) DJ Industrial 25,538.46 0.8 5.2 3.3 Crude Oil (Brent)/Barrel (FM Future) 58.71 (1.3) (0.2) (12.2) S&P 500 2,760.17 0.8 4.8 3.2 Crude Oil (WTI)/Barrel (FM Future) 50.93 (1.0) 1.0 (15.7) NASDAQ 100 7,330.54 0.8 5.6 6.2 Natural Gas (Henry Hub)/MMBtu 4.61 2.4 (1.9) 30.2 STOXX 600 357.49 (0.7) 0.8 (13.5) LPG Propane (Arab Gulf)/Ton 68.50 (2.1) (6.0) (29.9) DAX 11,257.24 (0.9) 0.4 (18.0) LPG Butane (Arab Gulf)/Ton 64.75 (3.0) (17.4) (38.7) FTSE 100 6,980.24 (1.0) (0.0) (14.4) Euro 1.13 (0.7) (0.2) (5.7) CAC 40 5,003.92 (0.6) 1.0 (11.3) Yen 113.57 0.1 0.5 0.8 Nikkei 22,351.06 0.2 2.6 (2.7) GBP 1.27 (0.3) (0.5) (5.7) MSCI EM 994.72 (0.3) 2.6 (14.1) CHF 1.00 (0.3) (0.1) (2.4) SHANGHAI SE Composite 2,588.19 0.6 0.2 (26.8) AUD 0.73 (0.2) 1.0 (6.4) HANG SENG 26,506.75 0.2 2.2 (11.5) USD Index 97.27 0.5 0.4 5.6 BSE SENSEX 36,194.30 0.1 5.3 (2.7) RUB 66.98 1.1 1.1 16.2 Bovespa 89,504.03 (0.4) 2.4 0.1 BRL 0.26 (0.4) (1.0) (14.3) RTS 1,126.14 (1.3) 1.1 (2.5) 76.4 75.3 73.6