Daily Market Report February 01

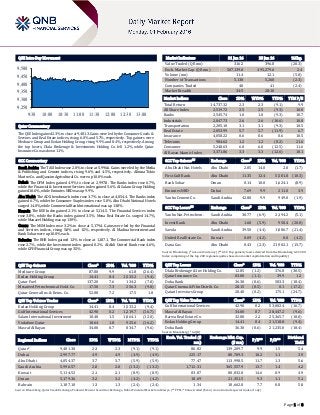

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 2.3% to close at 9,481.3. Gains were led by the Consumer Goods & Services and Real Estate indices, rising 6.0% and 5.7%, respectively. Top gainers were Medicare Group and Ezdan Holding Group, rising 9.9% and 8.4%, respectively. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 1.2%, while Qatar Insurance Co. was down 1.1%. GCC Commentary Saudi Arabia: The TASI Index rose 2.0% to close at 5,996.6. Gains were led by the Media & Publishing and Cement indices, rising 9.6% and 4.5%, respectively. Alinma Tokio Marine Co. and Qassim Agricultural Co. were up 10.0% each. Dubai: The DFM Index gained 4.9% to close at 2,997.8. The Banks index rose 6.7%, while the Financial & Investment Services index gained 5.6%. Al Salam Group Holding gained 10.6%, while Emirates NBD was up 9.9%. Abu Dhabi: The ADX benchmark index rose 3.7% to close at 4,054.4. The Banks index gained 6.7%, while the Consumer Staples index rose 5.0%. Abu Dhabi National Hotels surged 14.0%, while Commercial Bank International was up 13.8%. Kuwait: The KSE Index gained 2.1% to close at 5,114.5. The Financial Services index rose 3.8%, while the Banks index gained 3.5%. Mena Real Estate Co. surged 14.7%, while Manazel Holding was up 13.9%. Oman: The MSM Index rose 3.2% to close at 5,179.4. Gains were led by the Financial and Services indices, rising 5.0% and 1.5%, respectively. Al Madina Investment and Bank Sohar were up 10.0% each. Bahrain: The BHB Index gained 1.3% to close at 1,187.1. The Commercial Bank index rose 2.7%, while the Investment index gained 0.2%. Al-Ahli United Bank rose 4.6%, while GFH Financial Group was up 3.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 87.80 9.9 61.8 (26.4) Ezdan Holding Group 14.41 8.4 1,533.2 (9.4) Qatar Fuel 137.20 7.6 134.2 (7.0) Mesaieed Petrochemical Hold. Co. 17.50 7.3 256.3 (9.8) Qatar General Ins. & Reins. Co. 52.00 7.2 17.5 1.8 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 14.41 8.4 1,533.2 (9.4) Gulf International Services 42.90 0.2 1,219.7 (16.7) Salam International Investment 10.40 1.5 1,064.1 (12.0) Vodafone Qatar 10.64 1.8 925.6 (16.2) Masraf Al Rayan 34.00 0.7 834.7 (9.6) Market Indicators 31 Jan 16 28 Jan 16 %Chg. Value Traded (QR mn) 316.2 396.8 (20.3) Exch. Market Cap. (QR mn) 507,139.0 495,279.6 2.4 Volume (mn) 11.4 12.1 (5.8) Number of Transactions 5,138 5,260 (2.3) Companies Traded 40 41 (2.4) Market Breadth 34:5 28:10 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 14,737.32 2.3 2.3 (9.1) 9.9 All Share Index 2,519.72 2.5 2.5 (9.3) 10.0 Banks 2,545.74 1.0 1.0 (9.3) 10.7 Industrials 2,847.73 2.6 2.6 (10.6) 10.8 Transportation 2,205.10 3.1 3.1 (9.3) 10.5 Real Estate 2,053.99 5.7 5.7 (11.9) 6.7 Insurance 4,058.22 0.6 0.6 0.6 10.5 Telecoms 984.62 1.2 1.2 (0.2) 21.6 Consumer 5,248.63 6.0 6.0 (12.5) 11.6 Al Rayan Islamic Index 3,371.86 3.3 3.3 (12.6) 10.1 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Hotels Abu Dhabi 2.85 14.0 2.0 (1.7) First Gulf Bank Abu Dhabi 11.35 12.4 5,581.8 (10.3) Bank Sohar Oman 0.14 10.0 1,624.1 (8.9) Emirates NBD Dubai 7.69 9.9 211.0 3.9 Yanbu Cement Co. Saudi Arabia 42.80 9.9 949.0 (1.9) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Yanbu Nat. Petrochem. Saudi Arabia 30.77 (6.9) 2,194.2 (5.1) Invest Bank Abu Dhabi 1.60 (5.9) 950.4 (20.0) Savola Saudi Arabia 39.50 (4.4) 1,086.7 (21.4) United Real Estate Co. Kuwait 0.09 (4.2) 0.0 (4.2) Dana Gas Abu Dhabi 0.43 (2.3) 21,902.1 (15.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv Holding Co. 12.85 (1.2) 376.8 (30.5) Qatar Insurance Co. 83.00 (1.1) 39.9 1.2 Doha Bank 36.30 (0.6) 583.3 (18.4) Qatar Cinema & Film Distrib. Co. 28.15 (0.5) 0.1 (17.2) Qatari Investors Group 28.40 (0.2) 175.1 (24.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 42.90 0.2 53,002.4 (16.7) Masraf Al Rayan 34.00 0.7 28,447.2 (9.6) Barwa Real Estate Co. 32.80 2.2 25,365.7 (18.0) Ezdan Holding Group 14.41 8.4 21,518.8 (9.4) Doha Bank 36.30 (0.6) 21,235.0 (18.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,481.30 2.3 2.3 (9.1) (9.1) 86.82 139,209.7 9.9 1.5 5.4 Dubai 2,997.77 4.9 4.9 (4.9) (4.9) 225.17 80,709.3 10.2 1.1 3.9 Abu Dhabi 4,054.37 3.7 3.7 (5.9) (5.9) 77.47 113,998.5 11.7 1.3 5.6 Saudi Arabia 5,996.57 2.0 2.0 (13.2) (13.2) 1,712.31 365,557.9 13.7 1.4 4.2 Kuwait 5,114.52 2.1 2.1 (8.9) (8.9) 83.87 80,832.8 14.6 0.9 4.9 Oman 5,179.36 3.2 3.2 (4.2) (4.2) 18.69 21,351.5 9.3 1.1 5.1 Bahrain 1,187.10 1.3 1.3 (2.4) (2.4) 1.34 18,662.8 7.7 0.8 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,250 9,300 9,350 9,400 9,450 9,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index gained 2.3% to close at 9,481.3. The Consumer Goods & Services and Real Estate indices led the gains. The index rose on the back of buying support from non-Qatari and GCC shareholders despite selling pressure from Qatari shareholders. Medicare Group and Ezdan Holding Group were the top gainers, rising 9.9% and 8.4%, respectively. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 1.2%, while Qatar Insurance Co. was down 1.1%. Volume of shares traded on Sunday fell by 5.8% to 11.4mn from 12.1mn on Thursday. However, as compared to the 30-day moving average of 6.5mn, volume for the day was 74.3% higher. Ezdan Holding Group and Gulf International Services were the most active stocks, contributing 13.5% and 10.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Finance House Capital Intelligence Abu Dhabi LT CCR/ST CCR BBB-/A3 BBB-/A3 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, CCR – Corporate Credit Rating) Earnings Releases Company Market Currency Revenue (mn) 4Q2015 % Change YoY Operating Profit (mn) 4Q2015 % Change YoY Net Profit (mn) 4Q2015 % Change YoY Jabal Omar Development Co. Saudi Arabia SR – – -21.4 NA -75.5 NA Al Mazaya Holding Co.* Dubai AED 59.8 258.9% – – 9.3 15.2% Al Safwa Islamic Financial Services * Dubai AED 6.7 -58.6% – – -2.5 NA Abu Dhabi Aviation Co. Abu Dhabi AED 2,181.6 35.4% 553.7 33.1% 267.6 25.4% Al Batinah Power Co.* Oman OMR 67.9 31.0% – – 7.1 41.4% Al Madina Investment Co. ** Oman OMR – – – – -1,494.0 NA Oman Fiber Optic Co. * Oman OMR 22.6 -3.2% 2.0 19.1% 1.6 -79.6% National Biscuit Industries* Oman OMR 10.9 -3.8% – – 0.6 1.3% Taageer Finance Co.* Oman OMR 34.3 5.8% – – 4.4 13.9% Source: Company data, DFM, ADX, MSM (*FY2015 results, **3QFY2015-16 results) Earnings Calendar Tickers Company Name Date of reporting 4Q2015 results No. of days remaining Status GISS Gulf International Services 2-Feb-16 1 Due IQCD Industries Qatar 4-Feb-16 3 Due QIMD Qatar Industrial Manufacturing Company 7-Feb-16 6 Due MPHC Mesaieed Petrochemical Holding Company 7-Feb-16 6 Due ERES Ezdan Real Estate Company 7-Feb-16 6 Due QGRI Qatar General Insurance & Reinsurance 10-Feb-16 9 Due WDAM Widam Food Company 11-Feb-16 10 Due SIIS Salam International Investment 14-Feb-16 13 Due MCGS Medicare Group 14-Feb-16 13 Due UDCD United Development Company 14-Feb-16 13 Due DBIS Dlala Brokerage & Investment Holding Company 15-Feb-16 14 Due AKHI Al Khaleej Takaful Insurance 15-Feb-16 14 Due AHCS Aamal Company 15-Feb-16 14 Due BRES Barwa Real Estate Company 21-Feb-16 20 Due ORDS Ooredoo 1-Mar-16 29 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 51.84% 53.17% (4,215,972.65) Qatari Institutions 7.46% 12.61% (16,291,878.86) Qatari 59.30% 65.78% (20,507,851.51) GCC Individuals 4.89% 1.55% 10,565,111.25 GCC Institutions 6.25% 3.68% 8,110,946.35 GCC 11.14% 5.23% 18,676,057.60 Non-Qatari Individuals 19.96% 15.95% 12,656,949.45 Non-Qatari Institutions 9.60% 13.03% (10,825,155.54) Non-Qatari 29.56% 28.98% 1,831,793.91

- 3. Page 3 of 8 News Qatar DOHI reports net profit of QR68.8mn in 4Q2015 – Doha Insurance Company (DOHI) reported a net profit of QR68.8mn in 4Q2015 as compared to a net loss of QR2.3mn in 3Q2015. Net profit surged 247% YoY. Earnings per share amounted to QR1.38 in 4Q2015 as compared to loss per share of QR0.05 in 3Q2015. The Board of Directors has also decided to submit a proposal to the General Assembly Annual Meeting, to ratify a proposal for distribution of cash dividends of 10% from the share par value (i.e. QR1.00 for each share). (QSE, QNBFS Research) DBIS BoD meeting on February 15 – Dlala Brokerage & Investment Holding Company’s (DBIS) board of directors (BoD) will meet on February 15, 2016 to discuss its financial results for the year ending December 31, 2015. (QSE) UDCD BoD meeting on February 14 – United Development Company’s (UDCD) board of directors (BoD) will meet on February 14, 2016 to discuss its financial results for the year ending December 31, 2015. (QSE) AKHI BoD meeting on February 15 – Al Khaleej Takaful Group’s (AKHI) board of directors (BoD) will meet on February 15, 2016 to discuss its financial results for the year ending December 31, 2015. (QSE) BRES BoD meeting on February 21 – Barwa Real Estate Company’s (BRES) board of directors (BoD) will meet on February 21, 2016 to discuss its financial results for the year ending December 31, 2015. (QSE) AHCS BoD meeting on February 15 – Aamal Company’s (AHCS) board of directors will meet on February 15, 2016 to discuss its financial results for the year ending December 31, 2015. (QSE) GWCS seeks shareholders’ nod to 15% dividend, to hold AGM & EGM on Feb 14 – Gulf Warehousing Company (GWCS) will hold its ordinary and extraordinary general assembly (AGM & EGM) meetings on February 14, 2016. Shareholders at the AGM will consider approving a dividend payment of QR1.5 per share (15%). The meeting will also discuss and verify the annual corporate governance report, as well as look into clearing the board members of any possible liability and set their bonuses. Shareholders at the EGM will consider increasing foreign ownership limit to 49% of the company’s capital, as stated by Law No. 9 of the year 2014. The meeting will also consider amending the company’s by-laws and Articles of Association in line with the provisions of the new companies act issued by the Ministry of Economy and Commerce No. (11) for 2015. (QSE) IHGS seeks shareholders’ nod for 15% dividend distribution – Islamic Holding Group (IHGS) will hold its annual general meeting on February 16, 2016. Shareholders at the meeting will consider approving the board of directors’ (BoD) proposal to distribute 15% dividend (QR1.5 per share). The meeting will discuss electing the board of directors for a period of three years from 2016 until the end of the fiscal year 2018 and holding the general assembly of shareholders. (QSE) NLCS seeks shareholders’ nod for distribution of 5% cash dividend – Alijarah Holding (NLCS) will hold its ordinary general assembly meeting (AGM) on February 14, 2016. Shareholders at the meeting will consider approving the board of directors’ (BoD) proposal to distribute cash dividends at the rate of 5% of the nominal share value, i.e. QR0.5 for each share. The meeting will also discuss approving the corporate governance report for 2015. (QSE) Qatar to begin polling opinions for 2016 IMD World Competitiveness Report – The Ministry of Development Planning and Statistics (MDPS), in collaboration with the Institute for Management Development (IMD) in Switzerland, will be carrying out the ‘Executive Opinion Survey’ during February and March of 2016. The survey data will complement hard statistical data and provide qualitative analysis about the economic policy, regulations and various aspects of the business environment, which influence the nation’s competitiveness ranking. The 2016 IMD World Competitiveness Report, scheduled for release in June 2016, will measure strengths and weaknesses in Qatar’s economic environment and compare these with other nations. Qatar ranked 13th (out of 61 countries) in the 2015 Competitiveness Yearbook. (MDPS) QSE to organize margin trading public awareness sessions – The Qatar Stock Exchange (QSE) will organize a series of lectures on margin trading. This move is part of the QSE’s efforts to enhance investors’ awareness about margin trading, which is aimed at enhancing market liquidity and providing new financing channels for investors. (QSE) Doha wins bid to host 2023 world FINA championships – Doha has won the bid to host the 2023 FINA (International Swimming Federation) World Championships and the FINA World Masters Championships. Following final presentations in Budapest, the FINA Bureau elected Doha over Nanjing, bringing FINA’s flagship event to the Middle East for the first time in history. (Gulf- Times.com) QATI rebrands, launches new website for personal products – Qatar Insurance Group (QATI) has rebranded itself and launched its new online platform for personal insurance products under the name ‘QIC Insured’. The Middle East’s largest insurance group said the revamped website would provide a “true one-stop solution” for personal insurance products. QATI-Mena Deputy Group President and CEO Salem al-Mannai said the online platform has had “significant growth” since its launch some two years ago. (Gulf- Times.com) BoAML keeps Qatar external debt rating at ‘underweight – Bank of America Merrill Lynch (BoAML) has retained Qatar’s external debt (EXD) at “underweight” as its savings “cushion” sovereign creditworthiness. BoAML said given the country’s strong balance sheet and the lack of strong directional catalysts, bonds have traded generally in line with USTs (US treasury). According to BoAML downside risks are geopolitics, a more competitive or oversupplied liquefied natural gas market and lower hydrocarbon prices. On Qatar’s credit ratings, it said, “We expect ratings will be unchanged, as in our view they are constrained by institutional factors rather than macroeconomic performance as long as sovereign wealth provides a cushion.” Qatar has ‘AA2’, ‘AA’ and ‘AA’ with “stable” outlook ratings from Moody’s, Standard & Poor’s and Fitch, respectively. (Gulf-Times.com) QDB, ICD sign MoU to support Qatar SMEs – Qatar Development Bank (QDB) has signed a memorandum of understanding (MoU) with the Islamic Corporation for the Development of the Private Sector (ICD), the private sector arm of Islamic Development Bank (IDB) Group. The new agreement is part of a joint strategic collaboration in examining innovative means and opportunities to support small and medium enterprises (SMEs) in Qatar. The MoU commits the two institutions to share knowledge and expertise relating to the SME sector in Qatar. A work group composed of key stakeholders and experts from each party will be formed in order to work on the feasibility of co-developing an investment and financing vehicle that will focus on supporting and developing SMEs and local businesses. The preliminary work to be undertaken by the joint parties will cover among other areas concept design, market analysis, structure and governance, as well as potential positioning and product development. The MoU will enhance the

- 4. Page 4 of 8 ability of both organizations to achieve its respective objectives and mandate. (Gulf-Times.com) ‘Discover America Week’ to open in Qatar on February 15 – The US embassy, in partnership with the American Chamber of Commerce Qatar, will launch the second “Discover America Week Qatar 2016” during February 15-22, 2016 to celebrate the US-Qatar partnership. The event will highlight the diversity and breadth of American goods and services and bring a little bit of America to Qatar. A high-level forum for business leaders interested in doing business in the US, a special American film showcase, an authentic American Sports Day, exhibits of leading American fashion designers, food and education will highlight the deep bilateral ties shared between the people of the US and Qatar. (Gulf-Times.com) ‘Make in India Week’ to offer investment opportunities for Qatari companies – Indian Ambassador to Qatar Sanjiv Arora has said that the upcoming “Make in India Week,” including the “Digital India” and the “Smart Cities” program, are among the national initiatives that could offer investment opportunities to a range of sectors in Qatar’s business community. Arora, accompanied by members of the management committee of the Indian Business and Professionals Network (IBPN), met with their counterparts at the Qatar Chamber. The ambassador said one of the major objectives of the “Make in India Week” is to invite foreign businesses “to join hands with Indian companies and to take advantage of the distinctive capabilities of India.” (Gulf-Times.com) New OBG Qatar report to focus on tax, regulatory reforms – The changing face of Qatar’s tax regime and the impact of planned reforms on investors are among the topics set for analysis in a forthcoming report on the country by the global publishing firm Oxford Business Group (OBG). ‘The Report: Qatar 2016’ will update readers on the latest changes to the country’s tax and regulatory systems, including the introduction of the Wage Protection System (WPS), which came into effect in November 2015. Other developments to be explored include a shift under way in the Qatar Tax Authority’s approach to the taxation of capital gains on the disposal and transfer of shares in domestic companies by non-resident companies. PwC Qatar has signed a memorandum of understanding (MoU) with OBG for the publishing firm’s 2016 report on the country. Under the deal, the professional services firm will team up for a third time with OBG to compile and produce the Accountancy and Tax Chapter of ‘The Report: Qatar 2016’. (Gulf-Times.com) EMRQ gets first Qatari research director – ExxonMobil has announced the appointment of Dr Mohamad al-Sulaiti as the research director for ExxonMobil Research Qatar (EMRQ), succeeding Dr Jennifer Dupont. Dr al-Sulaiti’s appointment marks the first time a Qatari national will head EMRQ. Previously EMRQ’s technical interface coordinator, Dr Al-Sulaiti has been part of the EMRQ team for the past five years. (Gulf-Times.com) International Barclays, Credit Suisse strike record deals with SEC, NY over dark pools – Federal and New York state officials said Barclays and Credit Suisse have settled federal and state charges that they misled investors in their dark pools, with Barclays admitting it broke the law and agreeing to pay $70mn. The settlements between the banks and the US Securities and Exchange Commission (SEC) and the New York state attorney general mark the two largest fines ever paid in connection with cases involving dark pools. The amount to be paid, in fines and disgorgement, is a combined total of $154.3mn. At the heart of the cases against both Barclays and Credit Suisse are allegations they misled investors in the dark pools, saying they would be protected from predatory high-frequency trading tactics. Barclays will pay a $70mn fine split evenly between the SEC and New York State, admit it violated securities laws and agree to install an independent monitor to ensure that its dark pool "Barclays LX" operates properly in the future. Credit Suisse will pay a $60mn fine split between the regulators, plus an additional $24.3mn in disgorgement to the SEC for executing 117mn illegal sub-penny orders out of its dark pool known as "Crossfinder." Dark pools are trading venues that differ from public exchanges because orders are not visible to other traders until they are executed. (Reuters) HSBC to freeze salaries, hiring in 2016 in battle to cut costs – According to sources, Europe's largest lender, HSBC, is imposing a hiring and pay freeze across the bank globally in 2016. Like numerous other global banks, HSBC is in the midst of a cost- cutting drive to boost profitability and returns to shareholders, and is pushing through with plans for annual cost savings of up to $5bn by 2017. Europe's biggest bank said in June that it planned to slash nearly one in five jobs and shrink its investment bank by a third in response to sluggish economic growth and tighter global regulation of bank balance sheet risk. (Reuters) Mid-tier Chinese banks piling up trillions of dollars in shadow loans – Mid-tier Chinese banks are increasingly using complex instruments to make new loans and restructure existing loans that are then shown as low-risk investments on their balance sheets, masking the scale and risks of their lending to China's slowing economy. According to a UBS analysis the size of this 'shadow loan' book rose by a third in 1H2015 to an estimated $1.8tn, equivalent to 16.5% of all commercial loans in China. For smaller banks, the rate is much faster. This growing practice, which involves financial structures known as Directional Asset Management Plans (DAMPs) or Trust Beneficiary Rights (TBRs), comes at a time when some mid-tier lenders, under pressure from China's slowest economic growth in 25 years, are already delaying the recognition of bad loans. (Reuters) China official manufacturing PMI eases to 49.4 in January, misses forecasts – According to an official survey, activity in China's manufacturing sector contracted more than expected in January, missing market expectations and weaker than in December 2015. The official Purchasing Managers' Index (PMI) stood at 49.4 in January, compared to December 2015 reading of 49.7 and below the 50-point mark that separates growth from contraction on a monthly basis. Reuters predicted a reading of 49.6, suggesting the sixth consecutive month of contraction. China's economic growth cooled to 6.9% in 2015, the slowest pace in 25 years, adding pressure to policy makers who are already struggling to restore the confidence of investors after a renewed plunge in stock markets and the yuan currency. Meanwhile, the country's official non-manufacturing Purchasing Managers' Index (PMI) survey showed growth in China's services sector activity slowed in January. The official non-manufacturing PMI stood at 53.5 in January, compared with the December 2015 reading of 54.4, above the 50-point mark. (Reuters) South Korea to allow foreign investors to use omnibus accounts – South Korea said it plans to introduce next year the omnibus account system that it hopes will help save the cost while enhancing convenience for foreign investors in the local stock markets. The government also hopes the move will help the country's stocks be reclassified into the developed market category by index compiler MSCI from the current emerging market status, a goal the country has been pursuing for a long time. An asset management company will be able to conduct transactions of South Korean stocks through one omnibus account on behalf of multiple foreign investors, compared to the current system requiring each investor to open an account. (Reuters)

- 5. Page 5 of 8 Regional CMA approves United International Transportation’s capital increase request – The Saudi Capital Market Authority (CMA) Board has approved United International Transportation Company’s request to increase its capital from SR508.33mn to SR610mn through issuing one bonus share for every five existing shares owned by the shareholders. This will increase the company’s outstanding shares from 50,833,334 shares to 61,000,001 shares. Such increase will be paid by transferring an amount of SR101.67mn from the retained earnings account to the company’s capital. The bonus shares eligibility is limited to the shareholders, who are registered in the shareholders registry at the close of trading on the day of the extraordinary general assembly, the date for which will be decided later by the company’s board. The meeting should be held within six months from the approval date. This approval is conditional on the company satisfying the regulatory requirements of Companies Law and any other applicable laws. (CMA) Experts: Saudi Arabia real estate one of most attractive investment sectors – Saudi Arabian King Salman has said his government is planning to launch a comprehensive economic, financial and structural reform program to build a strong economy based on solid foundations and diversified resources of income, while minimizing any negative impact on middle- and low-income citizens. Based on the 2016 Saudi budget, real estate experts and investors in the Kingdom are anticipating a remarkable revitalization of the real estate investment sector in the coming period. With a total value exceeding SR1.3tn, which is estimated to reach SR1.5tn in the coming years, the real estate sector is becoming one of the most attractive investment sectors in Saudi Arabia. (GulfBase.com) Saudi Airlines Catering BoD appoints Chairman – Saudi Airlines Catering Company’s board of directors (BoD) has appointed Yahya Abdullah Alyahya as the chairman of the board. Moreover, the board formed the audit, nomination and remuneration committees, in accordance with the duties and authorities stated in its charters and the relevant regulations. (Tadawul) SAMA suspends GGIC from issuing new or renewing existing motor policies – The Saudi Arabian Monetary Agency (SAMA) has suspended Gulf General Insurance Cooperative Company (GGIC) from issuing new motor policies or renewing existing motor policies effectively from January 31, 2016. The suspension was due to the violations of regulations relating to the issuance of motor insurance cover that were conducted because of the weaknesses in the company’s internal controls. (Tadawul) JODC in talks with lenders after missing SR650mn payment – Jabal Omar Development Company (JODC) is in talks with creditors after failing to make the first repayment worth SR650mn on a SR3bn state loan. The company said its sustainability depended on finding funds to repay short-term debts and has long-term debt of over SR8bn. JODC said it plans to use a SR900mn credit facility from a local bank to cover the repayment. The facility has SR751mn remaining. It said the terms of the government loan allow land put up by JODC as collateral to be sold by the lender. (Reuters) Shurooq, Emaar & Eagle Hills to establish new real estate company in Sharjah – Sharjah Investment and Development Authority (Shurooq) has signed a partnership agreement with Emaar Properties and Eagle Hills to establish a new real estate company in Sharjah called Omran Properties. The new entity will develop and manage the real estate sector in the Emirate and beyond, as well as provide management and maintenance services to projects that concern all parties. Shurooq will hold a 34% of Omran’s capital, while the remaining 66% stake will be held by Emaar and Eagle Hills equally. The agreement follows the three parties’ intention to strengthen inter-cooperation and exchange expertise in the field of property investment and to further develop it Sharjah and the UAE as a whole. (DFM) DEWA opens consultancy tender for $27bn green fund – Dubai Electricity and Water Authority (DEWA) has said that it is inviting consulting firms to file bids for a tender for advisory and regulatory development services for the Emirate’s planned AED100bn clean energy fund. The Dubai Green Fund, announced in November 2015, will provide low-cost loans for investors in Dubai’s clean energy sector as part of a wide green energy investment program in the desert city state of 2.4mn people. Offers for the tender will be accepted until the end of February 2016. (GulfBase.com) Al-Khaleej says sugar export prospects weak – Dubai's Al-Khaleej Sugar Refinery has said that it was operating at only 70% of its capacity due to slow physical demand for white sugar, despite high white premiums. (GulfBase.com) Al Mazaya Holding BoD recommends 7% cash dividend – Al Mazaya Holding Company’s board of directors (BoD) has recommended the distribution of 7% cash dividend from the paid-up capital (7 fils per share) for the year ended December 31, 2015. This recommendation is subject to the approval of general assembly and the concerned authorities. (DFM) OIC BoD recommends 20% cash dividend – Orient Insurance Company’s (OIC) board of directors (BoD) has recommended 20% cash dividend. (DFM) Damac Properties to open three new projects in 2016– Damac Properties Dubai Company has announced that it is going to open three new projects in the hospitality sector during 2016. The company will open DAMAC Maison Upper Crest and DAMAC Maison The Distinction in Burj area and Naya Tenora in Dubai south city. These projects will provide about 900 hotel rooms and hotel apartments, in addition to the previous five projects, which opened in Burj area. The opening of the three projects bring the total keys operated by the company at the end of 2016 to 2350 hotel rooms and serviced apartments, with five-star services level, in addition to the exclusive services provided by hospitality arm ‘DAMAC Maison Hotels & Resorts’. (DFM) NBAD appoints Vice Chairman – National Bank of Abu Dhabi’s (NBAD) board of directors (BoD) has decided to appoint HE Sultan Nasser Al Suwaidi as the Vice Chairman of NBAD. (ADX) Dana Gas announces temporary halt to Khor Mor plant – Dana Gas has notified the market of a temporary interruption of the flow of gas from the Khor Mor plant in the Kurdistan Region of Iraq. The sale gas pipeline between the Chemchemal and Erbil power stations was ruptured near the sub-district of Shwan in Kirkuk province in the early hours of January 29, 2016. This resulted in the isolation of the gas pipeline and the shut-down of the Khor Mor plant for a few hours. No casualties or injuries have been reported. (ADX) ADCB reports 17% YoY surge in 2015 net profit – Abu Dhabi Commercial Bank (ADCB) reported a net profit of AED4.93mn in 2015 as compared to AED4.2mn in 2014, representing an increase of 17% YoY. Operating profit before impairment allowances reached AED5.43mn in 2015, up 9% YoY as compared to AED4.97mn in the year-ago period. The bank recoded AED2.05mn non-interest income and AED8.26mn operating income in 2015. ADCB’s total assets stood at AED228.27bn at the end of December 31, 2015 as compared to AED204.02bn as of December 31, 2014. Net loans & advances grew 9% YoY to AED153.68bn, while customer deposits were up 14% YoY at AED143.53bn. EPS amounted to AED0.93 in 2015 versus AED0.74 in 2014. The capital adequacy ratio was 19.76% for 2015. Meanwhile, the board of

- 6. Page 6 of 8 directors has recommended the distribution of 45% cash dividend from the capital for the year 2015. (ADX) FGB reports AED1.72bn net profit in 4Q2015 – First Gulf Bank (FGB) reported a net profit of AED1.72bn in 4Q2015 as compared to AED1.55bn in 4Q2014, representing an increase of 11% YoY. The bank also proposed paying a cash dividend of AED1 per share for 2015. KFH plans capital-boosting Sukuk issue – Kuwait Finance House (KFH) is studying the issuance of Islamic bonds that would boost its capital reserves. The firm could issue capital bonds that either enhance its core Tier 1 capital or its supplementary Tier 2 capital. KFH CEO Mazen al-Nahedh said the offering still requires necessary approvals. KFH is also planning to issue Tier 2- enhancing Sukuk in 2016 for its Turkish subsidiary. (Reuters) KNPC to set up company to run refinery complex – Kuwait National Petroleum Company (KNPC) has announced that it will set up a new company, KBRC, to run its planned Al-Zour refinery and petrochemical complex, which, after completion, will be the biggest in the Middle East. KNPC CEO Mohammed Al-Mutairi said the new company will also manage a planned permanent liquefied natural gas (LNG) import terminal. He said setting up KBRC would allow independent management of the projects under one structure. (Reuters) Oman Fiber Optic BoD recommends 25% cash & 15% stock dividend – Oman Fiber Optic Company’s board of directors (BoD) has recommended distribution of 25% cash dividend from the share capital and 15% stock dividend for the year 2015. This recommendation is subject to shareholders’ approval. (MSM) Taageer Finance BoD recommends 9.4% cash dividend for 2015 – Taageer Finance Company board of directors (BoD) has recommended distribution of 9.4% cash dividend for the year 2015. This recommendation is subject to approval of Central Bank of Oman and annual general meeting of the company. (MSM) Bank Sohar BoD proposes 15% dividend for 2015 – Bank Sohar’s board of directors (BoD) has proposed a 9% cash dividend (9 baizas per share) and a stock dividend of 6% of the share capital (6 shares for every 100 shares held) for the year 2015. The proposed dividends are subject to the approval of the regulators and the shareholders of the bank. (MSM) Al Anwar BoD approves Falcon Insurance stake sale – Al Anwar Holding’s board of directors (BoD) has reviewed and approved the offer received for the sale of its substantial stake held in Falcon Insurance Company. The company has updated that the transaction price would be 1.2 multiples of book value subject to the due diligence and the audited financial statements as of December 31, 2015. The transaction is subject to completion of due diligence by the buyer and approval from the regulatory authorities concerned. Meanwhile, the company’s BoD has approved the purchase of a plot of land at Azaiba North, held in the books of its subsidiary Falcon Insurance Company for a cash consideration of OMR1.9mn. (MSM) NCSI: Oman’s GDP declines 14.2% by 3Q2015-end – According to figures issued by the National Centre for Statistics and Information (NCSI), Oman’s gross domestic product (GDP) at market prices registered a decline of 14.2% during January-September 2015 at OMR20.09bn as compared to OMR23.41bn in the same period of 2014. By 3Q2015-end, petroleum activities posted a sharp 38.5% fall to record OMR6.95bn as against OMR11.29bn in the year-ago period. Crude oil contributed OMR6.03bn with a significant drop of 42.7% as against OMR10.53bn in 2014, while natural gas posted a rise of 20% to reach OMR912.3mn as against OMR760.2mn in the year-ago period. Meanwhile, total value of non-petroleum activities registered a 4.7% growth by 3Q2015-end, reaching OMR14.08bn as compared to OMR13.45bn on 3Q2014 end. Oman’s GDP at producer prices during January-September 2015 decreased 15.4% to OMR20.54bn as compared to OMR24.28bn in the year-ago period. (GulfBase.com) Oman’s plans to award one more oil block in 2016 – The Omani government is planning to award one more oil block to an international oil company on a production sharing basis in the Al Wusta region in 2016. The government on Thursday had signed an oil concession agreement with Hydrocarbon Finder to take over an existing block on a production sharing basis. As per the agreement, Hydrocarbon Finder, a 100% locally-owned independent oil producer, will take over block seven from Petrogas for producing oil from the concession area, which spans over around 2,331 kilometers in the Al Wusta region. (GulfBase.com) Ibdar Bank invests £8mn in Manchester City project – Ibdar Bank has made an investment of £8mn in a prime new residential project in Manchester’s city center, UK. The project Angel Gardens will consist of 458 residential apartments and a total development value of £124mn. It forms part of the wide NOMA re-development project aimed at transforming Manchester city center. Ibdar is a Bahrain-based wholesale Islamic investment bank. (GulfBase.com) Finance Minister: Austerity plans in line with IMF – Bahraini Finance Minister Sheikh Ahmed bin Mohammed Al Khalifa has said that the country is planning austerity steps to cut its budget deficit in line with the International Monetary Fund (IMF) recommendations that could help the island Kingdom to sell its bonds, when it returns to international markets later in 2016. Bahrain is one of several Gulf Arab oil states using the IMF’s assistance to plan economic reforms as low crude prices put heavy pressure on state finances. The IMF is also providing valuable political cover for reforms. He said the Kingdom is expected to return to bond markets in 2016 to help finance its budget deficit, which is estimated by the IMF at about 15% of gross domestic product in 2016. He added that Bahrain's government action plan, currently underway, includes wide-ranging measures that will ensure the sustainability of Bahrain’s financial resources and development, benefiting the entire country. Earlier on January 29, 2016, the IMF urged Bahrain to take sizeable steps to reduce its budget deficit, saying it could introduce a value-added tax being planned by the Gulf States, cut spending on social transfers and freeze public-sector wages. (GulfBase.com) Batelco completes major global network expansion project – Bahrain Telecommunications Company (Batelco) has announced the completion of a major global network expansion project. The project allowed Batelco to boost its global business, ensure network diversity, avoid single points of failure, provide better country resiliency and efficiently use international capacities. (Bahrain Bourse) Bahrain Bourse announces listing of government T-Bills, Ijarah Sukuk – Bahrain Bourse has informed the listing of government treasury bills (T-Bills) and short-term Islamic lease (Ijarah) Sukuk. The bourse witnessed listing of three month T-Bills worth BHD210mn, along with six-month and nine-month T-Bills worth BHD105mn and BHD400mn, respectively. Ijarah Sukuk worth BHD78mn with six months maturity period was also listed. (Bahrain Bourse) AIB eyes France, Indonesia for expansion – Bahrain’s Al Baraka Islamic Bank (AIB) is planning to open a Shari’ah-compliant bank in France in 2017 to expand into Europe. France has one of the largest Muslim populations in Europe but cultural and legal obstacles have impeded the development of its Islamic finance industry. AIB CEO Adnan Ahmed Yousif said the bank is in the midst of launching an Islamic bank in France, but with the global financial crisis, the project was halted. It is now looking to revive the project again. He said AIB is also planning to acquire a bank in

- 7. Page 7 of 8 Indonesia either in 2016 or in 2017 and is in talks with the Indonesian central bank governor. He said the bank also wants to launch banking operations in China in 2016 and is awaiting a decision in March 2016 from Morocco’s central bank about its plans to enter the market there. (Reuters)

- 8. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 QSE Index S&P Pan Arab S&P GCC 2.0% 2.3% 2.1% 1.3% 3.2% 3.7% 4.9% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,115.34 (0.9) 1.6 5.1 MSCI World Index 1,532.68 0.1 (0.3) (7.8) Silver/Ounce 14.24 (1.7) 1.6 2.8 DJ Industrial 16,069.64 0.8 (0.1) (7.8) Crude Oil (Brent)/Barrel (FM Future) 33.89 2.4 5.3 (9.1) S&P 500 1,893.36 0.6 (0.7) (7.4) Crude Oil (WTI)/Barrel (FM Future) 33.22 2.8 3.2 (10.3) NASDAQ 100 4,506.68 0.9 (1.8) (10.0) Natural Gas (Henry Hub)/MMBtu 2.12 (5.5) (4.5) (8.5) STOXX 600 334.89 (0.9) 0.2 (7.8) LPG Propane (Arab Gulf)/Ton 35.00 4.9 4.1 (10.5) DAX 9,639.59 (1.8) (0.1) (10.0) LPG Butane (Arab Gulf)/Ton 52.00 2.0 6.1 (9.6) FTSE 100 5,931.78 (0.3) 1.1 (7.3) Euro 1.09 0.4 1.3 0.7 CAC 40 4,322.16 (0.7) 0.9 (6.1) Yen 118.82 0.1 0.0 (1.2) Nikkei 17,041.45 (0.6) 0.3 (9.1) GBP 1.44 0.9 0.7 (2.5) MSCI EM 722.23 0.9 1.6 (9.1) CHF 0.99 0.1 0.3 (1.1) SHANGHAI SE Composite 2,655.66 (2.9) (8.9) (26.0) AUD 0.71 0.8 1.2 (2.8) HANG SENG 19,195.83 0.8 0.6 (12.9) USD Index 98.51 (0.4) (1.1) (0.1) BSE SENSEX 24,469.57 (0.0) (0.5) (8.8) RUB 76.30 (2.3) (2.3) 5.2 Bovespa 38,630.19 0.5 2.5 (13.5) BRL 0.25 0.9 0.6 (2.7) RTS 727.13 3.2 5.2 (4.0) 109.4 95.1 94.0