Insolvency, Bankruptcy and Liquidation Explained

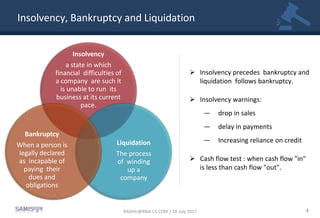

- 1. Insolvency, Bankruptcy and Liquidation 3 Insolvency a state in which financial difficulties of a company are such it is unable to run its business at its current pace. Liquidation The process of winding up a company Bankruptcy When a person is legally declared as incapable of paying their dues and obligations Insolvency precedes bankruptcy and liquidation follows bankruptcy. Insolvency warnings: — drop in sales — delay in payments — Increasing reliance on credit Cash flow test : when cash flow "in" is less than cash flow "out". RAGHU@RNA-CS.COM / 28 July 2017

- 2. Banks in India are going through unprecedented times with stressed loan portfolio touching all-time high. There is an apprehension that there could be further significant additions as many stressed loan accounts have been disguised as standard. Realizing the problem, RBI has attempted to force banks to clean up balance sheets and come out with many regulatory steps aimed at improving banks’ ability to deal with such stressed accounts. However, such frameworks have proved unsuccessful. India currently has multiple laws to deal with insolvency, which leads the entire resolution process fragmented, expensive and time-consuming with very low recovery rate. In this scenario, the Indian Government has introduced the Bankruptcy and Insolvency Code, 2016 which will consolidate the existing frameworks and create a new institutional structure. The Code creates time-bound processes for insolvency resolution of companies and individuals which thereby will help India improve its World Bank insolvency ranking. 4RAGHU@RNA-CS.COM / 28 July 2017 Background

- 3. Current stress in the banking sector March 2013 2014 2015 2016 Total Gross NPA Ratio (%) 3.27 3.86 4.37 7.61 Net NPA Ratio (%) 1.72 2.17 2.48 4.63 Stressed Assets/advances (%) NA 9.75 11.01 11.5 March 2013 2014 2015 2016 Public Sector Banks Gross NPA Ratio (%) 3.59 4.34 4.94 9.6 Net NPA Ratio (%) 1.99 2.53 2.9 6.1 Stressed Assets/advances (%) NA 11.04 12.68 14.5 March 2013 2014 2015 2016 Private Sector Banks Gross NPA Ratio (%) 1.86 1.82 2.14 2.7 Net NPA Ratio (%) 0.52 0.63 0.87 1.3 Stressed Assets/advances (%) NA 4.29 4.59 4.5 Stressed assets in the banking system Our intent is to have clean and fully provisioned banks’ balance sheets by March 2017 All out of the court debt restructuring processes like CDR, SDR, S4A and 5:25 have proved unsuccessful and bad loans have piled up in the system after their implementation Source:RBI 5RAGHU@RNA-CS.COM / 28 July 2017

- 4. Concerns of currently used options Option Concern CDR Lost charm after withdrawal of forbearance benefit by RBI from 1st April, 2015. Not helped much. Too many failures post CDR implies it deferred the inevitable. 5:25 Available for large cases and a few select industries only – Infrastructure and Core Industries. SDR For old cases cannot be forced upon. Existing management may continue in disguise. Finding new promoter is always a challenge Banks not comfortable towards steep discount to debt and need for refinancing S4A Current cash flows of company taken as basis to ascertain sustainable debt, so there are not enough companies which can come under its purview Terms and conditions of the loan cannot be changed. 6RAGHU@RNA-CS.COM / 28 July 2017

- 5. Erstwhile Legal Framework Presidency Towns Insolvency Act, 1909 / Provincial Insolvency Act, 1920 / Indian Partnership Act Applicable to individuals and partnerships Companies Act, 2013 / Companies Act, 1956 Deals with rehabilitation / revival / winding up of companies *only court supervised winding up available now under the 2013 Act; other proceedings under the Code Limited Liability Partnership Act, 2008 r/w. Limited Liability Partnership (Winding up and Dissolution) Rules, 2012 No provisions for rehabilitation / revival of LLPs SARFAESI / Recovery of Debt Due to Banks and Financial Institutions Act,1993 Debt recovery / enforcement of security No revival / rehabilitation of the defaulting entity SICA Revival / rehabilitation of only sick industrial companies CDR , JLF, SDR and S4A Introduced by RBI as out of court process No legal sanction Due to the complexity of multiple laws, the entire resolution procedure is fragmented, expensive and time-consuming with very low recovery rate. 7RAGHU@RNA-CS.COM / 28 July 2017

- 6. Some Statistics 8 Ease of doing business Rank 2017 0 5 10 15 20 25 Recovery Rate (in %) 100 90 80 70 60 50 40 30 20 10 0 Cost of liquidation (in %) 1.5 1.5 0.8 1 0.8 4 2 4.3 1.7 2.1 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 5 Time taken for liquidation (in years) 7 8 2 15 22 123 40 130 78 74 140 120 100 80 60 40 20 0 12 10 4 8 7 12 9 22.7 18 13 88.6 88.7 82.8 87.4 78.6 38.6 36.9 35.1 26 15.8

- 7. Why Code was needed? 9RAGHU@RNA-CS.COM / 28 July 2017

- 8. Objective of the Code The Insolvency and Bankruptcy Code, 2016 has been formed with the following objectives: To promote entrepreneurship; To make credit available; To balance the interest of all stakeholders by consolidating and amending the existing laws relating to insolvency and bankruptcy; To reduce the time of resolution for maximizing the value of assets. 10 Market needs freedom at a broadly three stages of a business – to start a business (free entry), to continue the business (fair competetion) and to discontinue the business (free exit) — M.S. Sahoo, Chairman – Insolvency and Bankruptacy Board of India RAGHU@RNA-CS.COM / 28 July 2017

- 9. Key Highlights of IBC 2016 The Code brings a paradigm shift from "Debtors in possession" to "Creditors in Control" Insolvency test moved from "erosion of net worth" to "payment default" Single insolvency and bankruptcy framework. It replaces/modifies/amends certain existing laws Time bound resolution process at each stage Establishment of Insolvency and Bankruptcy Board-a regulator as an independent body A clearly defined distribution of recovery proceeds Insolvency Professional to take over management and control of the Corporate Debtor Government dues would rank below the claims of other creditors Have provisions to deal with concealment, fraud and /or manipulation leading to fine and/or imprisonment Provide confidence to Lenders and Investors in the debt market 11RAGHU@RNA-CS.COM / 28 July 2017

- 10. Supreme Court (Question of law) Corporate Persons (Companies and LLPs Debt Recovery Tribunal Debt Recovery Appellate Tribunal Individuals / Partnerships 12 Legal Structure National Company Law Tribunal National Company Appellate Law Tribunal RAGHU@RNA-CS.COM / 28 July 2017

- 11. Institutional Framework The Insolvency and Bankruptcy Code, 2016 has introduced the following entities for successful implementation and smooth function. 13 Insolvency and Bankruptcy Board of India (IBBI) Adjudicating Authority (AA) Insolvency Professionals Agencies (IPA) Insolvency Professionals (IP) Information Utilities(IU) Regulatory authority of IPA, IP, and IU Empowered to make regulations in respect of all the processes, appointments, procedures, investigation, monitoring, etc. The AA will exercise jurisdiction during the insolvencyand liquidation process. For corporates, LLPs – NCLT is AA For individuals and partnerships – DRT is AA IPA are those specialized bodies/agencies that will be entrusted with the task of registration and governance of IPs IPs are appointed by IPA, who would take on the roles of Resolution Professional/Liqu idator/bankruptc y Trustee in the process of different entities An IU is an agency that is in charge of collecting, collating, authenticating and disseminating financial information RAGHU@RNA-CS.COM / 28 July 2017

- 12. Financial Debt 14 "financial debt" means a debt along with interest, if any, which is disbursed against the consideration for the time value of money and includes - money borrowed against the payment of interest; any amount raised by acceptance under any acceptance credit facility or its de-materialised equivalent; any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; the amount of any liability in respect of any lease or hire purchase contract which is deemed as a finance or capital lease under the Indian Accounting Standards or such other accounting standards as may be prescribed; receivables sold or discounted other than any receivables sold on nonrecourse basis; any amount raised under any other transaction, including any forward sale or purchase agreement, having the commercial effect of a borrowing; any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price and for calculating the value of any derivative transaction, only the market value of such transaction shall be taken into account; any counter-indemnity obligation in respect of a guarantee, indemnity bond, documentary letter of credit or any other instrument issued by a bank or financial institution; the amount of any liability in respect of any of the guarantee or indemnity for any of the items referred to in sub-clauses (a) to (h) of this clause; RAGHU@RNA-CS.COM / 28 July 2017

- 13. Some key definitions 15 Debt A liability or obligation in respect of a claim which is due from any person and includes financial debt and operational debt Default Non-payment of debt when whole or any part or installment of the amount of debt has become due and payable and is not repaid by the debtor or the corporate debtor, as the case may be Creditors Any person to whom a debt is owed and includes a financial creditor, an operational creditor, an unsecured creditor and a decree holder Financial creditors Any person to whom a financial debt is owed and includes a person to whom such debt has been legally assigned or transferred to; Includes Secured and Unsecured Financial Creditors Operational creditors A person to whom an operational debt is owed and includes any person to whom such debt has been legally assigned or transferred; Includes Secured and Unsecured Operational Creditors RAGHU@RNA-CS.COM / 28 July 2017

- 14. CorporateApplicant CIRP – Corporate Insolvency Resolution Process - 1 16 FinancialCreditor OperationalCreditor Filing of application on occurrence of default; Based on the information from IU, other financial creditor may file an application aswell Deliver a default notice to the corporate debtor on occurrence of default Filing of occurrence of default Adequate reply Not adequate reply Settlement of dues Dispute Along with the application, to furnish record of default and to propose name of interim resolution professional Filing of application To ascertain the existence of default, if satisfied, it shall accept, or otherwise reject Within 14 days Prior torejection Accept Suggest rectification Proceed with Phase II Re-apply Reject Within 7 days Alongwith the application, to furnish record of default and propose name of interim resolution professional.

- 15. CIRP – Corporate Insolvency Resolution Process - 2 17 Order of admission of application by NCLT; Declaration of moratorium; Public announcement as per the order of NCLT; Appointment of Interim Resolution Process Liquidation If contravention on implementation of resolutionplan If planrejected Interim resolution Professional to appoint committee of creditors (financial creditors); First meeting of creditors; CoC may accept the IRP appointed by NCLT or may appoint a new RP; For any option, the NCLT is required to be communicated. CoC to approve plan (75%) and submit to NCLT; NCLT may accept / reject plan; Implementation of plan; Moratorium ceases here; RP to submit records to IU / IBBI RP to appoint Resolution Applicant; RA to submit Resolution plan basis the IM; RP to examine and approve the Resolution Plan and submit to CoC for approval. RP to conduct the corporate insolvency resolution process; As many number of CoC meetings can be convened as necessary; RP shall prepare Information memorandum. The entire process shall be completed within Resolution Period (180 days; extendable by 90 days) RAGHU@RNA-CS.COM / 28 July 2017

- 16. Insolvency commencement date Insolvency resolution process period Insolvency means the period of one hundred and eighty days beginning from the insolvency commencement date and ending on one hundred and eightieth day or such period extended by NCLT not more than 90 days. means the date of admission of an application for initiating corporate insolvency resolution process by the Adjudicating Authority under sections 7, 9 or section 10, as the case may be; 18RAGHU@RNA-CS.COM / 28 July 2017

- 17. COC - Committee of Creditors The committee of creditors shall comprise all financial creditors of the corporate debtor: Related Party excluded and no right to participate or vote. If Consortium then each financial creditor will have right If a creditor is both FC and OC then debt to be bifurcated for voting If assigned then assignee has voting right as original 19 Voting Share means the share of the voting rights of a single financial creditor in the committee of creditors which is based on the proportion of the financial debt owed to such financial creditor in relation to the financial debt owed by the corporate debtor Apart from financial creditors following can attend but not vote Members of the suspended board One representative of the operational creditors (only if debt is more than 10% of total debt) However, absence of them will not make meeting invalid Committee of Creditors (COC) Voting Share Who can attend RAGHU@RNA-CS.COM / 28 July 2017

- 18. AA shall declare moratorium order on the insolvency commencement date prohibiting – — institution of suits or continuation of pending suits or proceedings against the Corporate Debtor including execution of any judgment, decree or order in any court of law, tribunal, arbitration panel or other authority — transferring, encumbering, alienating or disposing of any of its assets or any legal right or beneficial interest — recovery of any property by an owner or lessor — action to foreclose, recover or enforce any security interest created by the corporate debtor in respect of its property including any action under the SARFAESI Act, 2002 Moratorium shall have effect till the completion of the CIR process or liquidation order Moratorium 20RAGHU@RNA-CS.COM / 28 July 2017

- 19. Resolution Professional – Role 21 Management of operations of Corporate Debtor as going concern Public Announcement seeking Creditors Claims Appointment of Registered Valuers Receive and Collate all the claims Verification and Admission of Claims Constitution of Committee of Creditors Conducting first meeting of Committee of Creditors Determining the Voting share of the Creditors Reporting and submitting information to NCLT RAGHU@RNA-CS.COM / 28 July 2017

- 20. Resolution Applicant – Company / Promoter / PE / Competitor / Lender What can contain Resolution Plan – Hair cuts / waivers /selling businesses or assets partly or fully / fresh infusion of funds / change of management Selected resolution plans confirming to requirements are presented to the committee of creditors Approved resolution plan is submitted by RP to AA Order of AA Admits the plan – moratorium ceases to exist, RP forwards all records relating to the conduct of the corporate insolvency resolution process and the resolution plan to the IBBI Rejects the plan – liquidation to be ordered Resolution Plan 22RAGHU@RNA-CS.COM / 28 July 2017

- 21. 23 Filing of applicationto NCLT Admission of application 0 3 Public announcement 14 –ve14 Appointment of IRP and declarationof moratorium Appoint 2 registered valuers Creditors to submit theirclaims 7 21 23 Submission of records to NCLT 30 44 Circulation of Information memorandum 150 Submissionof Resolution Plan toRP Approval of plan by Committee of creditors Submissionof plan to NCLT 180 Acceptance / Rejection of plan byNCLT First Committee Creditors meeting IRP to verify claims CIRP-3 – Time Chart RAGHU@RNA-CS.COM / 28 July 2017

- 22. ORDER OF PRIORITY A. Entire insolvency resolution process cost and liquidationcost + + 24 Distribution of Assets / Waterfall B1 Workmen’s dues for the period of twenty-four months preceding the liquidation commencement date B2 Debts owed to a secured creditor in the event such secured creditor has relinquished security in the manner set out in section 52 C. Wages and any unpaid dues owed to employees other than workmen for the period of twelve months preceding the liquidation commencement date D. Financial debts owed to unsecured creditors E1. Any amount due to the Central Government and the State Government E2. Debts owed to a secured creditor for any amount unpaid following the enforcement of security interest F. Any remaining debts and dues G. Preference shareholders, if any H. Equity shareholders or partners, as the case may be RAGHU@RNA-CS.COM / 28 July 2017

- 23. Lokhandwala Kataria Constructions Vs Nisus Finance Investment Manager LLP: — After admission by NCLT Parties approached NCLAT for dismissing the case — NCLAT rejected the appeal — Parties approached Supreme Court and SC passed order in favour of them Essar Steel — CIRP would have adverse impact on the business of the Company and Questioned the validity of RBI directions at the Company’s current position — Finally NCLT admitted the case for CIRP initiation ICICI Bank Vs Starlog Enterprises Ltd — NCLAT imposed a penalty of Rs.50000 on ICICI for stating incorrect claim amount — Set aside the order given by NCLT Sandira D’Souza & Others Vs Electrans Shipping Pvt. Ltd Part of the claim is disputed before Labour Court by the Petitioner themselves. Takeaways from decided cases 25RAGHU@RNA-CS.COM / 28 July 2017

- 24. Other Important Points 26 161 companies have been admitted under CIRP Innoventive Industries Ltd is first company admitted on 17 Jan 2017 under CIRP against application filed by ICICI Bank Three earliest cases which were admitted sought for extension of Insolvency Resolution Time line – UB Engineering, Innovative Industries and Nicco Corporation Impeact to various stake holders Opportunities for Professionals RAGHU@RNA-CS.COM / 28 July 2017

- 25. raghu@rna-cs.com www.samistilegal.in +91 984 802 7782 ADVOCATES AND LEGAL ADVISORS RAGHU@RNA-CS.COM / 28 July 2017