Red Meat Outlook: Hogs & Pork

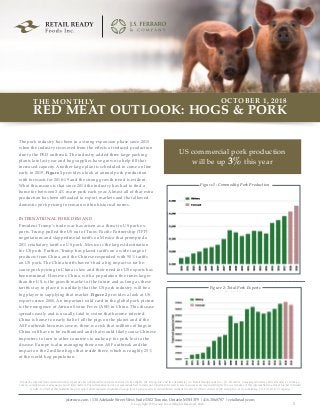

- 1. US commercial pork production will be up 3% this year The pork industry has been in a strong expansion phase since 2015 when the industry recovered from the effects of reduced production due to the PED outbreak. The industry added three large packing plants late last year and hog supplies have grown to help fill that increased capacity. Another large plant is scheduled to come on line early in 2019. Figure 1 provides a look at annual pork production with forecasts for 2018-19 and the strong growth trend is evident. What this means is that since 2014 the industry has had to find a home for between 3-4% more pork each year. Almost all of that extra production has been offloaded to export markets and that allowed domestic pork pricing to remain within historical norms. INTERNATIONAL PORK DEMAND President Trump’s trade war has arisen as a threat to US pork ex- ports. Trump pulled the US out of Trans-Pacific Partnership (TPP) negotiations and slapped metal tariffs on Mexico that prompted a 20% retaliatory tariff on US pork. Mexico is the largest destination for US pork. Further, Trump has placed tariffs on a wide range of products from China, and the Chinese responded with 50% tariffs on US pork. The China tariffs haven’t had a big impact so far be- cause pork pricing in China is low and their need for US exports has been minimal. However, China, with a population five times larger than the US, is the growth market of the future and as long as these tariffs stay in place it is unlikely that the US pork industry will be a big player in supplying that market. Figure 2 provides a look at US exports since 2000. An important wild-card in the global pork picture is the emergence of African Swine Fever (ASF) in China. This disease spreads easily and is usually fatal to swine that become infected. China is home to nearly half of all the pigs on the planet and if the ASF outbreak becomes severe, there is a risk that millions of hogs in China will have to be euthanized and that would likely cause Chinese importers to turn to other countries to make up for pork lost to the disease. Europe is also managing their own ASF outbreak and the impact on the 2 million hogs that reside there, which is roughly 25% of the world hog population. While the information contained in this report has been obtained from sources believed to be reliable, JSF Group Inc. and its subsidiaries (i.e. Retail Ready Foods Inc., J.S. Ferraro & Company) disclaims all warranties as to the ac- curacy, completeness or adequacy of such information. The information is not a recommendation to trade nor investment research. User assumes sole responsibility for the use it makes of this information to achieve his/her intended results. No Part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of JSF Group Inc. or its subsidiary, J.S. Ferraro & Company. Figure 1: Commodity Pork Production RED MEAT OUTLOOK: HOGS & PORK THE MONTHLY OCTOBER 1, 2018 jsferraro.com | 130 Adelaide Street West, Suite 3302 Toronto, Ontario M5H 3P5 | 416.306.8787 | retailready.com © Copyright JSF Group Inc. All Rights Reserved, 2018. 1 Figure 2: Total Pork Exports

- 2. As of today, we are working under the assumption that Chinese officials will get ASF under control, but pork users must keep in mind that there is a chance that the outbreak might expand rapidly and thus cause global pork prices to rise sharply. US DOMESTIC PORK SUPPLY We project that US commercial pork production will be up 3% this year while exports look like they may be up a similar amount. On a per capita basis, Americans will consume almost 2% more pork in 2018. That has been a concern at a time when beef and poultry pro- duction is also expanding. But, the industry has already invested in expansion and so there’s little doubt that an abundance of pork will be produced for the foreseeable future. Hog slaughter, and thus pork production, is seasonal with the largest production typically coming in the fourth quarter. As we approach Q4, the industry is bracing for big production once again. The recent hurricane in the Carolinas forced several packing plants to suspend operations and that short-term disruption reduced production and caused price levels in the pork complex to rise. But now those plants have come back online and we are regularly seeing daily hog kills in the area of 470,000 head per day. Kills during October are expected to exceed 2.5 million head per week and are likely to climb to 2.6 million head per week at their peak in late November. That seasonal growth in production is expect- ed to pressure product prices, but that is normal for the last quarter of the year. US DOMESTIC PORK DEMAND With big production coming down the pipeline, demand becomes particularly important. Pork demand has had some rough spots in 2018 and there is always the risk that demand could fail to live up to expectations in Q4. The first soft spot in demand came in late March and April, when the pork cutout fell to the mid $60 area and cash hogs into the low $50s. Those price levels were well below what is normally experienced in early spring. The second soft spot material- ized in early August and just happened to coincide with a transitory bulge in hog supplies. That incident drove the cutout down to the mid $60s and hog prices into the mid $40s. Demand has improved since then, but after those two events, the market remains quite ner- vous heading into a period of the year when production will be at its highest. Currently, the cutout is trading around $80, but most of that strength is probably related to the hurricane-related supply reduction that is now behind us and kills have ramped back up. We expect price levels to retreat in the weeks ahead. CONCLUSION Even good demand cannot absorb the large Q4 production increases without some price concession. The decline is likely to be gradual, but by the end of November the cutout could be trading at $70 or below. Loins, butts and hams are at most risk of price declines while bellies, ribs and picnics may do a better job of holding near current price levels. Our advice to buyers is to delay purchases as long as possible on most pork items since price levels are expected to work lower as kills increase during October and November. Bellies and bacon are the exception, and for those items there is additional upside risk so taking some coverage at today’s levels might not be a bad idea. For those looking to put product in the freezer, the most advan- tageous price levels are likely to be found between mid-November and early December when kills are near their tops. That will likely be the optimal time to move product into cold storage in anticipation of higher pork pricing in the first half of 2019. Cash hogs are likely to follow the pork market lower in Q4. Pork packing margins are currently near $25/hd and will likely remain in the low to mid $20s for most of Q4. Packers will have substantial leverage over producers during the fourth quarter due to large hog supplies. We currently project the Lean Hog Index to move from its current value in the mid $60s down to the mid $50s by late November. After that, hog supplies should slowly tighten and that might allow the index to get back into the $57-59 range in mid-De- cember when the December futures expire. Table 1 provides our forecasts for the next six weeks for all of the pork primals and the Lean Hog Index. While the information contained in this report has been obtained from sources believed to be reliable, JSF Group Inc. and its subsidiaries (i.e. Retail Ready Foods Inc., J.S. Ferraro & Company) disclaims all warranties as to the accuracy, completeness or adequacy of such information. The information is not a recommendation to trade nor investment research. User assumes sole responsibility for the use it makes of this information to achieve his/her intended results. No Part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of JSF Group Inc. or its subsidiary, J.S. Ferraro & Company. : J.S. Ferraro & Company and Retail Ready Foods Inc. are part of the JSF Group of companies. RED MEAT OUTLOOK: HOGS & PORK THE MONTHLY OCTOBER 1, 2018 jsferraro.com | 130 Adelaide Street West, Suite 3302 Toronto, Ontario M5H 3P5 | 416.306.8787 | retailready.com © Copyright JSF Group Inc. All Rights Reserved, 2018. 2 Table 1: JSF Cattle & Beef Price Forecasts Dr. Rob Murphy is an agricultural economist and business leader with over 27 years in the industry. He has a wealth of experience in the North American meat and livestock industries studying, analyzing and predicting market movements. DR. ROB MURPHY BS, MS, PhD Agri Economics, Executive Vice President, Research & Analysis, J.S. Ferraro & Company E: Rob.Murphy@jsferraro.com Table 1: JSF Cattle & Beef Price Forecasts Table 1: JSF Hog & Pork Price Forecasts