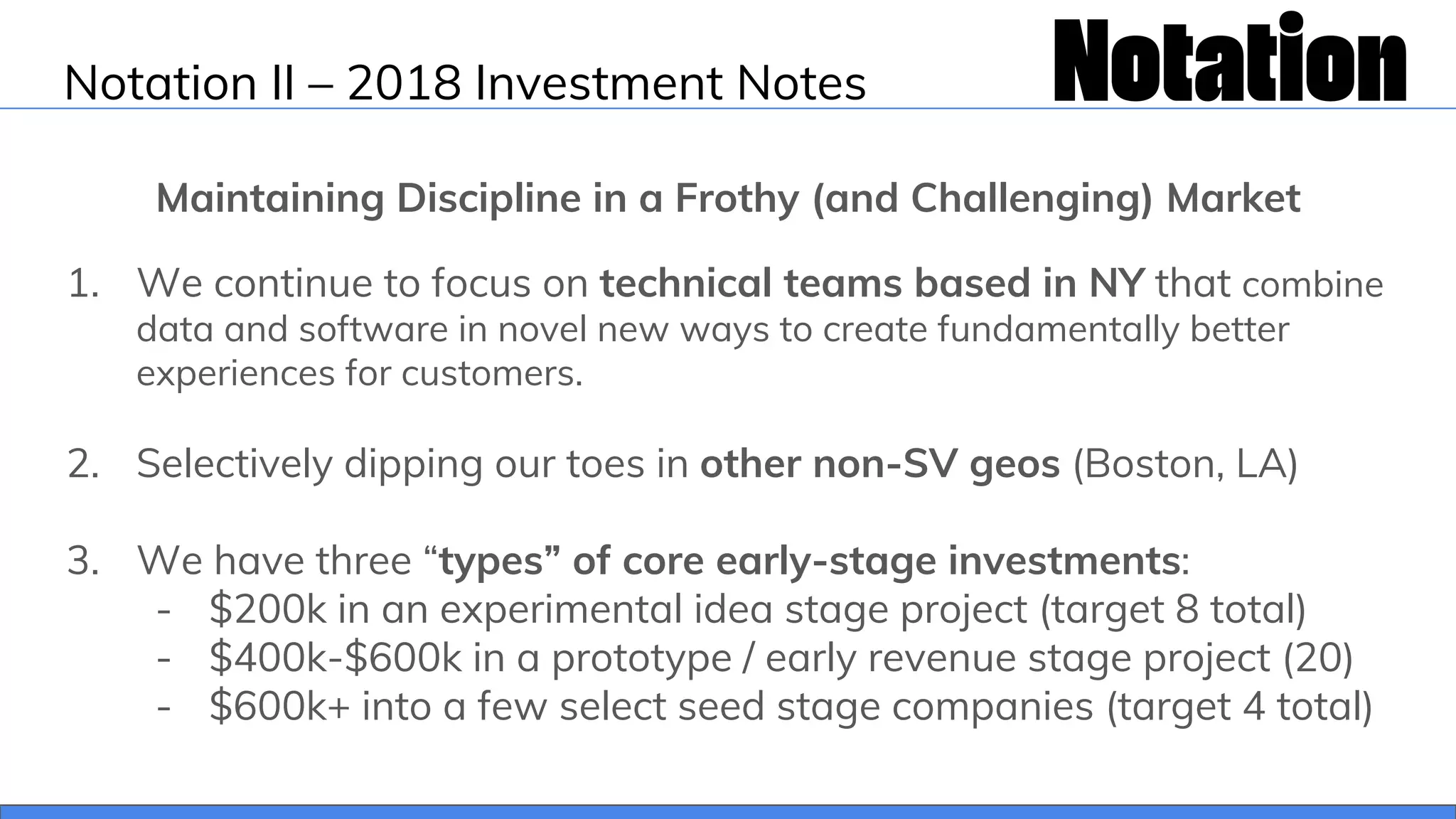

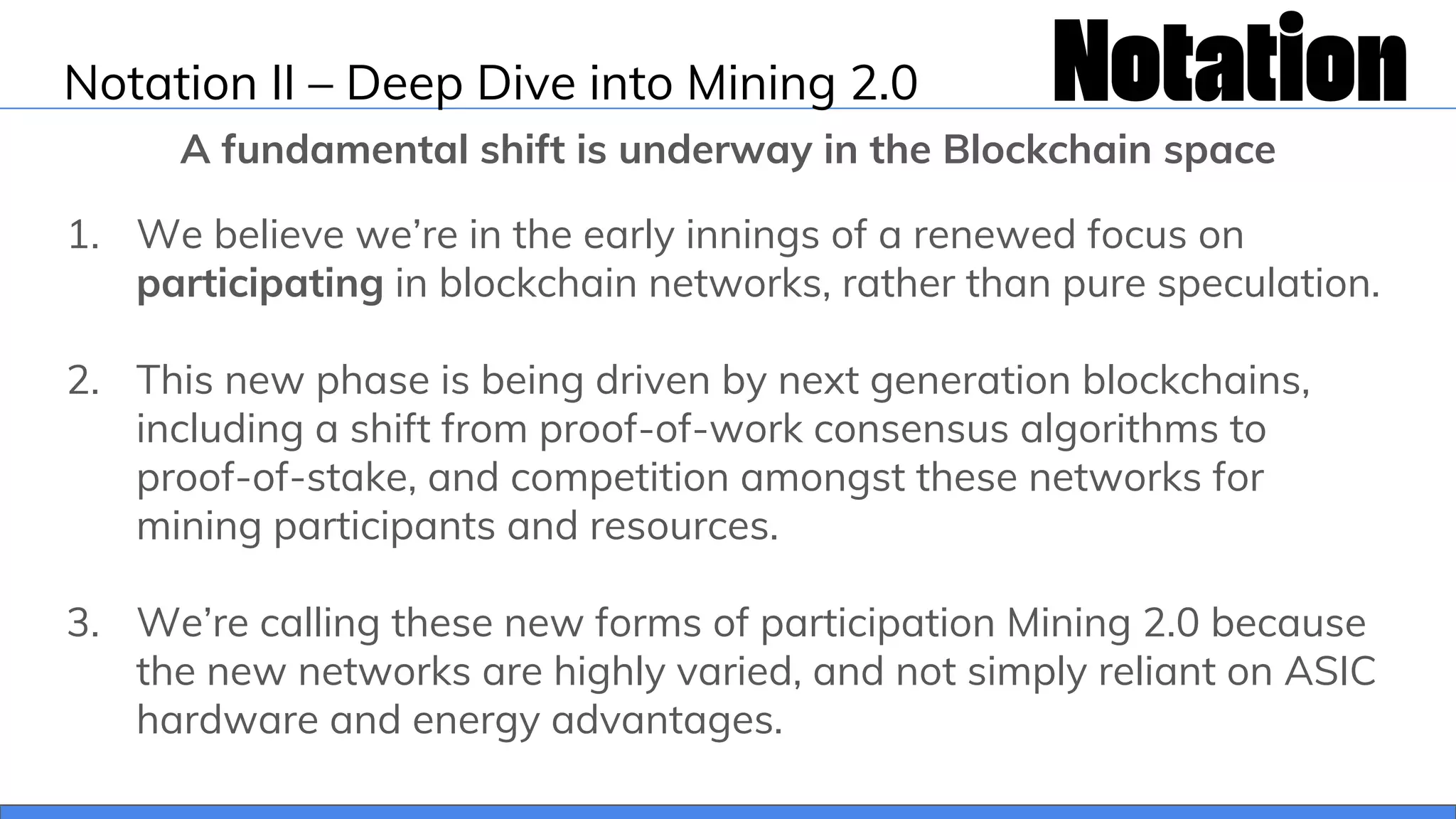

Notation reviewed the performance of its first two funds. Notation I has a 24.76% IRR and $900k still available for investment. Notation II has invested $3.4M of its $27.8M fund in 7 core companies focused on data and infrastructure. Notation sees opportunities in mining 2.0 and partnered with Bison Trails on Livepeer. For 2019, Notation wants a more diverse portfolio across early-stage investment types and new themes like health while maintaining discipline in a frothy market. Feedback and discussion on these strategies were discussed.

![Notation I - Notable Companies

[REDACTED - Company Sensitive Info]](https://image.slidesharecdn.com/notationannualmeeting2018-octpublic-190109154318/75/Notation-Annual-Meeting-Oct-2018-5-2048.jpg)

![Notation I - Potential Breakouts

[REDACTED - Company Sensitive Info]](https://image.slidesharecdn.com/notationannualmeeting2018-octpublic-190109154318/75/Notation-Annual-Meeting-Oct-2018-6-2048.jpg)

![Notation I - Challenges + Lessons Learned

[REDACTED - Company Sensitive Info]](https://image.slidesharecdn.com/notationannualmeeting2018-octpublic-190109154318/75/Notation-Annual-Meeting-Oct-2018-7-2048.jpg)