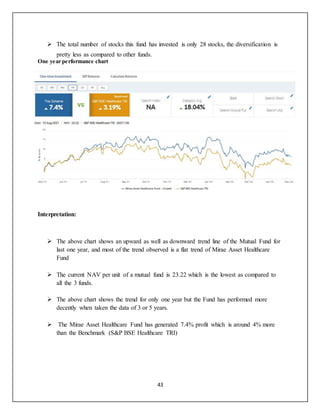

This document is a project report on a comparative study of mutual funds in India submitted by Nikhil Gupta to Thakur Institute of Management Studies and Research. It includes a project completion certificate, declaration, acknowledgements, executive summary, list of figures/charts, table of contents, and introduction to mutual funds which discusses the history of mutual funds in India, how they work, types of mutual funds, NAV, objectives of the study and limitations. The introduction provides a high-level overview of mutual funds as a way to pool money from investors which is then invested in stocks, bonds and other securities by professional managers for the benefit of the investors.

![49

xi. Other Costs – There are some indirect costs incurred by investors during the investment

tenure. This includes charges related to opening a Demat account, maintaining the Demat

account, brokerage charges, etc. While buying and selling stocks, a security transaction

tax is levied which has to be paid by investors. Included in this category are expenses not

included in the categories "Management Fees" or "Distribution [and/or Service] (12b-1)

Fees." Examples include: shareholder service expenses that are not included in the

"Distribution [and/or Service] (12b-1) Fees" category; custodial expenses; legal

expenses; accounting expenses; transfer agent expenses; and other administrative

expenses

Fund houses use the TER formula to finalise expense ratio per investor. TER or Total

Expense Ratio is what you get when you divide the total expense incurred in an

accounting period X 100 by the fund’s total net assets.

Every mutual fund comes in two variants. They can directly approach the AMC or buy

through an intermediary. It is cost-efficient to invest in direct funds, that is, buying

directly from the AMC. This is because you are exempt from the potential commission

you indirectly pay to an agent or distributor. However, understanding the market trends

and how a specific fund can meet your goals require plenty of research and market

expertise and this where an intermediary plays a critical role.

It is better to approach a qualified intermediary for guidance if you are not market savvy.

Plans bought this way are regular funds. They can be the same fund. However, availing

professional expertise means you will have to pay a commission to the distributor. This

becomes part of the overall expense ratio and pushes it higher. Regular plans come with a

host of benefits like instant and one-time KYC and convenience.](https://image.slidesharecdn.com/project1-functional-220505200625-1d893544/85/Functional-management-49-320.jpg)