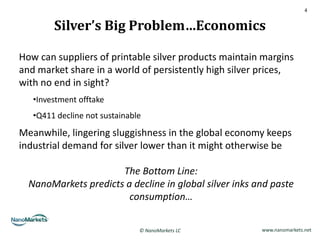

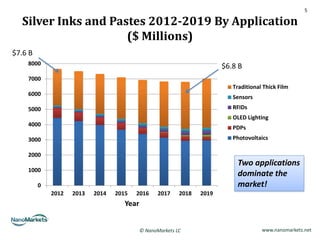

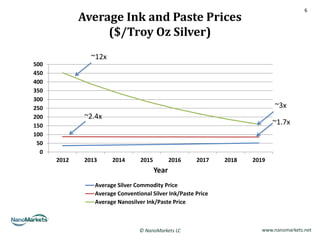

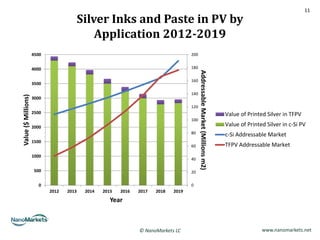

NanoMarkets hosted a webinar on January 5th, 2012 about the market for silver inks and pastes from 2012-2019. They predicted a decline in the global market due to high silver prices and problems in the photovoltaic sector, though some growth was expected in sensors and flexible electronics. Alternatives to silver such as copper and aluminum may gain market share. Opportunities exist in developing products that reduce costs and enable miniaturization.