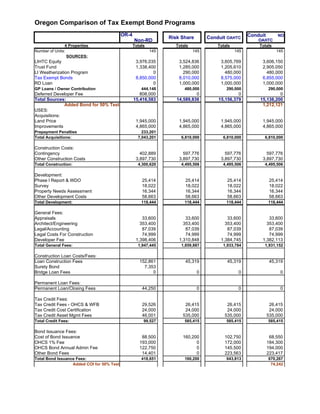

Oregon Tax Exempt Bond Program Comparison

- 1. Oregon Comparison of Tax Exempt Bond Programs OR-4 Conduit NO Risk Share Conduit OAHTC Non-RD OAHTC 4 Properties Totals Totals Totals Totals Number of Units: 145 145 145 145 SOURCES: LIHTC Equity 3,976,035 3,524,836 3,605,769 3,606,150 Trust Fund 1,338,400 1,285,000 1,205,610 2,905,050 LI Weatherization Program 0 290,000 480,000 480,000 Tax Exempt Bonds 8,850,000 8,010,000 8,575,000 6,855,000 RD Loan 0 1,000,000 1,000,000 1,000,000 GP Loans / Owner Contribution 444,148 480,000 290,000 290,000 Deferred Developer Fee 808,000 0 0 0 Total Sources: 15,416,583 14,589,836 15,156,379 15,136,200 Added Bond for 50% Test 1,212,121 USES: Acquisitions: Land Price 1,945,000 1,945,000 1,945,000 1,945,000 Improvements 4,865,000 4,865,000 4,865,000 4,865,000 Prepayment Penalties 233,201 Total Acquisitions: 7,043,201 6,810,000 6,810,000 6,810,000 Construction Costs: Contingency 402,889 597,776 597,776 597,776 Other Construction Costs 3,897,730 3,897,730 3,897,730 3,897,730 Total Construction: 4,300,620 4,495,506 4,495,506 4,495,506 Development: Phase l Report & WDO 25,414 25,414 25,414 25,414 Survey 18,022 18,022 18,022 18,022 Property Needs Assessment 16,344 16,344 16,344 16,344 Other Development Costs 58,663 58,663 58,663 58,663 Total Development: 118,444 118,444 118,444 118,444 General Fees: Appraisals 33,600 33,600 33,600 33,600 Architect/Engineering 353,400 353,400 353,400 353,400 Legal/Accounting 87,039 87,039 87,039 87,039 Legal Costs For Construction 74,999 74,999 74,999 74,999 Developer Fee 1,398,406 1,310,848 1,384,745 1,382,113 Total General Fees: 1,947,445 1,859,887 1,933,784 1,931,152 Construction Loan Costs/Fees: Loan Construction Fees 152,861 45,319 45,319 45,319 Surety Bond 7,353 Bridge Loan Fees 0 0 0 0 Permanent Loan Fees: Permanent Loan/Closing Fees 44,250 0 0 0 Tax Credit Fees: Tax Credit Fees - OHCS & WFB 29,526 26,415 26,415 26,415 Tax Credit Cost Certification 24,000 24,000 24,000 24,000 Tax Credit Asset Mgmt Fees 46,001 535,000 535,000 535,000 Total Credit Fees: 99,527 585,415 585,415 585,415 Bond Issuance Fees: Cost of Bond Issuance 88,500 160,200 102,750 68,550 OHCS 1% Fee 193,000 0 172,000 184,300 OHCS Bond Annual Admin Fee 122,750 0 145,500 194,000 Other Bond Fees 14,401 0 223,563 223,417 Total Bond Issuance Fees: 418,651 160,200 643,813 670,267 Added COI for 50% Test 74,242

- 2. Interest: Construction Period Portion 268,000 Acquisition Portion 390,631 232,567 241,600 197,599 Other: Lease-up Period Portion 228,880 Total Interest: 887,511 232,567 241,600 197,599 Reserves/Contingencies: Lease-up / Operating Reserve 0 0 0 0 Development 15,000 20,000 20,000 20,000 Tenant Dislocation Costs 262,500 262,500 262,500 262,500 Deposit to Replacement Reserves 0 0 0 0 3 Mos Debt Service 119,221 0 0 0 Total Reserves/Contingencies: 396,721 282,500 282,500 282,500 Total Uses of Funds: 15,416,583 14,589,836 15,156,379 15,136,200 Surplus / (Gap Funding) 0 (0) (0) 0