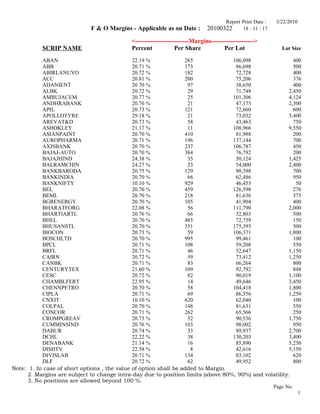

Moneysukh Margin level report 22/3/2010

- 1. Report Print Date : 3/22/2010 F & O Margins - Applicable as on Date : 20100322 18 : 11 : 17 <-------------------------Margins--------------------> SCRIP NAME Percent Per Share Per Lot Lot Size ABAN 22.19 % 265 106,098 400 ABB 20.71 % 173 86,698 500 ABIRLANUVO 20.72 % 182 72,728 400 ACC 20.81 % 200 75,206 376 ADANIENT 20.70 % 97 38,650 400 ALBK 20.72 % 29 71,748 2,450 AMBUJACEM 20.77 % 25 101,306 4,124 ANDHRABANK 20.76 % 21 47,173 2,300 APIL 20.73 % 121 72,660 600 APOLLOTYRE 29.18 % 21 73,032 3,400 AREVAT&D 20.73 % 58 43,463 750 ASHOKLEY 21.17 % 11 108,966 9,550 ASIANPAINT 20.70 % 410 81,988 200 AUROPHARMA 20.71 % 196 137,144 700 AXISBANK 20.70 % 237 106,787 450 BAJAJ-AUTO 20.70 % 384 76,792 200 BAJAJHIND 24.38 % 35 50,124 1,425 BALRAMCHIN 24.27 % 23 54,000 2,400 BANKBARODA 20.75 % 129 90,398 700 BANKINDIA 20.70 % 66 62,486 950 BANKNIFTY 10.10 % 929 46,453 50 BEL 20.70 % 459 126,598 276 BEML 20.70 % 218 81,636 375 BGRENERGY 20.70 % 105 41,904 400 BHARATFORG 22.08 % 56 111,790 2,000 BHARTIARTL 20.76 % 66 32,803 500 BHEL 20.70 % 485 72,759 150 BHUSANSTL 20.70 % 351 175,393 500 BIOCON 20.73 % 59 106,371 1,800 BOSCHLTD 20.70 % 995 99,461 100 BPCL 20.71 % 108 59,208 550 BRFL 20.71 % 46 52,647 1,150 CAIRN 20.72 % 59 73,412 1,250 CANBK 20.71 % 83 66,264 800 CENTURYTEX 21.60 % 109 92,792 848 CESC 20.72 % 82 90,019 1,100 CHAMBLFERT 22.95 % 14 49,646 3,450 CHENNPETRO 20.70 % 58 104,418 1,800 CIPLA 20.71 % 69 86,556 1,250 CNXIT 10.10 % 620 62,040 100 COLPAL 20.70 % 148 81,631 550 CONCOR 20.71 % 262 65,566 250 CROMPGREAV 20.73 % 52 90,536 1,750 CUMMINSIND 20.76 % 103 98,002 950 DABUR 20.74 % 33 89,937 2,700 DCHL 22.22 % 38 130,203 3,400 DENABANK 21.14 % 16 85,890 5,250 DISHTV 22.58 % 8 42,616 5,150 DIVISLAB 20.71 % 134 83,102 620 DLF 20.72 % 62 49,952 800 Note: 1. In case of short options , the value of option shall be added to Margin. 2. Margins are subject to change intra-day due to position limits (above 80%, 90%) and volatility. 3. No positions are allowed beyond 100 %. Page No: 1

- 2. Report Print Date : 3/22/2010 F & O Margins - Applicable as on Date : 20100322 18 : 11 : 17 <-------------------------Margins--------------------> SCRIP NAME Percent Per Share Per Lot Lot Size DRREDDY 20.71 % 263 105,058 400 EDUCOMP 21.49 % 162 60,634 375 EKC 21.48 % 25 50,660 2,000 ESSAROIL 22.08 % 30 42,939 1,412 FEDERALBNK 20.74 % 53 45,154 851 FINANTECH 20.70 % 336 50,467 150 FORTIS 21.35 % 38 49,290 1,300 FSL 21.80 % 6 59,850 9,500 GAIL 20.71 % 85 95,333 1,125 GESHIP 20.72 % 59 70,722 1,200 GLAXO 20.70 % 361 108,381 300 GMRINFRA 20.85 % 12 29,888 2,500 GODREJIND 20.98 % 30 39,611 1,300 GRASIM 20.70 % 601 105,790 176 GSPL 20.80 % 18 109,617 6,100 GTL 20.73 % 85 63,521 750 GTLINFRA 20.88 % 9 41,977 4,850 GTOFFSHORE 20.70 % 87 86,530 1,000 GVKPIL 20.79 % 9 41,278 4,750 HCC 20.75 % 28 59,745 2,100 HCLTECH 20.70 % 77 99,626 1,300 HDFC 20.70 % 546 81,892 150 HDFCBANK 20.70 % 380 76,053 200 HDIL 22.53 % 64 49,246 774 HEROHONDA 20.70 % 403 80,631 200 HINDALCO 22.45 % 38 134,229 3,518 HINDPETRO 20.72 % 66 42,959 650 HINDUNILVR 20.73 % 47 47,275 1,000 HINDZINC 20.70 % 258 128,833 500 HOTELEELA 20.76 % 10 74,100 7,500 IBREALEST 26.03 % 39 50,765 1,300 ICICIBANK 20.70 % 194 67,839 350 ICSA 21.65 % 29 34,212 1,200 IDBI 20.70 % 24 57,288 2,400 IDEA 21.67 % 15 39,703 2,700 IDFC 20.72 % 34 99,504 2,950 IFCI 21.00 % 11 83,055 7,880 INDHOTEL 21.76 % 22 83,841 3,798 INDIACEM 20.77 % 27 39,259 1,450 INDIAINFO 21.95 % 26 64,025 2,500 INDIANB 20.76 % 34 75,768 2,200 INFOSYSTCH 20.70 % 572 114,366 200 IOB 20.75 % 18 54,265 2,950 IOC 20.73 % 62 74,640 1,200 ISPATIND 21.02 % 4 50,111 12,450 ITC 20.72 % 54 61,048 1,125 IVRCLINFRA 20.76 % 34 68,120 2,000 JINDALSAW 20.73 % 46 227,700 5,000 JINDALSTEL 20.71 % 142 136,315 960 JISLJALEQS 22.42 % 215 53,849 250 JPASSOCIAT 22.41 % 33 55,636 1,688 Note: 1. In case of short options , the value of option shall be added to Margin. 2. Margins are subject to change intra-day due to position limits (above 80%, 90%) and volatility. 3. No positions are allowed beyond 100 %. Page No: 1

- 3. Report Print Date : 3/22/2010 F & O Margins - Applicable as on Date : 20100322 18 : 11 : 17 <-------------------------Margins--------------------> SCRIP NAME Percent Per Share Per Lot Lot Size JPPOWER 20.70 % 14 43,641 3,125 JSWSTEEL 21.39 % 263 108,558 412 KFA 21.85 % 11 45,603 4,250 KOTAKBANK 20.71 % 155 85,014 550 KSOILS 20.86 % 14 82,954 5,900 LICHSGFIN 20.71 % 167 70,818 425 LITL 23.09 % 12 75,635 6,380 LT 20.71 % 335 67,005 200 LUPIN 20.72 % 341 119,292 350 M&M 21.72 % 228 71,089 312 MARUTI 20.70 % 290 57,934 200 MCDOWELL-N 20.71 % 278 69,475 250 MCLEODRUSS 22.54 % 58 52,389 900 MINIFTY 10.10 % 527 10,533 20 MLL 21.57 % 13 61,397 4,900 MOSERBAER 22.70 % 17 41,679 2,475 MPHASIS 20.70 % 138 110,340 800 MRPL 20.79 % 15 68,775 4,450 MTNL 20.75 % 15 48,912 3,200 MUNDRAPORT 20.71 % 151 45,216 300 NAGARCONST 20.76 % 33 65,400 2,000 NAGARFERT 20.91 % 7 34,309 5,250 NATIONALUM 20.82 % 83 47,498 575 NEYVELILIG 20.70 % 32 46,647 1,475 NIFTY 10.10 % 527 26,327 50 NOIDATOLL 20.80 % 7 58,589 8,200 NTPC 20.73 % 42 68,039 1,625 OFSS 20.70 % 478 143,358 300 ONGC 20.70 % 220 49,461 225 ONMOBILE 21.63 % 86 47,284 550 OPTOCIRCUI 20.73 % 46 93,299 2,040 ORCHIDCHEM 22.04 % 34 72,083 2,100 ORIENTBANK 22.44 % 66 79,446 1,200 PANTALOONR 20.73 % 80 67,698 850 PATELENG 20.72 % 92 92,470 1,000 PATNI 20.70 % 109 142,006 1,300 PETRONET 20.70 % 16 69,960 4,400 PFC 20.71 % 53 64,002 1,200 PIRHEALTH 20.71 % 85 128,010 1,500 PNB 20.70 % 198 59,252 300 POLARIS 22.12 % 38 106,610 2,800 POWERGRID 20.71 % 22 42,928 1,925 PRAJIND 20.78 % 17 38,302 2,200 PTC 20.75 % 23 54,614 2,350 PUNJLLOYD 20.75 % 37 55,185 1,500 RANBAXY 20.72 % 95 76,324 800 RCOM 20.71 % 36 24,857 700 RECLTD 20.77 % 52 101,078 1,950 RELCAPITAL 20.71 % 162 44,636 276 RELIANCE 20.71 % 222 66,698 300 RELINFRA 20.71 % 210 58,030 276 Note: 1. In case of short options , the value of option shall be added to Margin. 2. Margins are subject to change intra-day due to position limits (above 80%, 90%) and volatility. 3. No positions are allowed beyond 100 %. Page No: 1

- 4. Report Print Date : 3/22/2010 F & O Margins - Applicable as on Date : 20100322 18 : 11 : 17 <-------------------------Margins--------------------> SCRIP NAME Percent Per Share Per Lot Lot Size RELMEDIA 21.88 % 48 29,031 600 RENUKA 26.75 % 20 100,775 5,000 RNRL 20.81 % 13 46,256 3,576 ROLTA 20.73 % 37 66,978 1,800 RPOWER 20.76 % 30 59,220 2,000 SAIL 20.71 % 50 67,028 1,350 SBIN 20.71 % 423 55,794 132 SCI 20.72 % 33 78,156 2,400 SESAGOA 22.29 % 99 148,395 1,500 SIEMENS 20.71 % 151 113,898 752 SINTEX 20.73 % 57 79,772 1,400 STER 20.71 % 169 73,921 438 STERLINBIO 21.17 % 23 57,000 2,500 SUNPHARMA 20.71 % 354 79,702 225 SUNTV 22.49 % 94 93,515 1,000 SUZLON 22.45 % 16 49,335 3,000 SYNDIBANK 20.73 % 18 67,754 3,800 TATACHEM 20.72 % 64 86,879 1,350 TATACOMM 20.71 % 60 31,658 525 TATAMOTORS 23.53 % 179 151,895 850 TATAPOWER 20.70 % 277 55,369 200 TATASTEEL 20.91 % 131 100,447 764 TATATEA 20.73 % 197 108,523 550 TCS 20.71 % 172 171,650 1,000 TECHM 20.71 % 189 113,457 600 TITAN 20.70 % 372 76,611 206 TRIVENI 27.86 % 39 148,629 3,850 TTML 20.72 % 5 52,720 10,450 TULIP 20.71 % 180 89,998 500 TV-18 20.72 % 15 27,941 1,825 UCOBANK 20.78 % 12 58,025 5,000 ULTRACEMCO 20.72 % 233 93,056 400 UNIONBANK 20.75 % 57 59,971 1,050 UNIPHOS 20.72 % 32 45,059 1,400 UNITECH 20.94 % 15 67,365 4,500 VIDEOIND 20.70 % 47 40,091 854 VIJAYABANK 20.87 % 10 67,827 6,900 VOLTAS 20.78 % 37 98,699 2,700 WELGUJ 20.73 % 57 91,784 1,600 WIPRO 20.71 % 151 90,768 600 YESBANK 20.91 % 50 110,407 2,200 ZEEL 20.73 % 54 75,950 1,400 Note: 1. In case of short options , the value of option shall be added to Margin. 2. Margins are subject to change intra-day due to position limits (above 80%, 90%) and volatility. 3. No positions are allowed beyond 100 %. Page No: 1