The Bitcoin Business Ecosystem (2015)

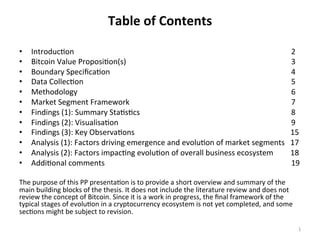

- 1. Table of Contents • Introduc)on 2 • Bitcoin Value Proposi)on(s) 3 • Boundary Specifica)on 4 • Data Collec)on 5 • Methodology 6 • Market Segment Framework 7 • Findings (1): Summary Sta)s)cs 8 • Findings (2): Visualisa)on 9 • Findings (3): Key Observa)ons 15 • Analysis (1): Factors driving emergence and evolu)on of market segments 17 • Analysis (2): Factors impac)ng evolu)on of overall business ecosystem 18 • Addi)onal comments 19 The purpose of this PP presenta)on is to provide a short overview and summary of the main building blocks of the thesis. It does not include the literature review and does not review the concept of Bitcoin. Since it is a work in progress, the final framework of the typical stages of evolu)on in a cryptocurrency ecosystem is not yet completed, and some sec)ons might be subject to revision. 1

- 3. The Bitcoin system (protocol, P2P network, global ledger/blockchain) exhibits two dis)nguishing proper)es (censorship-resistance and immutability) that serve as the base for the plaYorm’s value proposi)on, which can be divided into four parts: 1. Censorship-resistant digital cash • Non-sovereign/stateless à neutral, global and borderless • Irreversibility of transac)ons • User empowerment: “Be your own bank” 2. P2P payment network • Promise of low transac)on fees and rapid se_lement • High resilience and robustness: no single point of failure because no intermediaries • No need for storing confiden)al data (iden)ty, credit card informa)on, …) 3. New asset class (“Digital Gold”) • First digital bearer instrument: ar)ficially scarce because of fixed supply • Shares key proper)es of gold and even improves on certain quali)es (divisibility, transportability, storage costs, …) • High vola)lity and almost no correla)on to other major asset classes à good asset for specula)on/investment 4. Replicated, permanent 2me-stamped file system (term borrowed from Gideon Greenspan) • Immutability property enables the verifica)on of data existence and authen)city à proof-of-existence, data registry, … • Possibility to act as a base layer for complex overlay networks via meta-protocols à non-currency/non-monetary applica)ons (1), (2) and (3) are closely linked together, in that they relate to “currency/monetary applica)ons”. However, (1) and (3) are conflic)ng: defla)onary nature of bitcoin incen)vises hoarding and discourages use as medium of exchange. Bitcoin Value Proposi2on(s) 3

- 4. The Bitcoin ecosystem – Core developers: maintain and develop the open-source protocol – Companies and projects: cons)tute the business ecosystem – Other stakeholders: VC firms, governments, regulators, universi)es/researchers, … This study is going to focus exclusively on the business ecosystem that has formed around the open technological blocks and extends the core plaYorm’s func)onali)es by building complementary components and services that increase the overall value of the plaYorm. Inclusion criteria Projects and firms are subject to inclusion if they meet the following criteria: – Core ac)vi)es/opera)ons related to Bitcoin in the 3 following ways: • Use of the digital currency/asset bitcoin • Use of the integrated payment network • Use of the underlying data structure for non-monetary applica)ons à These do not include en))es accep)ng bitcoin as one of several payment methods (except if other cryptocurrencies) nor ledger-agnos)c plaYorms that offer Bitcoin as an op)on. – Services allow for commercial exploita)on, although no requirement for the service providers to do so. à This enables the inclusion of non-profit organisa)ons and projects that provide essen)al services 4 Boundary Specifica2on

- 5. Companies and projects that meet the inclusion criteria have been iden)fied by consul)ng various start-up lists from venture capitalists, industry experts and media plaYorms; as well as relevant news reports and user stories on reddit.com/r/bitcoin and bitcointalk.org. Data on the en))es has been collected through a variety of publicly available data sources ranging from company websites and blogs, official press releases and archival records from media companies to TwiBer and LinkedIn accounts. The most valuable resources have been the public discussion forums on reddit.com/r/bitcoin and bitcointalk.org where en))es ogen announced the launch of a new product or service. Type of data collected for each firm • FoundaFon Date: approximate date of founda)on of the en)ty (not necessarily date of legal incorpora)on) • Launch Date of each service/product: usually official launch date of product/service, in some cases also beta launch • Exit Date: when the en)ty leaves the ecosystem for various reasons • Exit reason: this also includes pivots away from Bitcoin • Funding: any raising of capital that is not related to debt (VC funding, crowdfunding, state grants, …) • Rebranding: new name and year, if applicable • Mergers & AcquisiFons (M&A): if applicable Final dataset • 513 projects and firms • Time window: 2010-2015 included (2009 was omi_ed since no project or firm was iden)fied) Limita2ons • Lack of reliable data in some cases • Difficult to cross-validate data 5 Data Collec2on

- 6. • Develop a theore)cal framework for grouping products and services together into market segments (product/service categories) – Combina)on of exis)ng (but limited) frameworks from VC firms and industry experts into a unified model serving as first reference – Itera)ve process: test drag model with each new en)ty and adapt/update if necessary • Apply framework to dataset Construct a binary adjacency matrix for each year, indica)ng if an en)ty is ac)ve in a par)cular market segment (1) or not (0) • Visualisa)on – Write custom scripts with R sogware package and compute graph for each year – Include categorical variable to indicate the “state” of each en)ty (e.g. newly founded, established but inacFve, ...) à represented by colour code in visualisa)on – Node size of en))es: number of market segments in which the en)ty is present 6 Methodology

- 10. 10

- 11. 11

- 12. 12

- 13. 13

- 14. 14

- 15. 15 Findings (3): Key Observa2ons • Diversity - Evolved from an small community formed around an experimental digital currency and payment system into a large sector composed of 22 dis)nct, but complementary market segments providing a wide variety of products and services harnessing the value proposi)on(s) that the plaYorm offers, thereby expanding beyond simple financial services. - From table 3 on p.8, we can observe that the first services to emerge were related to the acquisi)on and sale of bitcoins as well as secure storage, followed in 2011 by services enabling the spending and trading of bitcoins. In 2012, we witness the arrival of the first non-currency applica)ons* and API plaYorm. In 2013, all iden)fied market segments have already been established, and diversity is growing within and across those segments in 2014 and 2015. à On the one hand, replica)on of roles from tradi)onal financial system and payment networks but specifically tailored to Bitcoin, while on the other hand also crea)on of new roles that did not exist before (mining industry, mixing services, …) - In terms of numbers of companies, Exchange is the largest market segment for each year followed by Wallet, Brokerage Services and Payment Processor --> with excep)on of wallet, all services that act as gateways connec)ng the “Bitcoin economy” to the “outside economy” (entry and exit points to the Bitcoin ecosystem). Trading Pla;orm, Data Services and ATM have experienced massive growth since they first emerged, as have Money Transfer Pla;orm, Financial Services and Developer Tools. *In the context of this project, non-currency/non-monetary applicaFons refer to use cases of the Bitcoin protocol that are not related to the currency or the payment system. Other non-monetary services such as market data providers and consul)ng will be termed supporFng services. • Diversifica2on - Degree distribu)on shows that majority of en))es are opera)ng in a single market segment, however, there is a trend towards diversifica)on emerging in 2013 and con)nuing throughout 2014 and 2015 - Related diversificaFon (closely related market segments) vs. unrelated diversificaFon (market segments that are quite dis)nct from each other): observa)ons show that related diversifica)on is more common - Some market segments are more isolated in the sense that companies tend not to diversify once they have established themselves in their respec)ve niche: Marketplace, Gambling and Mixing Services, as well as non-currency applica)ons Blockchain InnovaFons and Notary Services. - In contrast, firms that are most diversified (>3-4 market segments) tend to operate in the following market segments: Wallet, Brokerage Services, Exchange, Payment Processor, Money Transfer Pla;orm and Financial Services. à emergence of full service providers a_emp)ng to offer a comprehensive customer experience by crea)ng a universal “go-to” internal plaYorm that provides all func)onali)es within the company plaYorm itself. à also some)mes verFcal integraFon by engaging in mining opera)ons to subsidise their other service offerings.

- 16. 16 • Funding PaVerns - First VC investments in 2012, growing exponen)ally in the following years. Also token sales, crowdfunding rounds and limited state grants. Figures are minimum funding amount per year since a number of en))es have refused disclosure of funding rounds. - 2012: $2.1m for 3 firms. - 2013: $93.3m for 38 firms, 2 addi)onal en))es have not disclosed amounts. - 2014: $369m for 96 firms, 7 addi)onal en))es have not disclosed amounts. - 2015: $448.4m for 69 firms, 13 addi)onal en))es have not disclosed amounts. - Although a growing number of firms able to secure funding, the majority of funds go to a limited number of companies, ogen in several funding rounds. - Difficult to a_ribute funding to specific market segments because many firms operate in several segments, but we can observe that majority of funds have gone to en))es providing consumer and merchant services (Money Transfer Pla;orm, Brokerage Services, Wallet and Payment Processor), Exchanges and Mining (mainly hardware manufacturers). - Developer PlaYorms have also received significant amounts in 2014 and 2015, emphasising the growing importance of middleware services in the Bitcoin business ecosystem that facilitate interac)on with the protocol. • Entries and Exits - Number of en))es leaving the ecosystem for a variety of reasons is growing over the years, but largely compensated by the entrance of new en))es: business ecosystem is growing each year in terms of number of en))es. - Main reasons include regulatory issues and difficul)es to secure banking rela)onships in the early stages, security breaches and hacks especially at custodial wallet services and exchanges as well as scams and frauds. Lagging user adop)on and lack of growth has also been a major reason in recent years for the closure of firms, as well as the departure of co-founders and the trend emerging in 2014 to pivot towards “blockchain-based” solu)ons that are not related to Bitcoin. - Findings indicate that firms that are ac)ve in at least 3 market segments generally do not shut down and are less likely to pivot away from Bitcoin. - Entry and exit pa_erns show that the majority of companies launch the same year as they are founded, although star)ng in 2011, there are a rising number of en))es that prefer delaying launch and spend more )me on development. - Some exis)ng companies established in different industries enter the Bitcoin business ecosystem, mostly through founda)on of a separate en)ty dedicated en)rely to Bitcoin. • M&A, Pivots and Rebranding - While first acquisi)on in 2011 was rather born out of an emergency situa)on (Mt. Gox taking over Bitomat ager the la_er lost access to customer funds), the business ecosystem has seen a wave of acquisi)ons beginning in 2013, with no specific market segment s)cking out. Mergers have been quite rare, only one per year since 2013 (of which two are related to mining industry). - “Blockchain” hype star)ng in 2014 has resulted in several parFal and complete pivots away from Bitcoin. - In 2014 and 2015, various en))es have rebranded themselves mostly by elimina)ng specific pre- and suffixes (“bit”, “coin”, …) in the company name and increasingly focusing marke)ng on the benefits of their services instead of the technology that powers them.

- 17. • Changes in market needs/demand – Unsurprisingly, changing user needs and wishes have led to certain market demand, which in turn is then fulfilled by newly formed and/or established en))es who develop and build the demanded services. – Earliest examples include the emergence of wallet providers who remove the need for users to download and sync the en)re blockchain and enable easier access to funds, as well as brokerage services that provide a convenient op)on for purchasing bitcoin. • Regulatory forces – They play a very important role in the Bitcoin business ecosystem due to the unique nature of its main value proposi)on – Different stages: in the first two years, li_le interest because of small size and relevance, but increased scru)ny and ac)on in following years with emergence of illegal services and accumula)on of consumer defrauding à As a result, split of business ecosystem in two parts: regulated economy (mainly formally incorporated firms complying with exis)ng regula)ons) and unregulated economy (lack of regula)ons and pseudonymity are considered useful features: mostly mixing services, darknet black markets, online gaming sites and services forgoing KYC/AML checks for a premium: self-organising and self-regula)ng) - Both regulaFon-driven innovaFon (emergence of new market segments specifically tailored to help Bitcoin companies comply) and regulaFon-delayed innovaFon (increasing legal expenses and )me-consuming applica)ons for licenses,…) • Evolu2on of value proposi2on – At different stages of the evolu)on, en))es have focused on building services tailored to a specific value proposi)on, evolving over )me: in the early years, main focus put on censorship-resistant digital cash, then use of bitcoin as a specula)ve digital asset, followed by discovery of non-currency/non-monetary applica)ons, and finally refocusing on the payment system. à The “perceived” nature of Bitcoin by all ecosystem par)cipants differs among actors and evolves over )me. • Low barriers to entry – Open nature of FOSS-based Bitcoin plaYorm enables easy par)cipa)on by simply requiring client download. Early services and firms only needed a minimum understanding of the technology and limited programming skills, and were ready for launch within a short amount of )me (ex: Mt. Gox launched several days ager founder read first about Bitcoin). – However, barriers to entry have significantly increased in almost all market segments, with some segments being more affected than others (e.g. Mining because of high capital investment requirements and economies of scale). • Technological changes/advances – Mostly visible in the Mining industry with successive introduc)on of more powerful and efficient mining rigs: has reshaped the en)re industry and shiged power within the sector. – Similarly, implementa)on of BIPs and other protocol-level changes put pressure on service providers to adapt and upgrade their infrastructure to stay compe))ve. 17 Analysis (1): Factors driving emergence and evolu2on of market segments

- 18. 18 Analysis (2): Factors impac2ng evolu2on of overall business ecosystem • Regulatory uncertainty - Variety of dis)nct regulatory approaches and taxa)on regimes differing from country to country has introduced legal uncertainty and reluctance from financial ins)tu)ons to join the business ecosystem and maintain good banking rela)onships out of reputa)onal risk à has led to the closure of projects in an)cipa)on of legal ac)ons and difficulty for early Bitcoin firms to have banking accounts. - However, recent posi)ve comments from certain central banks, supervisory authori)es and other government agencies has helped Bitcoin get more legi)macy in the eyes of the general public. • Public percep2on - Closely related to media a_en)on: indispensable for increased user and developer adop)on, but risk of focusing and emphasising the wrong aspects of the system (“money-laundering tool”, “used by criminals”, “unsecure because many security breaches”, etc.) à has an impact on “outsiders” regarding their decision to join the business ecosystem and assess its poten)al • Dependence on market price – Also closely related to public percep)on and interest from the “outside”: high bitcoin price raises interest and a_racts speculators, miners and investment. High vola)lity, however, retards use as a currency. Low price might have an impact on the security of the network since a drop in total hash rate is expected. – Some market segments are more dependent on the market price than others. This also applies to firms and projects that receive the majority of their revenues (and some)mes also capital if token sale) in bitcoins. • Changes in organisa2onal firm structure – In the early days, most en))es consisted of a single individual with a computer and several servers working from home à no legal incorpora)on nor organisa)onal structure, ogen immature and improvised infrastructure: mainly driven by ideology. – While s)ll the case in certain market segments, entrance of business people with professional experience at reputable technology and financial firms in mid-2013 a_rac)ng venture capital, talent and posi)ve public a_en)on à legal incorpora)on, hierarchical organisa)onal structure, be_er customer support and interfaces: “professionalisa)on” of business ecosystem • Environmental dynamics - Exogenous events highligh)ng the limita)ons of the current financial system as for instance the Cyprus banking crisis and the hyperinfla)on in certain countries have a posi)ve effect on bitcoin user adop)on. However, nega)ve endogenous events such as security breaches have the opposite effect. • Compe2ng ecosystems – “FinTech” industry as well as other cryptocurrency and alterna)ve finance ecosystems are compe)ng with Bitcoin for user adop)on, talent and funding.