Report

Share

Download to read offline

Recommended

Hanrick curran 2015 tax and superannuation post budget presentation

Hanrick curran 2015 tax and superannuation post budget presentationMazars Qld (Formerly Hanrick Curran)

More Related Content

What's hot

What's hot (10)

Property Developments - Queensland State Budget 2019- 2020

Property Developments - Queensland State Budget 2019- 2020

Deferred compensation – Comp & Benefits for Not-for-Profit Entities

Deferred compensation – Comp & Benefits for Not-for-Profit Entities

Similar to Tikun 16 - funds flowchart

Hanrick curran 2015 tax and superannuation post budget presentation

Hanrick curran 2015 tax and superannuation post budget presentationMazars Qld (Formerly Hanrick Curran)

Similar to Tikun 16 - funds flowchart (20)

Hanrick curran 2015 tax and superannuation post budget presentation

Hanrick curran 2015 tax and superannuation post budget presentation

Super Caps are coming soon, great investment alternatives are already here.

Super Caps are coming soon, great investment alternatives are already here.

Tax Foundation University 2017, Part 5: Details of the Nunes, Cardin, Trump, ...

Tax Foundation University 2017, Part 5: Details of the Nunes, Cardin, Trump, ...

Tikun 16 - funds flowchart

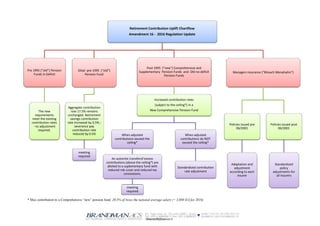

- 1. MauriceB@bacs.co.il * Max contribution to a Comprehensive “new” pension fund: 20.5% of twice the national average salary (= 3,880 ILS for 2016) Retirement Contribution Uplift Chartflow Amendment 16 - 2016 Regulation Update Pre 1995 ("old") Pension Funds In Deficit The new requirements meet the existing contribution rates - no adjustment required. Gilad pre-1995 ("old") Pension Fund Aggregate contribution rate 17.5% remains unchanged. Retirement savings contribution rate increased by 0.5% ; severance pay contribution rate reduced by 0.5% meeting required Post 1995 ("new") Comprehensive and Supplementary Pension Funds and Old no-deficit Pension Funds Increased contribution rates (subject to the ceiling*) in a New Comprehensive Pension Fund When adjusted contributions exceed the ceiling* An automtic transferof excess contributions (above the ceiling*) are alloted to a suplementary fund with reduced risk cover and reduced tax concessions. meeting required When adjusted contributions do NOT exceed the ceiling* Standardized contribution rate adjustment Managers insurance ("Bituach Menahalim") Policies issued pre 06/2001 Adaptation and adjustment according to each insurer Policies issued post 06/2001 Standardized policy adjustments for all insurers