Embed presentation

Download as PDF, PPTX

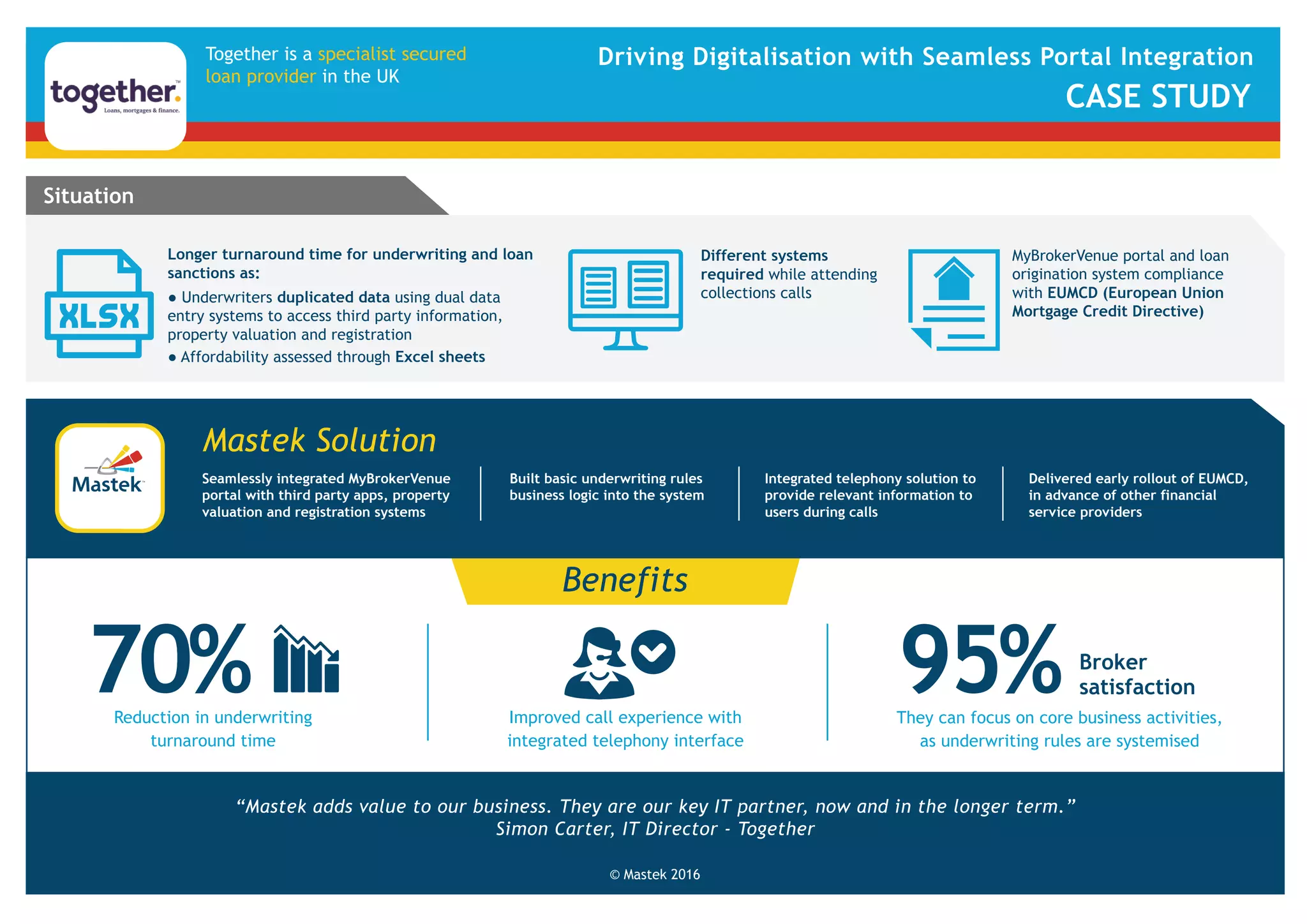

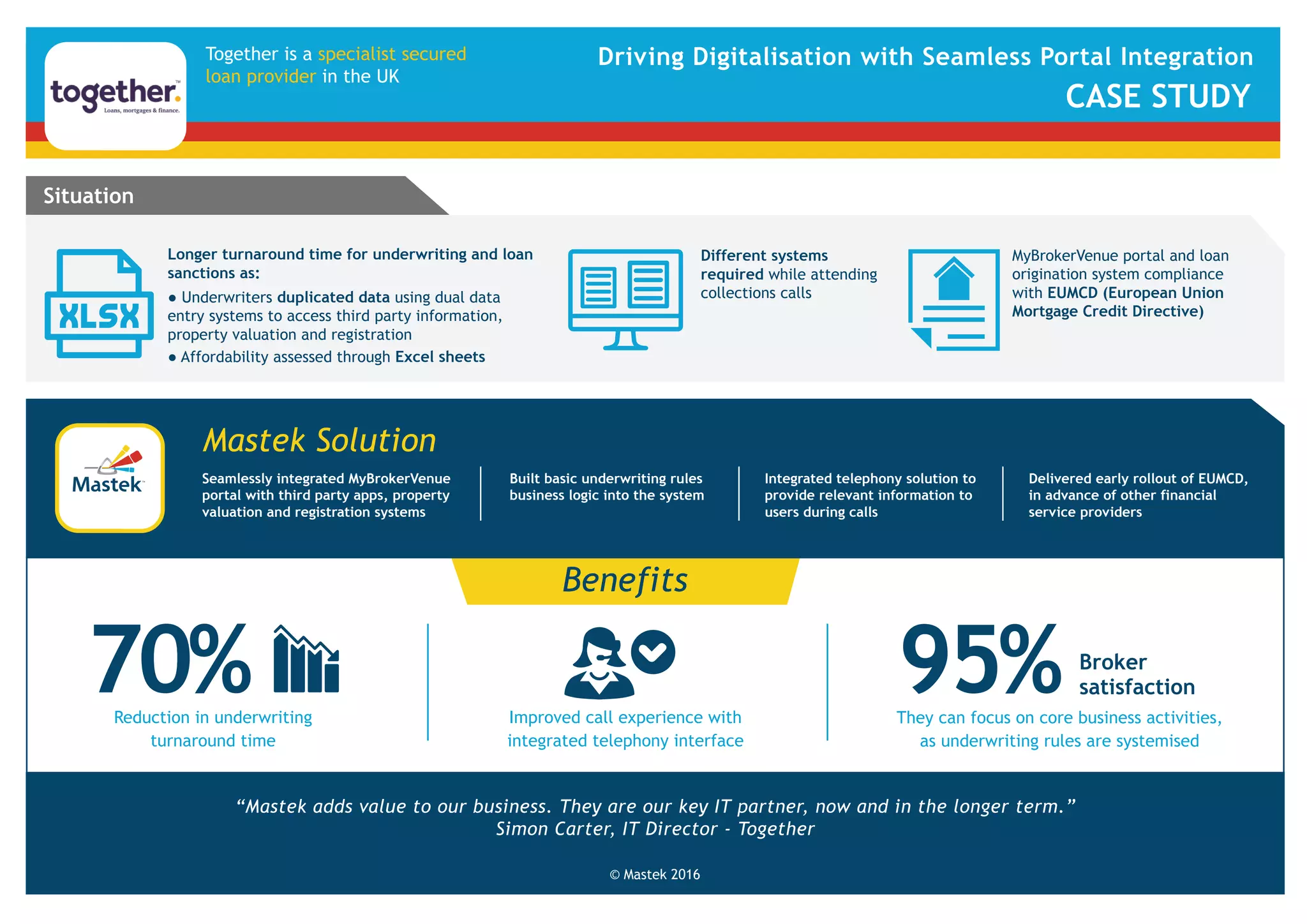

Together is a UK specialist secured loan provider that improved its underwriting process through digitalisation and seamless portal integration, reducing turnaround times significantly. Mastek's solution integrated various systems and automated underwriting rules, leading to high broker satisfaction and compliance with the European Union Mortgage Credit Directive. The enhancements included an integrated telephony system that improved call experiences for users.