[Last Updated 2/11/2016]

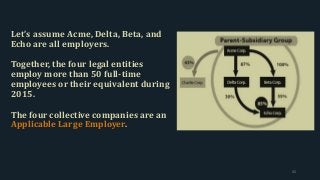

Employers subject to the Affordable Care Act (ACA) must begin collecting certain employee data to meet Section 6056 reporting requirement. Specifically, the ACA requires that employers subject to the law (Applicable Large Employers (ALEs) with 50 or more full-time employees or their equivalent) file Forms 1094-C and 1095-C. A draft version of these Forms was released on October 15, 2014. A final version is expected later this year. All employers subject to the ACA will have to file these two forms starting on 2016 for tax year 2015—this applies even to those employers who are delaying compliance due to the transition relief available to smaller ALEs. These forms are a vital part of the ACA because this is how regulators will know whether employers are complying with the ACA. These forms will also be used to substantiate whether employees maintained minimal essential coverage as required by the individual mandate. Covered employers must complete a Form 1095-C for each employee who was considered a full-time employee for any month of the calendar year. Covered employers have to also complete at least one authoritative1094-C for each Applicable Large Employer Member. Form 1095-C is due to the employee by January 31. Form 1094-C and a copy of 1095-C is due to the IRS by February 28 if filing by paper or March 31 if filing electronically. A $100 penalty will be assessed for each return that is not timely or correctly filed.

![Or, I did all those things on the slide, I just didn’t do it for all

months where the employee was a full-time employee because

[insert irrelevant excuse here].

129](https://image.slidesharecdn.com/final1232015nancy-150209180314-conversion-gate02/85/1094-C-Reporting-Requirements-A-Step-by-Step-Guide-129-320.jpg?cb=1455219428)

![John Q. Taxpayer

Widgets Company, LTD

123 Internal Revenue Love

Houston, Texas 123654

Ph. (281) 555 – 3986

Dear [22A-Eligible Full-Time Employee]:

Widgets Co. records indicate that you received a qualifying offer, along with your spouse and

dependents, if any, for all months in which you qualified as a full-time employee. According to our

records, you are therefore not eligible for a premium tax credit on the individual marketplace.

However, you are directed to see IRS Pub. 974, Premium Tax Credit (PTC) for more information on your

eligibility for a premium tax credit. For information about the offer of coverage you received or

inquiries regarding what Widgets reported to the IRS on Form 1095-C, please contact, via telephone,

the person listed above.

All the best,

Widgets Company, LTD

Federal Employer Identification No. 36--12536548

134](https://image.slidesharecdn.com/final1232015nancy-150209180314-conversion-gate02/85/1094-C-Reporting-Requirements-A-Step-by-Step-Guide-134-320.jpg?cb=1455219428)

![John Q. Taxpayer

Widgets Company, LTD

123 Internal Revenue Love

Houston, Texas 123654

Ph. (281) 555 – 3986

Dear [Full-Time Employee]:

Widgets Co. records indicate that you received a qualifying offer, along with your spouse and

dependents, if any, for all months in which you qualified as a full-time employee. According to our

records, you therefore are not eligible for a premium tax credit on the individual marketplace.

However, you are directed to see IRS Pub. 974, Premium Tax Credit (PTC) for more information on your

eligibility for a premium tax credit. For information about the offer of coverage you received or

inquiries regarding what Widgets reported to the IRS on Form 1095-C, please contact, via telephone,

the person listed above.

All the best,

Widgets Company, LTD

Federal Employer Identification No. 36--12536548

136](https://image.slidesharecdn.com/final1232015nancy-150209180314-conversion-gate02/85/1094-C-Reporting-Requirements-A-Step-by-Step-Guide-136-320.jpg?cb=1455219428)

![John Q. Taxpayer

Widgets Company, LTD

123 Internal Revenue Love

Houston, Texas 123654

Ph. (281) 555 – 3986

Dear [22-B Full-Time Employee]:

Widgets Co. records indicate that you received a qualifying offer, along with your spouse and

dependents, if any, for some months in which you qualified as a full-time employee. According to our

records, you might be eligible for a premium tax credit on the individual marketplace for the months

that you did not receive such a qualifying offer. However, you are directed to see IRS Pub. 974, Premium

Tax Credit (PTC) for more information on your eligibility for a premium tax credit. For information

about the offer of coverage you received or inquiries regarding what Widgets reported to the IRS on

Form 1095-C, please contact, via telephone, the person listed above.

All the best,

Widgets Company, LTD

Federal Employer Identification No. 36--12536548

151](https://image.slidesharecdn.com/final1232015nancy-150209180314-conversion-gate02/85/1094-C-Reporting-Requirements-A-Step-by-Step-Guide-151-320.jpg?cb=1455219428)