Report

Share

Download to read offline

Recommended

Recommended

August 15, 2013. Hosted by the U.S. Small Business Administration and Small Business Majority. This webinar focused on what the new healthcare law, the Affordable Care Act, means for small businesses. It focused on both federal and state provisions to help local small business owners understand how the law will affect them.Affordable Care Act 101: What the New Healthcare Law Means for Your Small Bus...

Affordable Care Act 101: What the New Healthcare Law Means for Your Small Bus...Small Business Majority

The Arkansas Small Business and Technology Development Center, partnering with the Arkansas Health Connector is offering free 2 hour training seminars across the state on the Affordable Care Act for Small Businesses.

As a small business owner, learn what you need to know to successfully Navigate the Affordable Care Act at any of these free, 2 hour workshops. The seminars are free but must re-register. Additional information and registration process in the flyerNavigating affordable care act for arkansas small businesses

Navigating affordable care act for arkansas small businessesArkansas State University Small Business & Technology Development Center

More Related Content

Similar to Affordable Care Act One Pager (1)

August 15, 2013. Hosted by the U.S. Small Business Administration and Small Business Majority. This webinar focused on what the new healthcare law, the Affordable Care Act, means for small businesses. It focused on both federal and state provisions to help local small business owners understand how the law will affect them.Affordable Care Act 101: What the New Healthcare Law Means for Your Small Bus...

Affordable Care Act 101: What the New Healthcare Law Means for Your Small Bus...Small Business Majority

The Arkansas Small Business and Technology Development Center, partnering with the Arkansas Health Connector is offering free 2 hour training seminars across the state on the Affordable Care Act for Small Businesses.

As a small business owner, learn what you need to know to successfully Navigate the Affordable Care Act at any of these free, 2 hour workshops. The seminars are free but must re-register. Additional information and registration process in the flyerNavigating affordable care act for arkansas small businesses

Navigating affordable care act for arkansas small businessesArkansas State University Small Business & Technology Development Center

Similar to Affordable Care Act One Pager (1) (20)

Affordable Care Act 101: What the Healthcare Law Means for Small Business

Affordable Care Act 101: What the Healthcare Law Means for Small Business

What The New Healthcare Law Means For Your Small Business

What The New Healthcare Law Means For Your Small Business

Affordable Care Act 101: What the New Healthcare Law Means for Your Small Bus...

Affordable Care Act 101: What the New Healthcare Law Means for Your Small Bus...

Affordable Care Act 101: What The Health Care Law Means for Small Businesses

Affordable Care Act 101: What The Health Care Law Means for Small Businesses

Navigating affordable care act for arkansas small businesses

Navigating affordable care act for arkansas small businesses

Startup Your Startup: Tips and Tricks for Founders at the Starting Line

Startup Your Startup: Tips and Tricks for Founders at the Starting Line

What the Health Care Law means for Small Businesses

What the Health Care Law means for Small Businesses

Navigating Health Care Reform: Guidance for Small Businesses & Individuals

Navigating Health Care Reform: Guidance for Small Businesses & Individuals

Affordable Care Act- Healthcare Act for Small Businesses

Affordable Care Act- Healthcare Act for Small Businesses

Affordable Care Act One Pager (1)

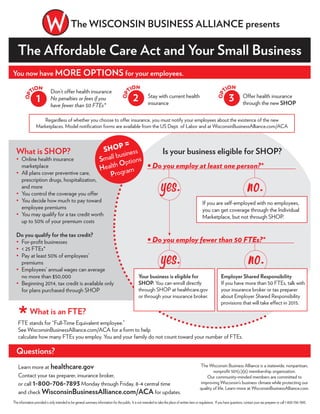

- 1. The Affordable Care Act and Your Small Business Regardless of whether you choose to offer insurance, you must notify your employees about the existence of the new Marketplaces. Model notification forms are available from the US Dept. of Labor and at WisconsinBusinessAlliance.com/ACA *What is an FTE? FTE stands for “Full-Time Equivalent employee.” See WisconsinBusinessAlliance.com/ACA for a form to help calculate how many FTEs you employ. You and your family do not count toward your number of FTEs. What is SHOP? Online health insurance marketplace All plans cover preventive care, prescription drugs, hospitalization, and more You control the coverage you offer You decide how much to pay toward employee premiums You may qualify for a tax credit worth up to 50% of your premium costs Do you qualify for the tax credit? For-profit businesses < 25 FTEs* Pay at least 50% of employees’ premiums Employees’ annual wages can average no more than $50,000 Beginning 2014, tax credit is available only for plans purchased through SHOP Learn more at healthcare.gov Contact your tax preparer, insurance broker, or call 1-800-706-7893 Monday through Friday, 8-4 central time and check WisconsinBusinessAlliance.com/ACA for updates. No. Questions? The Wisconsin Business Alliance is a statewide, nonpartisan, nonprofit 501(c)(6) membership organization. Our community-minded members are committed to improving Wisconsin’s business climate while protecting our quality of life. Learn more at WisconsinBusinessAlliance.com. The WISCONSIN BUSINESS ALLIANCE presents You now have MORE OPTIONS for your employees. Don’t offer health insurance No penalties or fees if you have fewer than 50 FTEs* Stay with current health insurance Offer health insurance through the new SHOP 1 OP TION 2 OP TION 3 OP TION SHOP = Small business Health Options Program Is your business eligible for SHOP? The information provided is only intended to be general summary information for the public. It is not intended to take the place of written laws or regulations. If you have questions, contact your tax preparer or call 1-800-706-7893. If you are self-employed with no employees, you can get coverage through the Individual Marketplace, but not through SHOP. Yes. No. Your business is eligible for SHOP. You can enroll directly through SHOP at healthcare.gov or through your insurance broker. Employer Shared Responsibility If you have more than 50 FTEs, talk with your insurance broker or tax preparer about Employer Shared Responsibility provisions that will take effect in 2015. Yes.