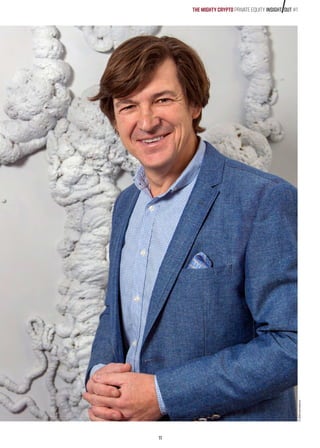

This document provides a summary of the Issue 1, 2018 magazine of the Luxembourg Private Equity & Venture Capital Association (LPEA). The cover article focuses on crypto assets and their impact on the venture capital sector. An interview with HLD Europe discusses their international investment platform based in Luxembourg. Other articles discuss the impact of regulatory changes like Brexit, BEPS, and ATAD on private equity structures and governance. The magazine also provides updates on deals, markets, and the private equity industry in Luxembourg and neighboring regions.