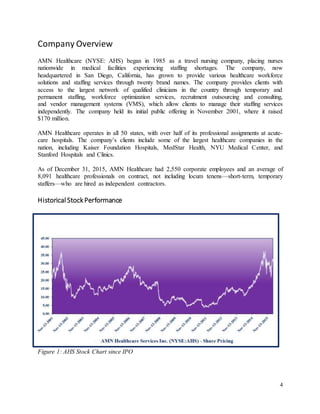

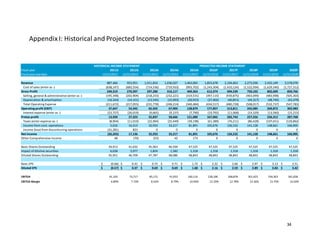

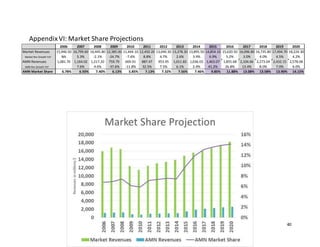

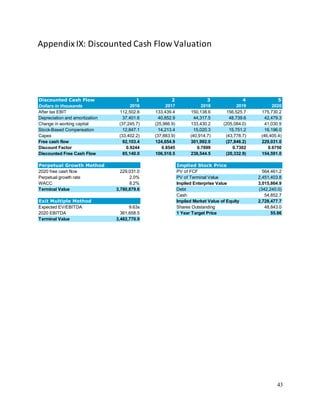

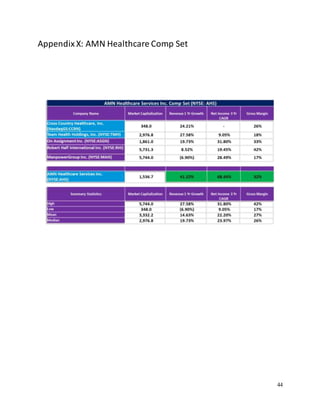

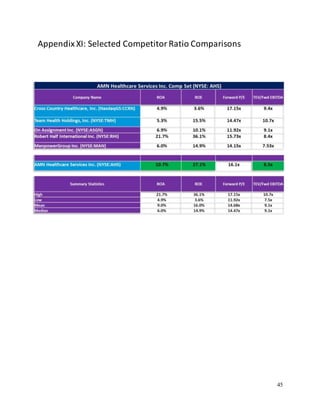

AMN Healthcare is a leading healthcare staffing and workplace solutions company in the U.S., specializing in temporary staffing for acute-care hospitals. The company has seen growth through successful acquisitions and offers services such as travel nurses and managed services programs to optimize staffing needs. Recommendations suggest a buy on AMN Healthcare, projecting a target price of $50.05, reflecting a 45% upside potential from the April 4, 2016 closing price.