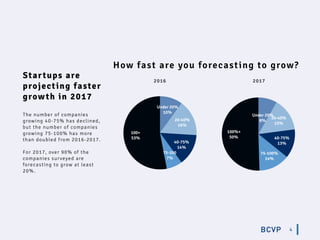

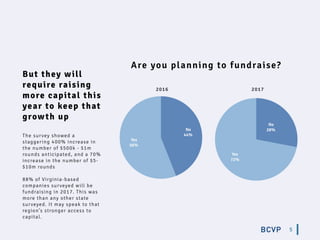

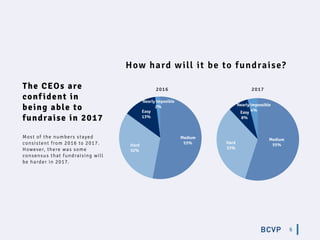

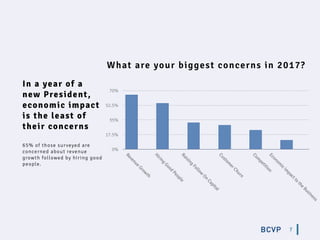

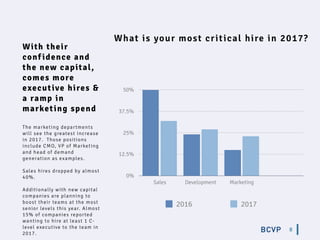

The 2017 entrepreneur survey by Bull City Venture Partners indicates a return to normalcy in the venture market, with declining VC activity and an increase in seed round sizes. Most surveyed companies are forecasted to grow at least 20% in 2017, although fundraising is perceived to be harder. The survey highlights a shift toward marketing roles over sales hires, with a notable confidence among CEOs in the ability to raise capital despite economic concerns.